Looking Good Tips About Journal For Provision Bad Debts

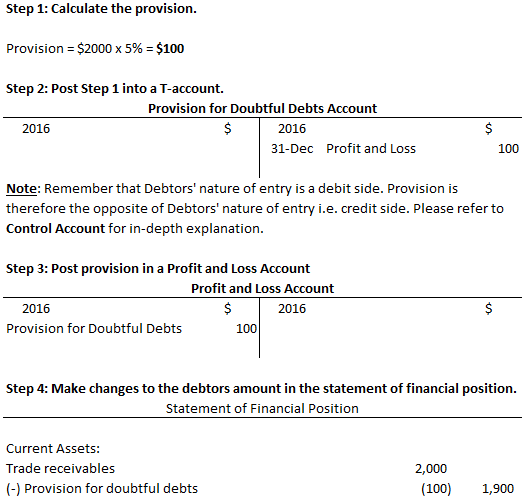

In the first year 1.

Journal for provision for bad debts. 35 paisa in a rupee means 35% coz one rupee is 100 paisa cash received = 25,000 @ 35% = rs 8,750* bad debts = 25,000 @ 65% = rs 16,250 cash received = 60,000 @ 45% = rs 27,000# bad debts = 60,000 @. A journal entry is made to write off a provision for bad debt expenditure if a receivable appears on your statement of financial position that you no longer deem collectible, you must write it off. Types of provision for bad debts journal entry.

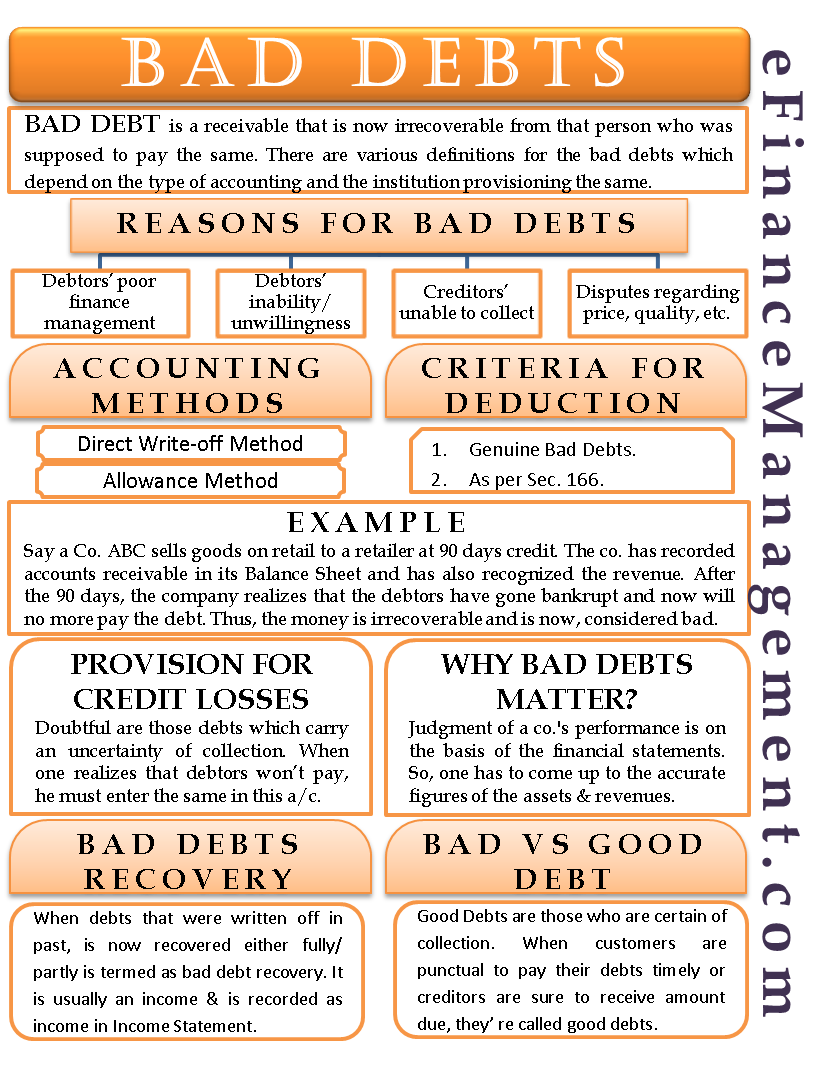

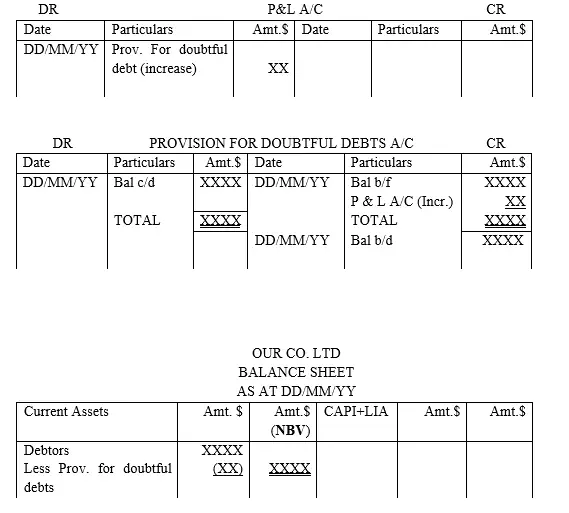

From the provision for bad debts maureen mcnichols and g. We may come across two methods of journal entry for bad debt expense as below: Provision for bad debts is an expense for the entity and charge is made to profit and loss account.it is reflected in profit and loss account on debit side as expense.as per nominal account rule (bad debt) “debit all expense or loss (expense account).

