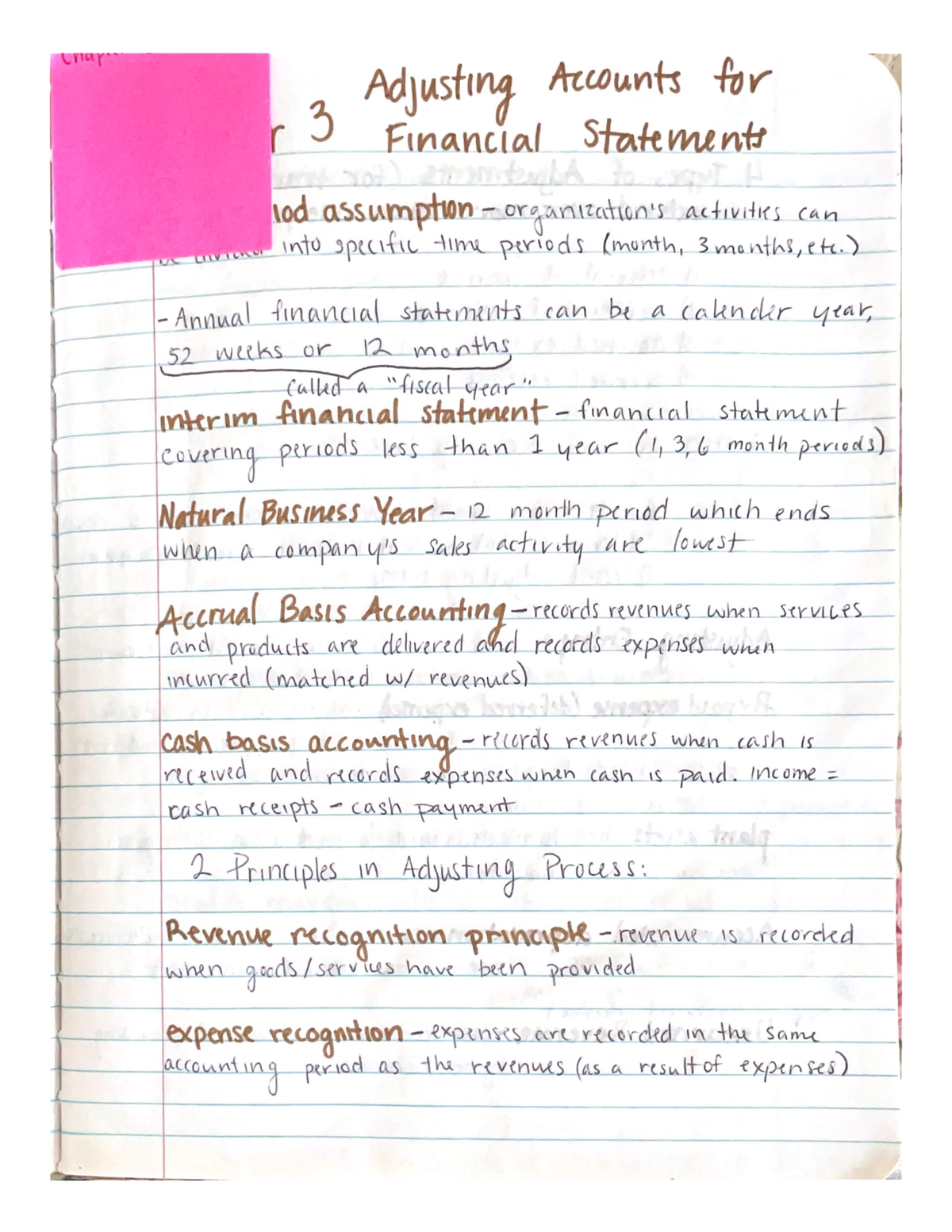

Formidable Tips About Adjusting Accounts For Financial Statements

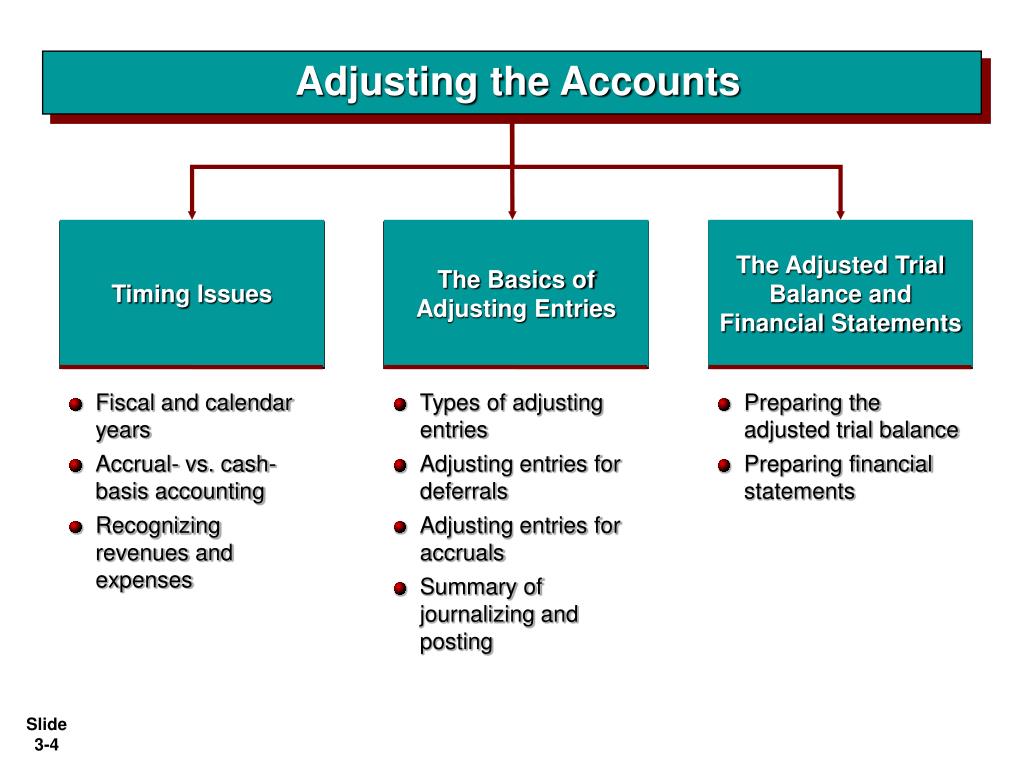

Evaluate the distinguishing characteristics of adjusting journal entries and differentiate them from regular journal entries.

