Real Info About Management Financial Statements

Balance sheets, income statements, and cash flow statements.

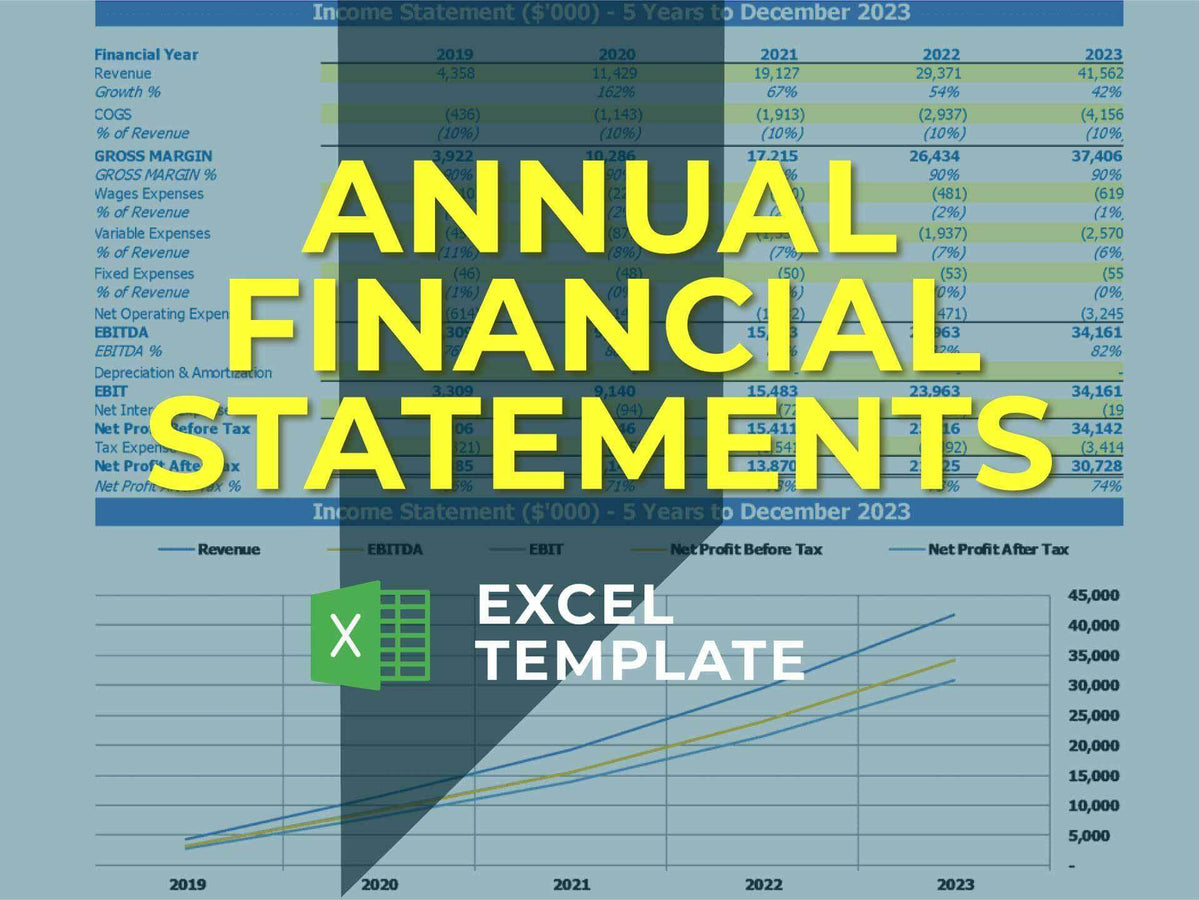

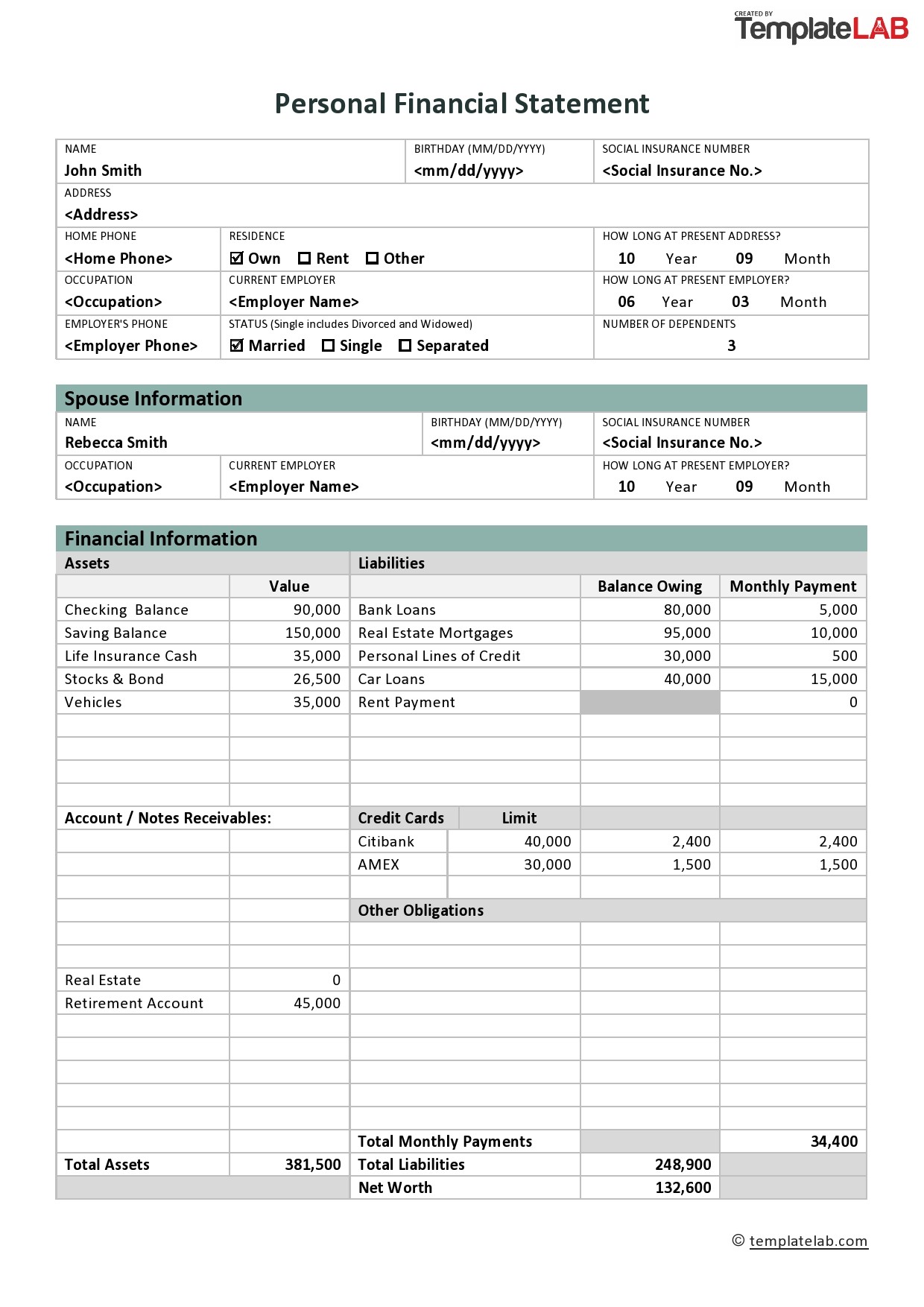

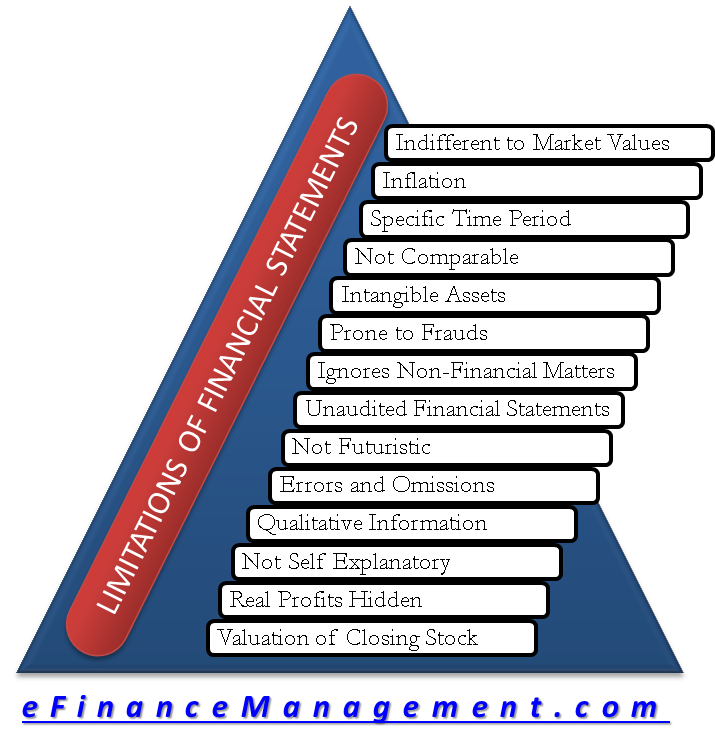

Management financial statements. Balance sheets, income statements, cash flow statements, and annual reports. They include key data on what your company owns and owes and how much money it has made and spent. Assessing a company’s risk profile:

