Glory Info About Income Statement Contribution Margin

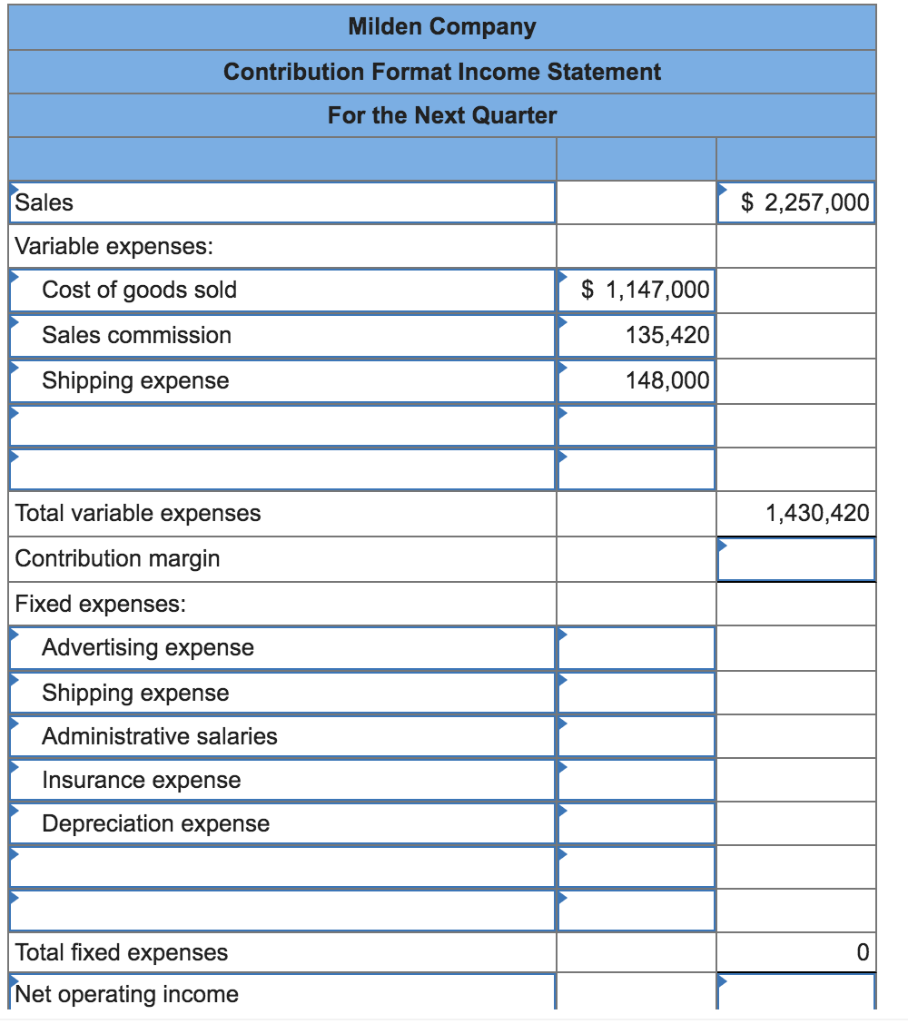

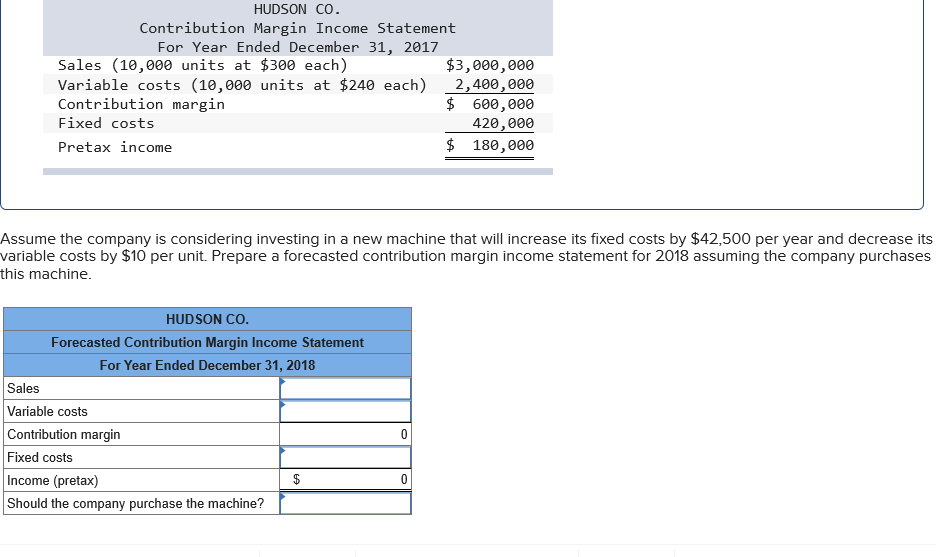

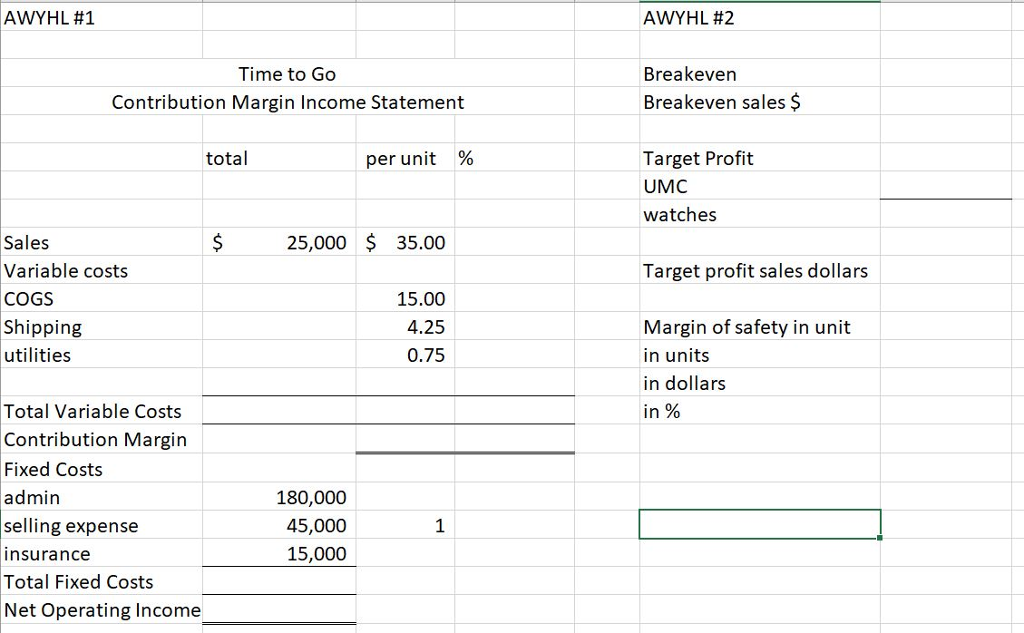

