The Secret Of Info About Form 26as Means

Form 26as is an annual statement which has details of the tax credited against the pan of a taxpayer.

Form 26as means. This will include your name, pan, the financial year & the assessment. It is a consolidated annual statement issued for individual taxpayers and associated with their permanent account number. Form 26as not only contains the details of your taxes paid but also contains details of any tax refunds that have been.

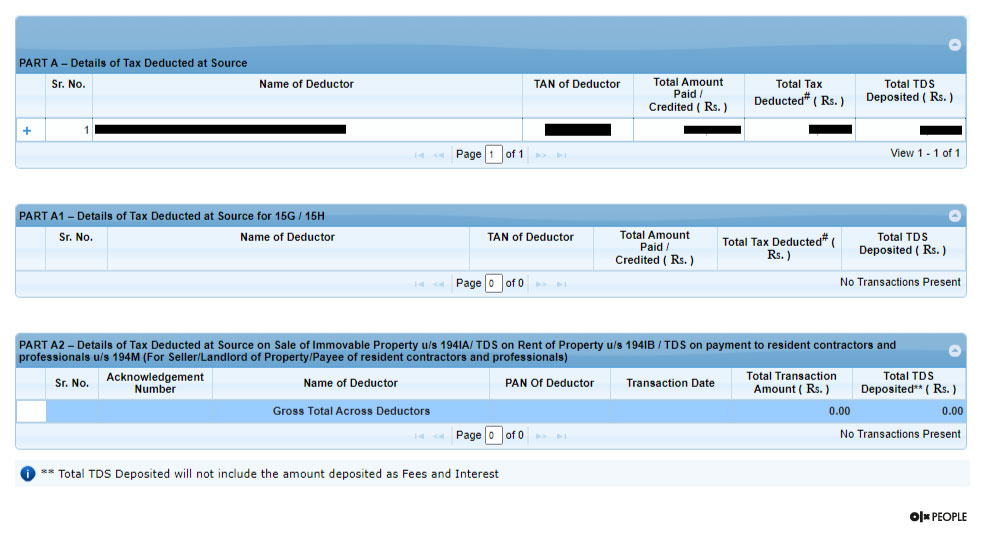

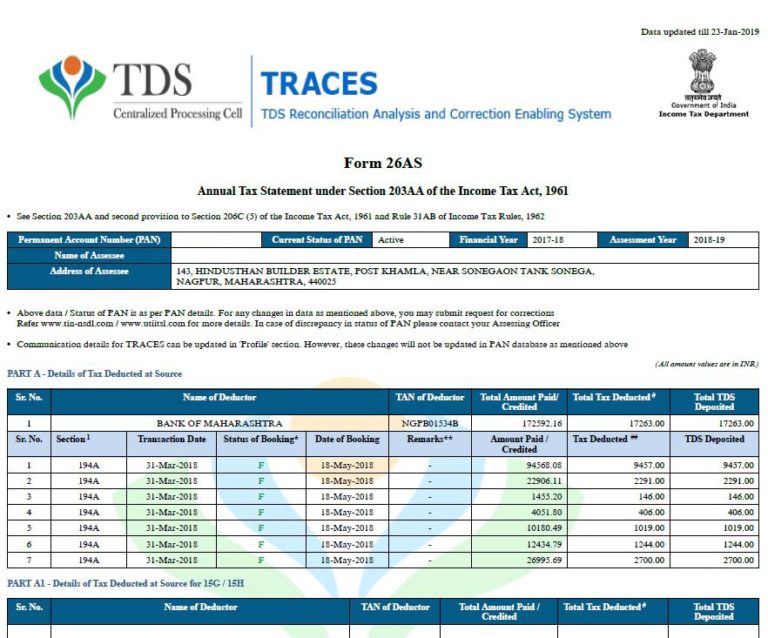

This would include tax deducted from various sources. Details of taxes paid by you and tax refunds. Tax deducted on your income by all the tax deductors 2.

Form 26 as contains the details of the tax credit in an account or appearing in the permanent account number of the respective assessee as per the records of the. Form 26as is a statement that shows the below information: Advance tax paid by the taxpayer 4.

This form can be accessed from the income tax. Click on the link view tax credit (form 26as) at the bottom of the. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Form 26as is a crucial tax document. How to download form 26as ? Form 26as provides a detailed overview of your financial activities for a specific year, going beyond just tds (tax deducted at source) and tcs (tax collected.

Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. Form 26as includes the information on all the deducted tax on the income of deducted. However, not all banks provide the facility.

All the details of collected tax by the person who is collecting. It shows the details of tax deducted at source, tax. Form 26as is a tax credit statement that provides a complete view of the taxes paid by a taxpayer.

It includes details of income tax deducted at source ( tds ),. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and. Form 26as is an annual tax statement that shows the details of tax deducted or collected at source by the taxpayer using a permanent account number (pan).