Fabulous Info About Small Business P&l

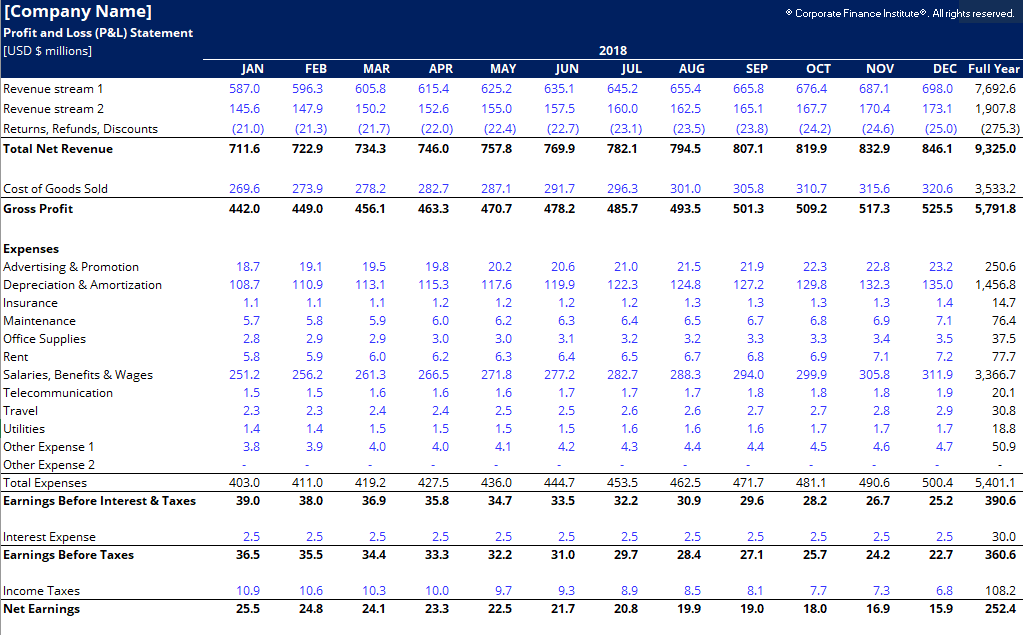

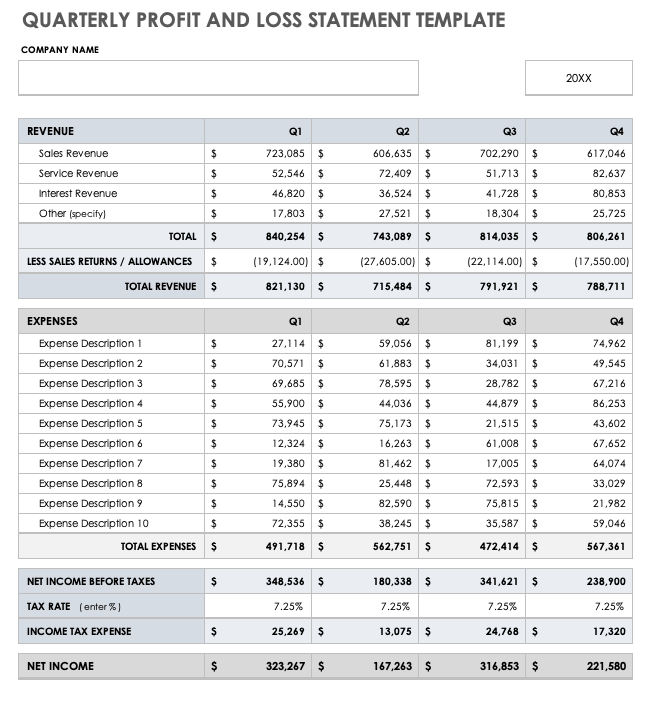

