Brilliant Strategies Of Tips About Dividend Received In Profit And Loss Account

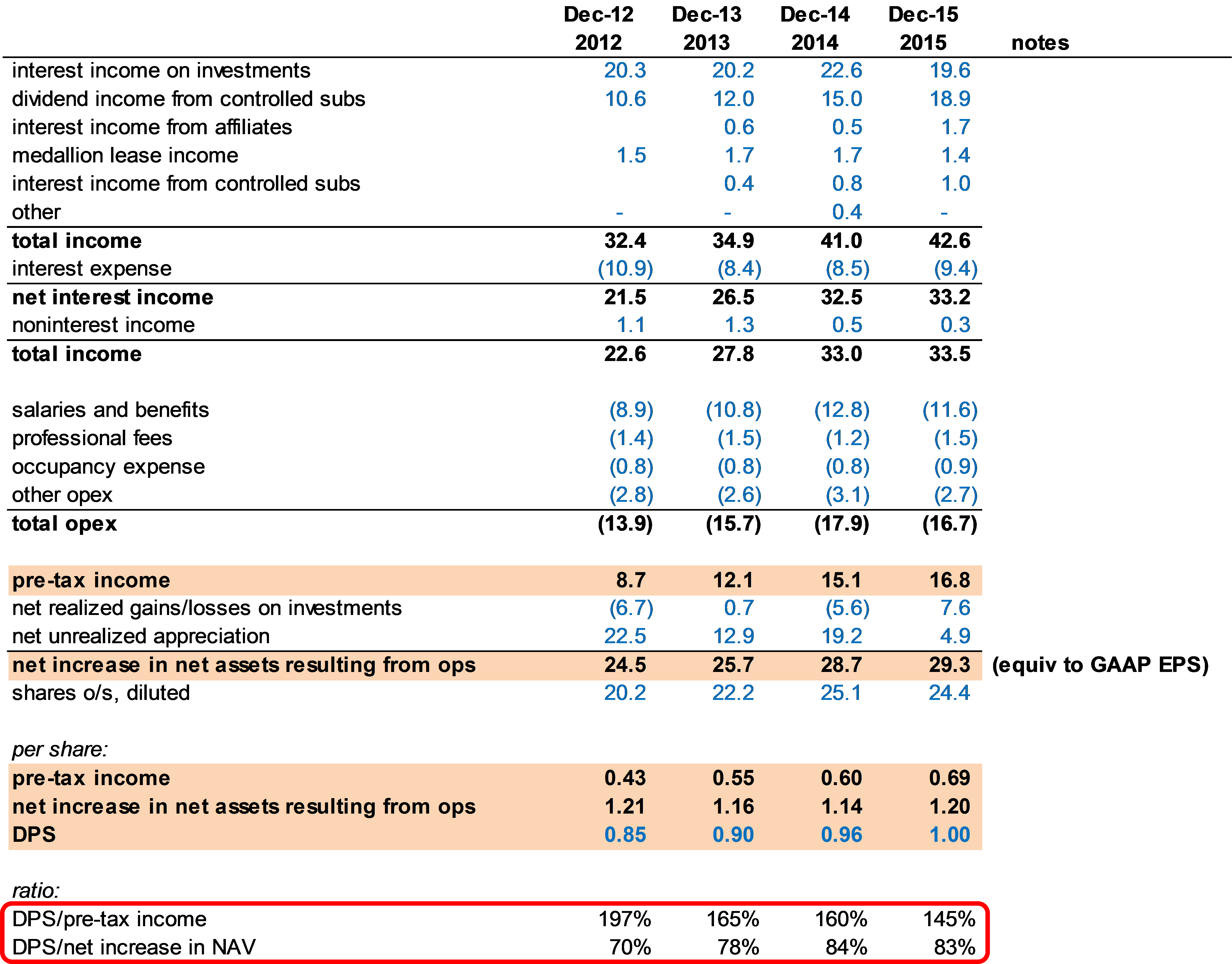

