Great Info About Contribution Approach Income Statement

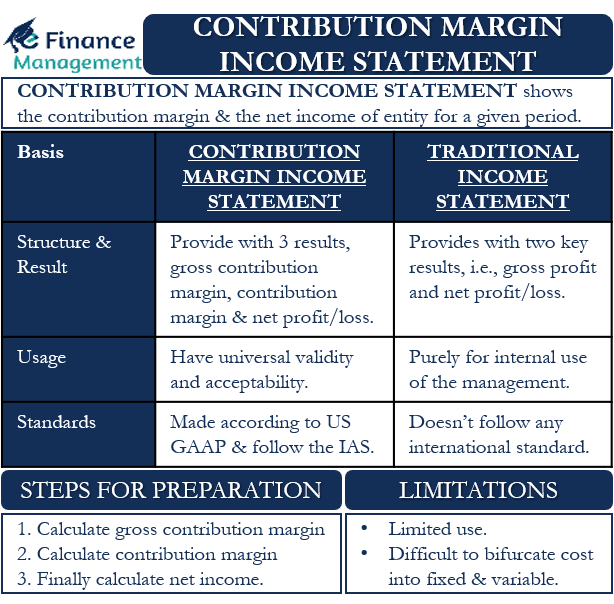

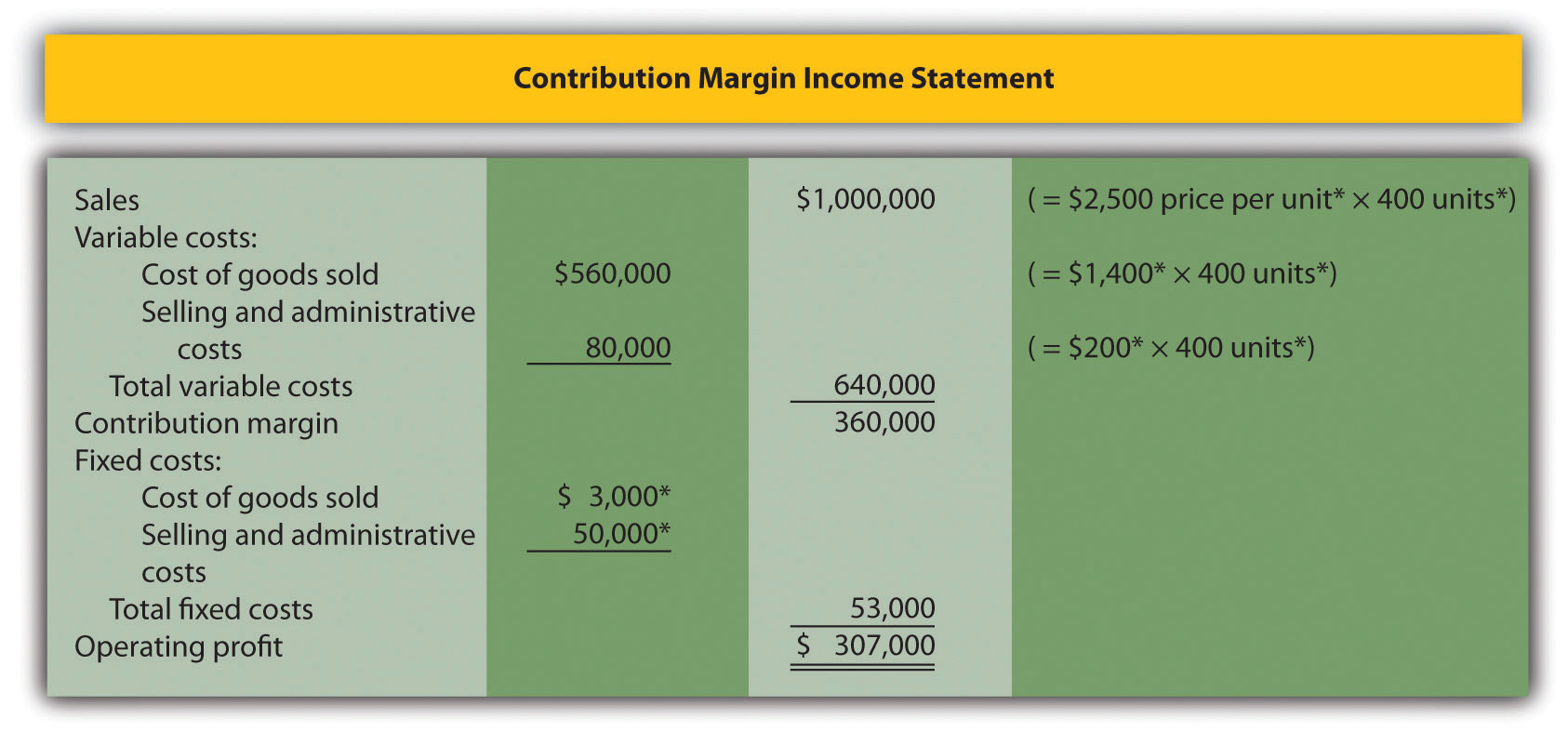

A contribution income statement is an income statement that separates the variable expenses and fixed costs of running a business.

Contribution approach income statement. Contribution margin income statement. (i) decisions to increase or decrease individual product production [or. Notice that all variable expenses are direct expenses of the segment.

