Outrageous Tips About Is Depreciation Included In Profit And Loss Statement

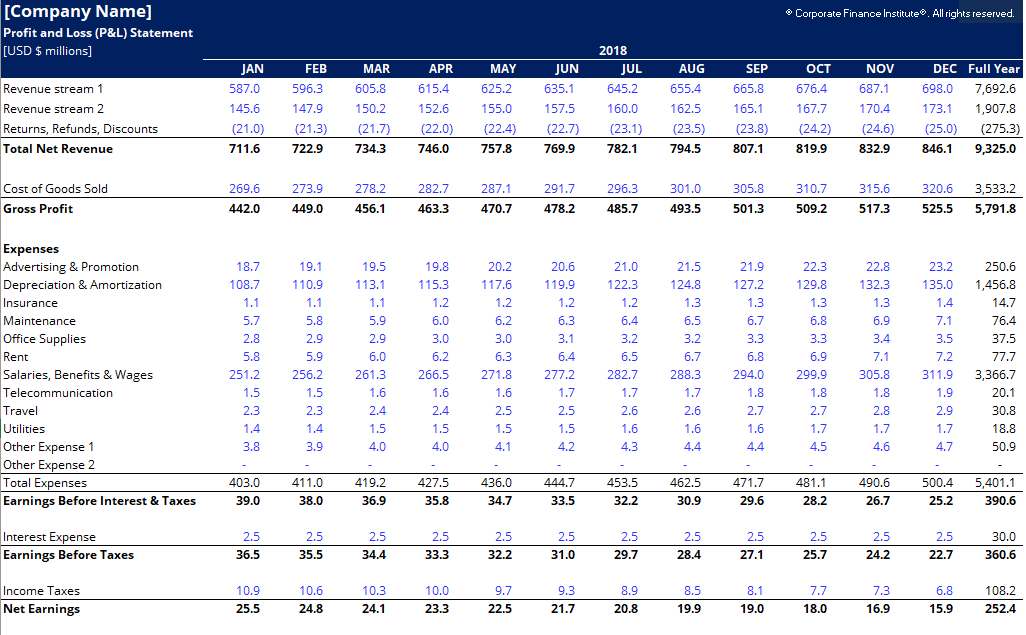

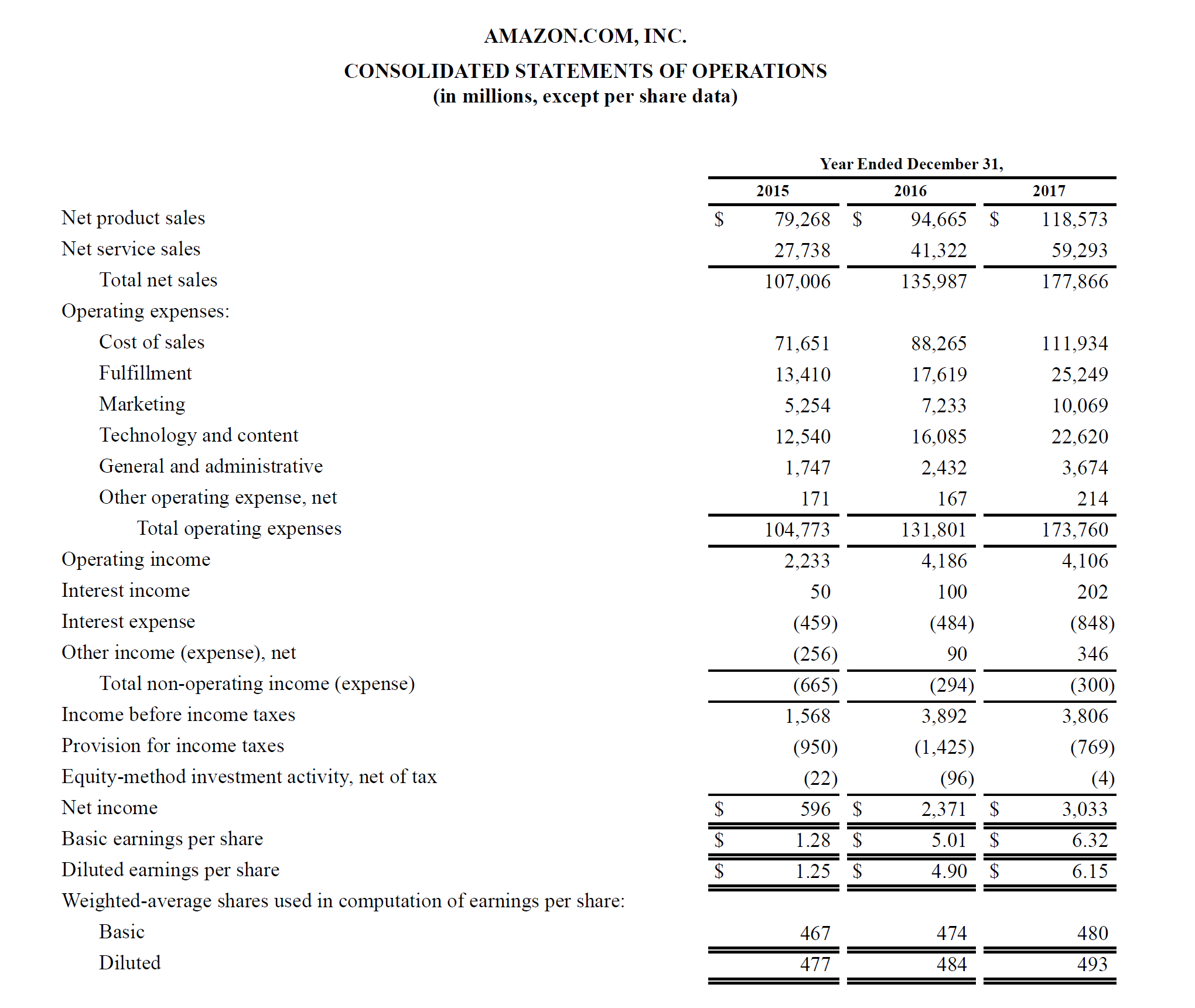

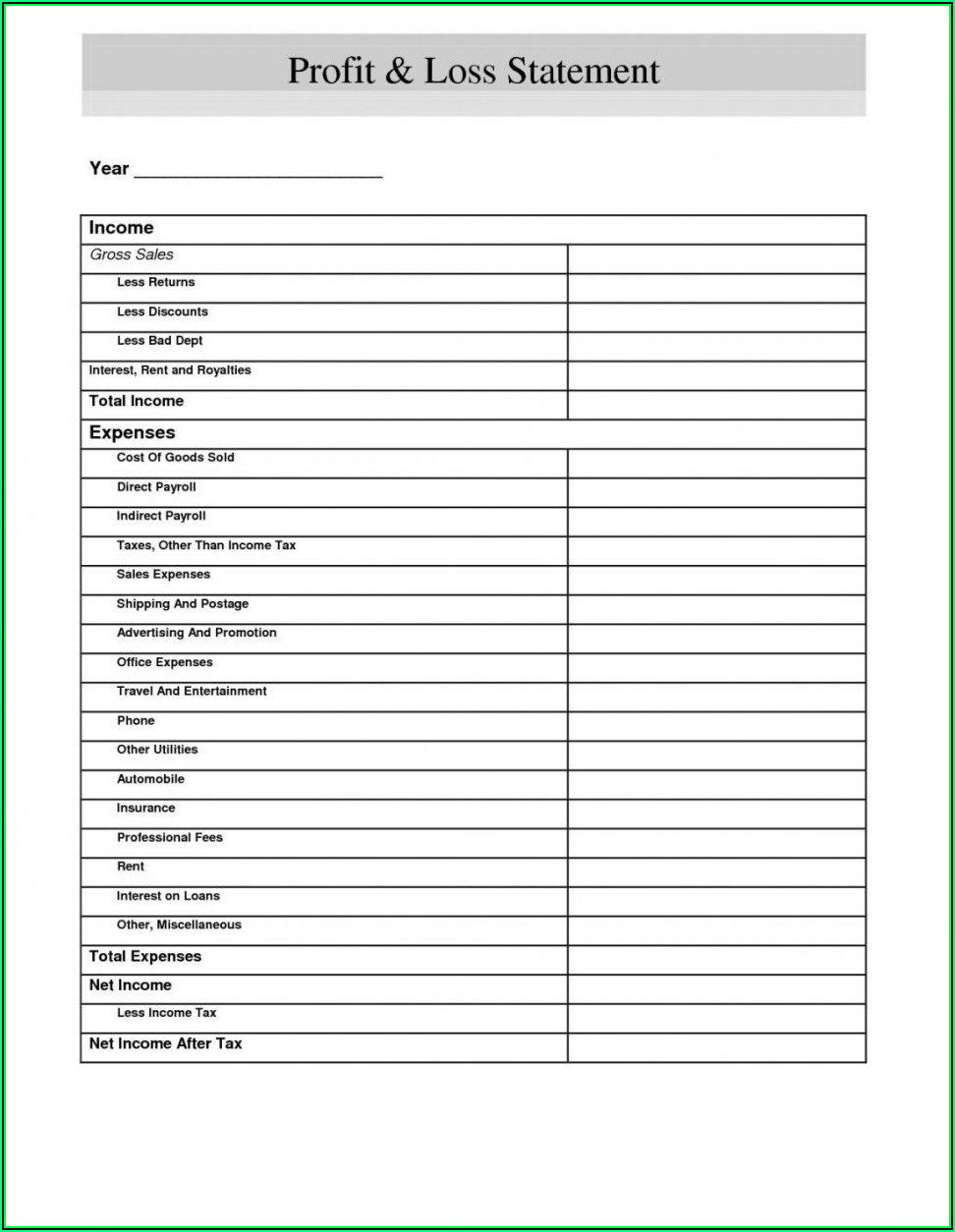