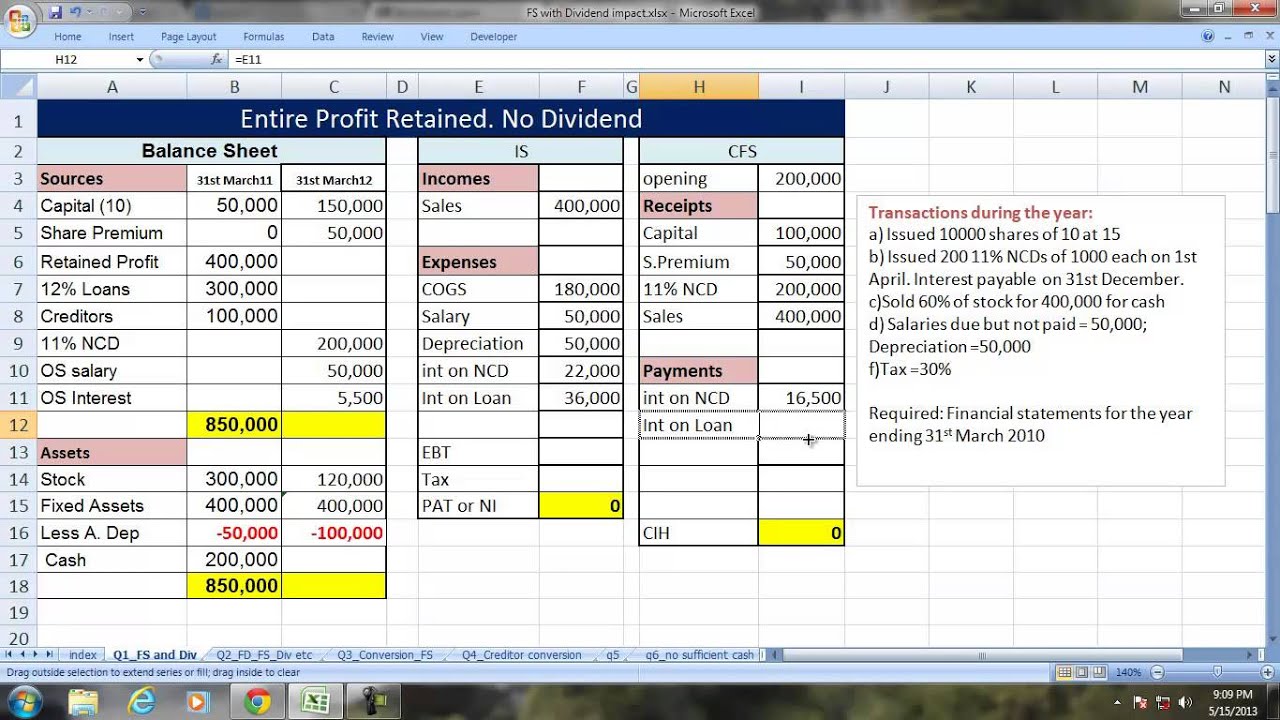

The dividend account acts as part profit and loss account and part balance sheet account.