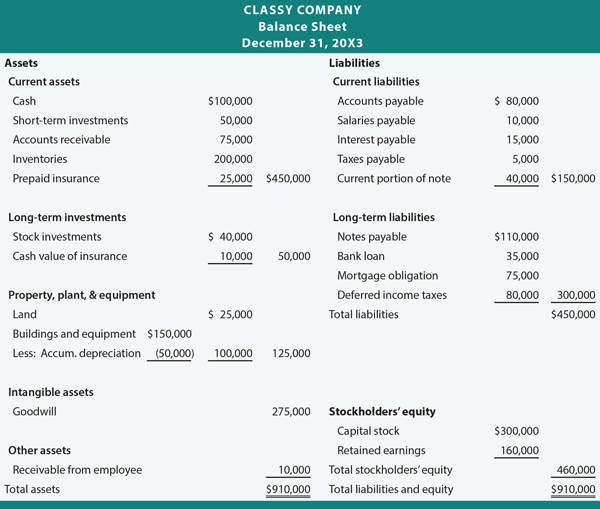

Condensed consolidated financial statements and the reported amounts of income and expense during the reporting periods. Total asset turnover = revenue / (beginning total assets + ending total assets / 2) 10. How to read a balance.

Managerial reports make it possible for you to dive deeper into your company’s financial standing. There are five basic financial statements: Total asset turnover.

Nvidia announces financial results for fourth quarter and fiscal 2024. There are three main types of financial statements: Wharton has regained its position as the world’s leading provider of mbas in 2024, according to the latest ft ranking of the top 100 global business schools.

Start free written by tim vipond reviewed by jeff schmidt Financial statements are a set of documents that show your company’s financial status at a specific point in time. Financial statements are used to give you much more than just a snapshot of your business’ health.

