Stunning Tips About Income Tax 26as Pdf

From there, you can choose the.

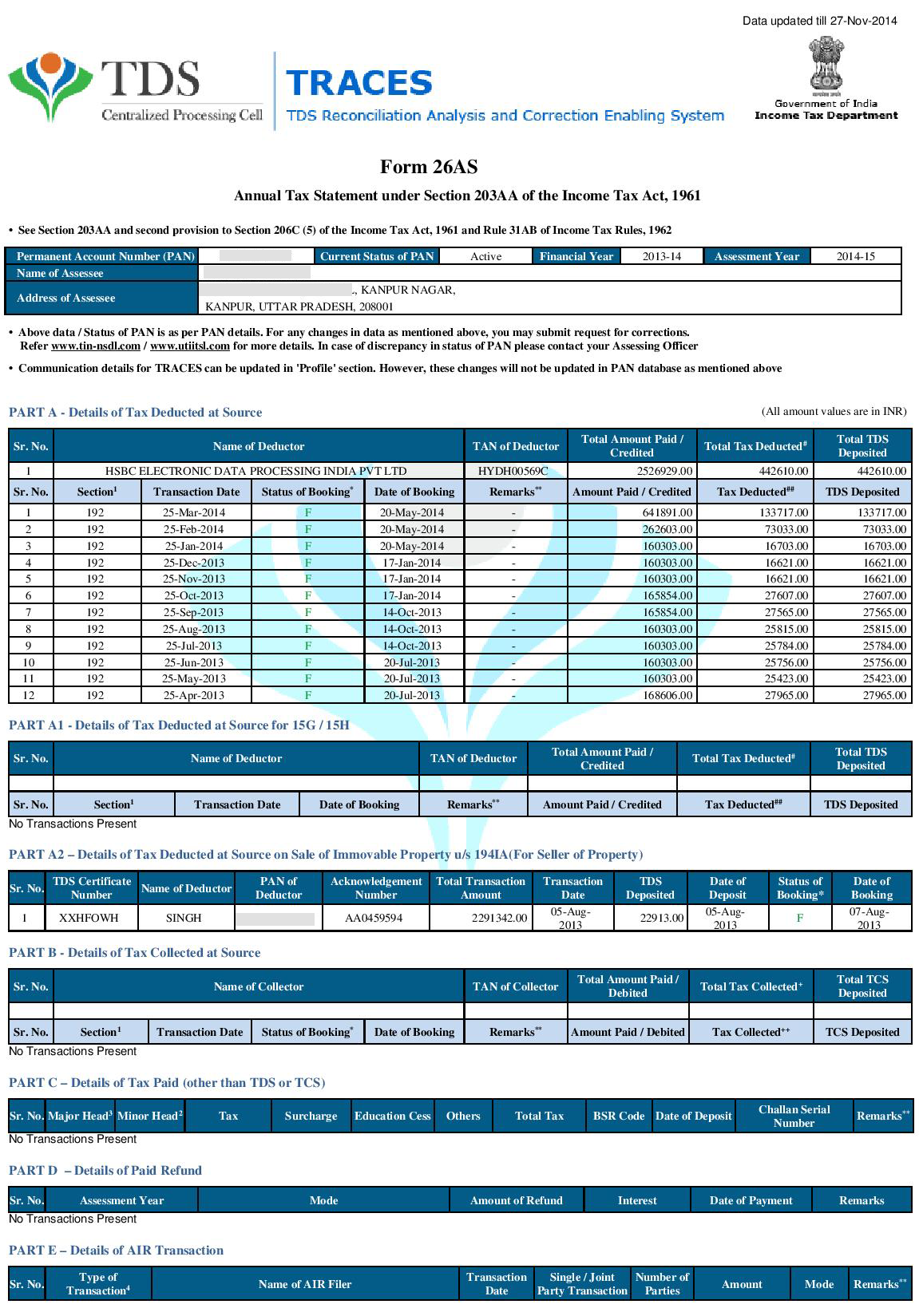

Income tax 26as pdf. Here are some steps to easily download form 26as on the new income tax portal. To view your form 26as, click the link at the bottom of the page and then select view tax credit (form 26as). Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Form 26as is an important income tax document containing all the details of taxes deducted and deposited against the pan during the financial year. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and self. Download offline utilities related to income tax returns/forms, dsc management software and mobile app.

Form 26as is a consolidated statement from the income tax department that contains details of tax deductions and tax exemptions. 10 important income tax form under income tax act, 1961, one must know. Tax deducted on income:

The website provides access to the pan holders to view the details of tax credits in form 26as. Form 26as displays the amount of tax deducted at source (tds) from various sources of income, such as salary, interest, or dividends. Form 26as is consolidated from multiple sources like your salary, pension, interest income etc.

If you are not registered with traces, please refer to our e. Firstly visit the official website of. It is available for all taxpayers.

Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf) click ‘view / download’ note to export the tax credit. Go to my account and click on view form 26as (tax credit) 3. Select the assessment year and the desired.