Glory Tips About Profit Sharing Journal Entry

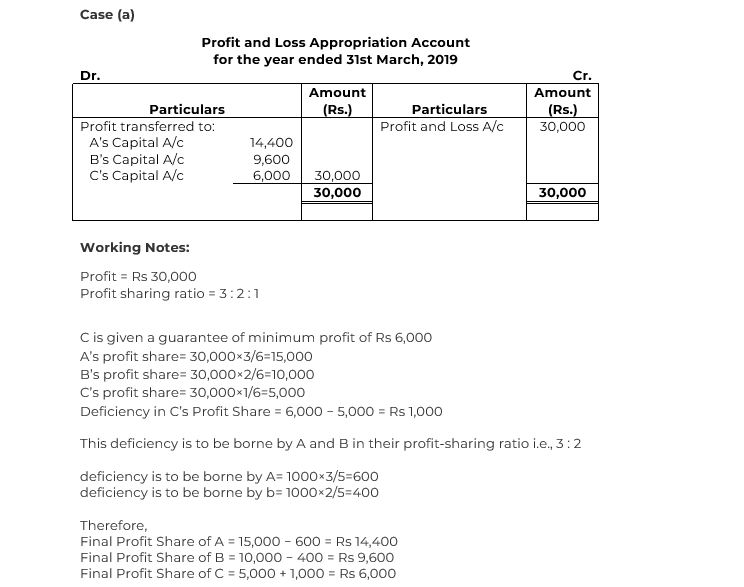

Calculate each partner’s share of the residual profit and total profit share;

Profit sharing journal entry. Welcome to the community! The entries could be separated as illustrated or it could be combined into one entry with a debit to cash for $125,000 ($100,000 from sam and. The best way to master journal entries is through practice.