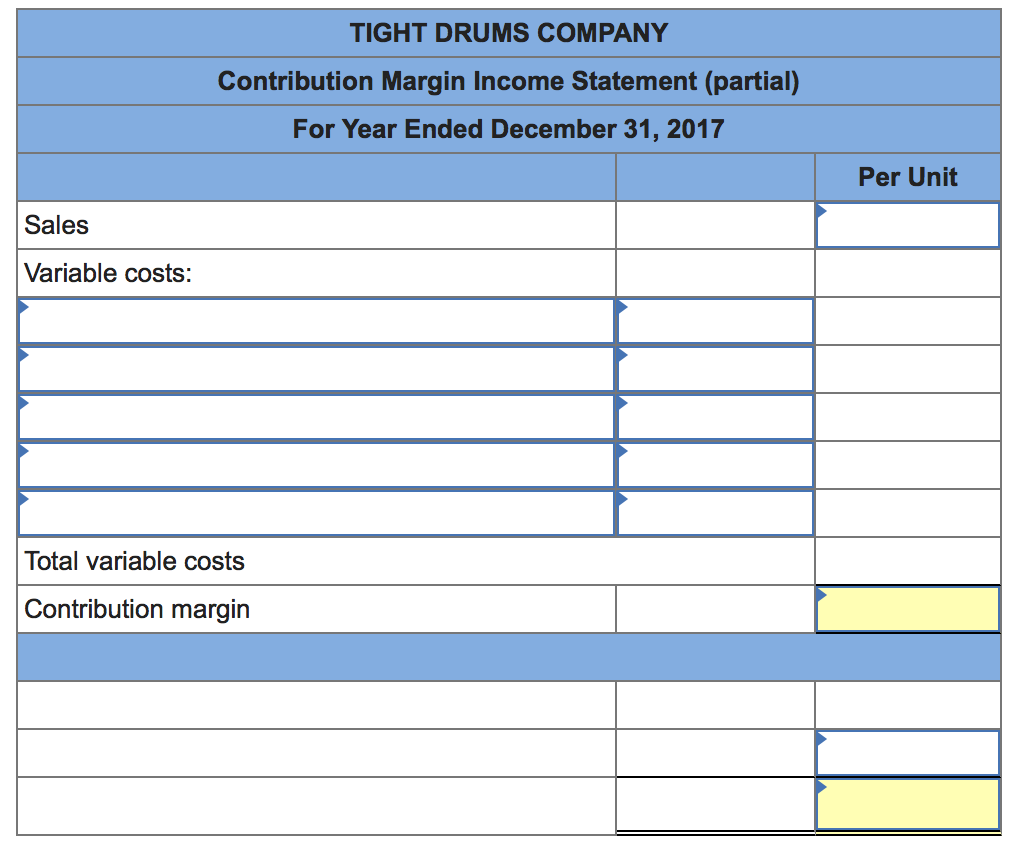

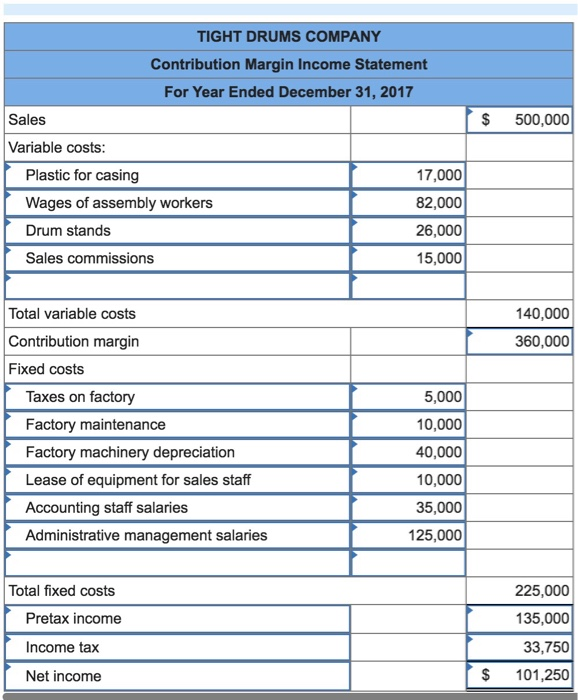

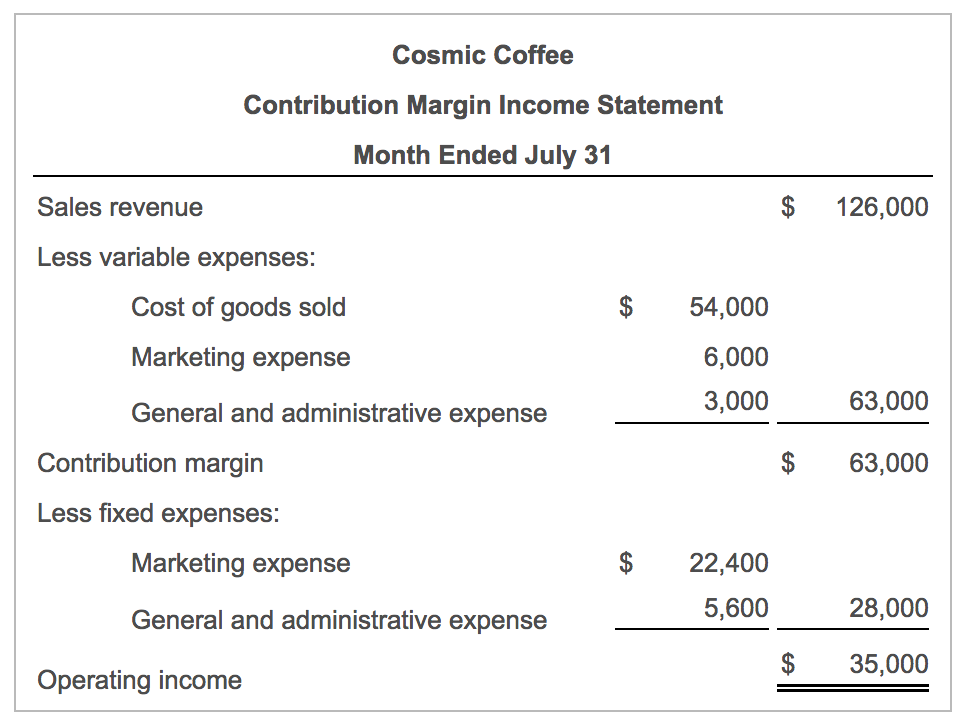

Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period.