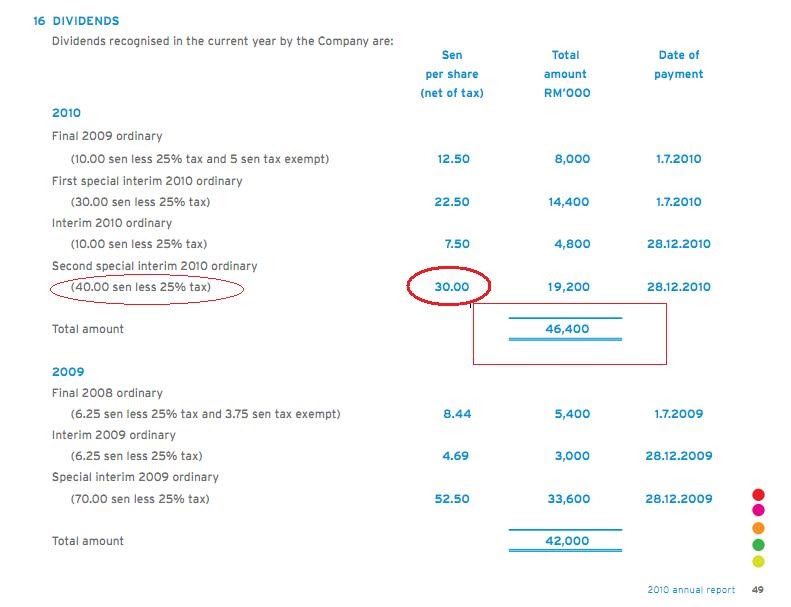

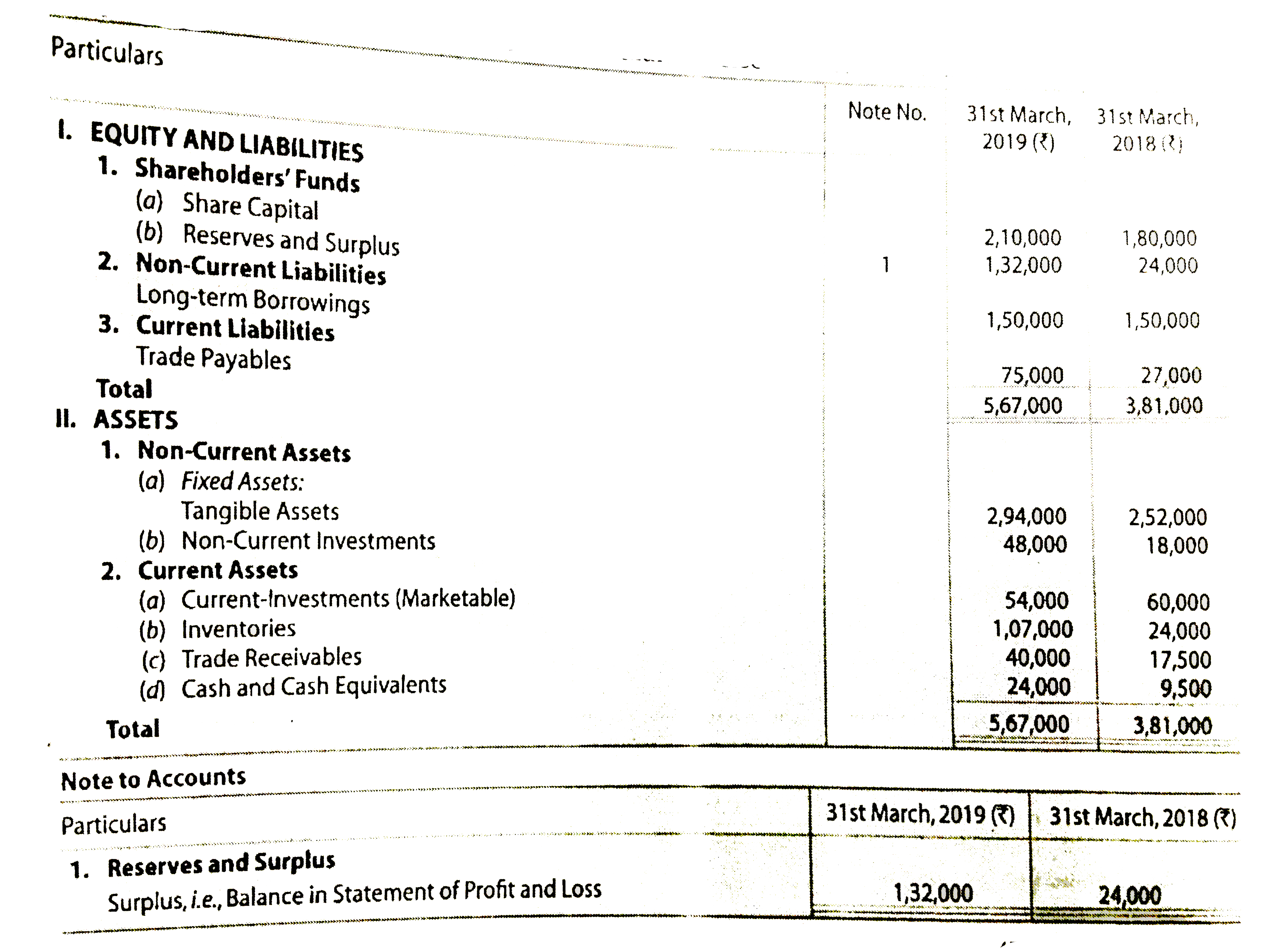

Dividend received in profit and loss account. Dividends in the balance sheet. Companies are not required to issue dividends on. Dividends that were declared but not yet paid are reported on the balance sheet under the heading.