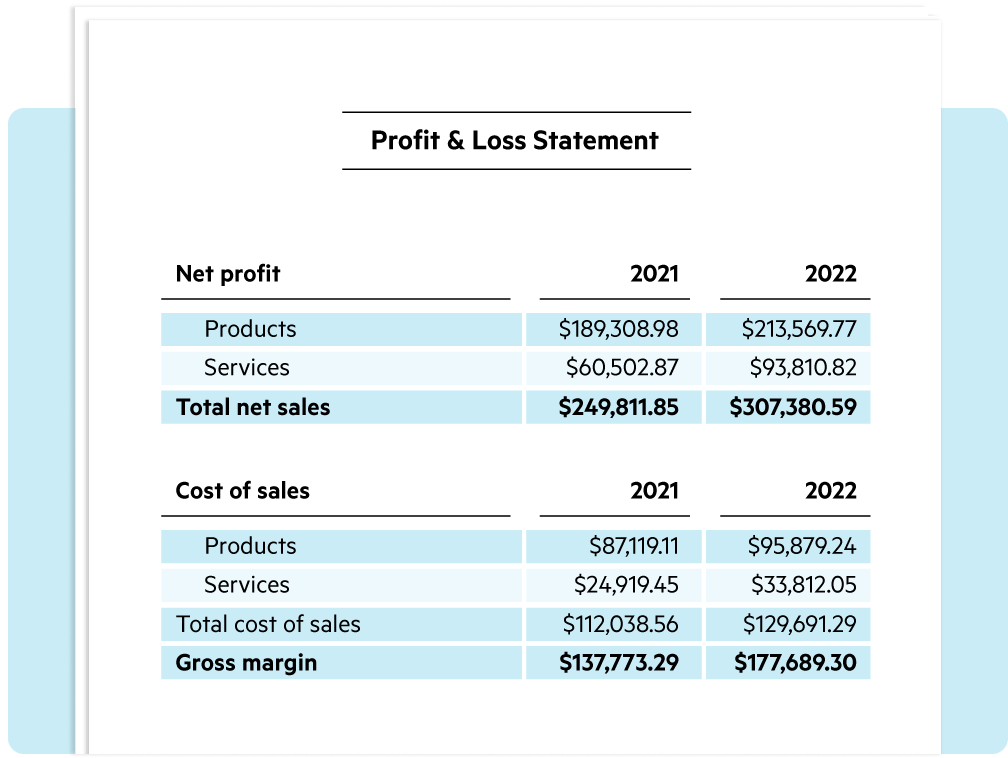

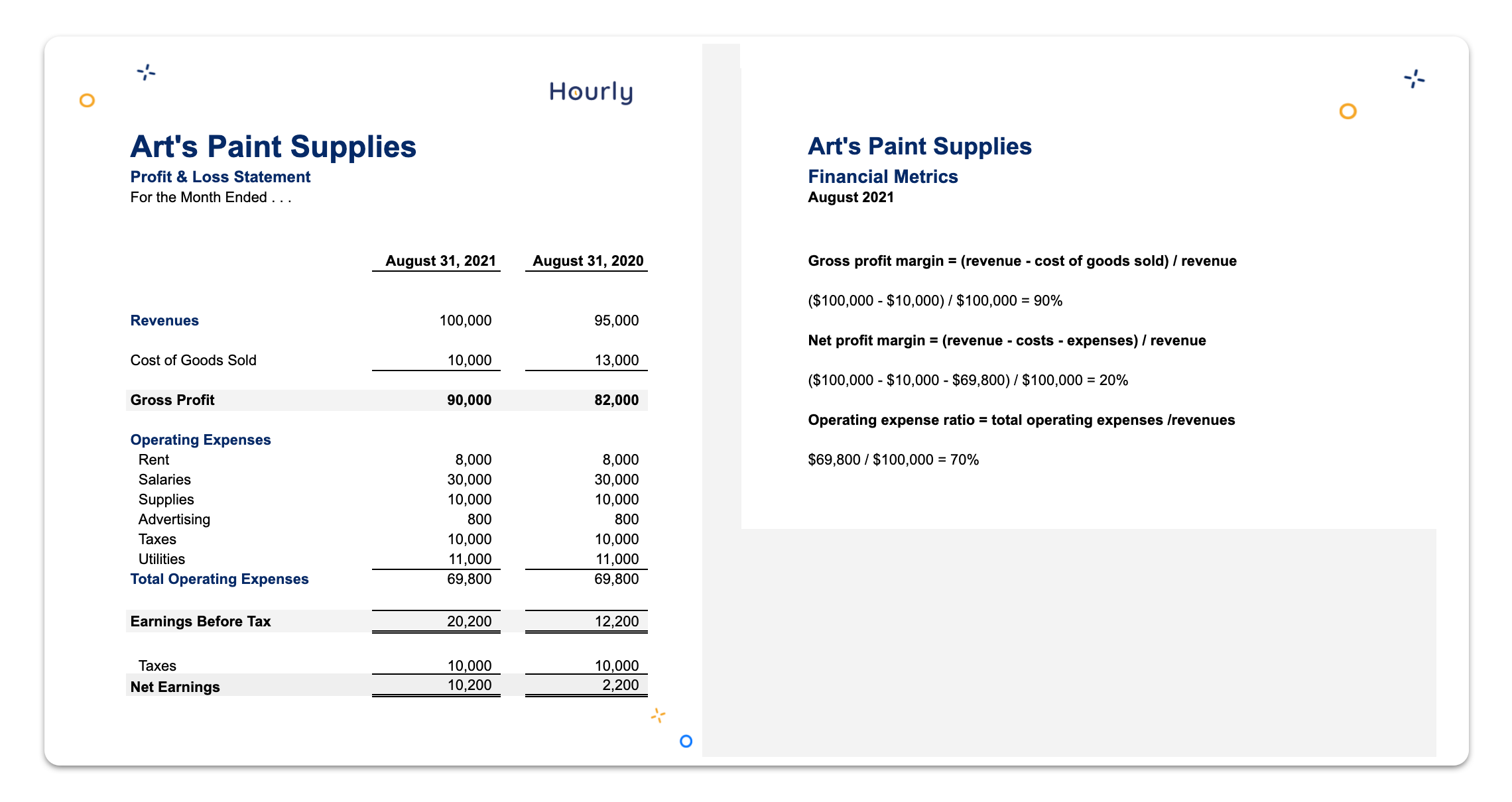

#2 example of profit and loss statement:

