Awesome Tips About Issuance Of Common Stock In Cash Flow Statement

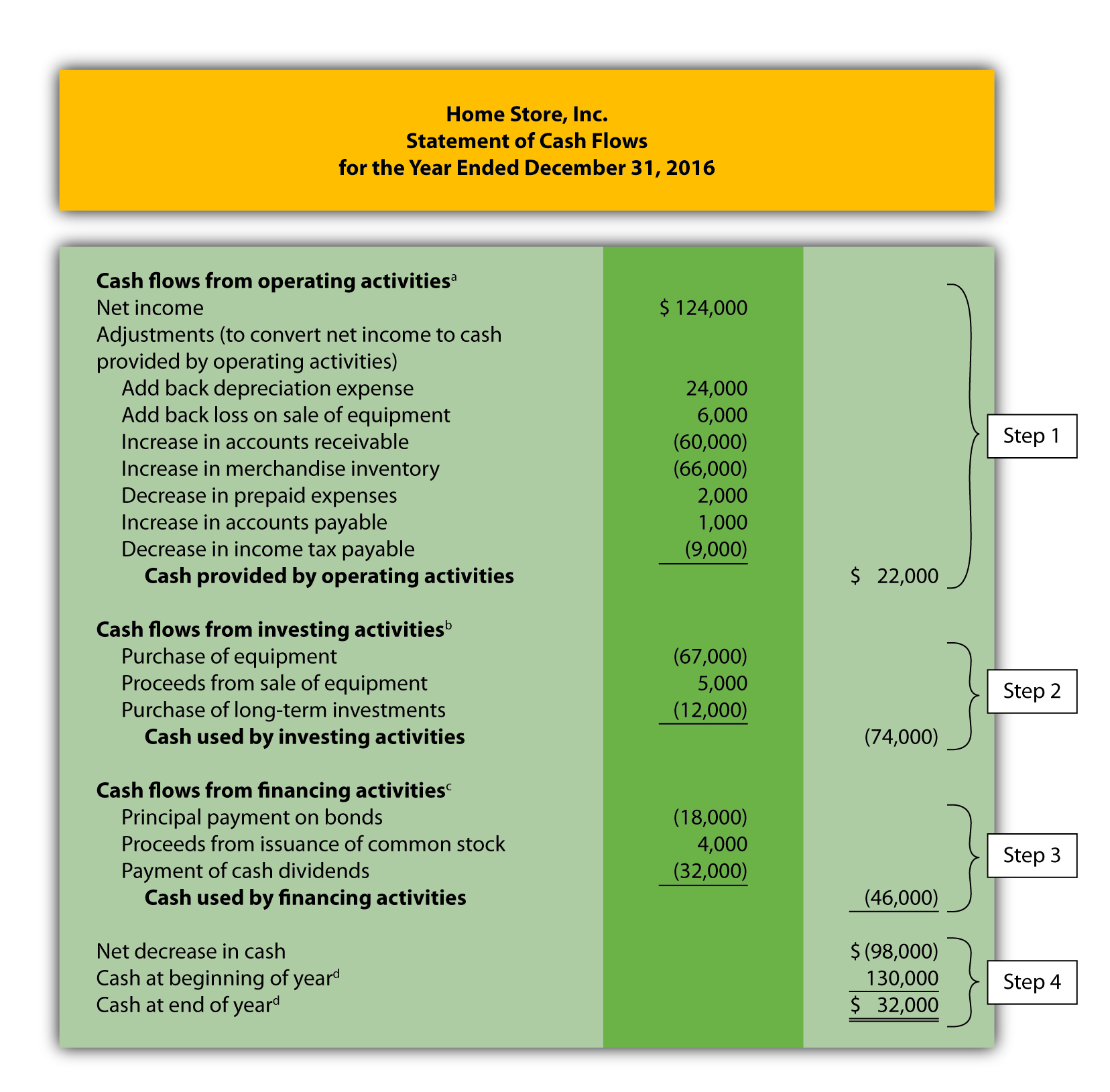

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during the year.

