What Everybody Ought To Know About Other Receivables In Balance Sheet

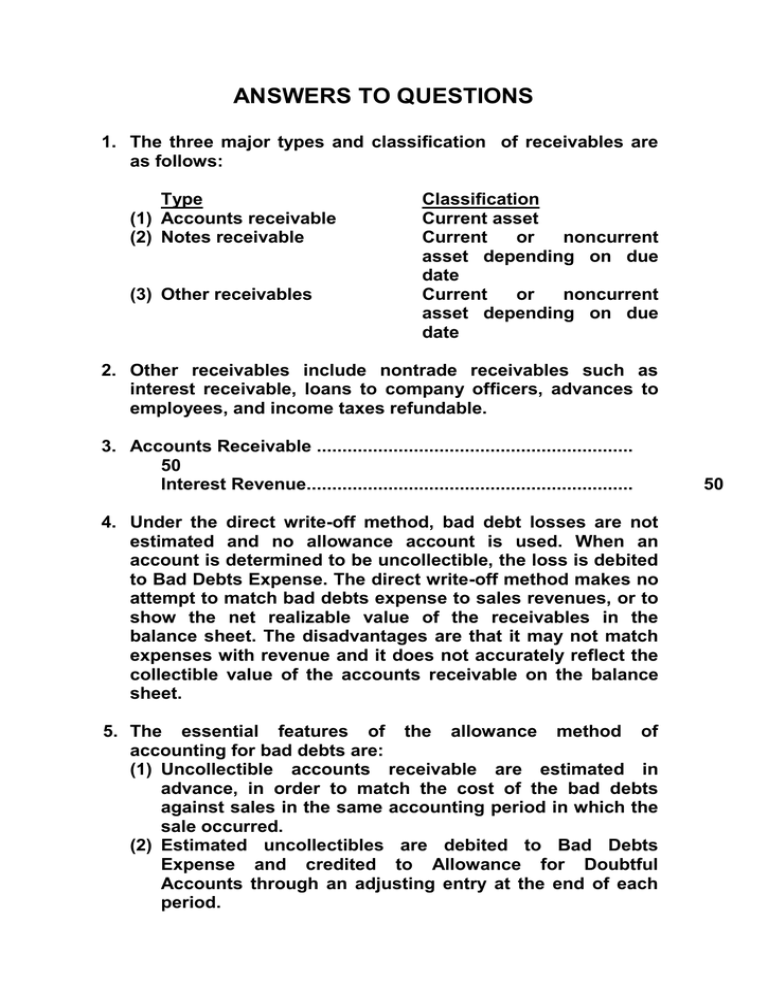

The money owed from customers that paid using credit.