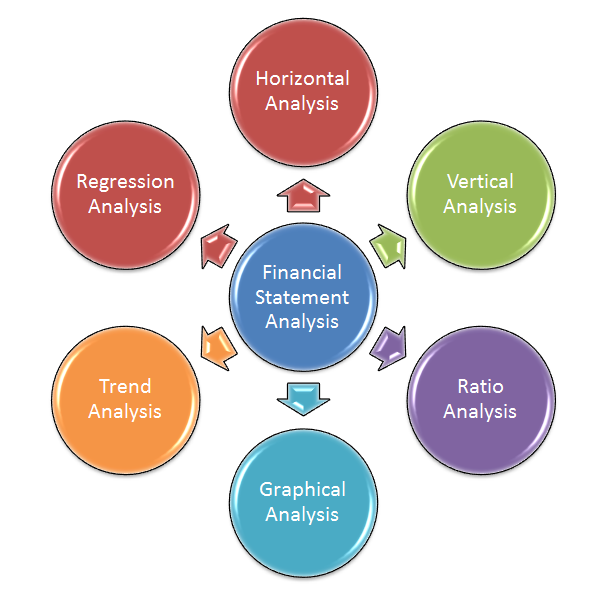

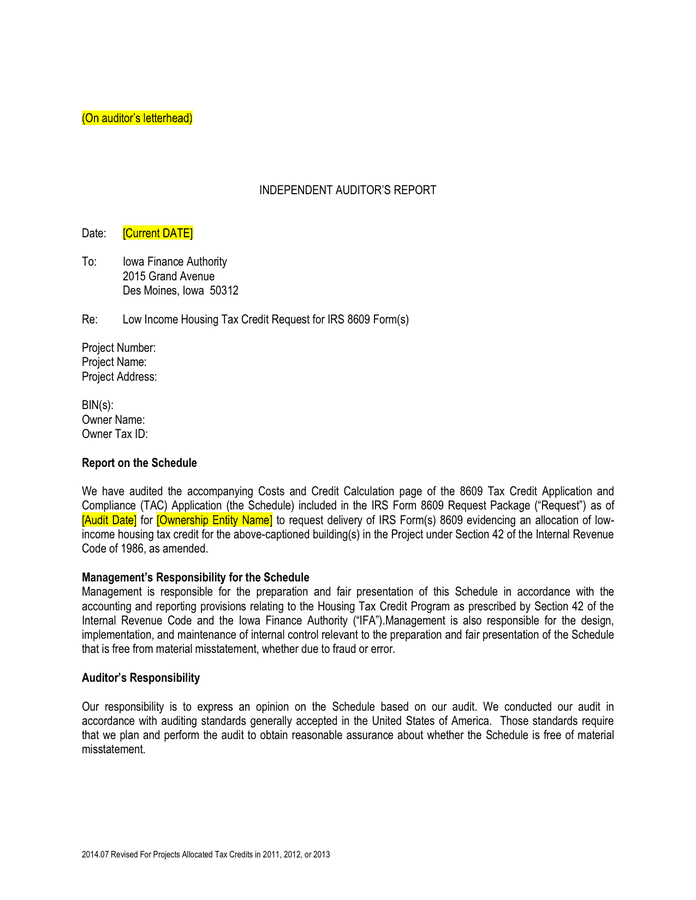

A financial statement is a formal record of the financial activities of a business. The consolidated financial statements and accompanying management’s discussion and analysis (“md&a”) are available on the company’s website at www.siennaliving.ca and on sedar+ at www. By understanding these risks, you can make informed decisions about whether to invest in or do business with the company.