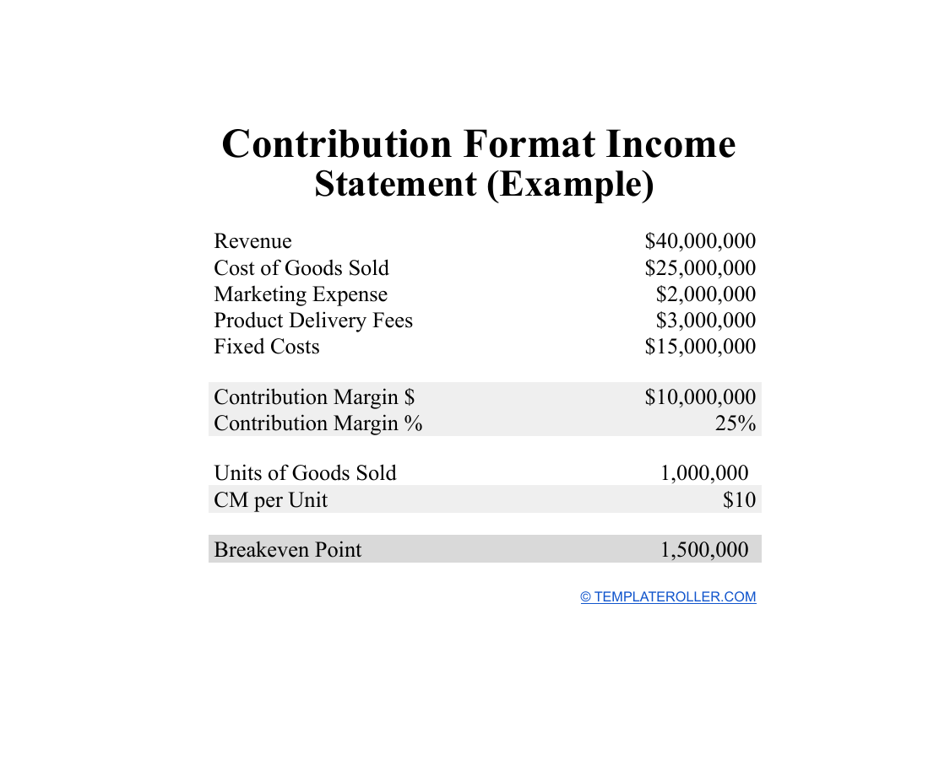

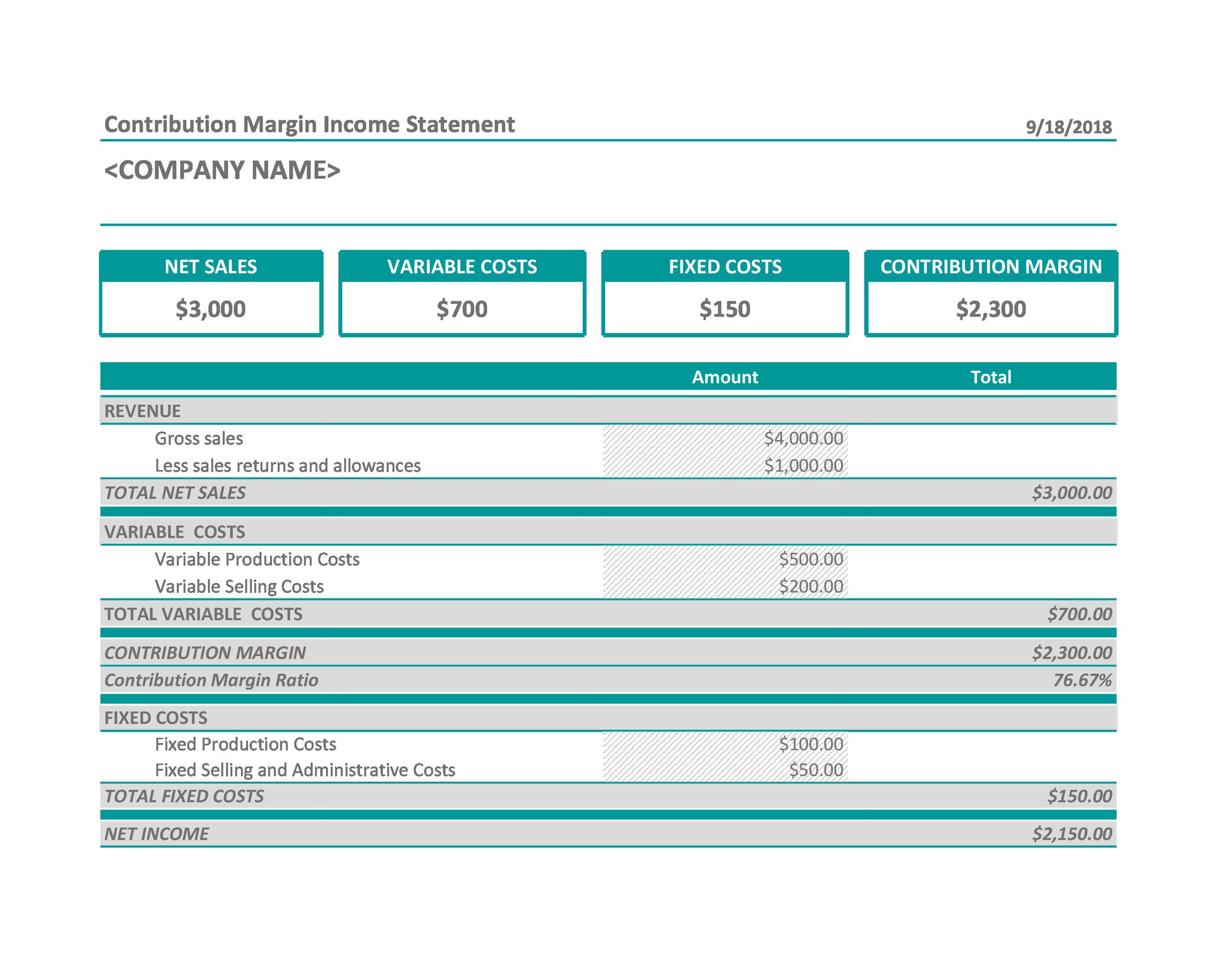

Income statement contribution margin. Santa clara, calif., feb. The 60% ratio means that the contribution margin for each dollar of revenue generated is $0.60. In the next step, the cm ratio can be calculated using the following formula:

