Peerless Tips About Different Financial Statements In Accounting

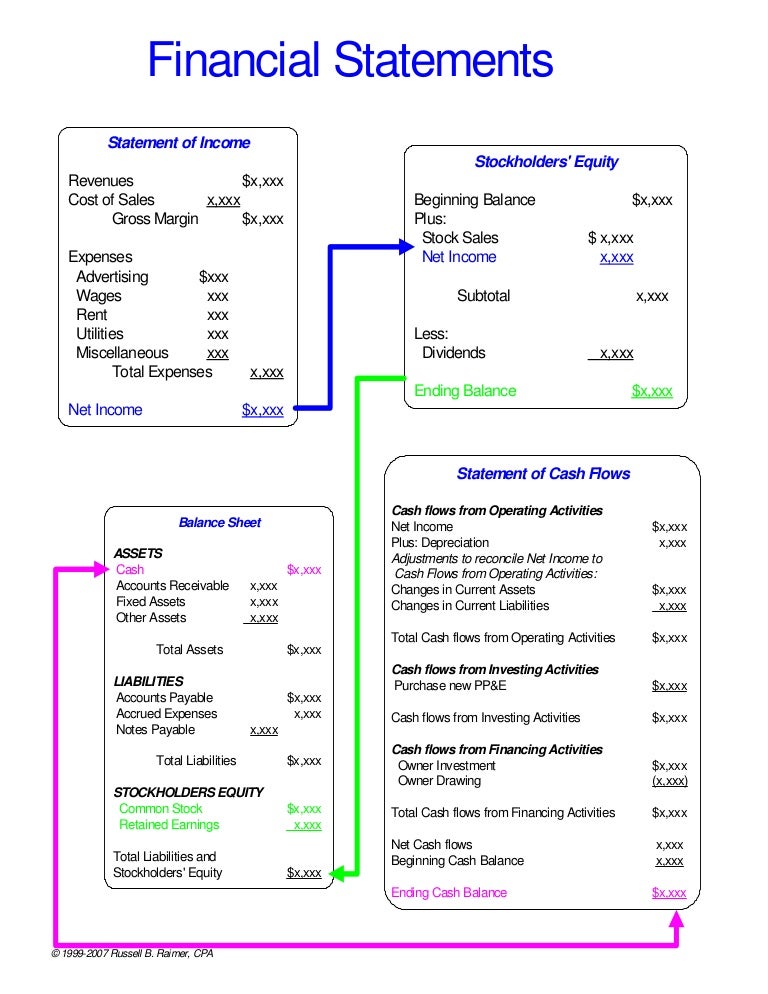

Analyzing these three financial statements is one of the key steps when creating a financial model.

Different financial statements in accounting. Download free blank excel template of business financial statements. Advantages of financial statements financial statements are useful for the following reasons: Ifrs 10 consolidated financial statements addresses the principle of control and the requirements relating to the preparation of consolidated financial statements.