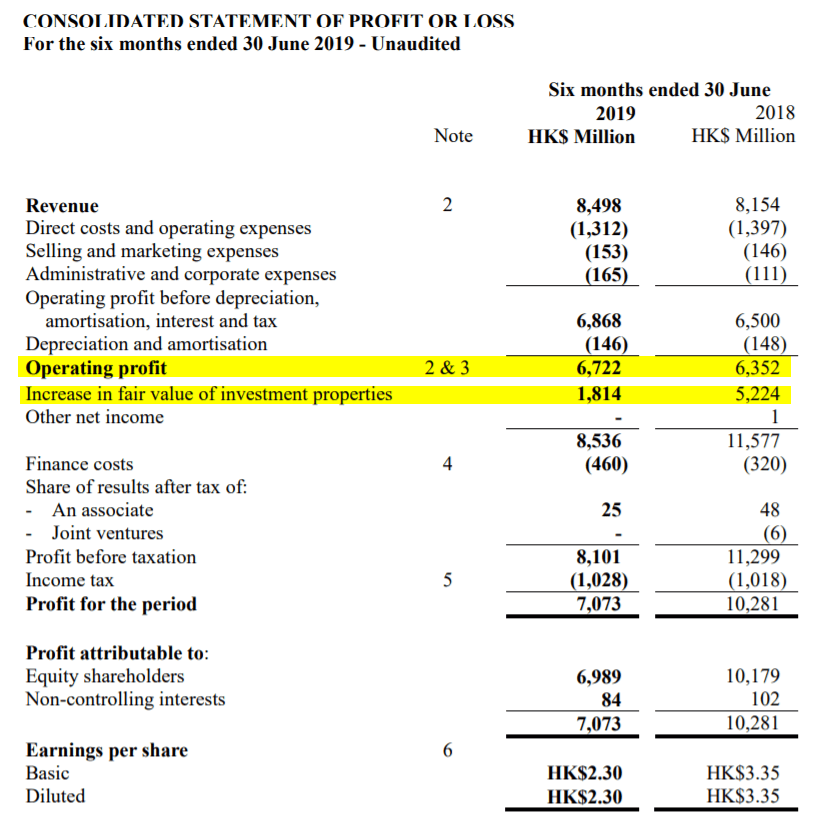

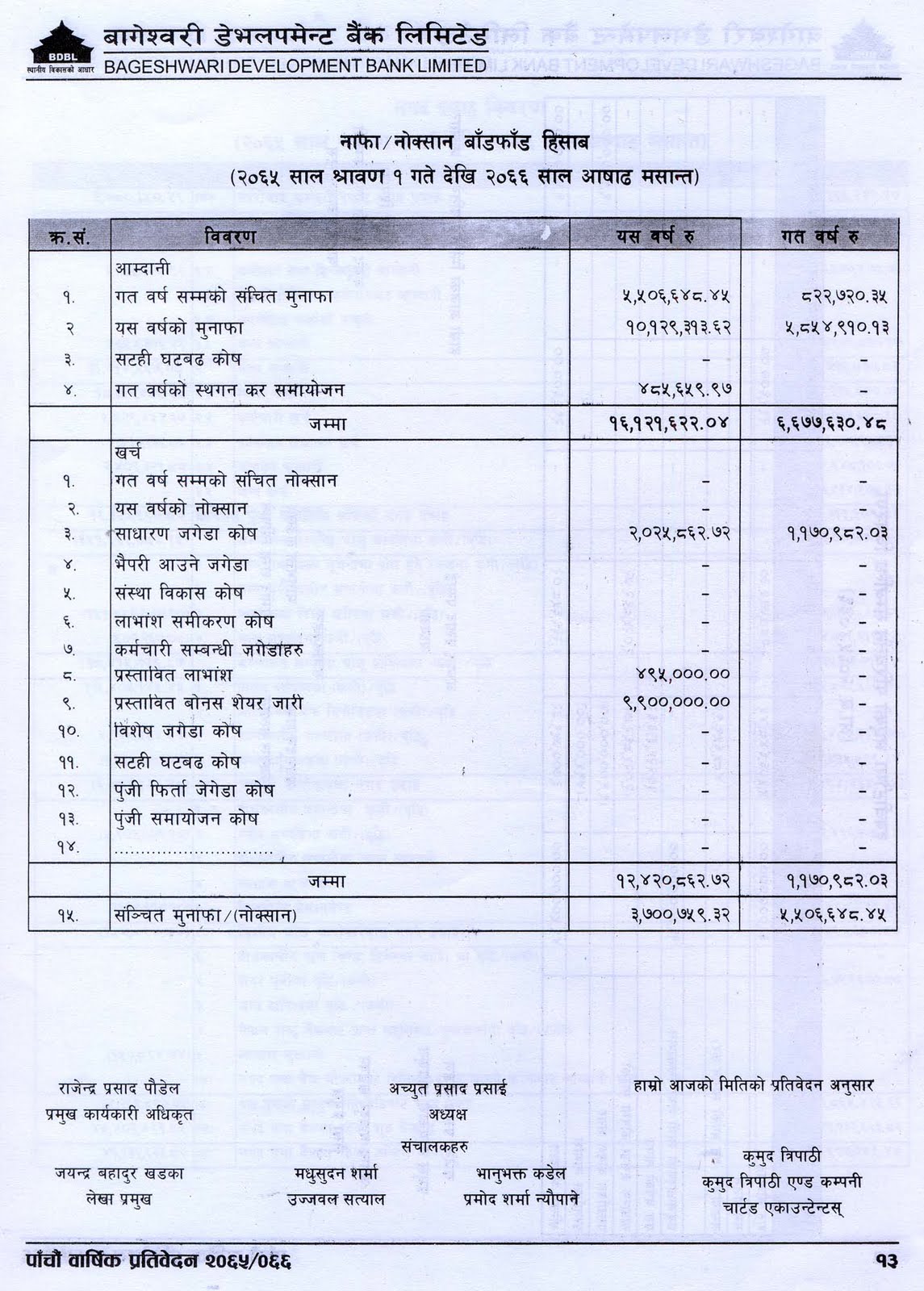

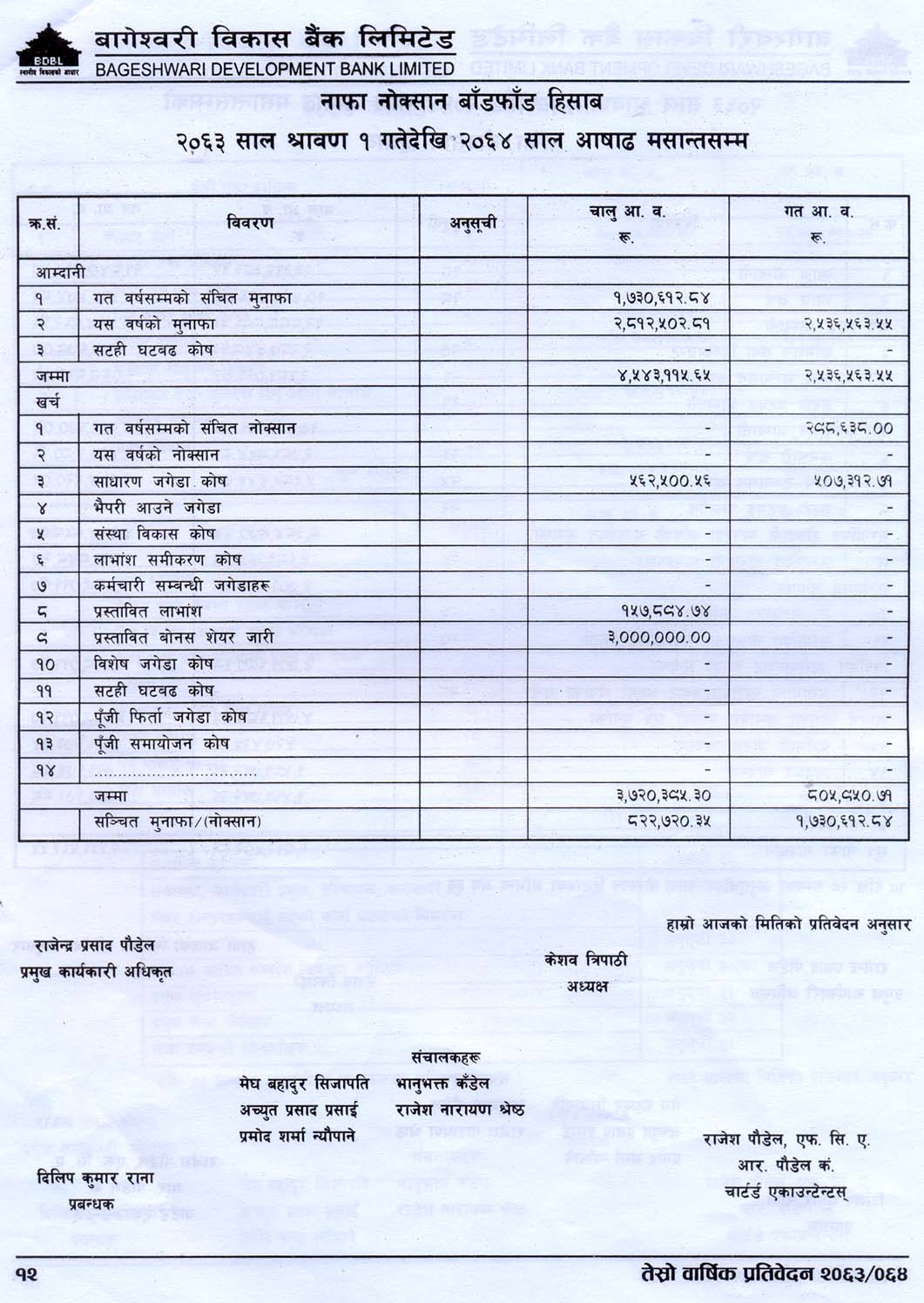

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. The amount allocated for the dividend, which is part of the appropriation of your profit, should appear on the profit and loss report after the net profit amount. Paying the dividends reduces the amount of retained earnings stated in the balance sheet.

Under company law, a company may only pay a dividend out of distributable profits. Statement of stockholders' equity as a subtraction from retained earnings. Stock dividends do not change the asset side of the balance sheet —only reallocates retained earnings to common stock.

A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment. The first step is when the board of directors of the. So if a company had £10,000 undrawn profits at the start of the year and had made £1,000 of profits after tax so far this year, they might want to pay a dividend of £11,000 but it.

Before dividends are paid, there is no impact on the balance sheet. Photo by gavin young/postmedia. Dividend received journal entry holding shares of less than 20%.