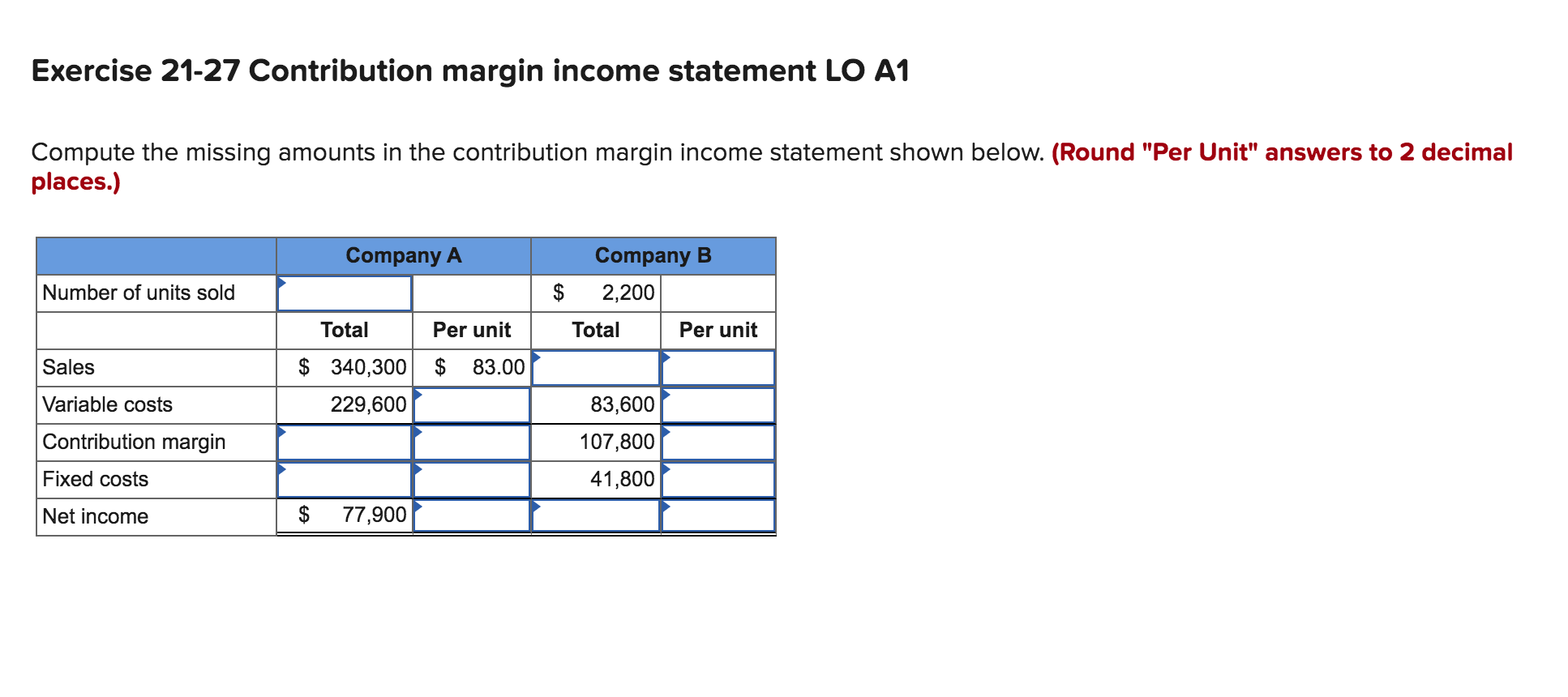

If fixed costs were $100,000, for example, operating income would be $45,400. The contribution margin ratio is also known as the profit volume ratio. That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales.