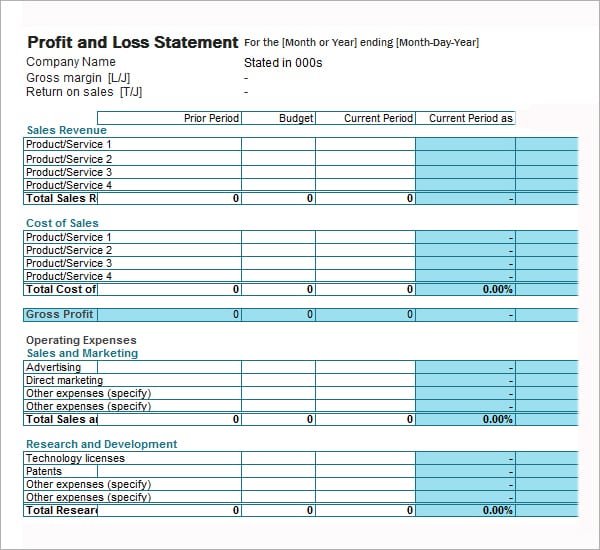

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

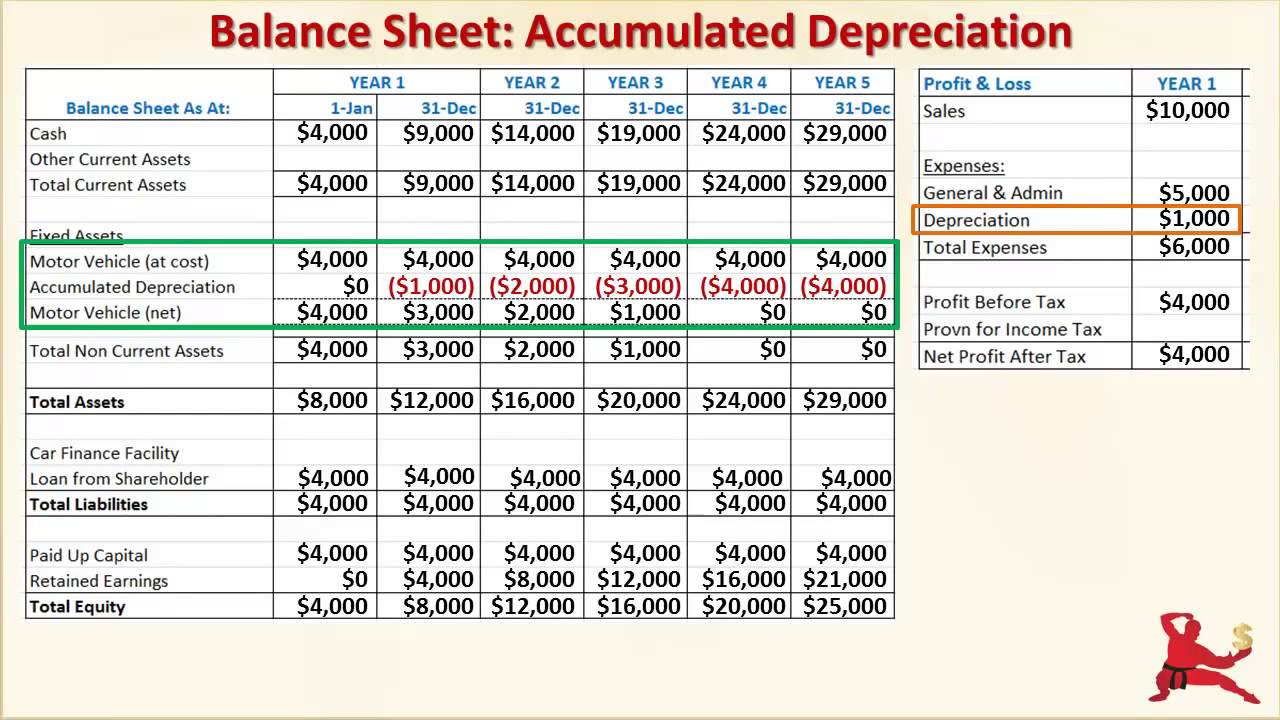

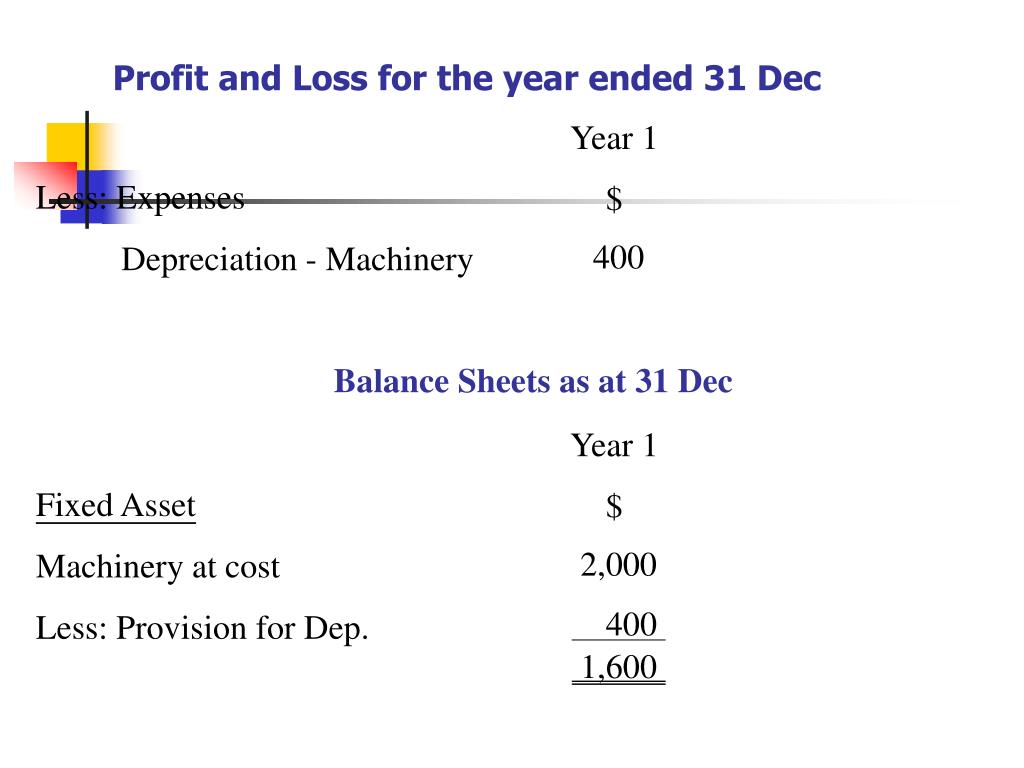