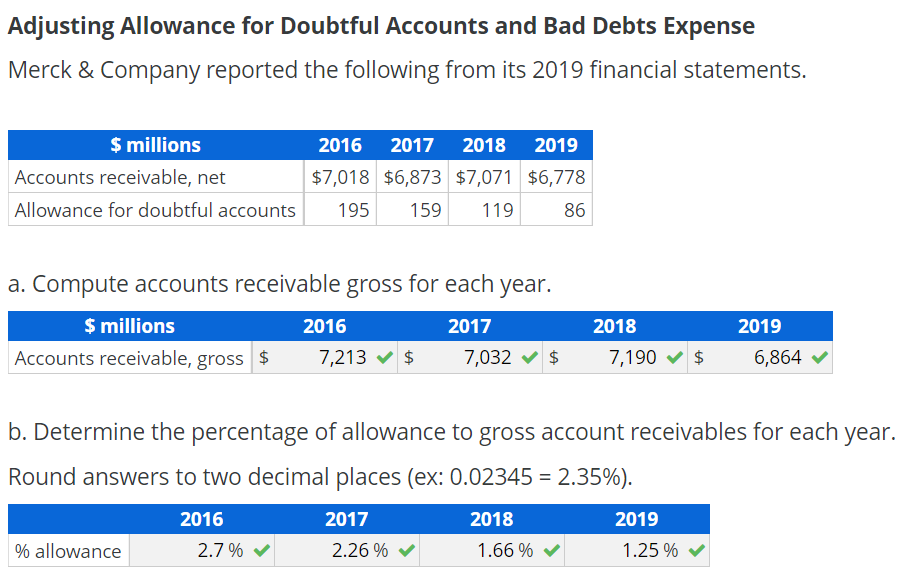

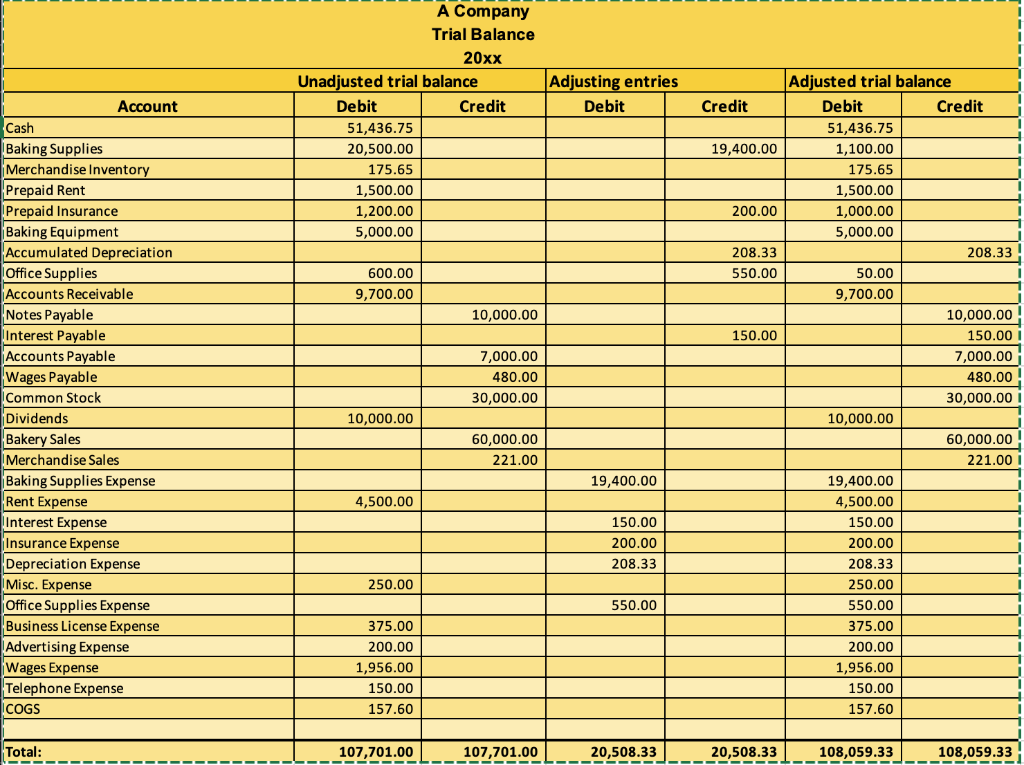

Adjusting accounts for financial statements. Adjusting your financial statements is one of the most important steps in preparing your business for sale. To prepare the financial statements, a company will look at the adjusted trial balance for account information. 105) a2 compute profit margin and describe its use in analyzing company performance.

The two main accounting methods include: 4 identify the major types of adjusting entries. To prepare the financial