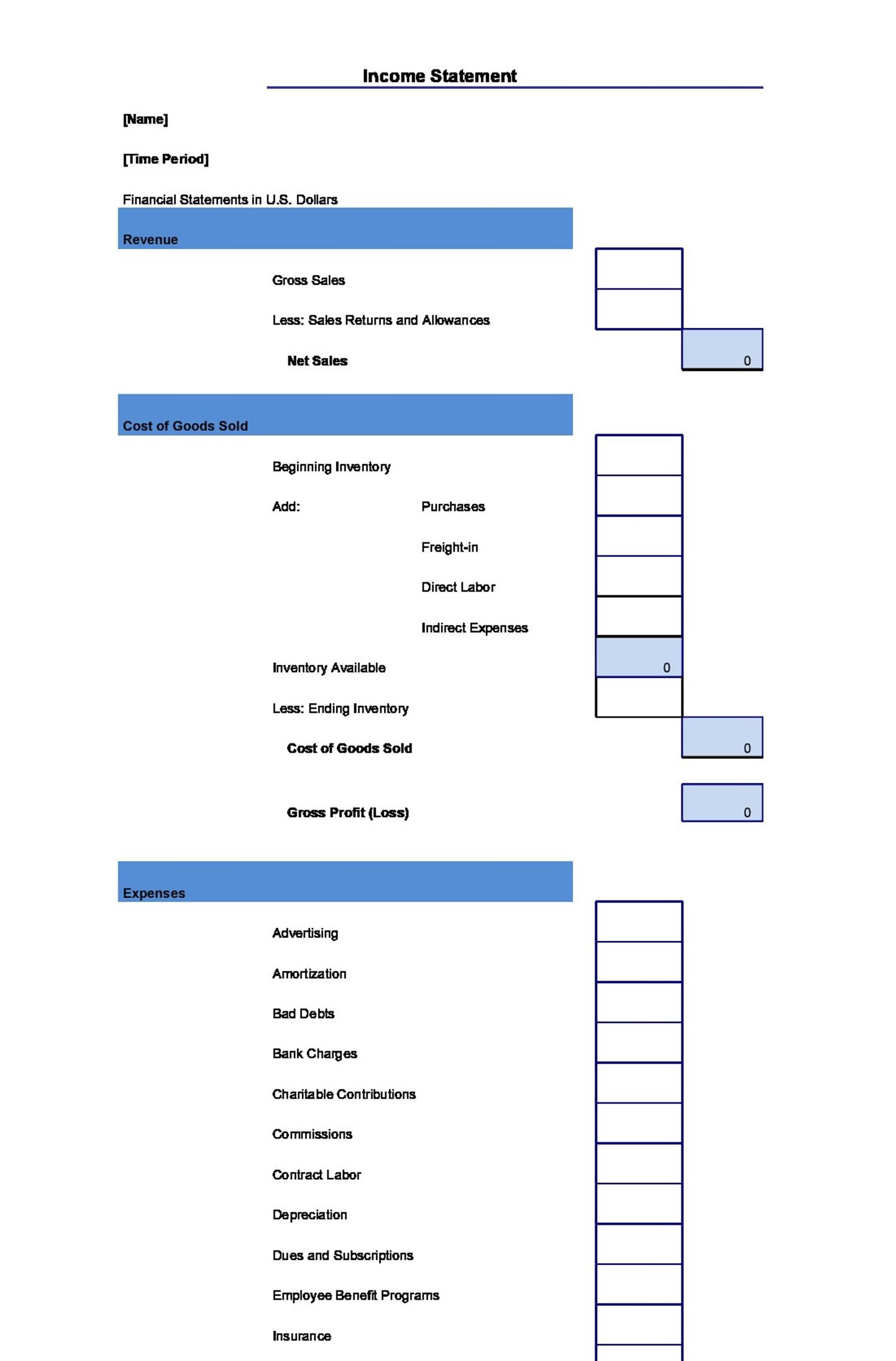

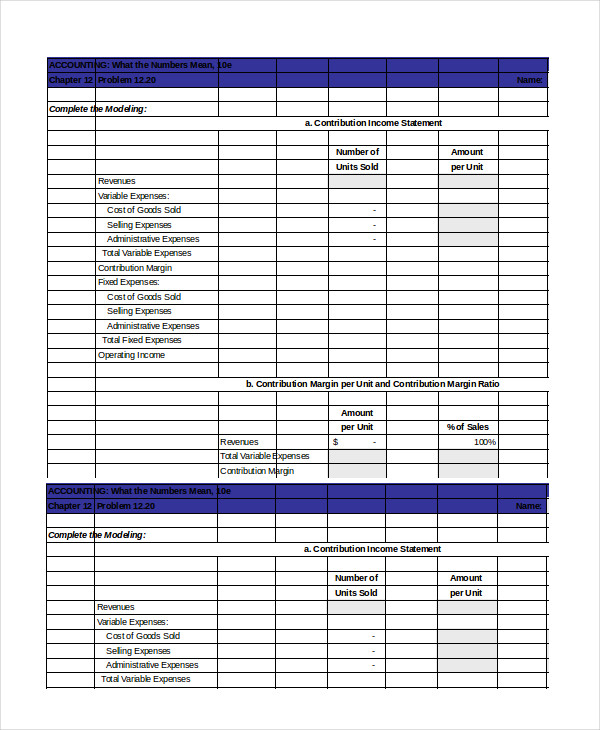

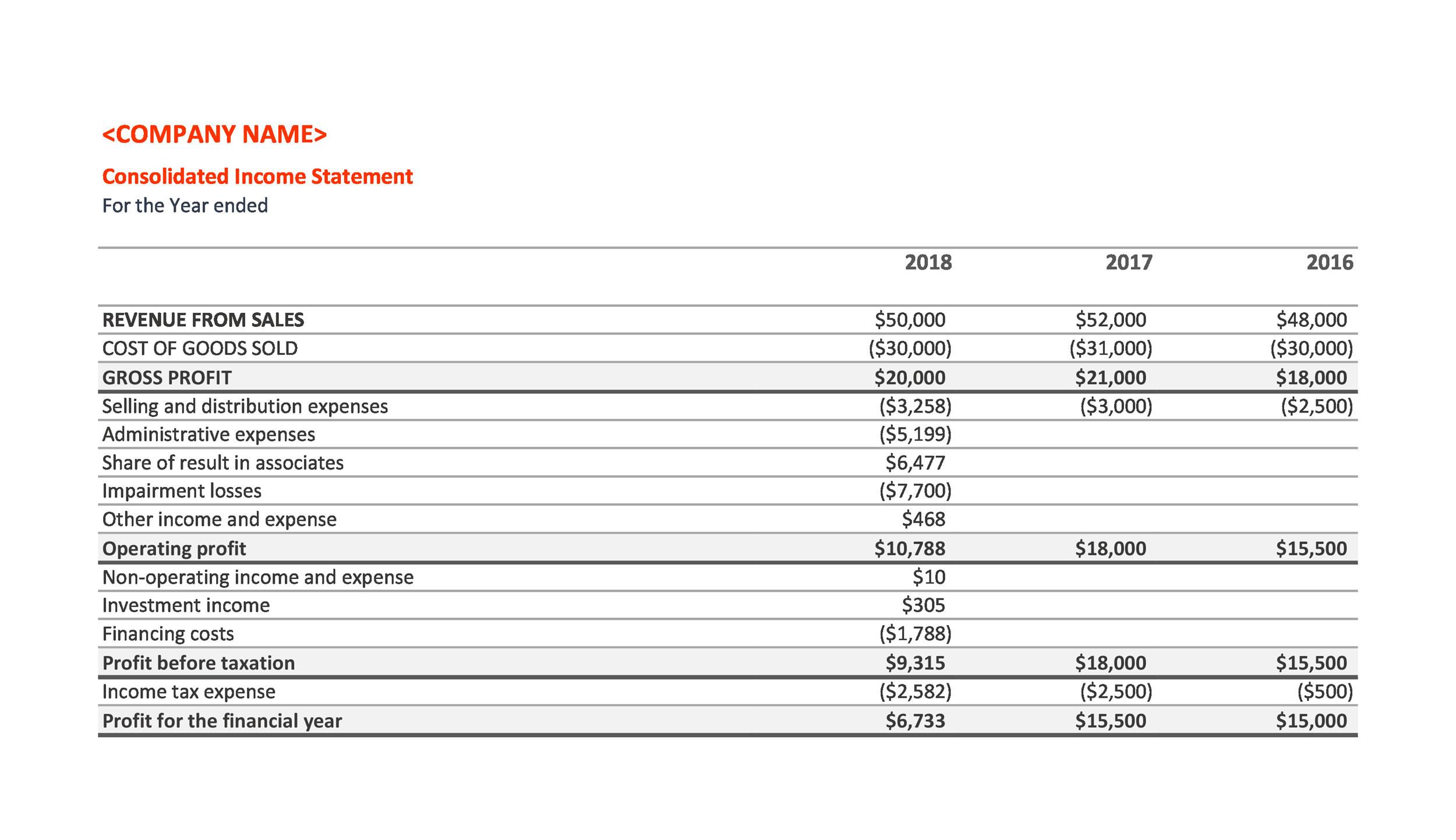

Construct a contribution margin income statement for two different months: Income how to calculate your contribution margin how to determine your