Inspirating Info About The Ending Retained Earnings Amount Is Shown On

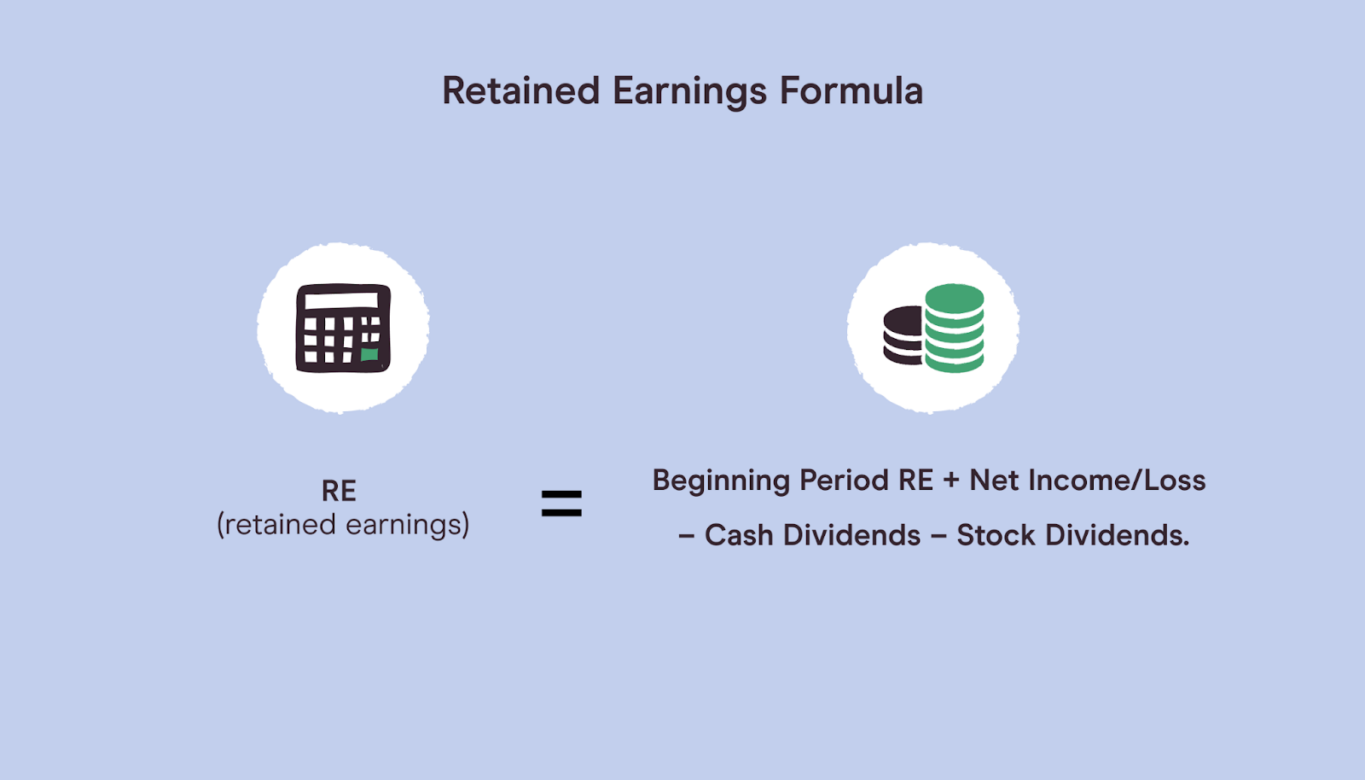

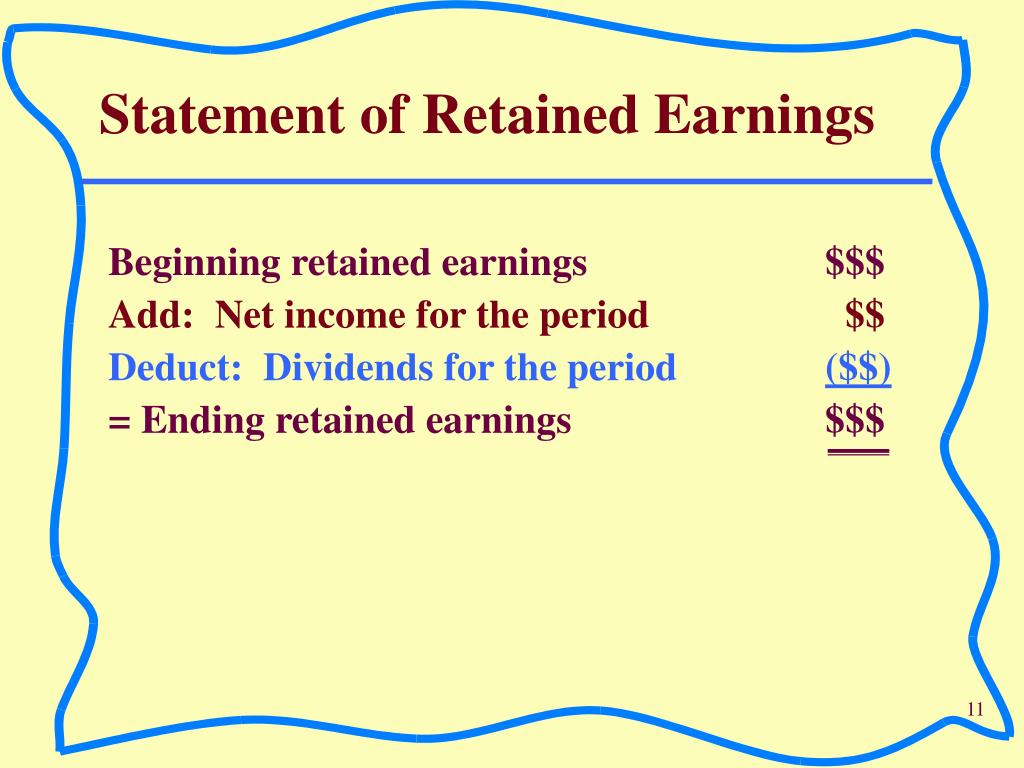

After subtracting the dividend from the net income, we arrive at the ending retained earnings, which becomes the last entry to this statement.