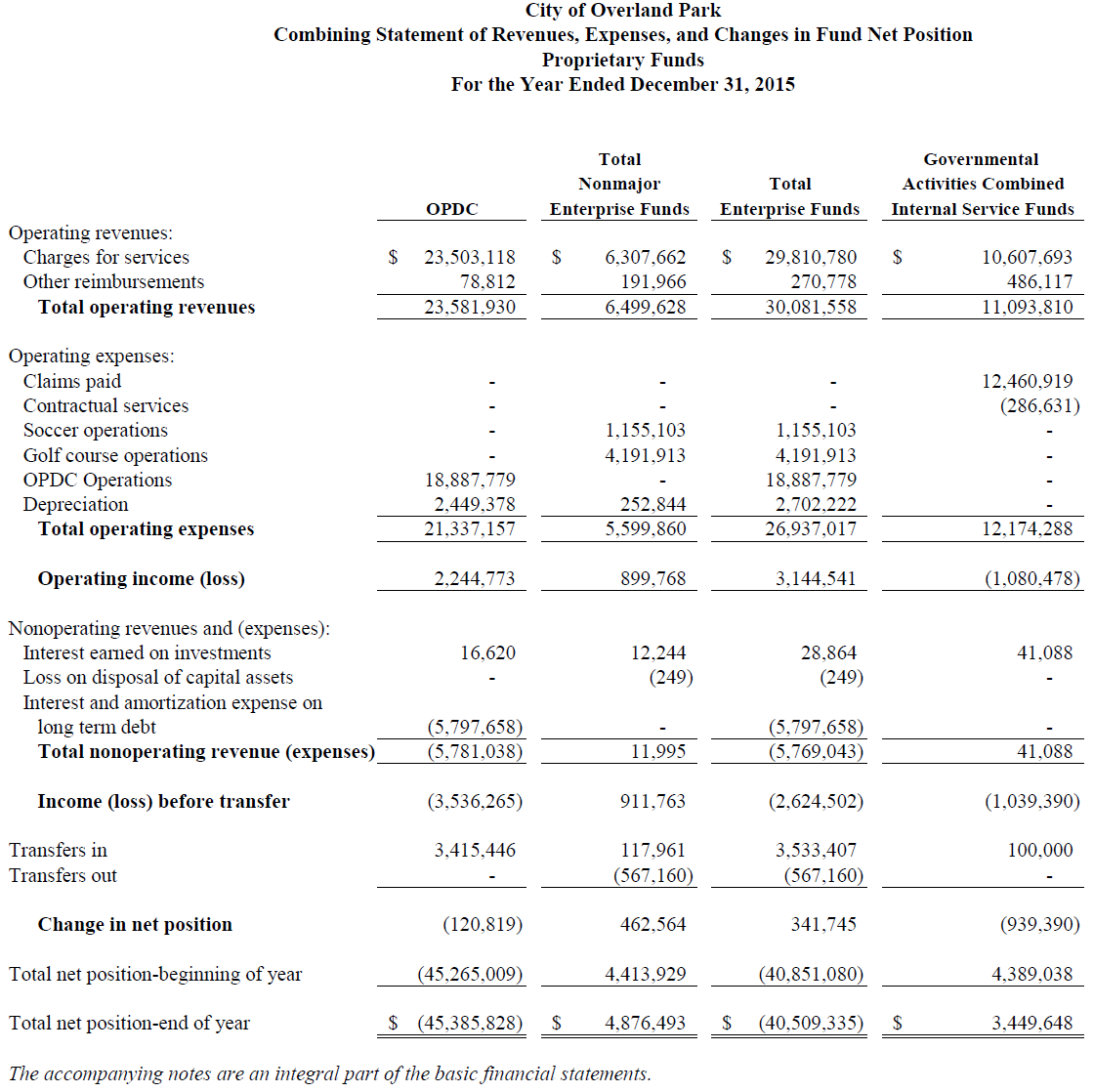

The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. The balance sheet, income statement, and cash flow statement. Government consolidates the financial statements from each department—such as the department of defense.

External stakeholders use it to understand the overall health of an. Balance sheet income statement cash flow statement statement of retained earnings Address financing gaps for medicare and social security, both of which are supported by trust funds that will be depleted within 10 years.

Total asset turnover is an efficiency ratio that measures how efficiently a company uses its assets to generate revenue. After completing this chapter, you should be able to (1) construct consistent and accurate coordinated financial statements (cfs) (2) describe the differences and connections among balance sheets, accrual income statements (ais), and statements of cash flows; These three financial statements are intricately linked to one another.

External stakeholders use it to understand the overall health of an. It lists the assets, liabilities, and equity line by line for. Ecb reports loss of €1.3 billion (2022:

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/exxonIS09-30-2018-5c5dc83c46e0fb00017dd129.jpg)