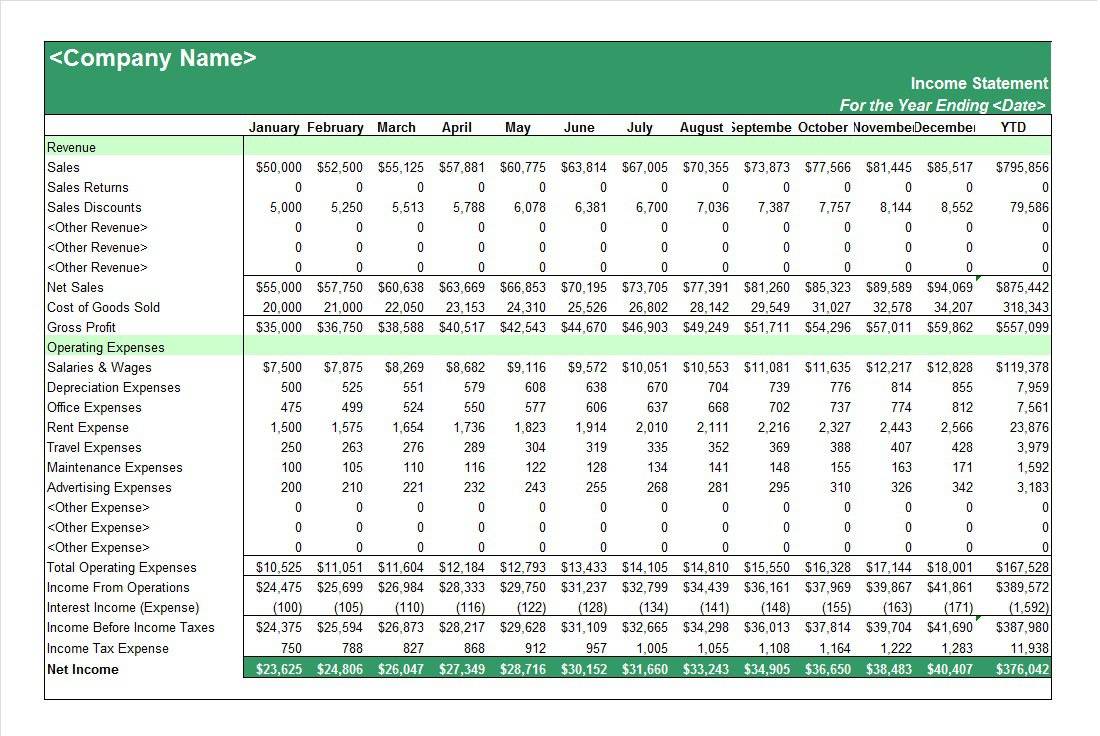

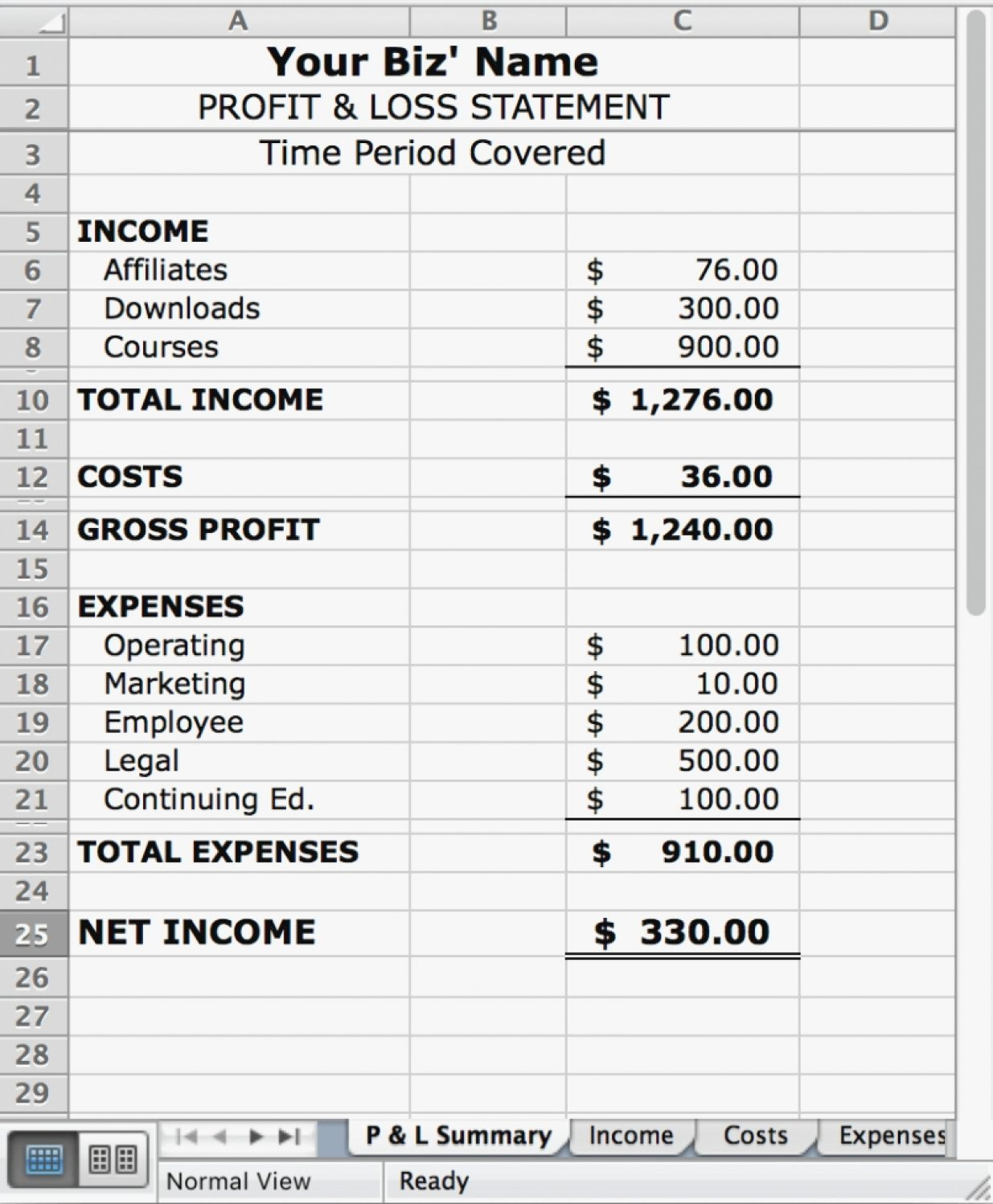

Small business p&l. February 8, 2024 at 1:30 pm pst. A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. You’ll sometimes see profit and loss statements called an income.

To determine net income as a percentage of sales simply divide net income by net revenue then multiple your result by 100. Wall street struggled to gain traction, with the bond market digesting another big sale of treasuries and stocks hovering near records. A profit and loss statement (p&l) is an effective tool for managing your business.