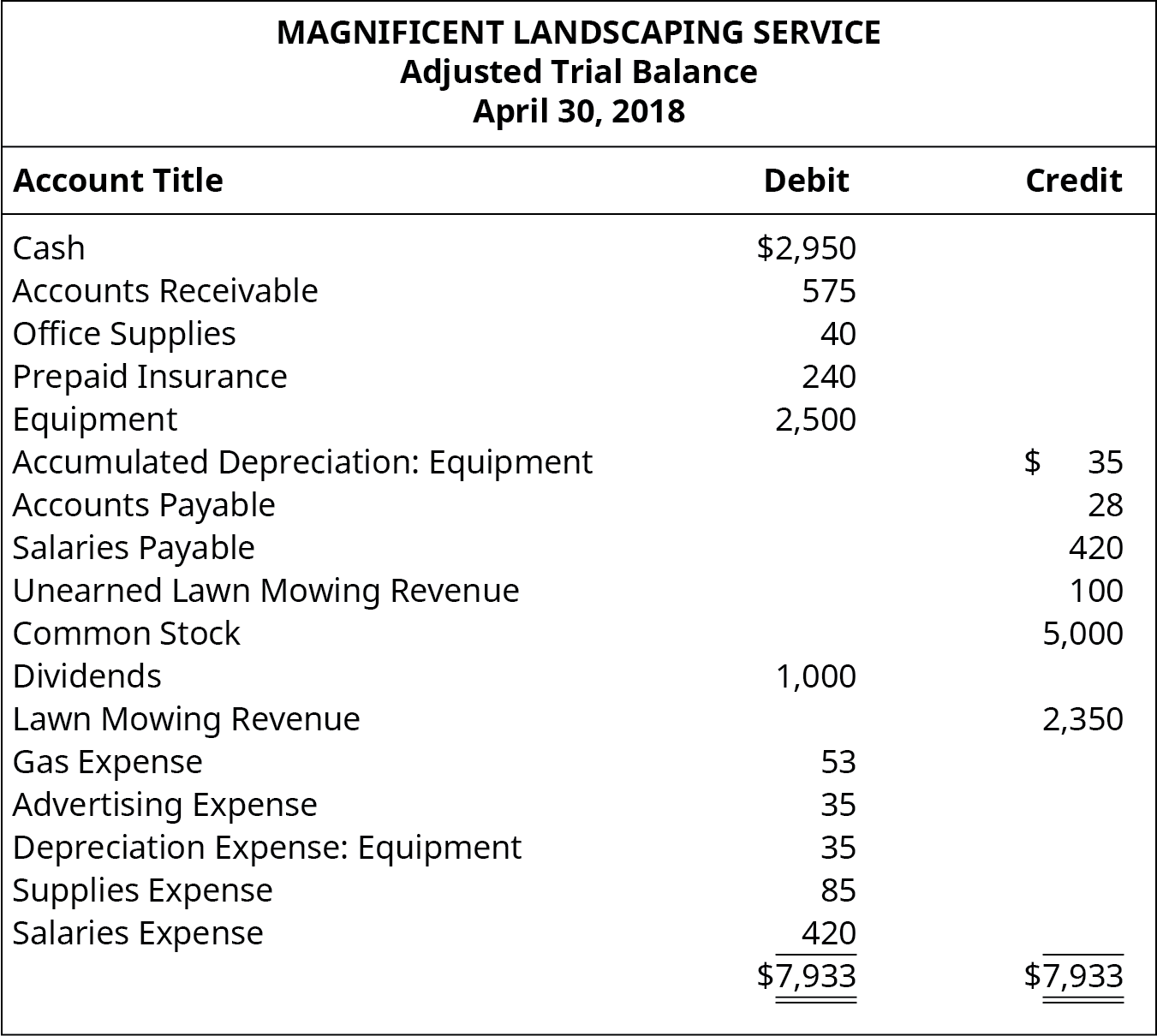

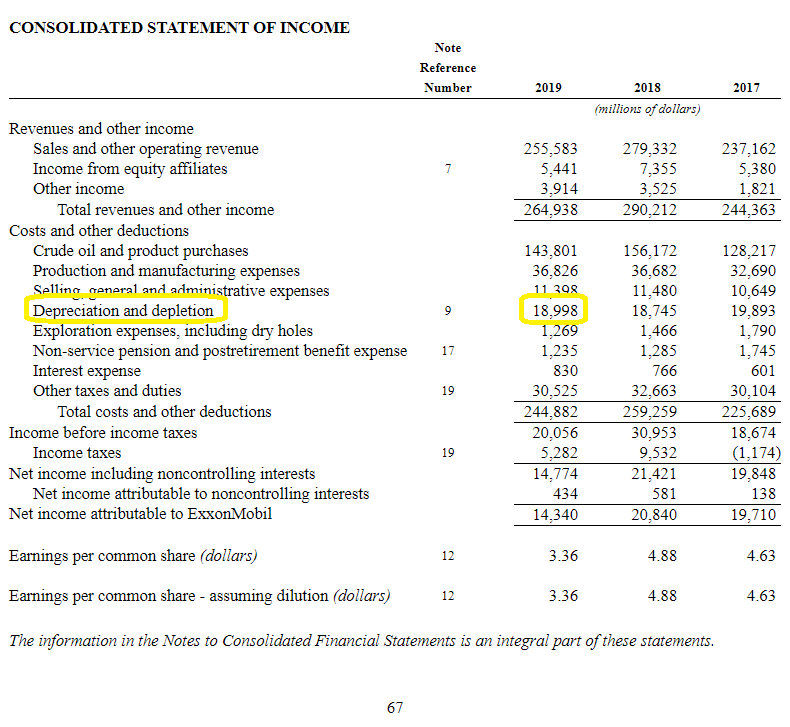

Is depreciation included in profit and loss statement. Depreciation expense is an income