statements, a company will look at the adjusted trial balance for account information.

A1 explain how accounting adjustments link to financial statements. Recognize revenues when cash is collected (e., cash is collected. The three most common types of adjusting journal.

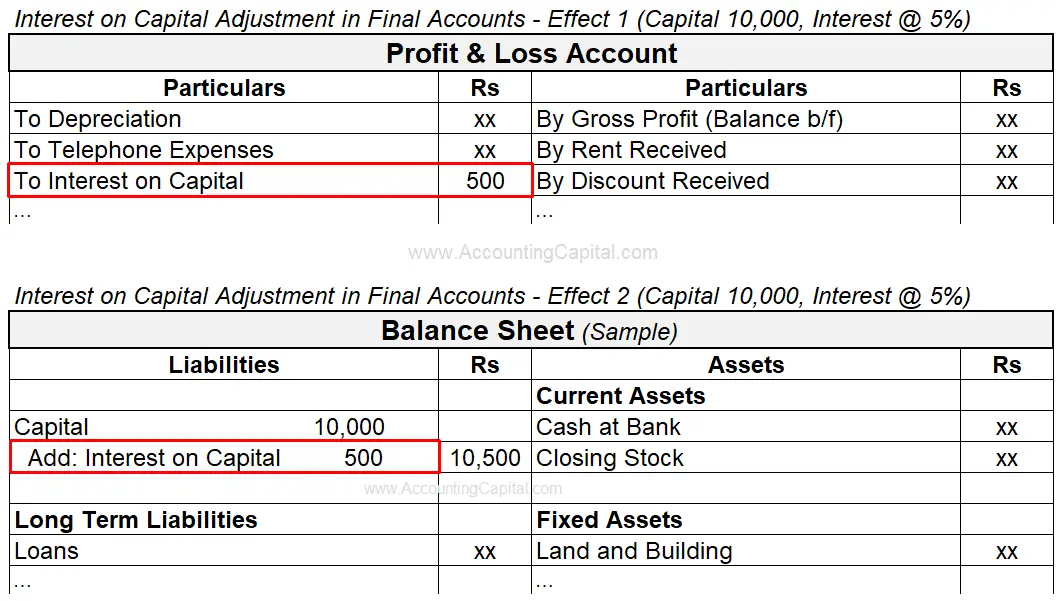

Making adjusting entries is a way to stick to the matching principle—a principle in accounting that says expenses should be recorded in the same accounting period as. Working capital and liquidity ; Cash will never be in an adjusting entry.

