Fabulous Info About Income Statement With Gross Profit

Income statement also forms the basis of important financial evaluation of an entity when it is analyzed in conjunction with information contained.

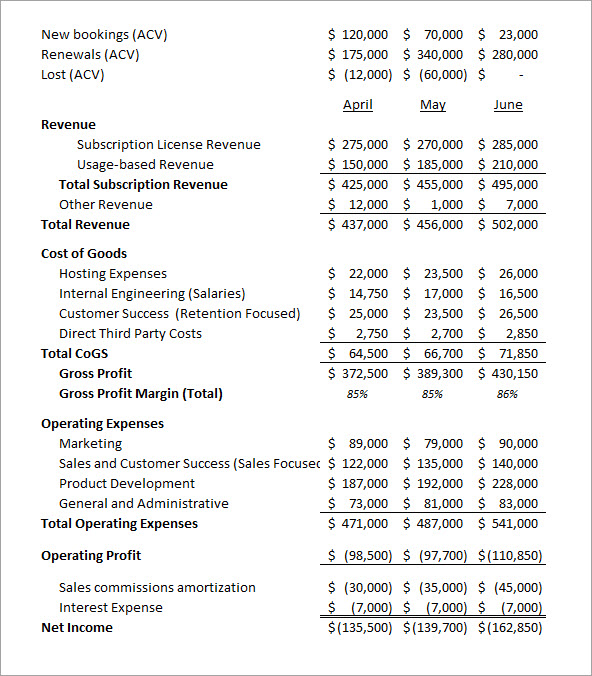