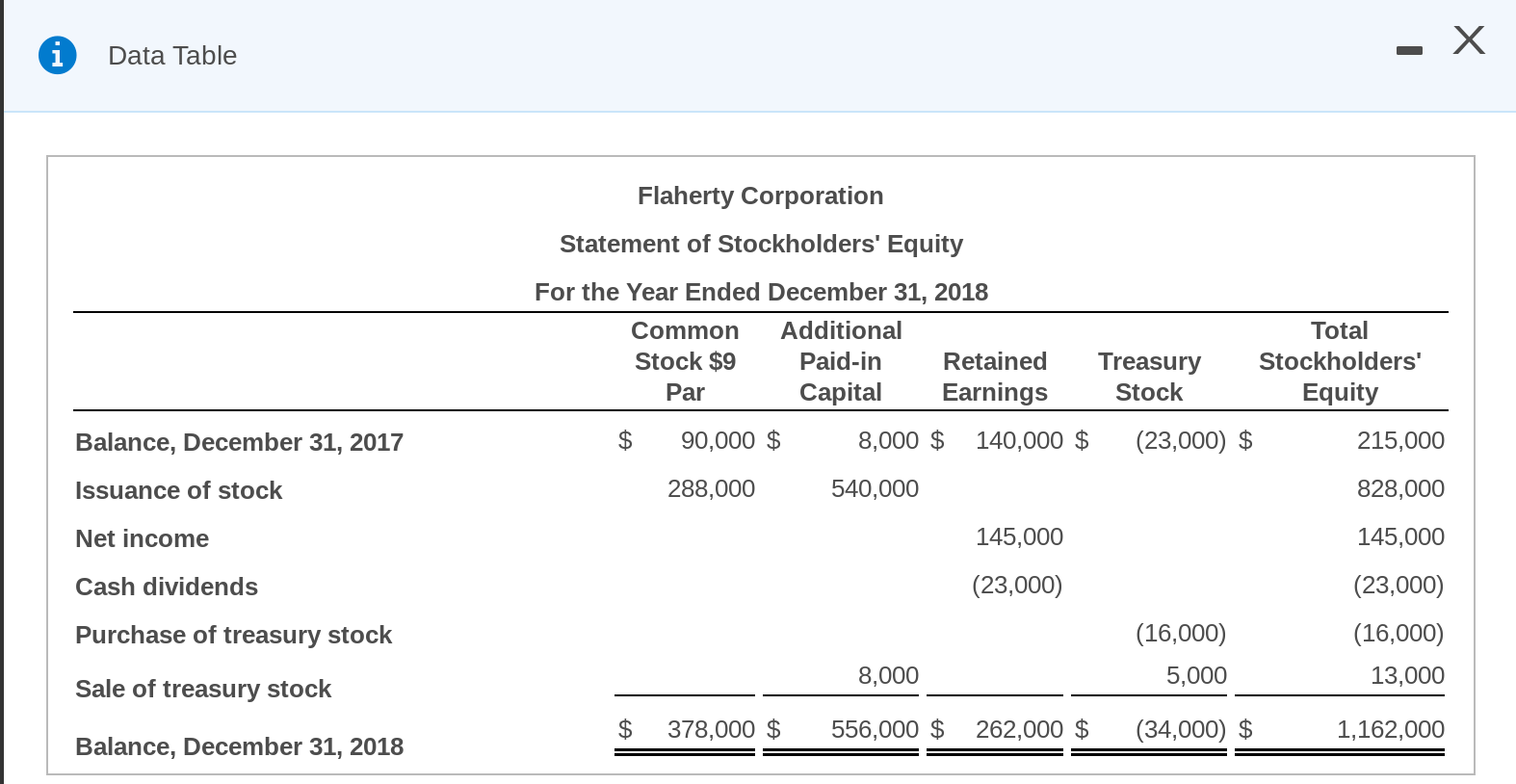

Issuance of common stock in cash flow statement. It tells you how cash moves in and out of a company's accounts via three main channels: Propensity issued common stock in exchange for $45,000 cash. During stock splits, for instance, a company issues.