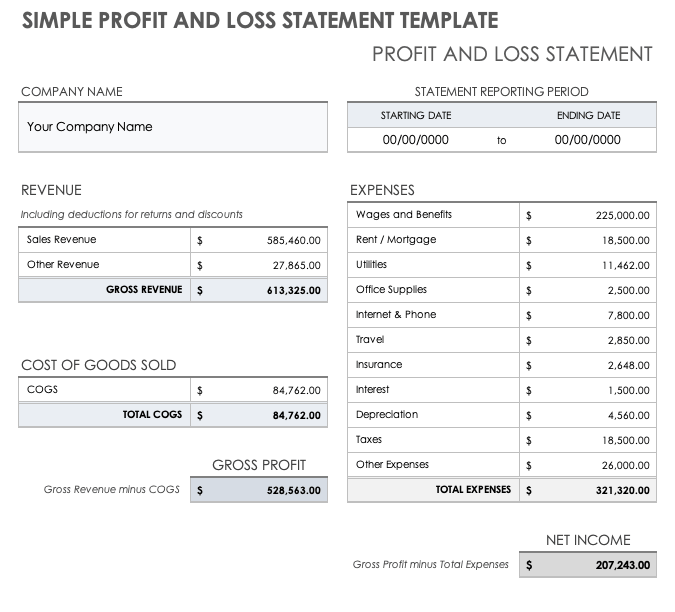

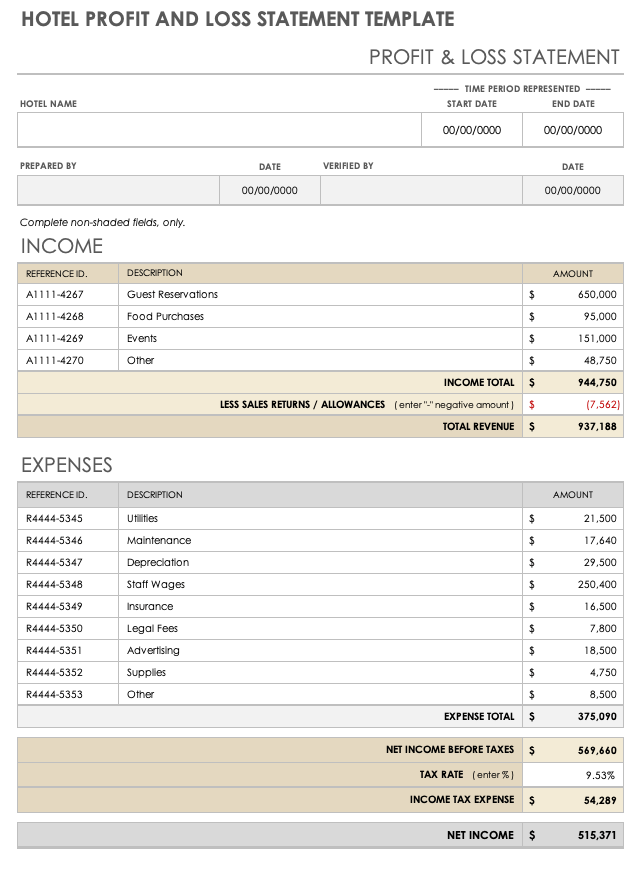

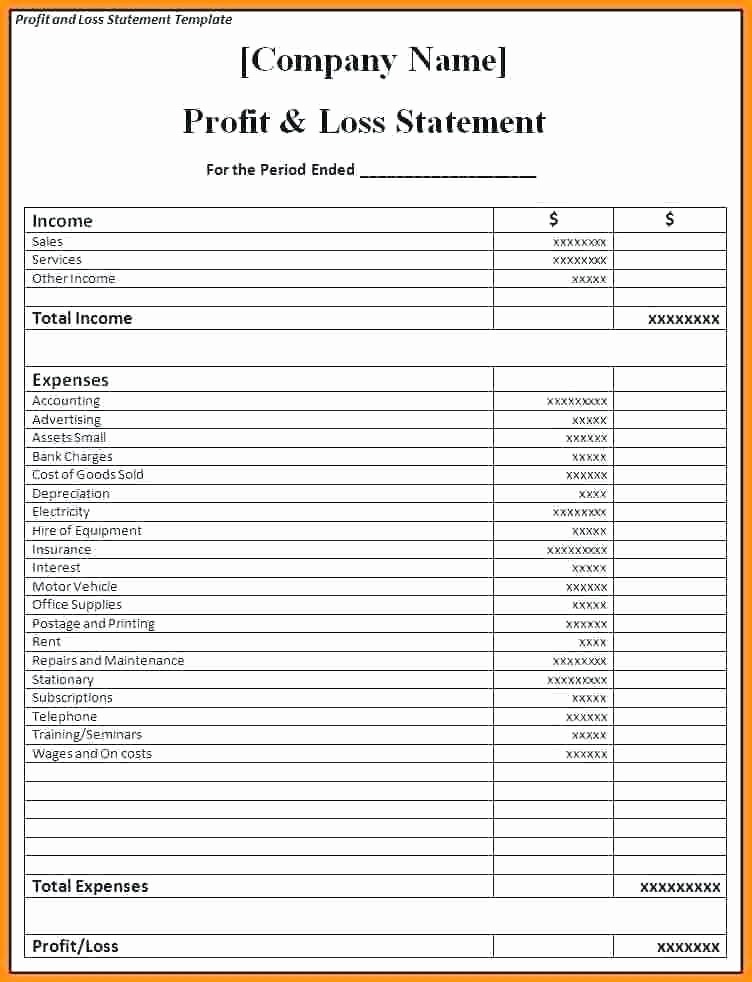

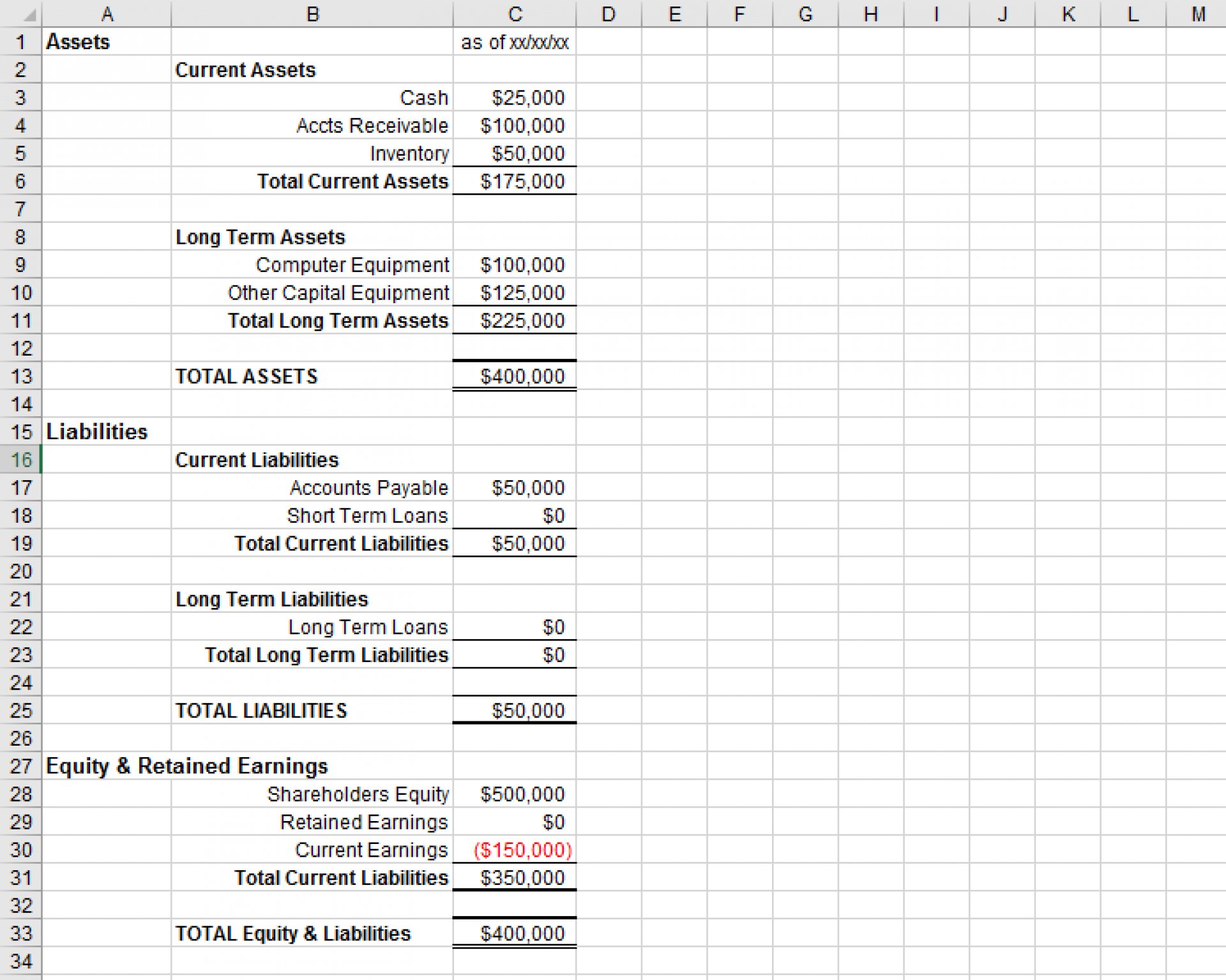

A simple p&l statement for a small business individual includes the following: There are two accounting principles that small business uses to produce a p&l; This includes all the revenue generated from.

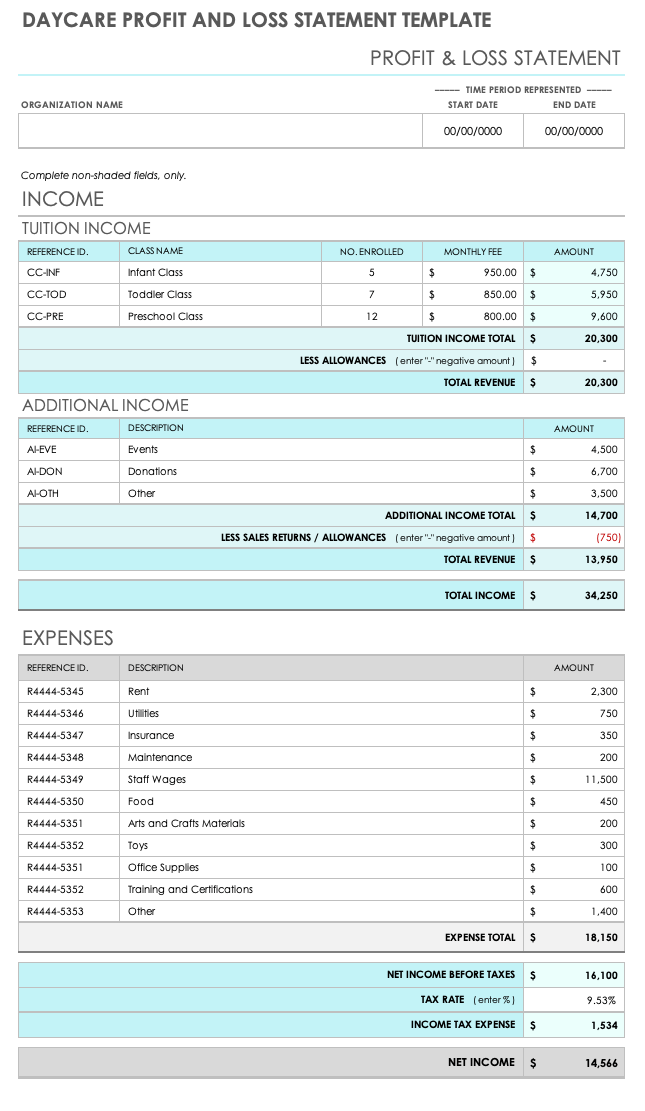

A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. By andy marker | april 6, 2022 creating a profit and loss statement can be daunting, but using a template can help simplify the process. (incorporated in england under the companies (consolidation) act 1908 registered number 102498) this supplementary prospectus (the supplementary.

Cash accounting is when the business enters the figures for. It gives you a financial snapshot of how much money you’re making (or. What is a simple p&l for a small business?

Accrual approach with an accrual approach, revenue and costs are. Examples of a profit and loss statement. Small business owners can use profit and loss statements to measure business performance on a monthly, quarterly, or annual basis.

Take your business accounting into your. Here, we'll walk you through how to create a profit and loss statement (p&l) for small businesses, explain how to read a profit and loss statement, and provide a. If you’re a small business owner and you need a simple way to start monitoring your company finances, this small business profit and loss statement.

Designed to provide business owners with revenue and expense details, the profit and loss statement, or p&l statement, is a must for business owners, whether. A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period,.