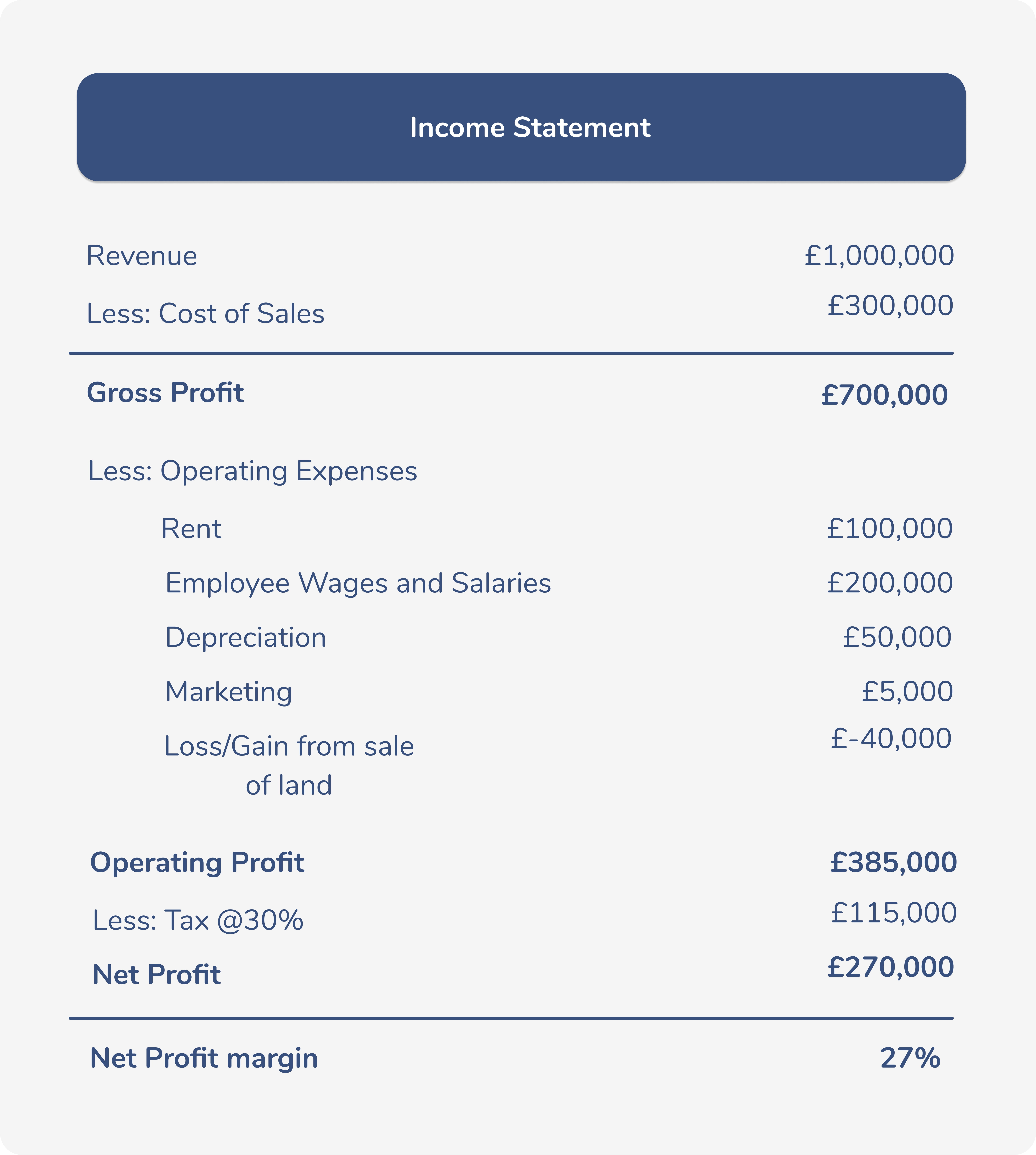

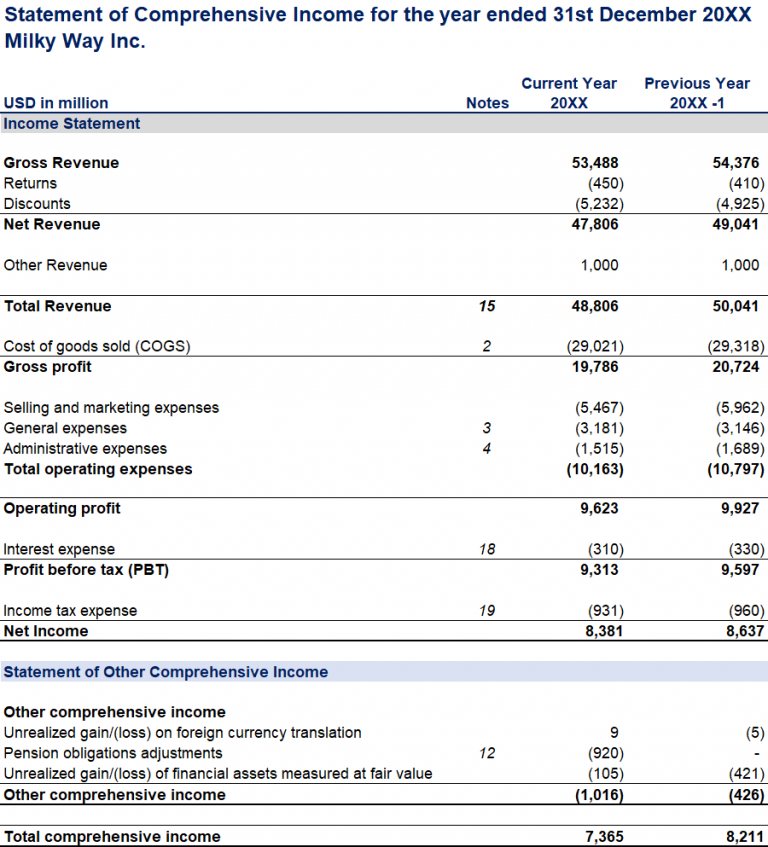

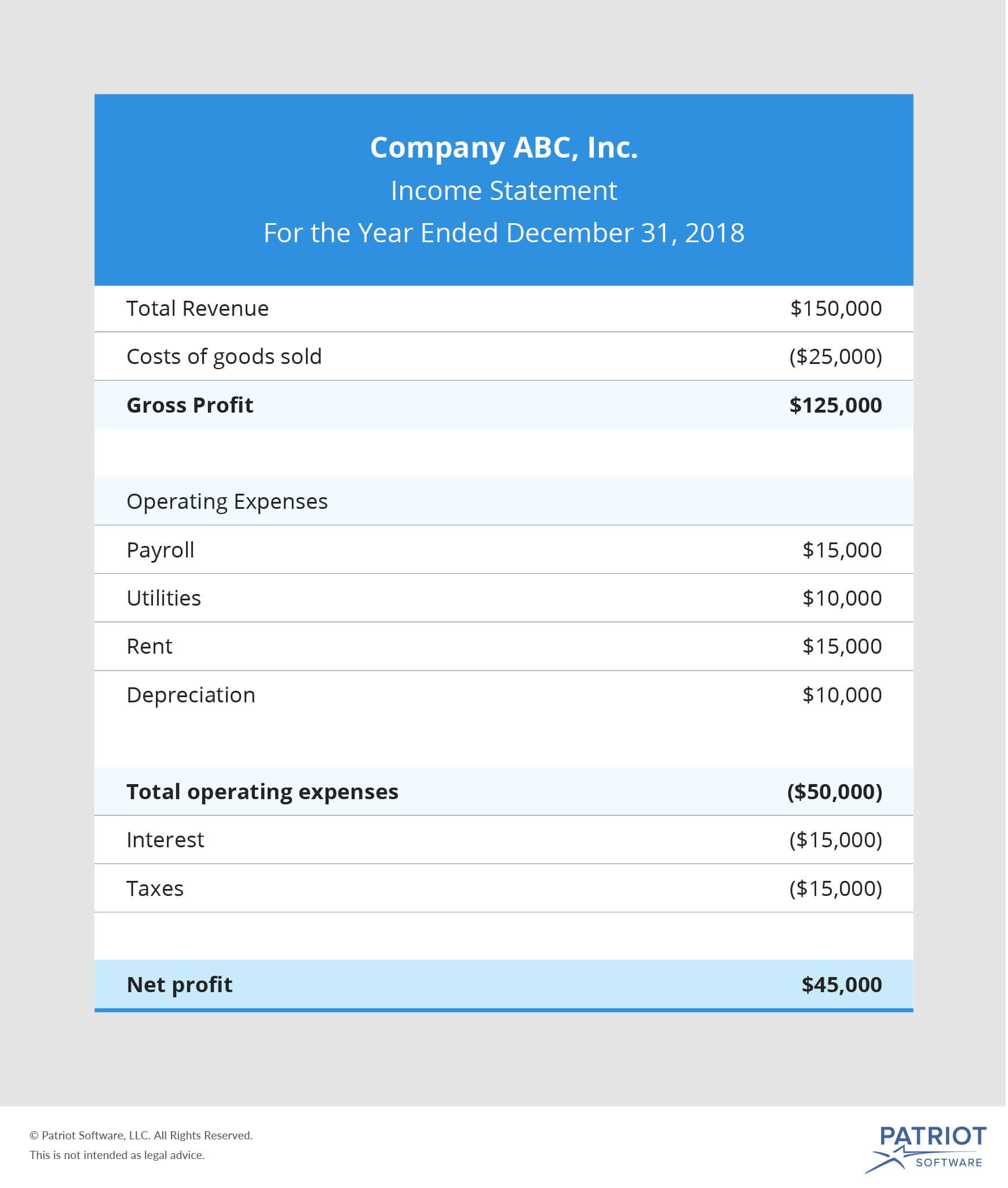

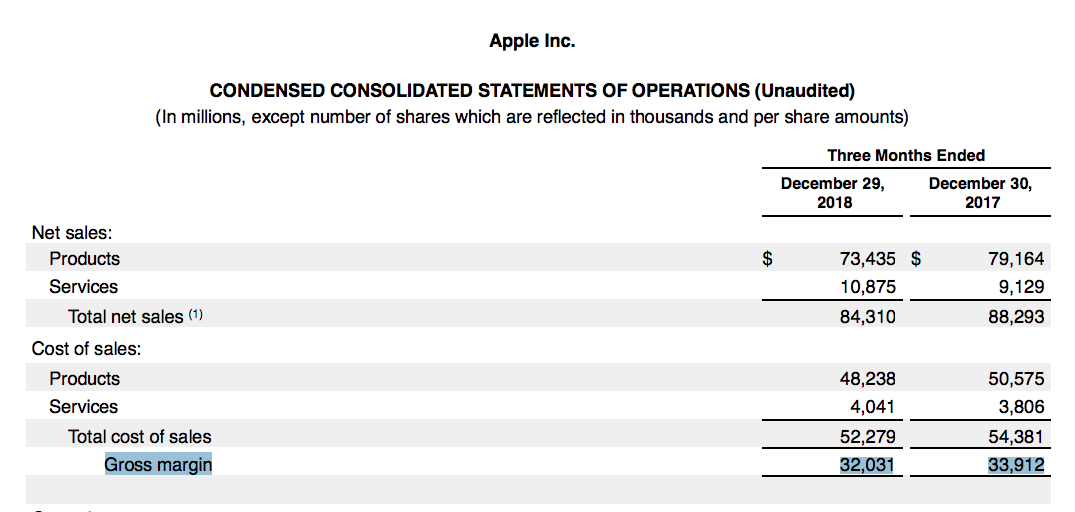

Income statement with gross profit. Net profit is what’s left when all