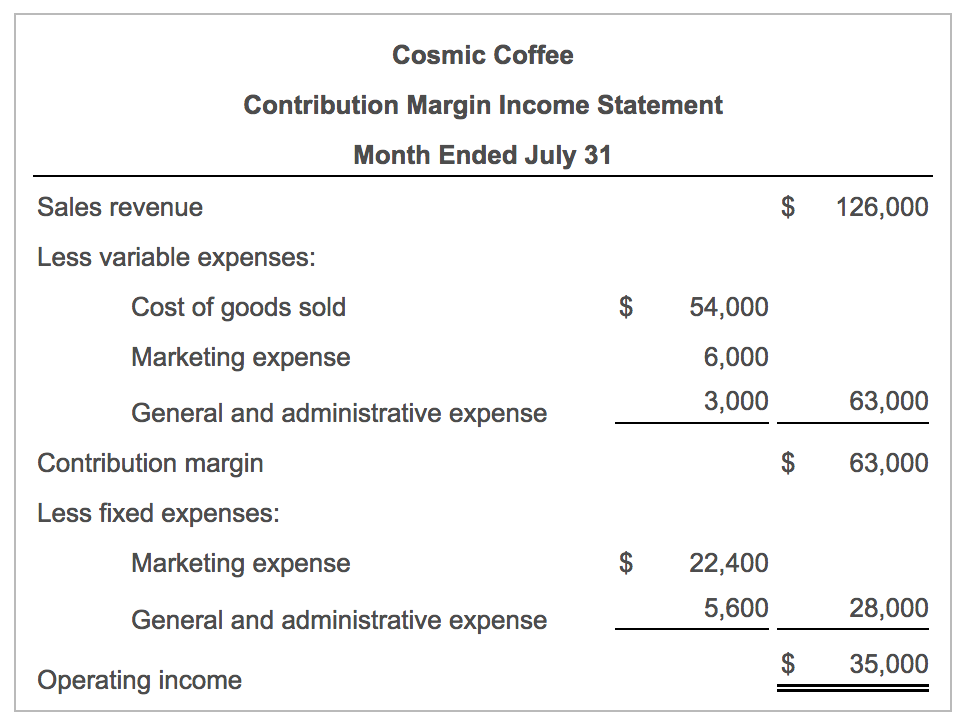

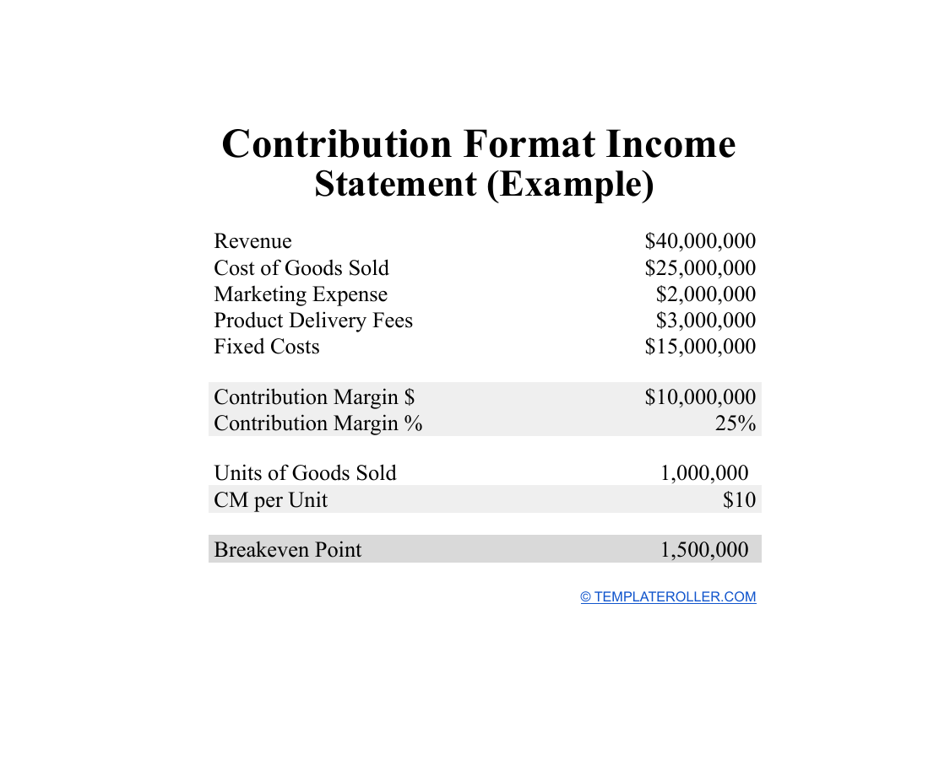

Contribution approach income statement definition. Every business necessitates the process of planning and decision. A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin.

