Breathtaking Info About Equity Share Capital Is Current Liability

How to calculate shareholders’ equity shareholders’ equity is the owner’s claim when assets are liquidated and debts are paid up.

Equity share capital is current liability. Combine them, and you get your total. For instance, if a preference. Shareholder equity (se) is a company's net worth and it is equal to the total dollar amount that would be returned to the shareholders if the company must be.

This is an increase of around $20 billion from the year prior. Equity share capital means the capital raised by a company by issuing the shares to the general public. Debts you owe within the next 12 months.

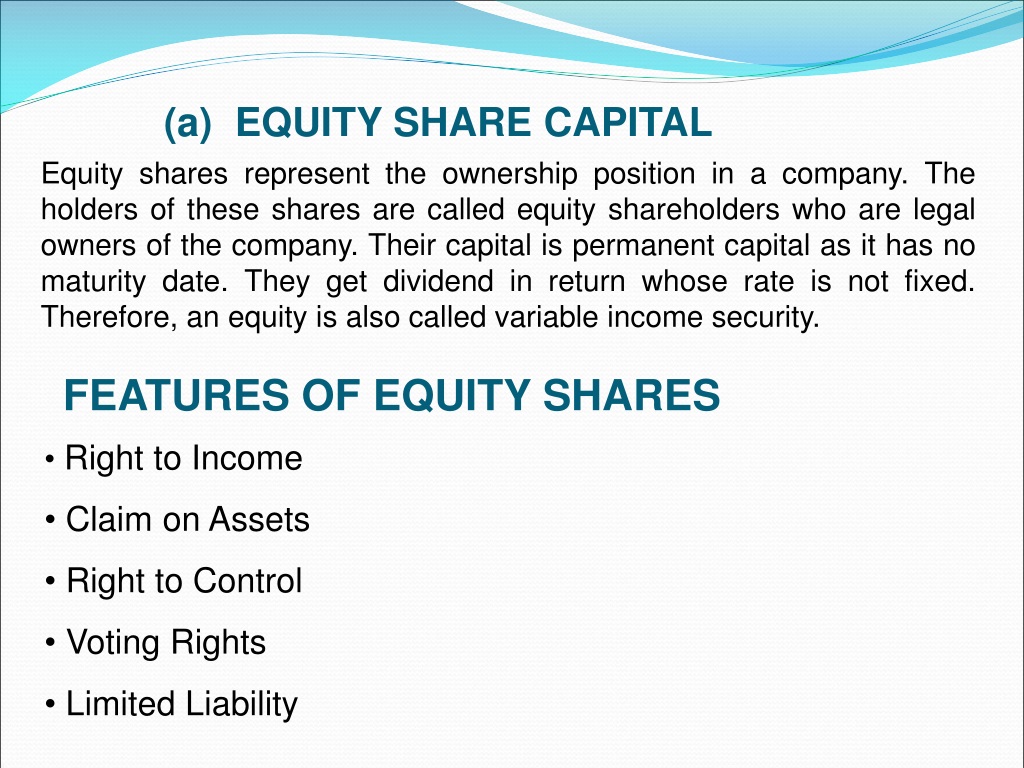

Stockholders' equity is the remaining amount of assets available to shareholders after paying liabilities. Learn more in detail about what is equity share capital & how to calculate equity share capital, along with their meaning, types, and formula, at upstox.com. Share capital in company law refers to the total value of funds raised by a company through the issuance of shares to its shareholders.

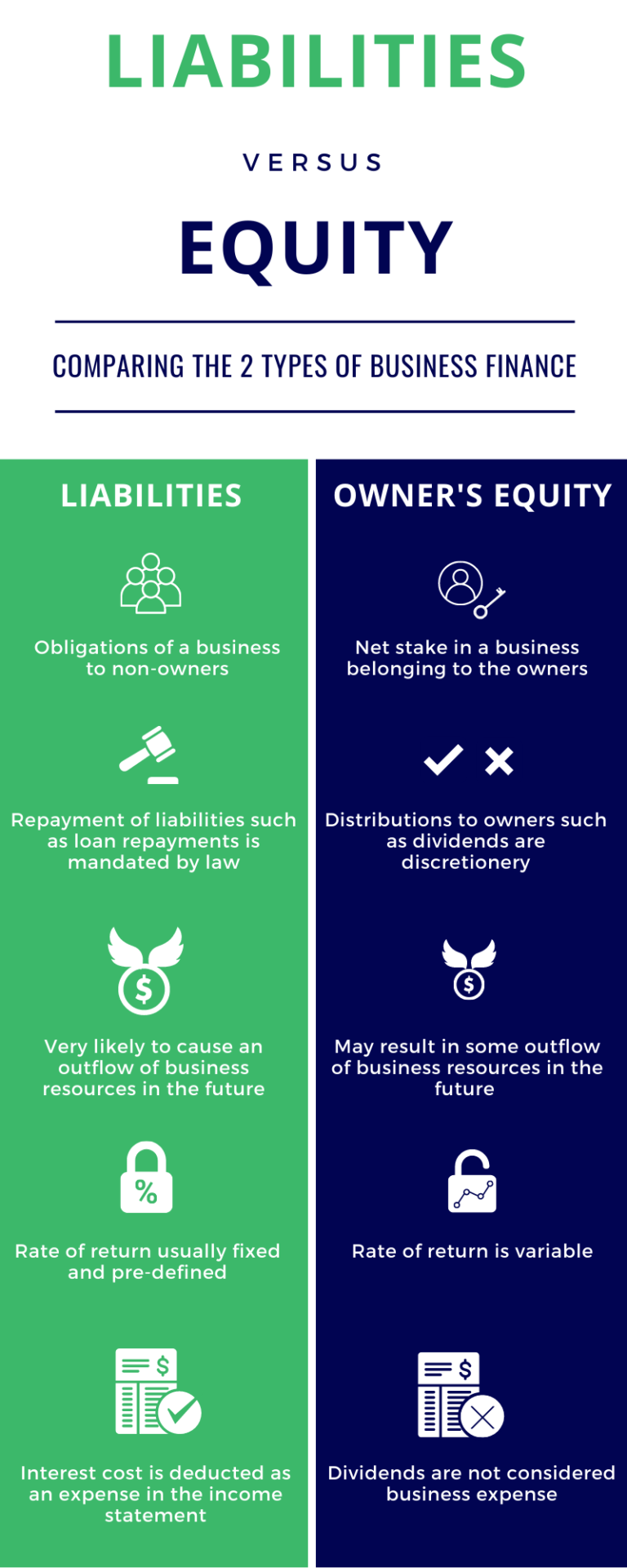

Equity, also known as owner’s equity, is the difference between the total assets and total liabilities of a business. The equity share capital is also the difference between the total assets owned by the company minus all the liabilities on the balance sheet. Equity share capital is the money raised by a company for its capital.

Current liabilities totaled $125.483 billion for the period. Learn how to calculate stockholders’ equity. Divided into equity share capital, preference share capital, reserves, surplus, etc.

To determine whether a preference share is a liability or an equity instrument, the standard definitions should be applied. Share capital is the owners’ contribution or the funds raised by issuance of shares whereas liabilities are the amounts owed by the company to other entities. It is not a liability.

As companies need to improve their net asset position either to secure additional funding, to strengthen their balance sheet, or even to. It is at the company’s discretion to pay a dividend; Converting liabilities to equity.

The company is obliged to repay the owners as it is an internal liability and interest on. Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of money that would be returned to a. For example, if a business has total assets worth $100,000 and.

Equity share capital is also known as risk capital. Below are some of the highlights from the income statement for apple inc. Equity is the fund of the.

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)