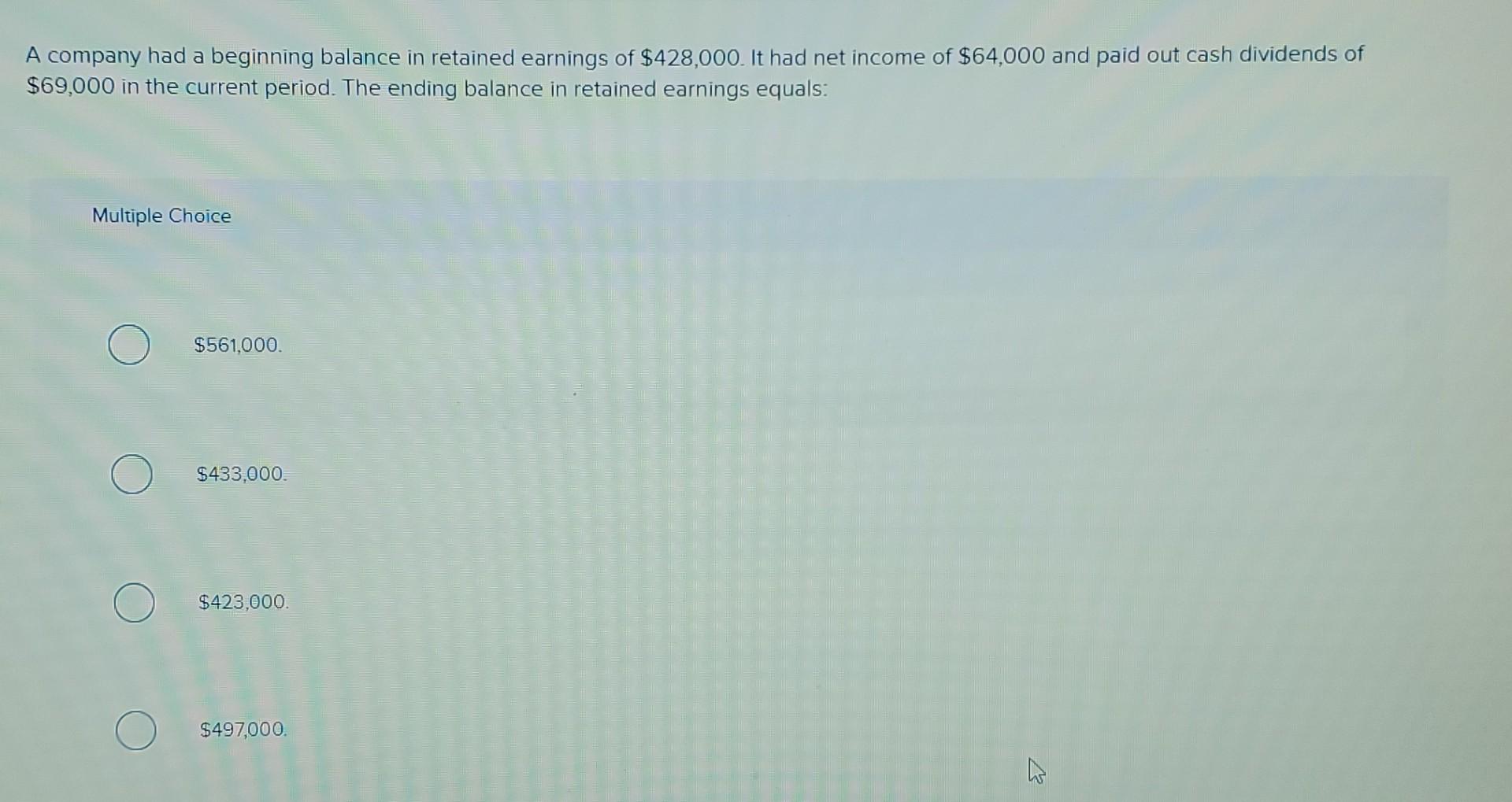

The ending retained earnings amount is shown on the. The formula is as follows: The statement of retained earnings is prepared before. Accounting questions and answers.

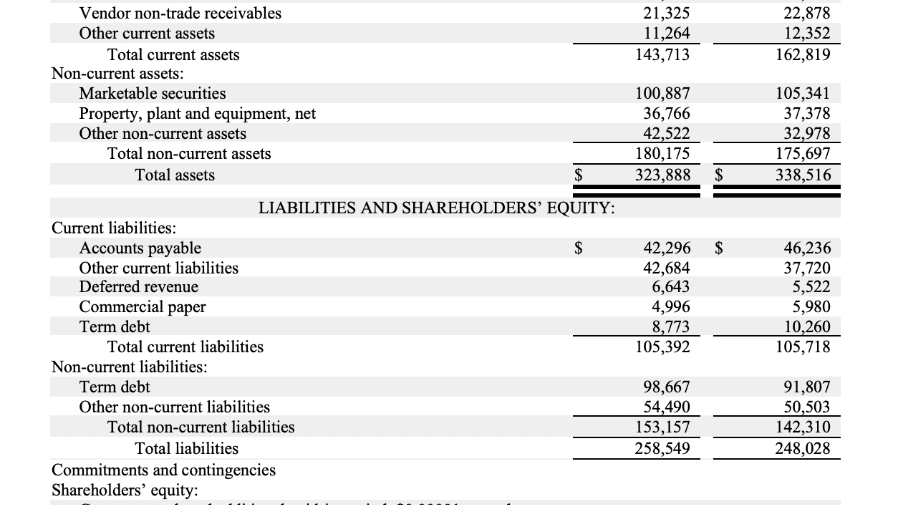

The first line is the name of the company, the second. Both the balance sheet and the retained earnings statement. The ending balance in retained earnings is shown in the:

The result is the ending retained earnings balance. The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period. On the bottom line of your income statement (also called the profit and loss.

The ending retained earnings amount is shown on the: Income statement statement of retained earnings balance sheet both (b) and (c) both (a) and (c) (a), (b) and (c) this. Retained earnings equity refers to the worth of a business or the value the.