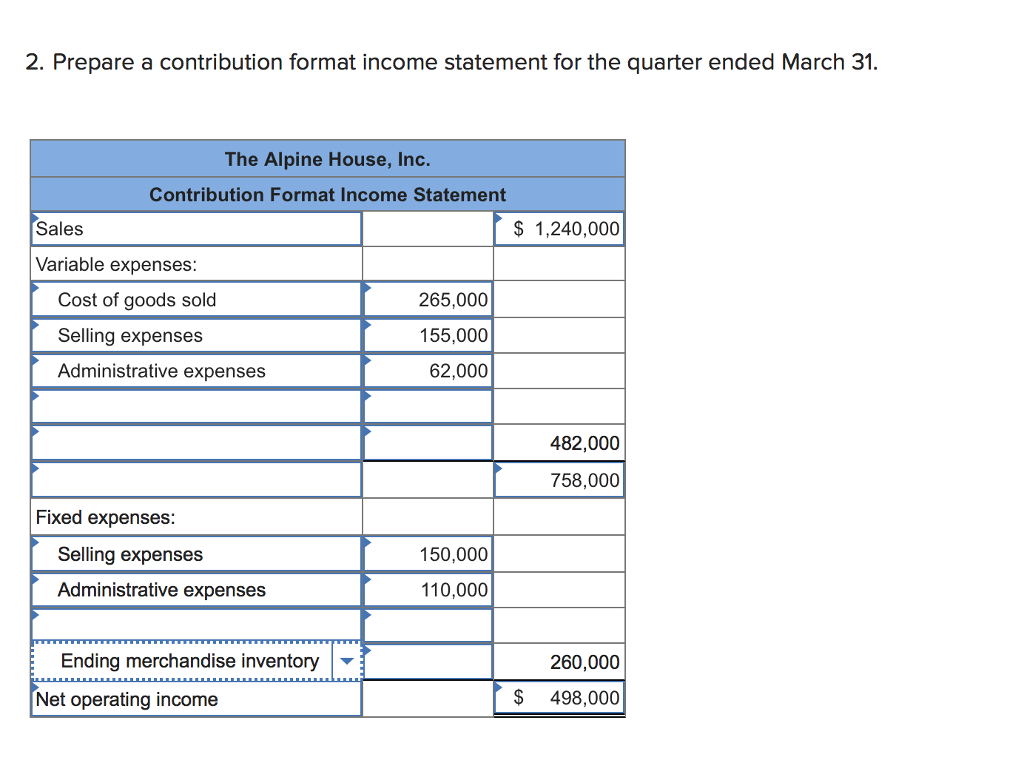

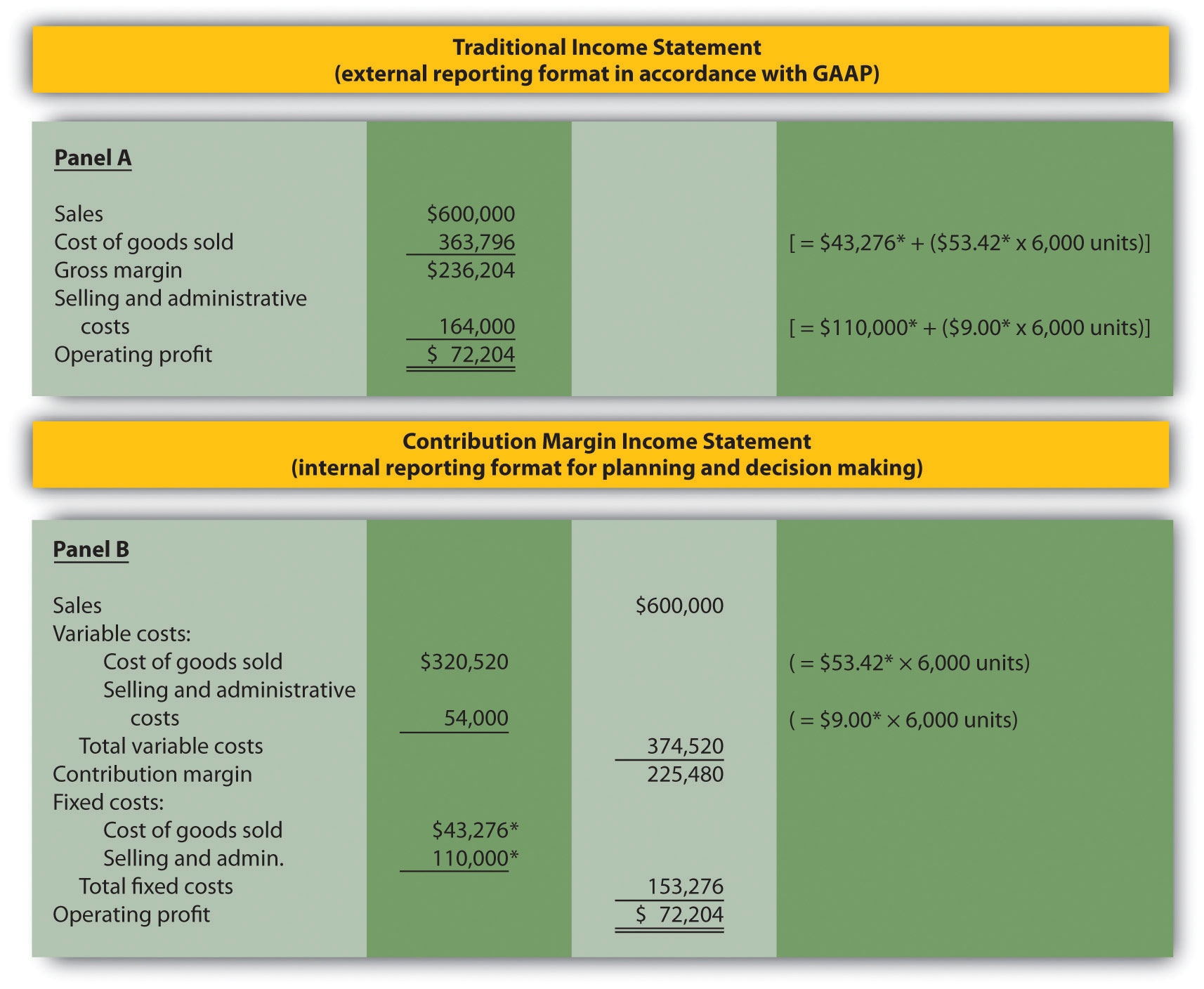

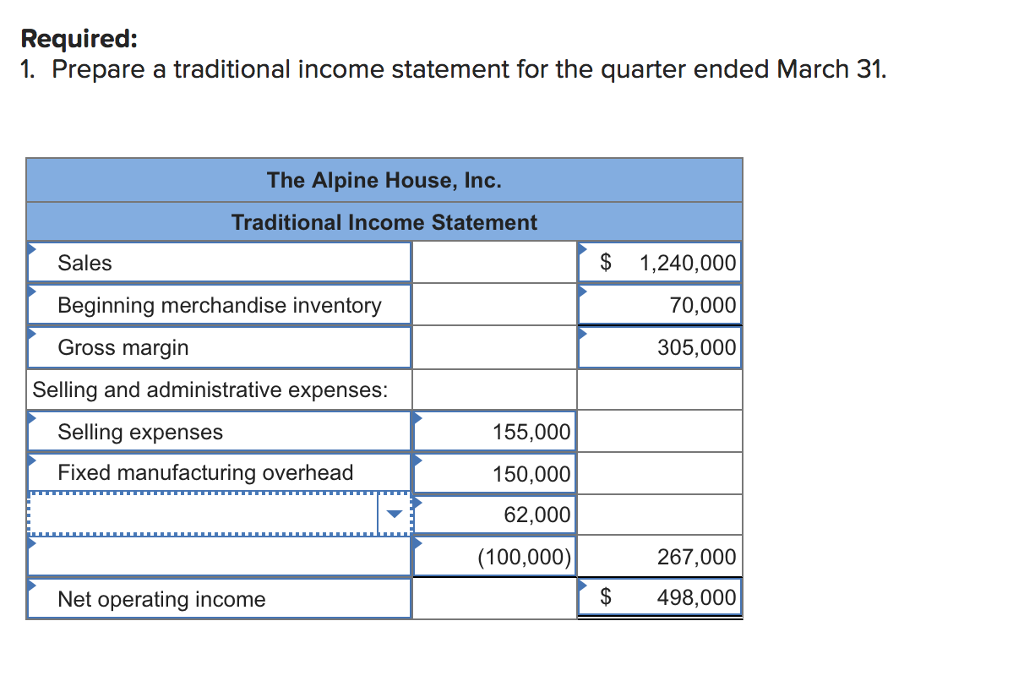

The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will. The contribution approach is a presentation format used for the income statement, where all variable costs are aggregated and deducted from revenue in order to arrive at a contribution margin, after which all fixed costs are deducted from the. The traditional and contribution margin income statements both communicate a company's revenues, expenses and profits or losses for an accounting.

A contribution approach income statement is an alternative way to look at a company’s profit and loss. When used with the contribution approach, it is known as contribution income statement. In a contribution margin income statement, a company's variable expenses are deducted from sales to arrive at a contribution margin.