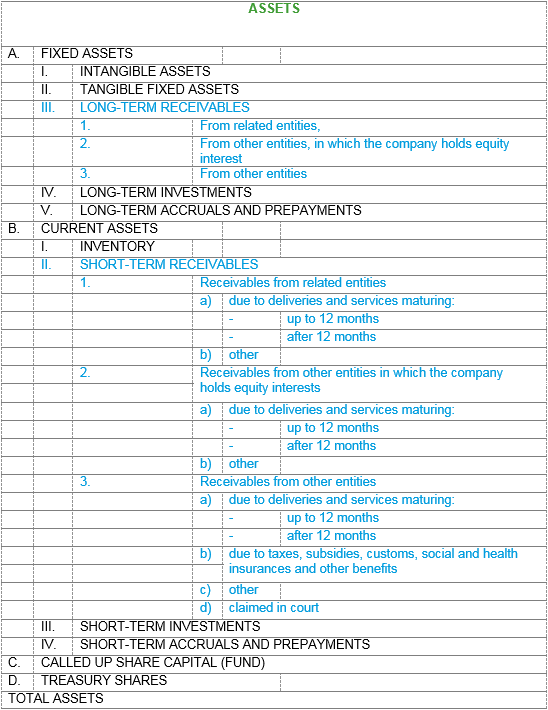

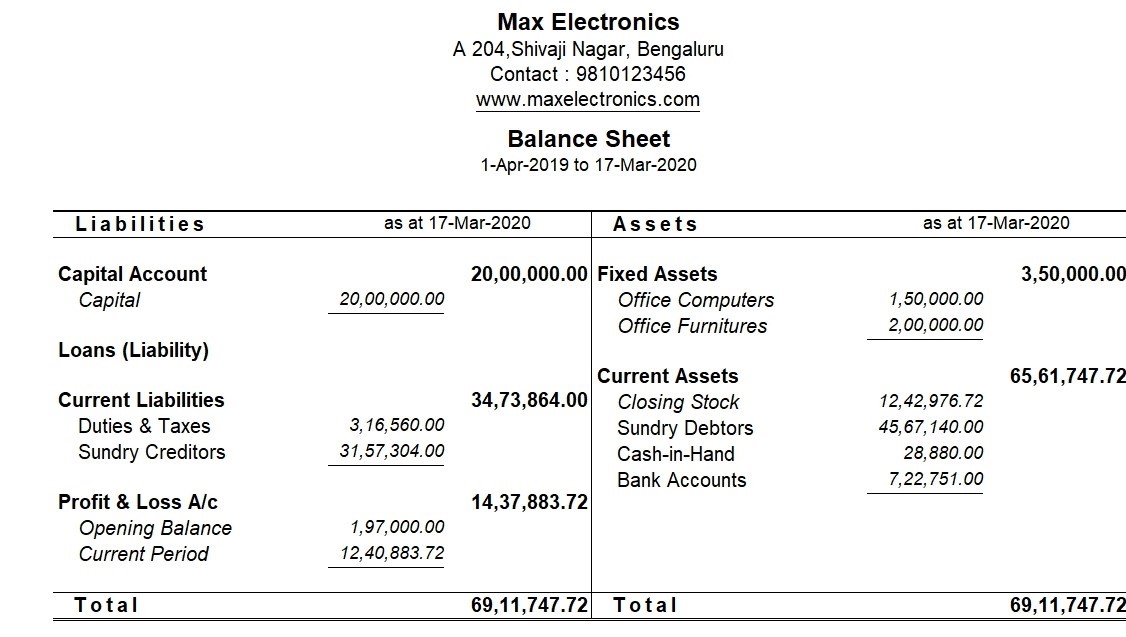

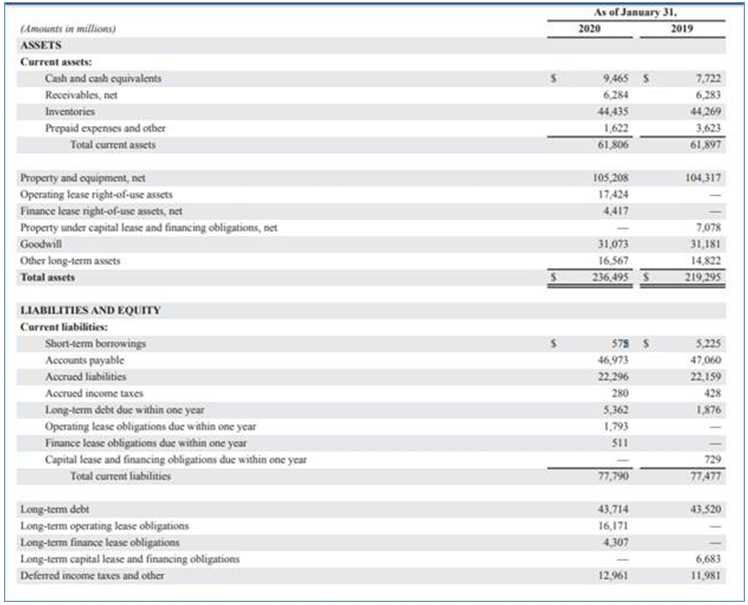

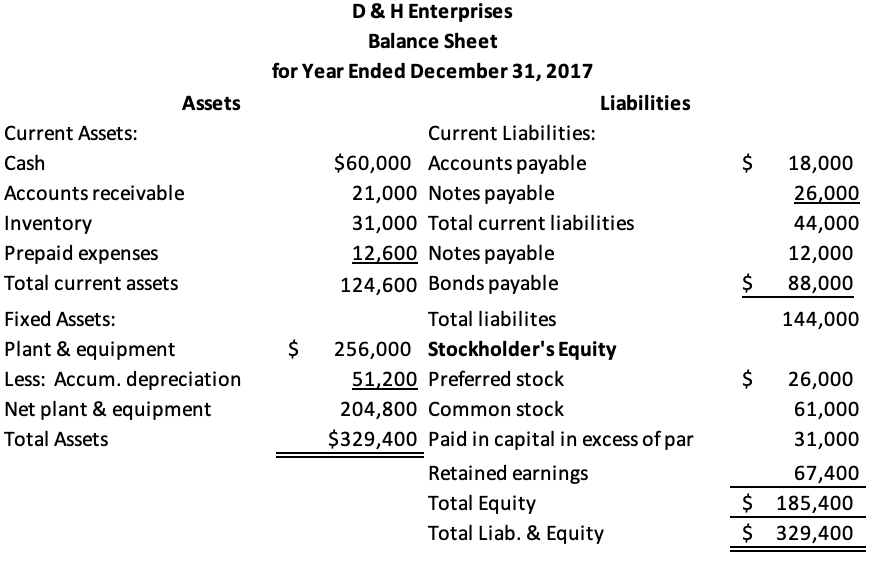

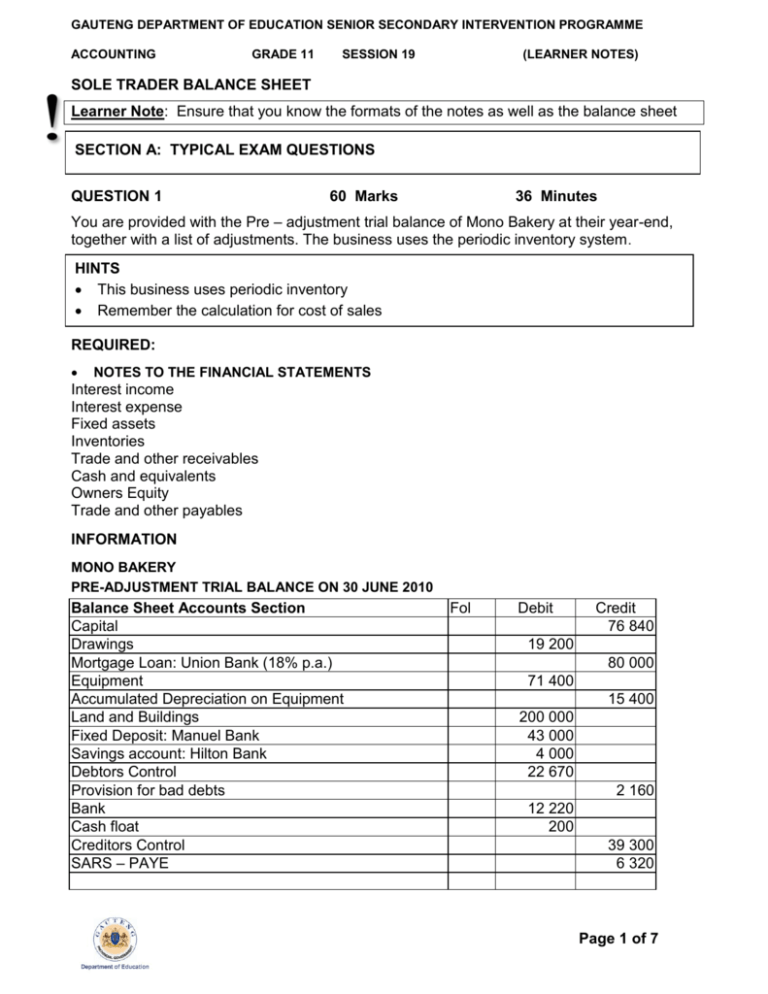

Other receivables in balance sheet. What kind of account is accounts receivable? A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. On the balance sheet of the lender (payee), a note is a receivable.

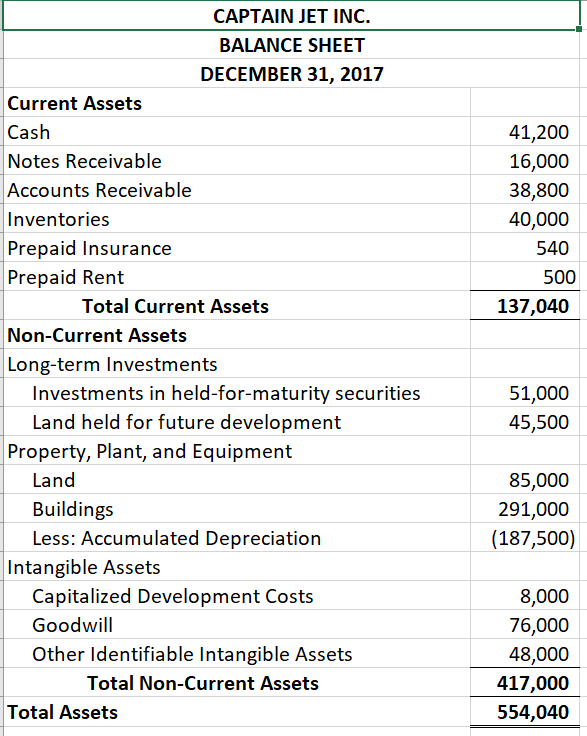

Unearned discounts (other than cash or quantity discounts), finance charges, or prepaid interest should be reflected as deductions from the related receivable. Receivables that are held for sale should be presented separately on the balance sheet from other receivables. The reported amount on the retailer's balance sheet is the cost of merchandise that was purchased, but not yet sold.

Another example of other receivables is a corporation's income tax refund related to its recently filed income tax return. Inventory is likely the largest current asset on a retailer's or manufacturer's balance sheet. Ar is any amount of money owed by.

Example from vodafone group plc annual report 2018: On the other hand, it had cash of us$25.0b and us. In general, receivables are claims that a company has against customers and others, usually for specific cash receipts in the future.

Other receivables are characterized as uncommon or insignificant. You use accounts receivable as part of accrual basis accounting. Is other receivables debit or credit?

A customer may give a note to a business for an amount due on an account receivable, or for the sale of a large item such as a refrigerator. Therefore, they appear as “trade and other receivables” in the balance sheet. Each of these balance sheet components can tell a story.

It is the quickest asset to convert to cash; Trade and other receivables are categorized or classified as current assets on the company’s. Here are a few ratios to consider:

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. Accounts receivable (ar) is an asset account on the balance sheet that represents money due to a company in the short term. Next to cash, accounts receivable is the most important number on the balance sheet.

Accounts receivable is created when a company lets a buyer. June 10, 2022 calculating accounts receivable on the balance sheet is not a formula, rather it is the sum of all unpaid credit invoices that have been issued to customers. Receivables are listed as assets on the balance sheet and are a significant component of a company’s financial status.

What is the journal entry for accounts receivable? Accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Receivables are asset accounts applicable to all amounts owing, unsettled transactions, or other monetary obligations owed to a company by its credit customers or debtors.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)