contribution margin income what is the difference between a contribution margin income statement and a standard income statement? Record adjusted ebitda margin fourth.

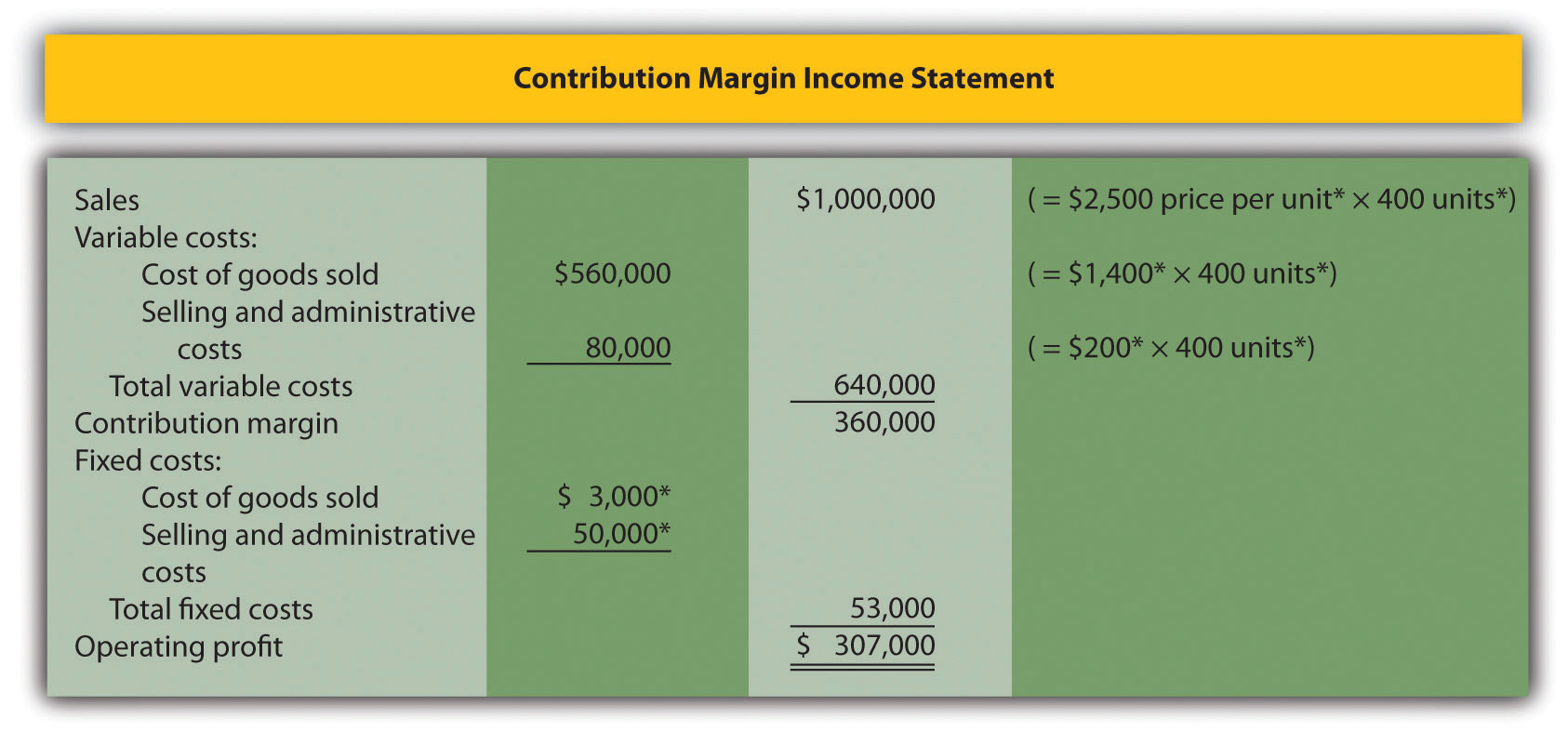

Recall that the variable cost per unit remains constant, and variable costs in total change in proportion to changes in activity. The contribution margin 12 represents sales revenue left over after deducting variable costs from sales. The contribution margin represents sales revenue left over after deducting variable costs from sales.