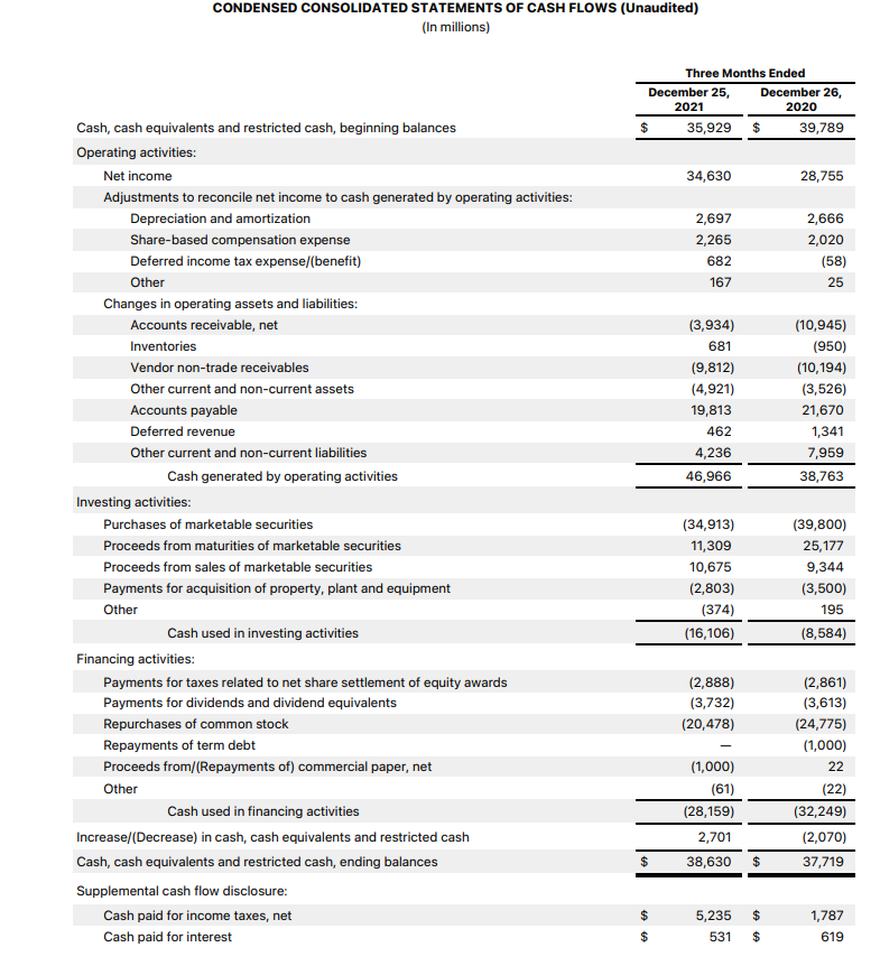

How issuing common stock can increase cash flows. Figure 16.4 statement of cash flows. Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

Although issuing common stock often increases cash flows, it doesn't always. How does a company report the issuance of a share of common stock for more than par value? The statement of cash flows acts as a bridge between the income statement and balance sheet by.

Propensity issued $20,000 in common stock to employees as a bonus. Capital raising efforts, such as issuing debt or equity financing, are recorded in the cash flow from financing section. Issuing stock in connection with a stock compensation plan where no cash payment is required;

The issuance of common stock for cash is shown as a a) positive cash flow in the financing activities section of the statement of cash flows b) negative cash flow in the investing activities section of the statement of cash flows c) negative cash flow in the financing activities section of the statement of cash flows d) positive cash f. The financing activities section of the statement of cash flows. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Operating, investing, and financing activities. The purchase of treasury stock is the transaction that causes cash flow out of the company. Principal payment under capital leases

The cash flow statement is typically broken into three sections: A potential stockholder contributes assets to a company in order to obtain an ownership interest. On the balance sheet, within the stockholders’ equity section, the amount that owners put into a corporation when they originally bought stock is the summation of the common stock and capital in excess of par value accounts.

See fg 4.5.1 for additional information. The operating activities section of the statement of cash flows. Proceeds from issuance of common stock:

The issuance of common stock in exchange for cash is reported in: The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time. Cash flows from financing activities :

The company needs to spend cash to acquire its own shares back. In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000. What is cash flow from investing activities?

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)