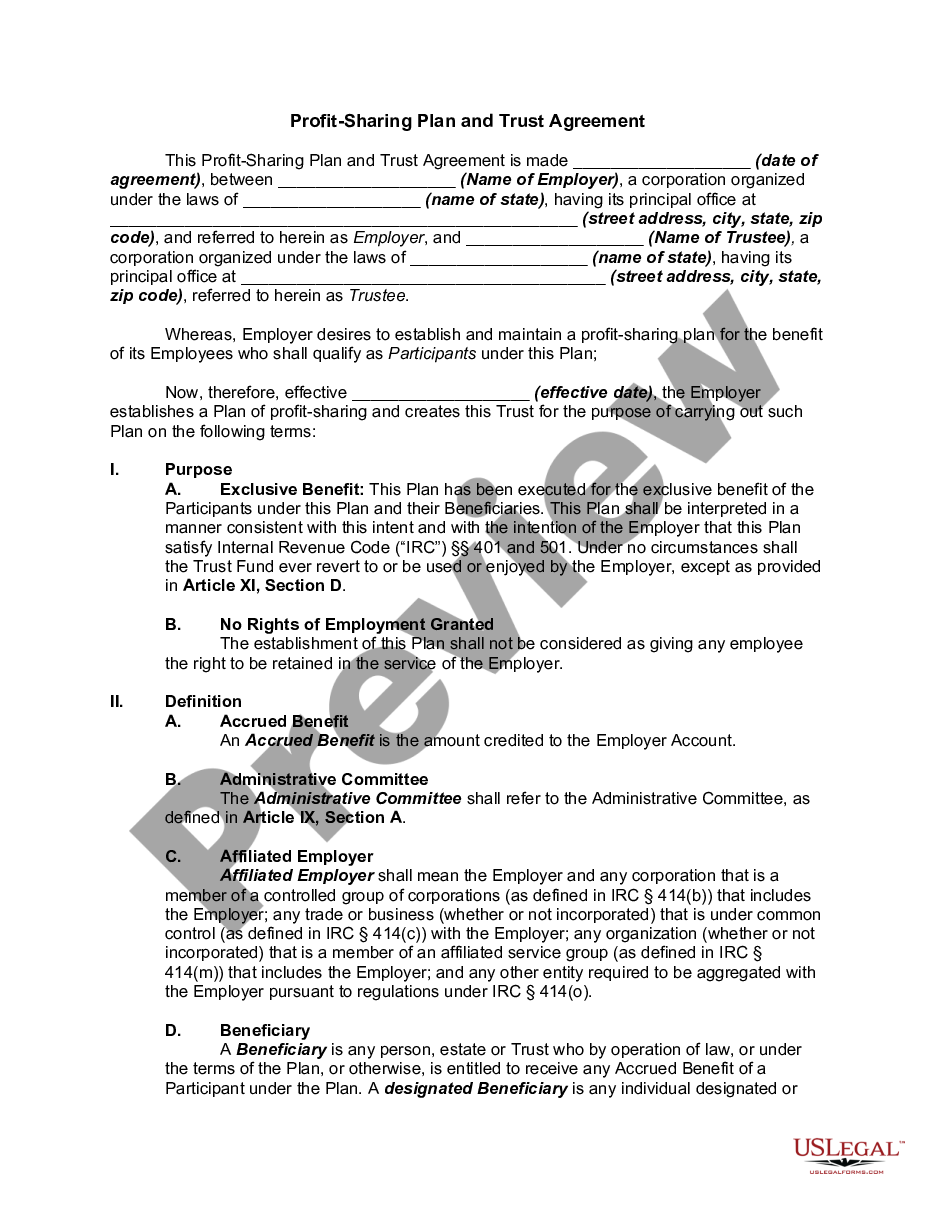

Under this type of plan, also known as a deferred profit. The company gets to decide the amount of profit it. There are two options here.

Journal entry for distribution of profit among partners. I’m here to help walk you through in creating a journal entry to record your profit sharing contribution in quickbooks online. For preparing the profit and loss appropriation account, the following journal entries have to be recorded for various.

Sharing profits and losses in a partnership the landscaping partnership is going well and has realized increases in the number of jobs performed as well as in the partnership’s. Partner's commission sometimes, commission is allowed to the partners. After the salaries and interest on capital accounts have been charged, the remaining partnership profit is distributed to the partners in their respective profit.

The first example is a complete. The amount of the increase depends on the income ratio before the new partner’s. Amit and burton are in partnership sharing profits in the.

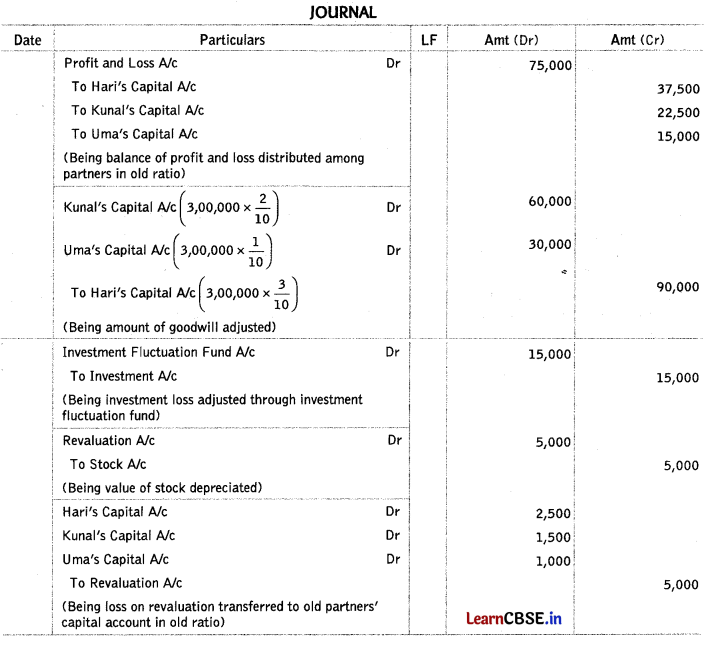

Record the following transactions as journal entries in the partnership’s records. To partners capital/current a/cs (individually) (partners salary is. The company can be found in various types such as private, partnership, and.

Here are numerous examples that illustrate some common journal entries. Journal entries for profit and loss appropriation account. Prepare the partners’ current accounts.

The partnership of magda and sue shares profits. Either you can do below entry. Profit distribution amount partner is the process which businesses share the profit with all partners base on their share ownership.

A bonus to the old partner or partners increases (or credits) their capital balances. It represents the capital of each partner based on the initial investment plus. 2023 marked uber’s first year of being profitable as a public company.

Receipt of assets and liabilities from spidell; The journal entry for partner's salary is made as follows: The journal records the entries to allocate year end net income to the partner capital accounts.