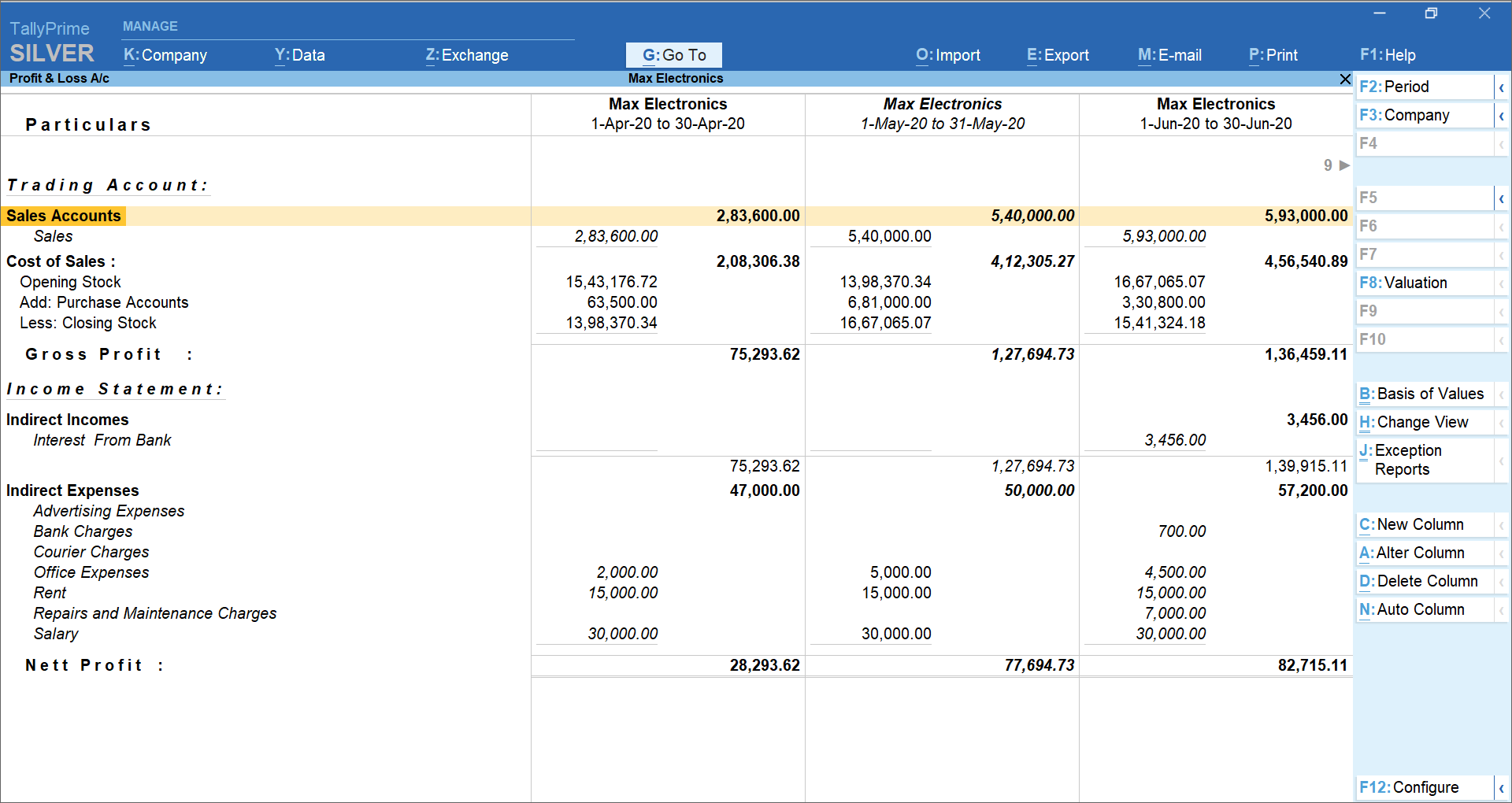

What are accounting enteries for dividends received from a subsidiary by a parent company ? What is the profit and loss statement (p&l)?