types of expenses are deducted from sales. Aapl) , which refers to the dollar amount, from fiscal years 2019 to 2021, is as follows. Revenue, gains, expenses, and losses.

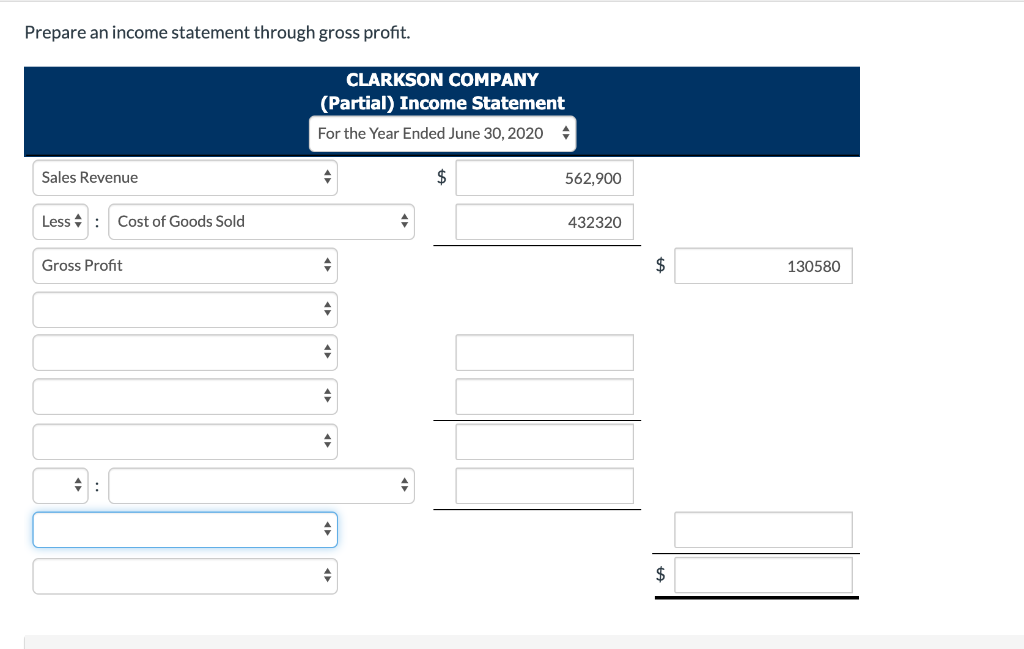

If you are preparing your income statement, you can calculate your gross profit by. Gross profit is calculated by subtracting cost of goods sold from net sales. Comparison of the entity’s profitability with other organizations operating in similar industries or sectors.