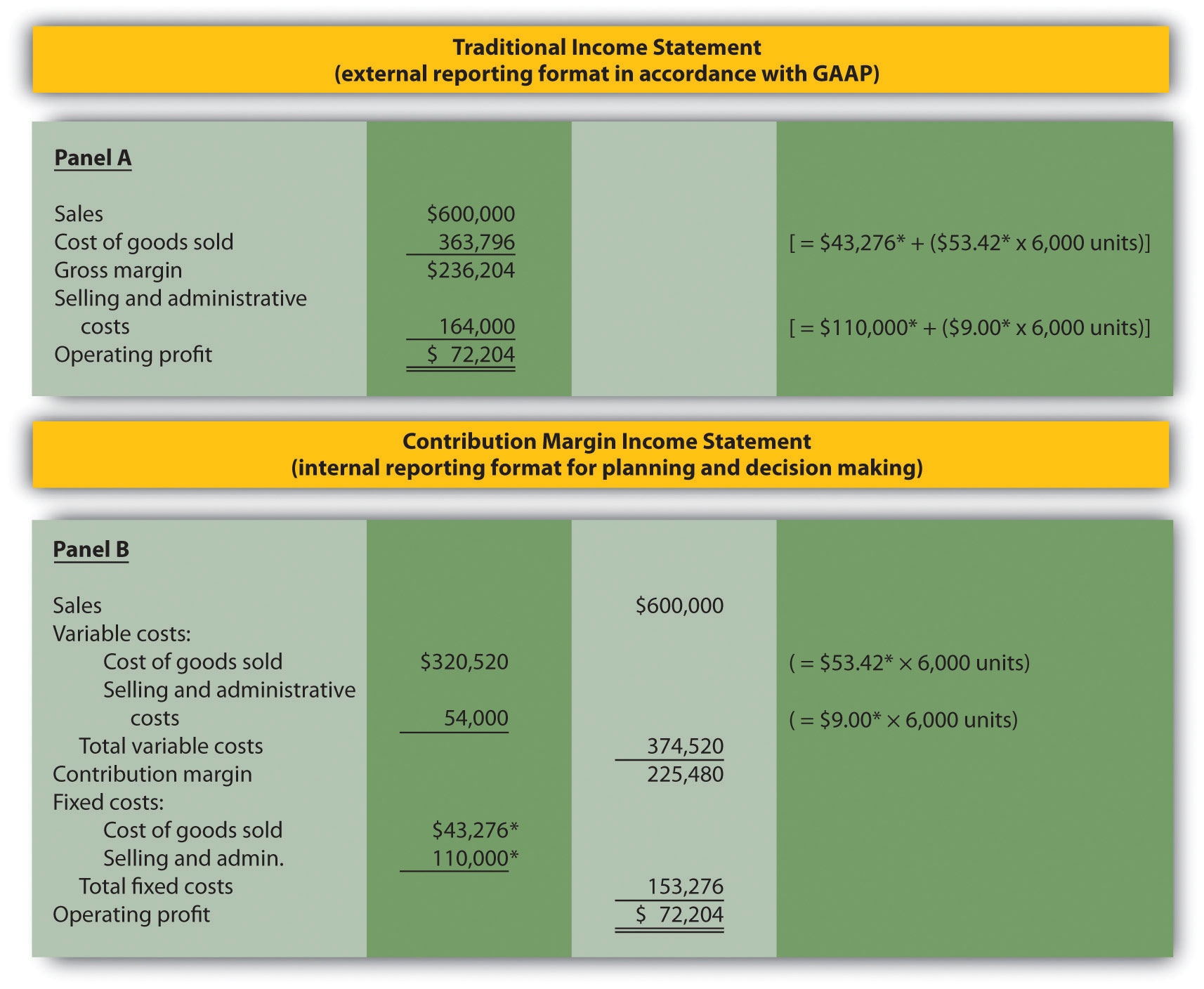

The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. Because 6,000 units are expected to be sold in august, total variable costs are.

The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. Formula for contribution margin. The contribution margin income statement shown in panel b of figure 3.7 clearly indicates which costs are variable and which are fixed.

Contribution margin income statement refers to the income statement which is used for the purpose of calculation of the contribution margin of the company where the contribution margin is derived by the way of subtracting the variable expenses incurred by the company for the period from the total sales of the company and when the. The contribution margin income statement is a useful tool when analyzing the results of a previous period. What it is, how to calculate it, and why you need it by amy gallo october 13, 2017 ross m.

A contribution margin income statement separates fixed and variable business expenses and shows the revenue generated after those two categories of expenses have been paid. The resulting value is sometimes referred to as operating income or net income. What is a contribution margin income statement?

Also important in cvp analysis are the computations of contribution margin per unit and contribution margin ratio. This is all the money that was made by the company. A contribution margin is essentially a company's.

The contribution margin represents sales revenue left over after deducting variable costs from sales. Then, further fixed expenses are deducted from the contribution to get the net profit/loss of the business entity. To understand how profitable a business is, many.