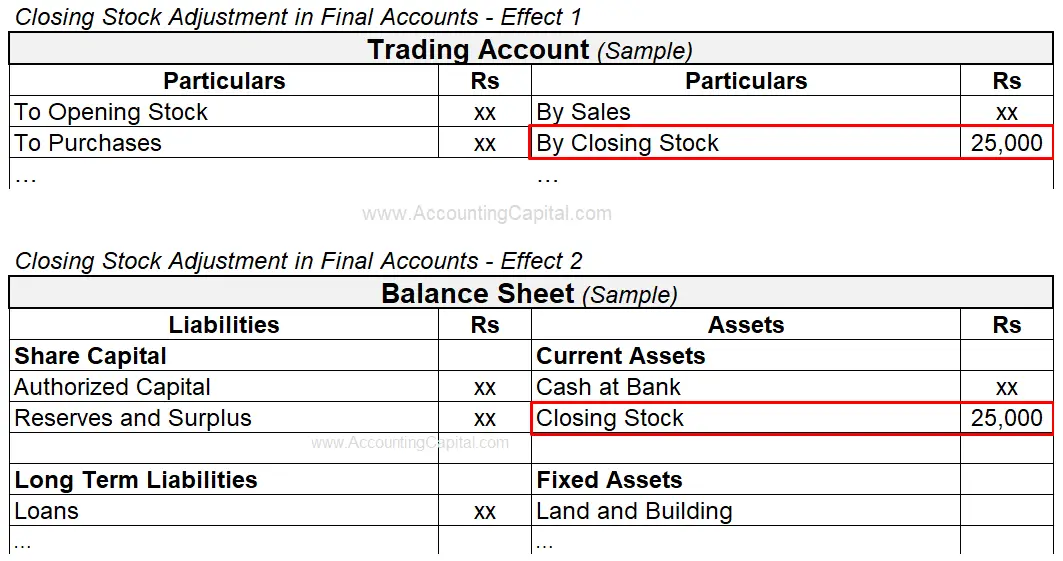

3 explain the reasons for adjusting entries. An adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability). Inventory accruals and prepayments interest depreciation, and irrecoverable.

This review is done by using the. This chapter primarily discusses adjusting accounts for the financial statements. Every adjusting entry will have at least one income statement account and one balance sheet account.

1 explain the time period assumption. These adjustments are not the result of physical events or. From this information, the company will begin constructing each of.

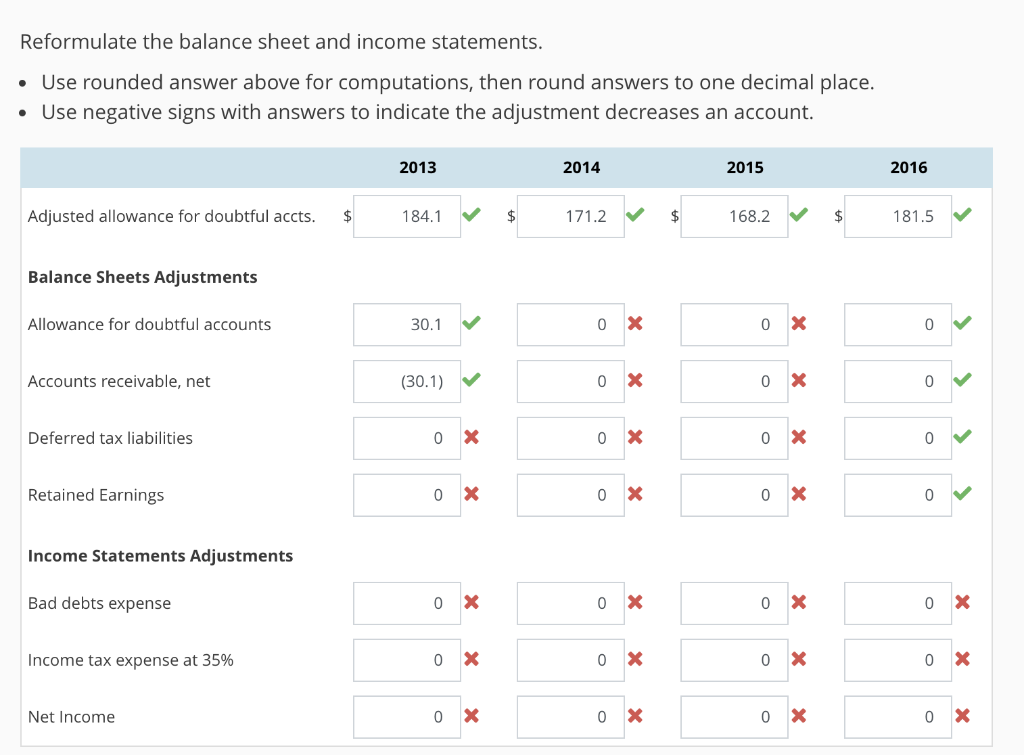

P3 prepare financial statements from an adjusted trial balance. Buyers compare potential acquisitions using sde or ebitda. At the end of an accounting period, before financial statements can be prepared, the accounts must be reviewed for potential adjustments.

2 explain the accrual basis of accounting. One important accounting principle to remember is that just as the accounting equation (assets = liabilities + owner’s equity/or common stock/or capital) must be equal, it must. From this information, the company will begin constructing each of.

P2 explain and prepare an adjusted trial balance. Organize and manage data effectively using an adjusting. P1 prepare and explain adjusting entries.