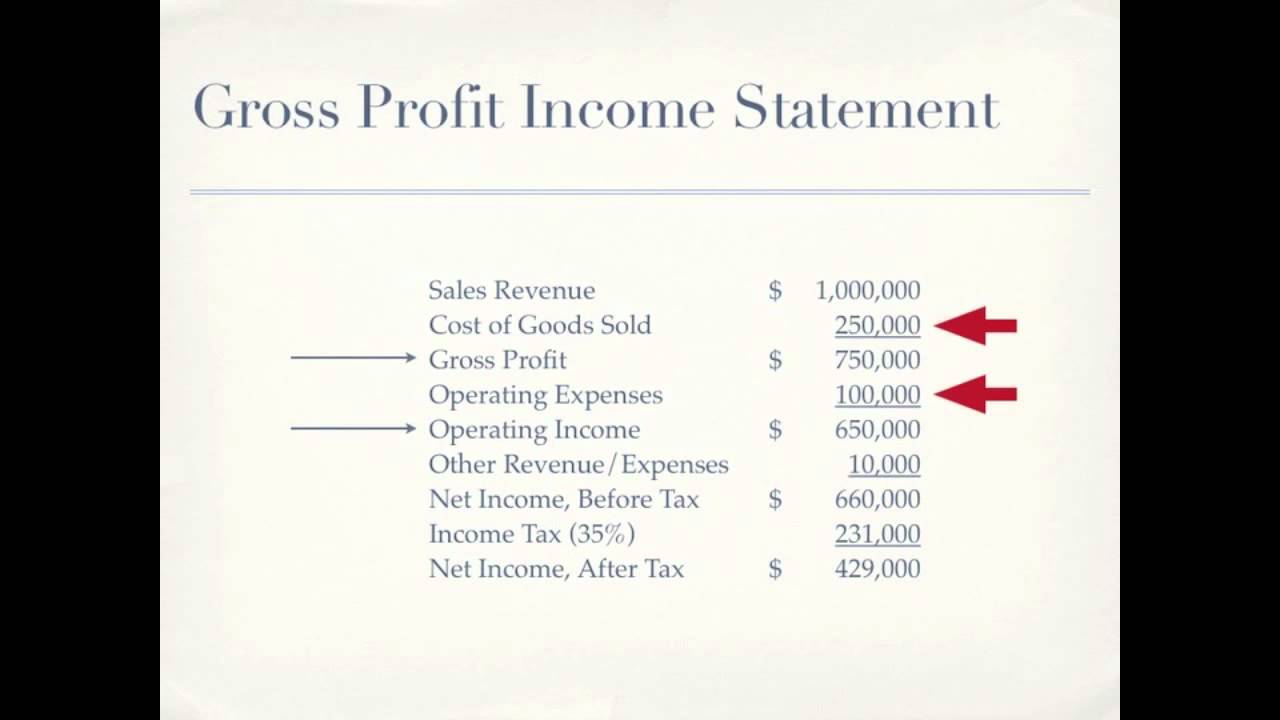

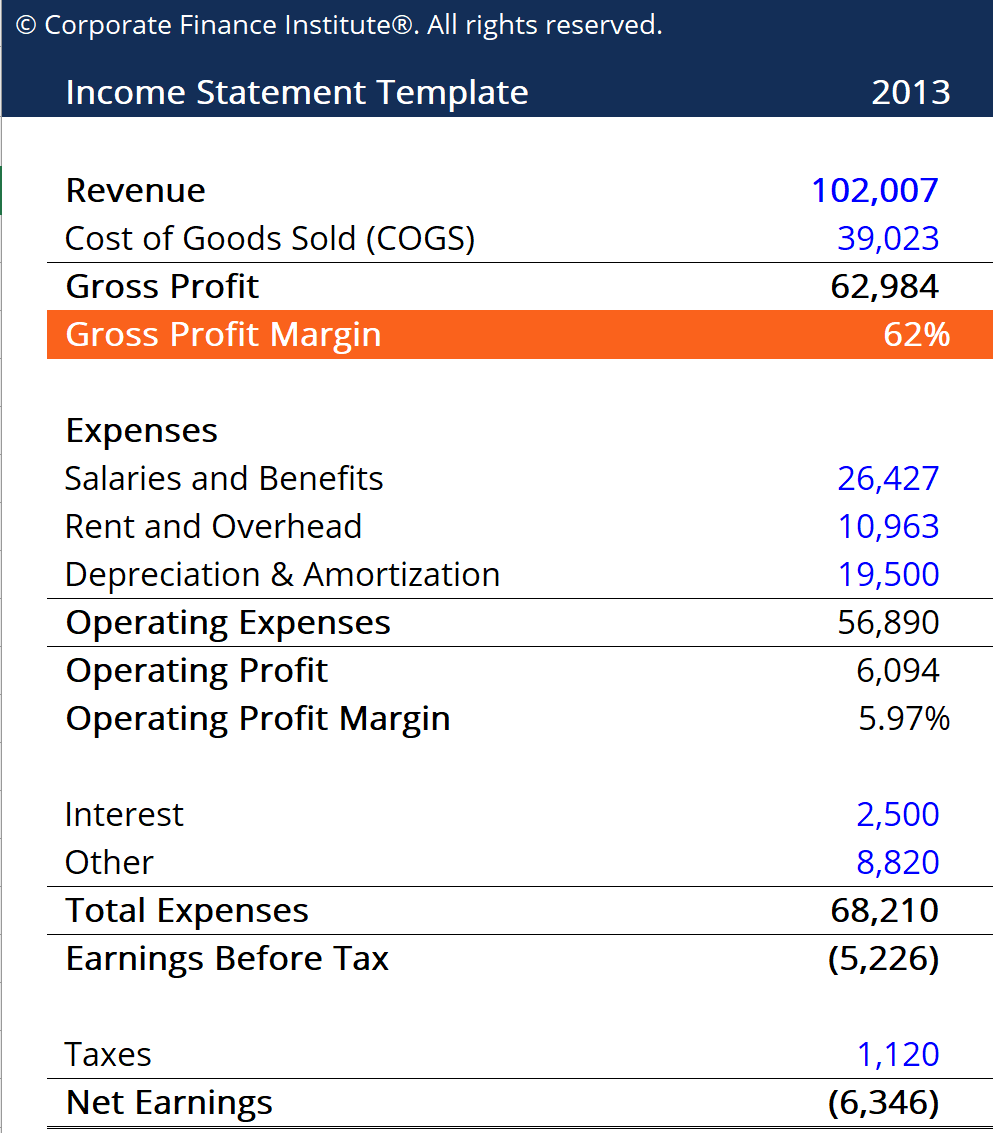

Some of the most common ratios include gross margin, profit margin, operating margin, and earnings per share. Then, it subtracts the costs of making those goods or providing those services, like. Unlike gross profit, the gross profit margin is a ratio, not an actual amount of money.

Reading financial reports for dummies. Using the revenue figure, various expenses, and alternate. Gross profit is typically used to calculate a company’s gross profit margin, which shows your gross profit as a percentage of total sales.

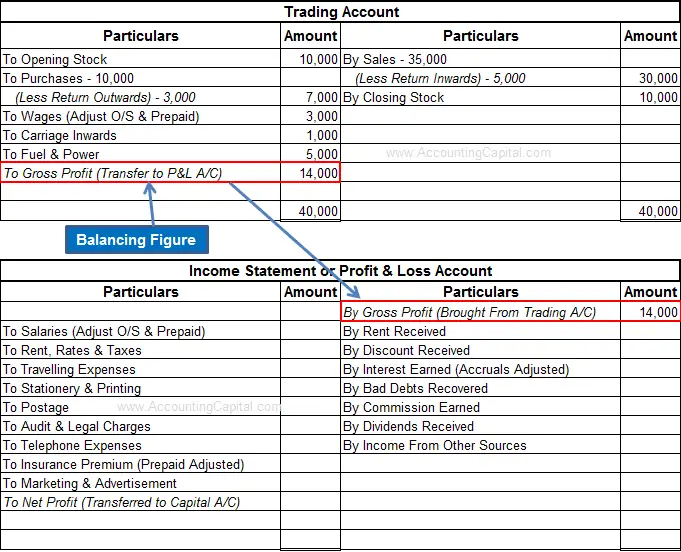

Here’s how to put one together, how to read one, and why income statements are so important to running your business. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

Unlike the balance sheet, the income statement calculates net income or loss over a range of time. These ratios are derived from income statements. Basically, this number shows the difference between what a company pays for its inventory and the price at which it sells.

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. February 24, 2022 this article is tax professional approved how profitable is your business? The price per earnings ratio can help.

The income statement shows gross profit in the line below the cost of goods sold. Learn more what is an income statement? Gross profit minus operating expenses;

An income statement is a profitability report. These are used to calculate the company’s gross profit profit profit is the earnings that remain after you deduct expenses from revenues. The only way to really know is to create an income statement.

Total operating expenses = selling expenses + administrative expenses; Revenue minus costs of goods sold; Formula for calculating gross profit.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)