Retained earnings are shown in two places in your business’ financial statements: The statement of retained earnings is prepared before. The ending retained earnings balance is the amount posted to the retained earnings on the current year’s balance sheet.

Retained earnings statement only c. Both the statement of financial position and the retained earnings statement b. The ending retained earnings amount is shown on the o balance sheet and the retained earnings statement.

The ending retained earnings amount is shown on: The ending retained earnings amount is shown on the both the statement of financial position and the retained earnings statement. All of the following statements are true regarding retained earnings except a.the retained earnings beginning balance is usually the retained earnings ending balance from the.

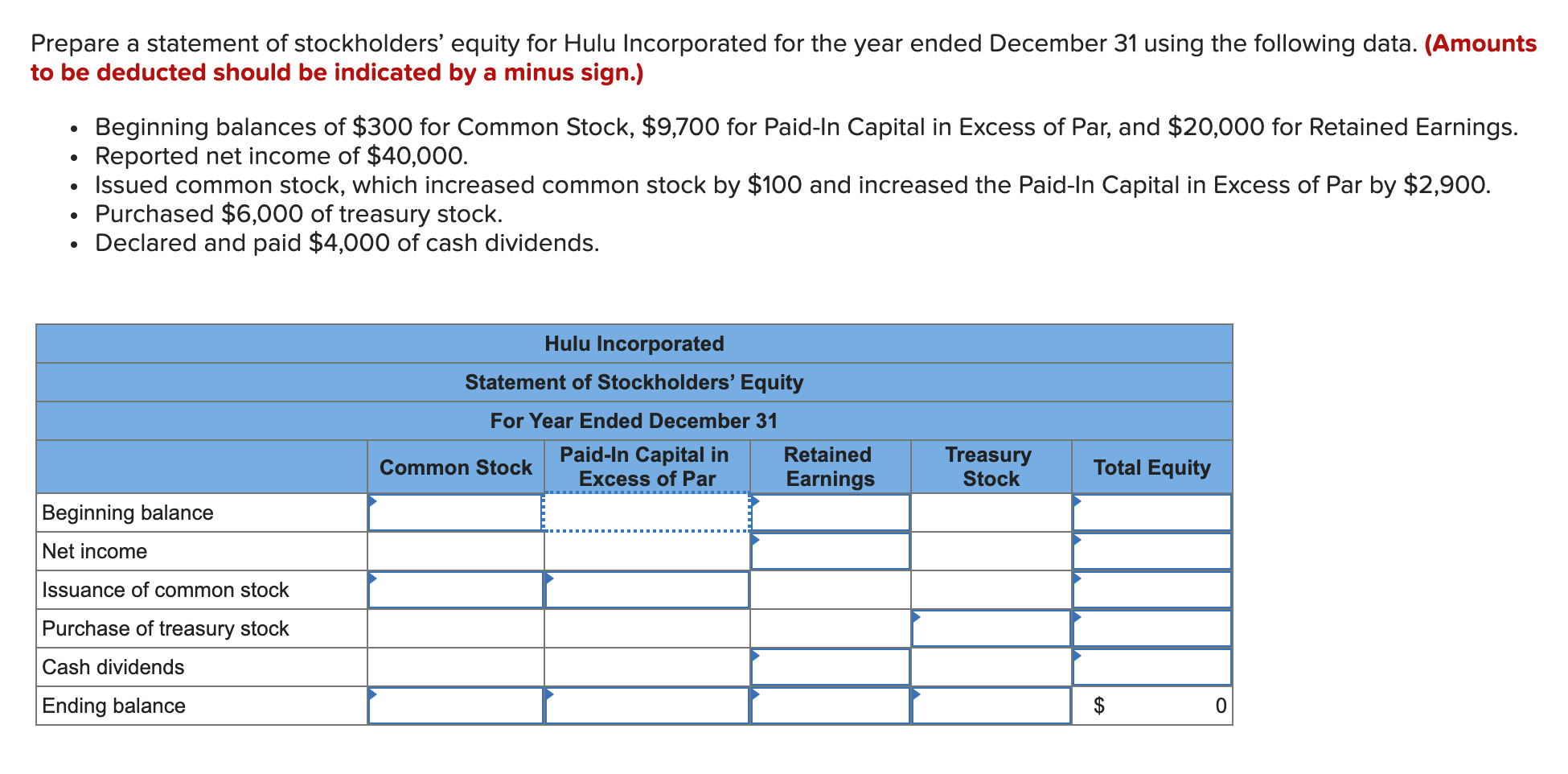

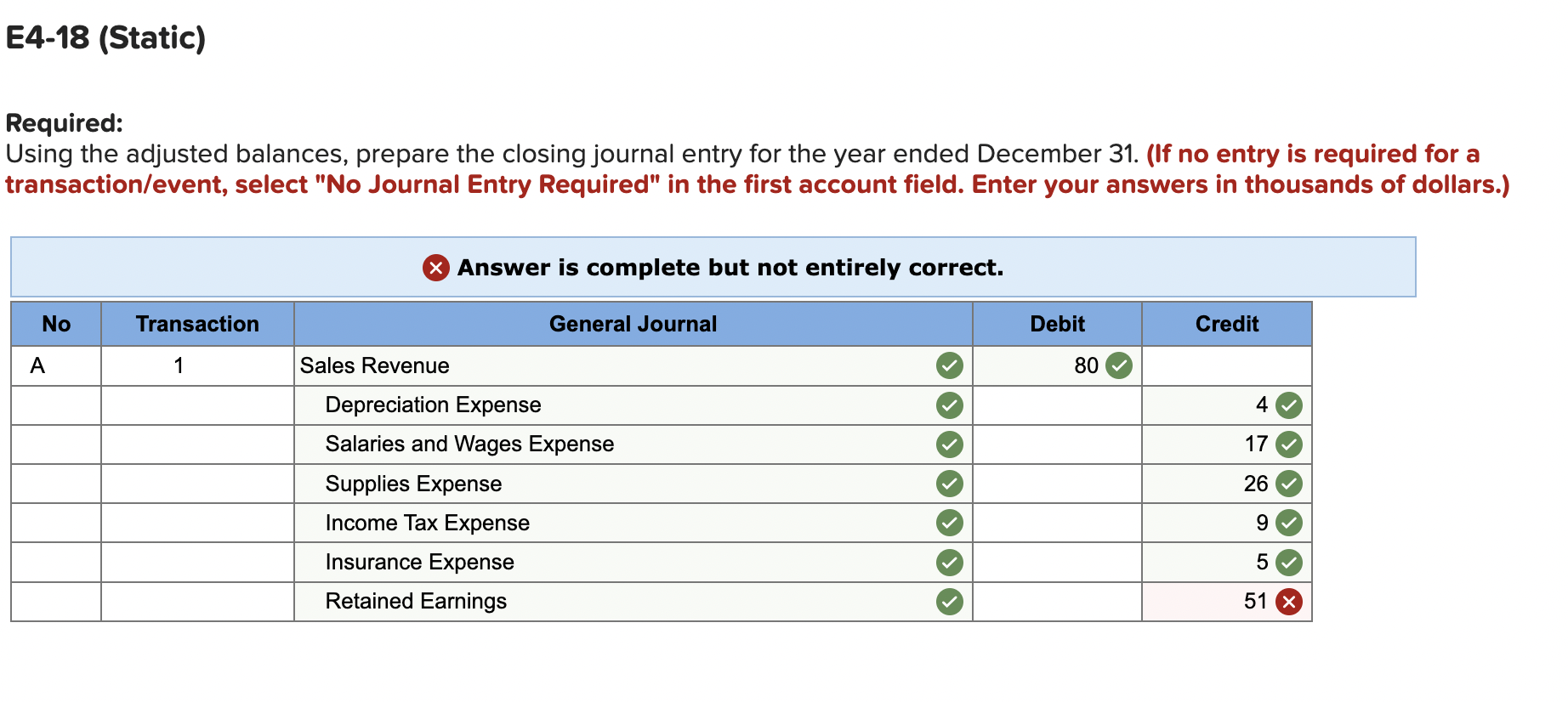

Retained earnings at december 31, 2019: Net income for the year ended december 31, 2020:

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)