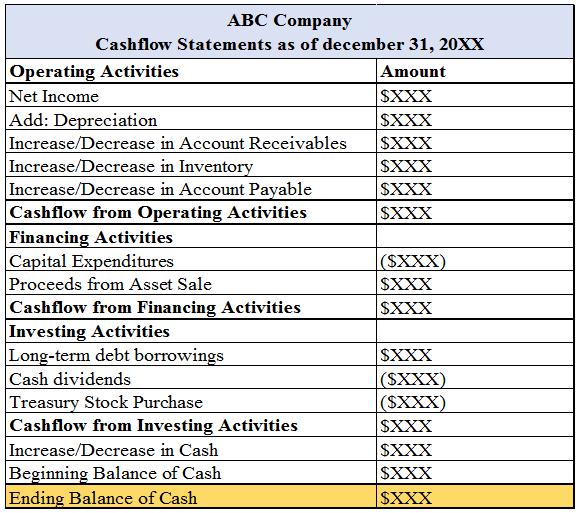

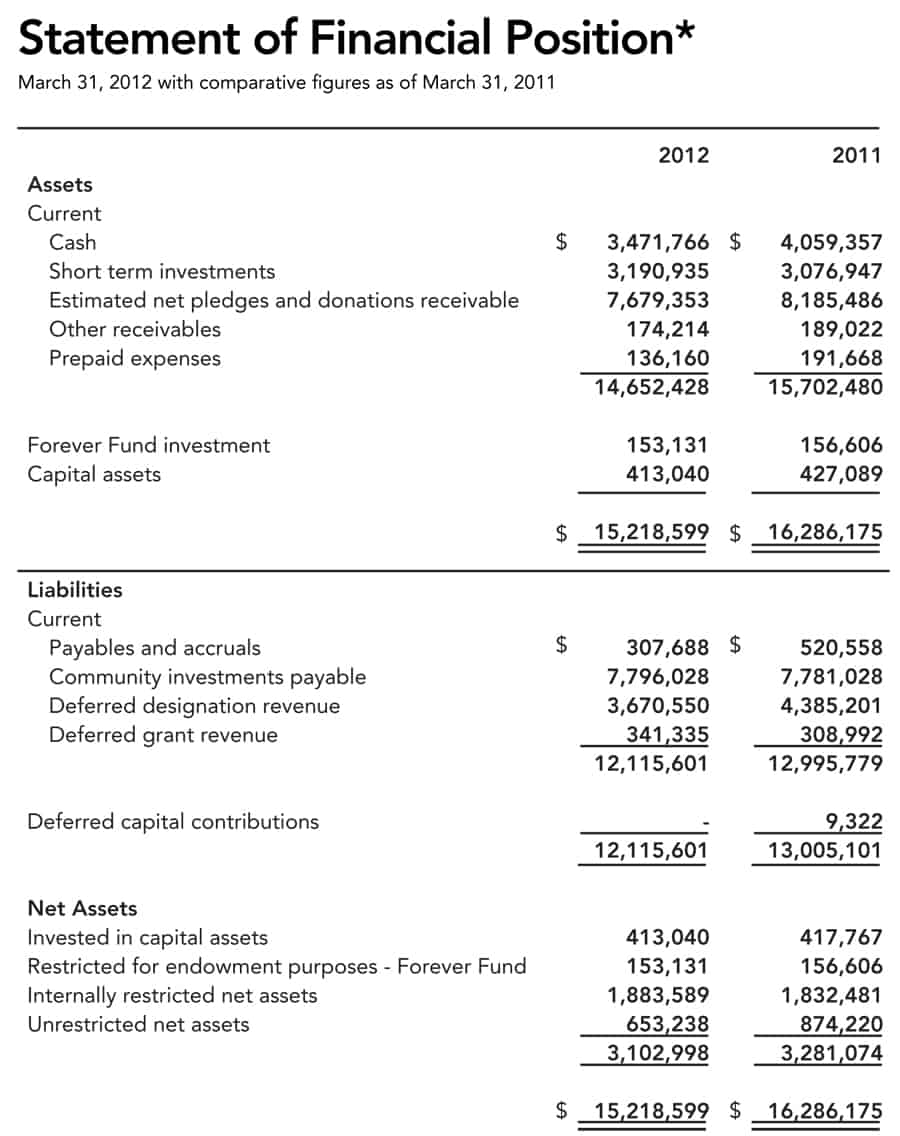

Current conditions are shown on the balance sheet. Financial statements are written reports that quantify the financial strength, performance and liquidity of a company. Balance sheets, income statements, cash flow statements, and annual reports.

What are the types of financial statements? There are four types of financial statements.each has a different level of complexity, validity and cost. Financial statements consist of ten elements that show the amounts, claims, and changes to an organization's resources.

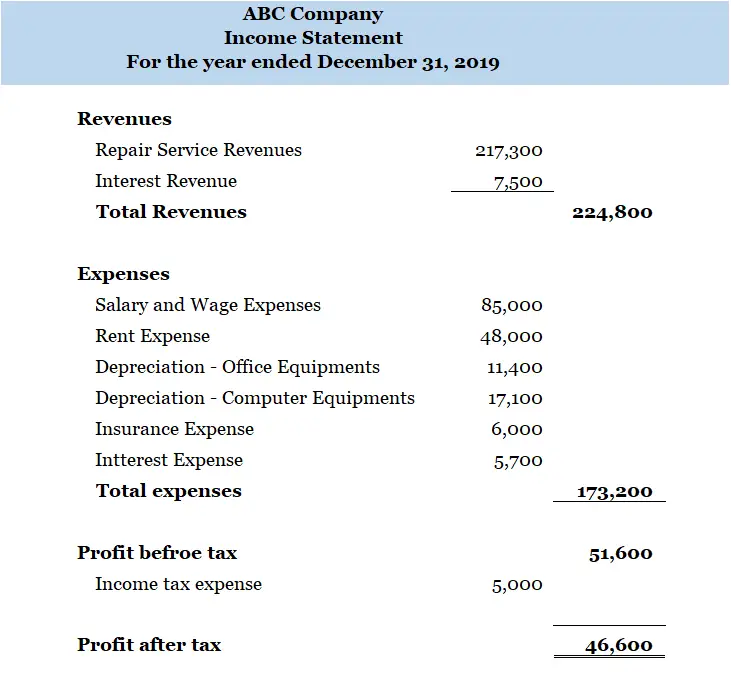

Results for a period are shown on the income statement and the cash flow statement. Guide to analyzing financial statements for financial analysts. They tell the story, in numbers, about the financial.

There are four main types of financial statements, which are noted below. These documents are used by the investment community, lenders, creditors, and management to evaluate an entity. Assets, liabilities, equity, revenues, expenses, gains, losses, comprehensive income, investment by owners, & distributions to owners.

The income statement lists income and expenses. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position, and cash flows.

Each one—the income statement, cash flow statement, and balance sheet—conveys a. Financial statements provide a picture of the performance, financial position, and cash flows of a business. The income statement, statement of retained earnings, balance sheet, and statement of cash flows, among other financial information, can be analyzed.

They tell you where your money is going, where it’s coming from, and how much you’ve got to work with. These three financial statements are intricately linked to one another. They include the income statement, balance sheet, and statement of cash flows.

Financial accounting isn’t just about numbers; Financial statements, such as the income statement, balance sheet, and cash flow statement, provide a comprehensive view of a company’s financial health. Internally prepared statements are prepared by a company without involvement of an external accounting professional.

The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. Overview of the three financial statements 1. Financial statement analysis reviews financial information found on financial statements to make informed decisions about the business.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)