statement item. The $39,000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. Depreciation allows businesses to spread the cost of physical assets (such as a piece of machinery or a fleet of cars) over a period of years for accounting and tax purposes.

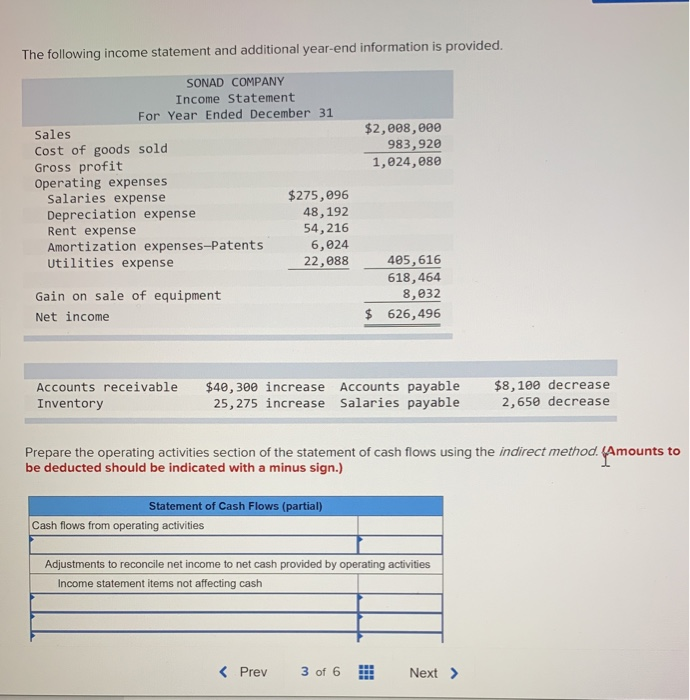

Accounting depreciation expense vs. It’s important to calculate depreciation accurately, because it can significantly impact a company’s financial results and tax liability. It accounts for depreciation charged to expense for the income reporting period.