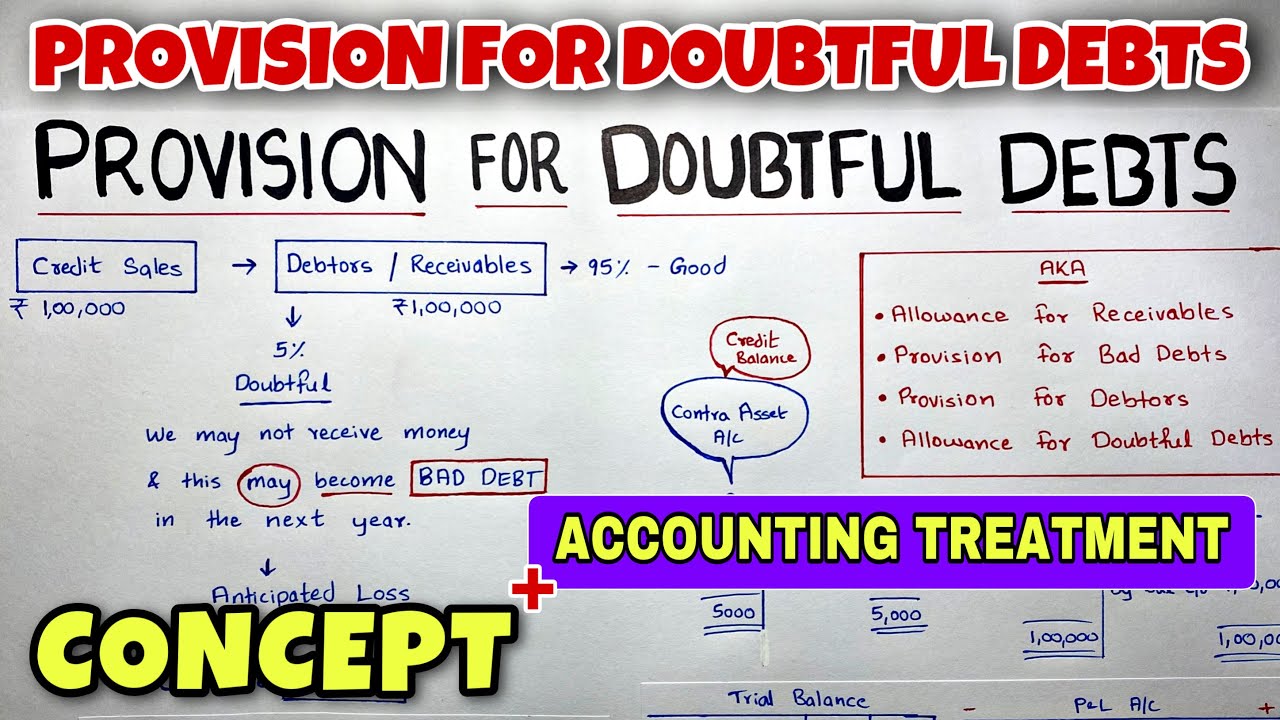

Profit & loss account example on 31 december 2017, david's trade debtors stood at $432,000 only. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the debtors. Introduction our paper examines whether managers manipulate earnings.' we begin by modeling how a specific accounting number, the provision for bad debts, would be.

Provision for doubtful debts, on the one hand, is shown on the debit side of the profit and loss account, and on the other hand, is also shown as a deduction from debtors on the. Provision for bad debts account cr: New provision for bad debts is deducted from debtors in balance sheet.

Journal entry for bad debts treatment in financial statement what is provision for bad debts why provision for bad debts is the liability! The balance in this account does not belong to any. There will likely be customers who can’t pay their.

The bad debt provision accounting process allows the management to prepare for potential losses. A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in respect of bad debts next year. November 05, 2023 what is the provision for doubtful debts?

December 10, 2019 by md. For provision for bad debts journal. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

Let’s say that a 10% bad debt provision is considered appropriate. Bad debt is the term used for any loans or outstanding balances that a business deems uncollectible. Irrecoverable debts is the term that is used to describe this.

It is similar to the allowance for doubtful accounts. Any company that has a policy of selling goods on credit has to deal with the problem of bad debts. Overview, calculate, and journal entries.

To record the collection of cash: In this case, make the following. For businesses that provide loans and credit to customers, bad debt is normal and expected.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)