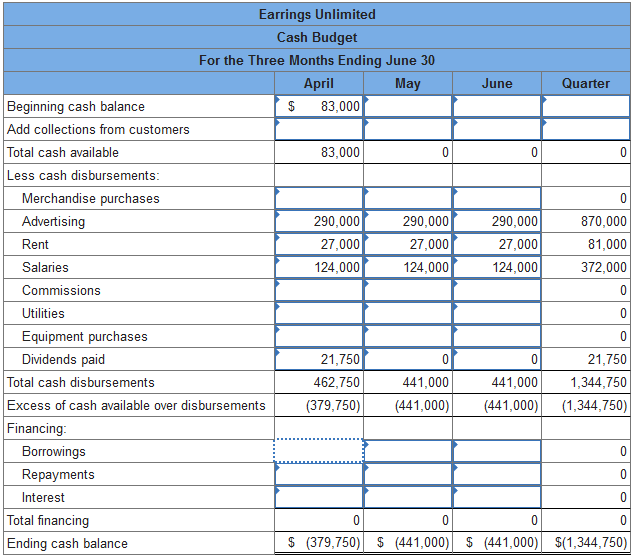

This statement tells you whether your efforts for the. The traditional income statement approach is the dominant format used by nearly all companies, because it is required by the accounting standards for the reporting. A contribution margin approach is commonly used in financial decision making as follows:

To illustrate how this form of income statement can be used, contribution margin income statements for hicks manufacturing are shown for the months of april. A contribution approach income statement and a traditional income statement produce the same result in terms of determining a company’s net income. A contribution income statement is a financial tool that separates variable costs from fixed costs, highlighting the contribution margin of sales revenue.

The contribution margin income statement is a useful tool when analyzing the results of a previous period. Contribution approach using income statements (cost accounting tutorial #34) notepirate 43.2k subscribers subscribe share 36k views 8. In a contribution margin income statement, a company's variable expenses are deducted from sales to arrive at a.

An income statement that subtracts all variable costs and expenses from revenues in order to show the contribution margin. Contribution approach income statement can usually be easily prepared from the information contained in a corporation's published income statement. This type of statement separates a company’s revenue and.