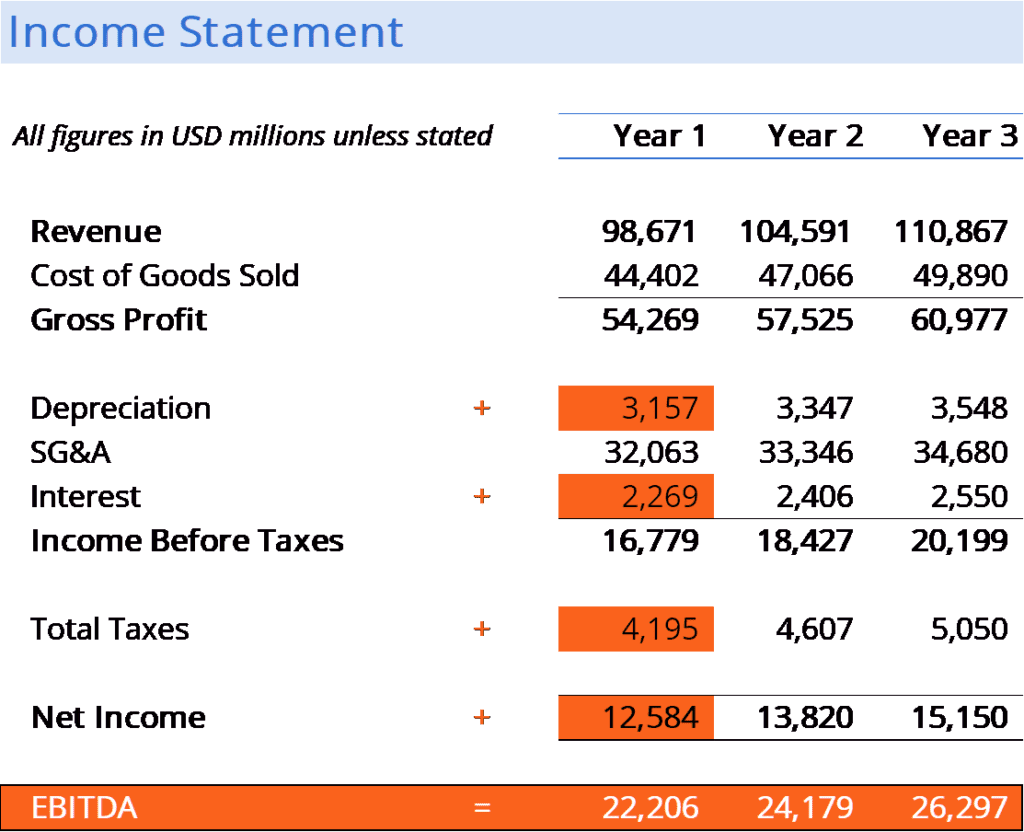

However, a portion of depreciation on a. Depreciation expense flows through an income statement, and this is where accumulated depreciation connects to a statement of profit and loss — the other name for an income statement or p&l. Net income is the amount of revenue left after all expenses, depreciation, taxes, and.