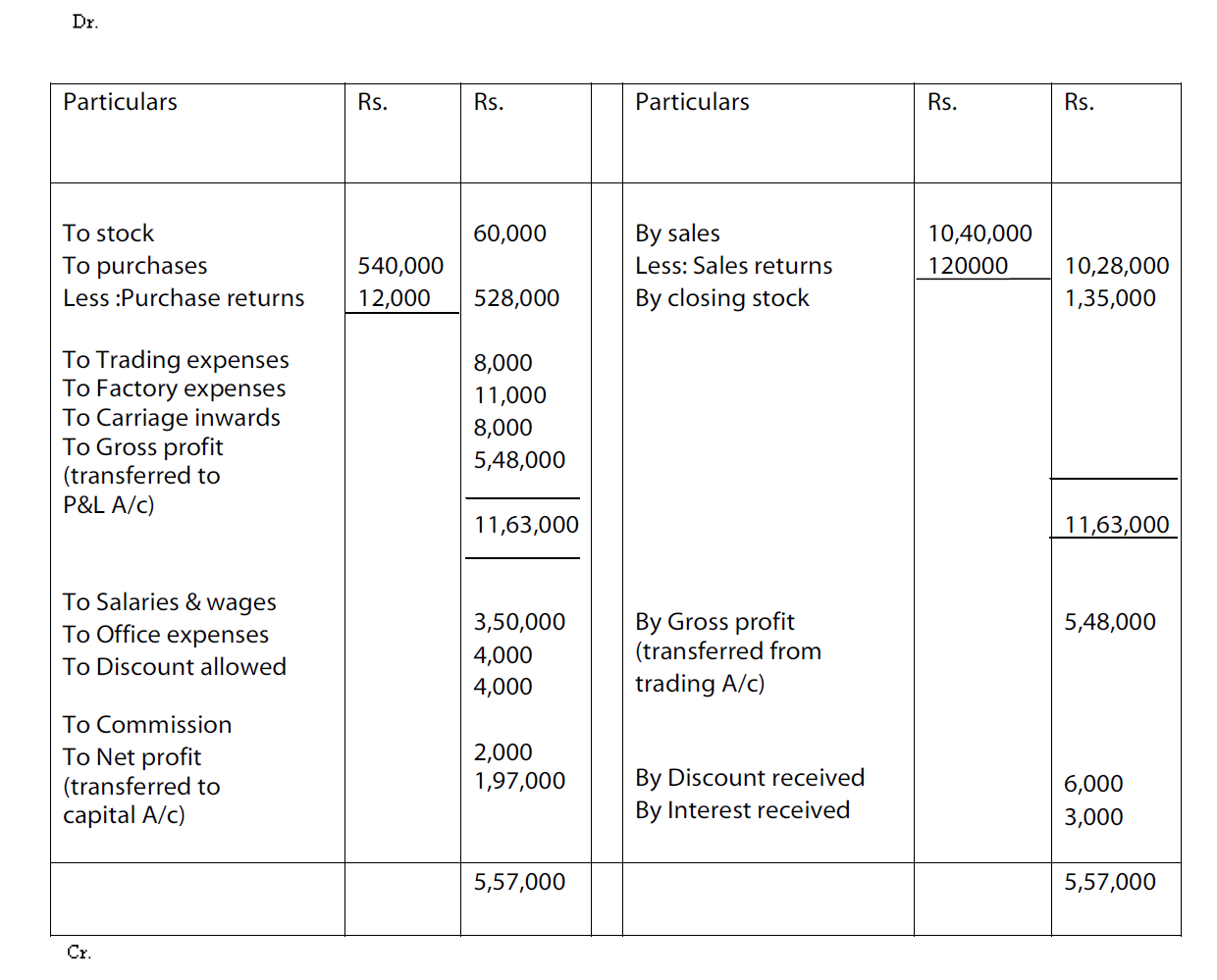

It is possible to edit the p&l layout and put dividends paid into its own group, which would allow you to have profit after. Only indirect expenses are shown in this account. Accounts to be used in calculating realised profits or losses under the dividend legislation, a company’s realised profits are those included in its ‘relevant.

It does not affect any. Profit and loss account is made to ascertain annual profit or loss of business. The distributable profits of a company, being the accumulated realised profits.