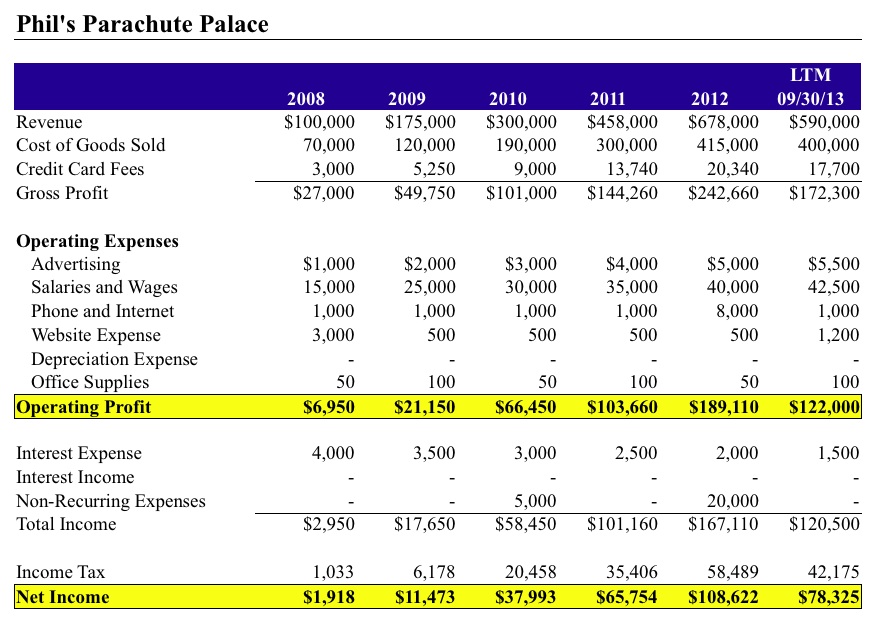

Key takeaways depreciation allocates the cost of an item over its useful life. P&l statements help provide a financial account or overview of a company's financial health that summarises the costs, expenses, and revenue made during a specified period. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda).

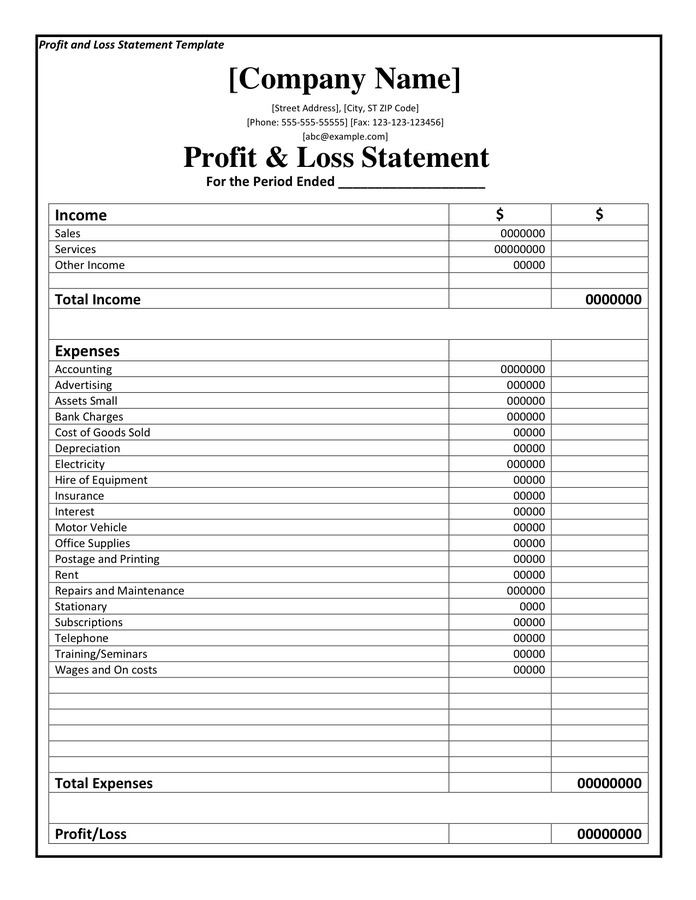

On an income statement or balance sheet. Typically, depreciation and amortization are not included in cost of goods sold and are expensed as separate line items on the income statement. A profit and loss statement contains three basic elements:

Depreciation is an accounting concept that applies to a business’ fixed assets, such as buildings, furniture and equipment. Depreciation is considered a cost of doing business — as such, it should be accounted for on your profit and loss (p&l) report as an expense. Depreciation is an amount that reflects the loss in value of a company's fixed asset.

What is an asset and which types of assets depreciate? Physical assets, such as machines, equipment, or vehicles, degrade. Depreciation in accounting is the systematic process of allocating the cost of an asset (fixed assets) over its estimated useful life.

It’s a measure of how profitable your business is, without taking into account external costs, like interest payments, taxes, depreciation, and amortization. By the investopedia team updated july 06, 2023 reviewed by melody bell fact checked by vikki velasquez. Depreciation is typically tracked one of two places:

The p&l statement is one of three. This amount shows the portion of the asset's cost used up during the accounting period. On the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period.

Revenue, expenses, and net income. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. It spreads the cost of the fixed asset over its useful life so that the.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)