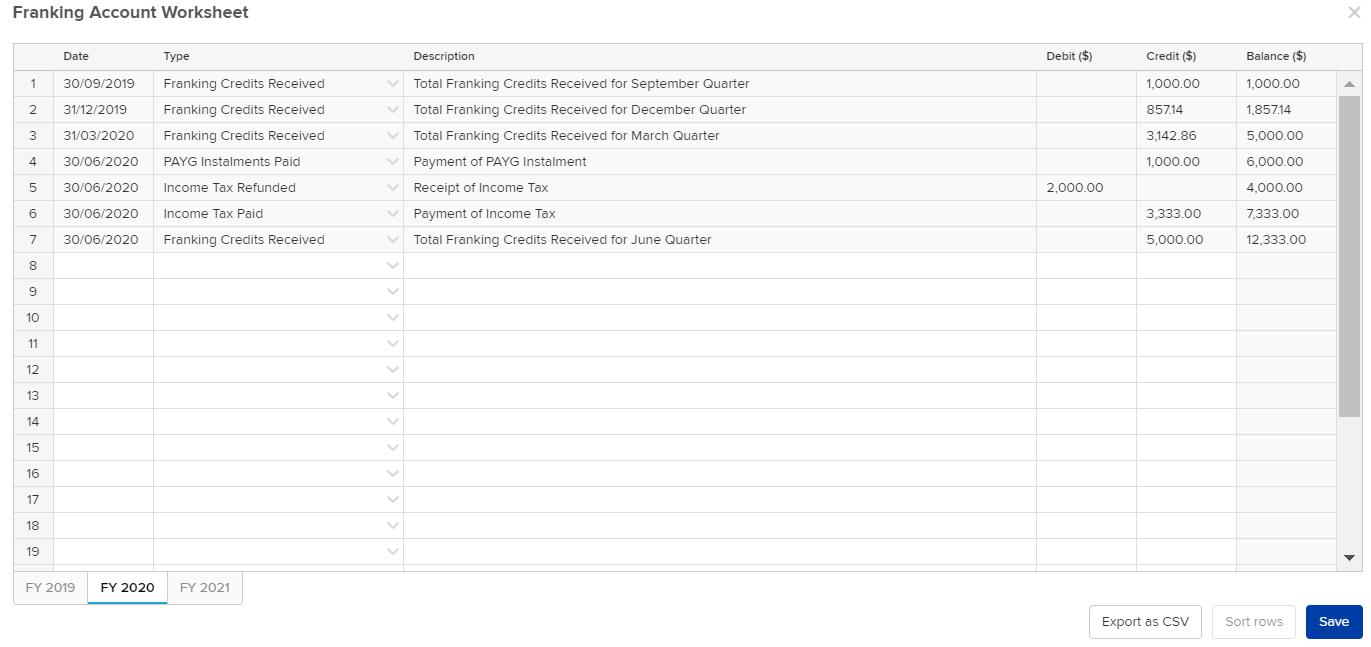

All the items of revenue and expenses. The dividends that a company pays out are recorded and presented in its financial statements in two different steps. Consolidated statement of profit and loss.

Dividends are paid out of profit after tax. I have some shorts questions about accounting treatment for profit and dividend! Cash dividends can be made via.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)