Beautiful Tips About Statement Of Taxable Income

Your taxable income from all sources that hmrc knew about at the time that it was.

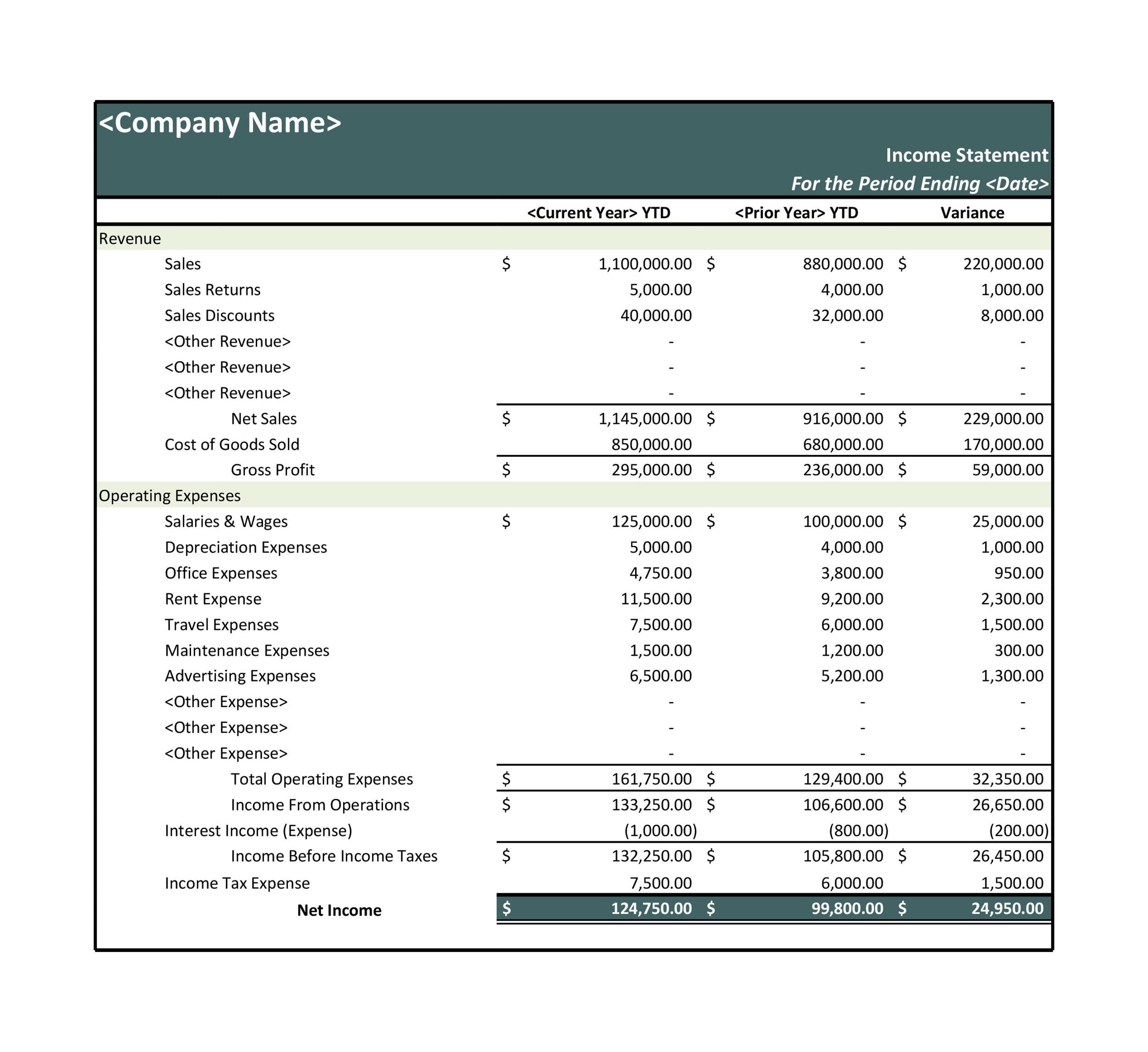

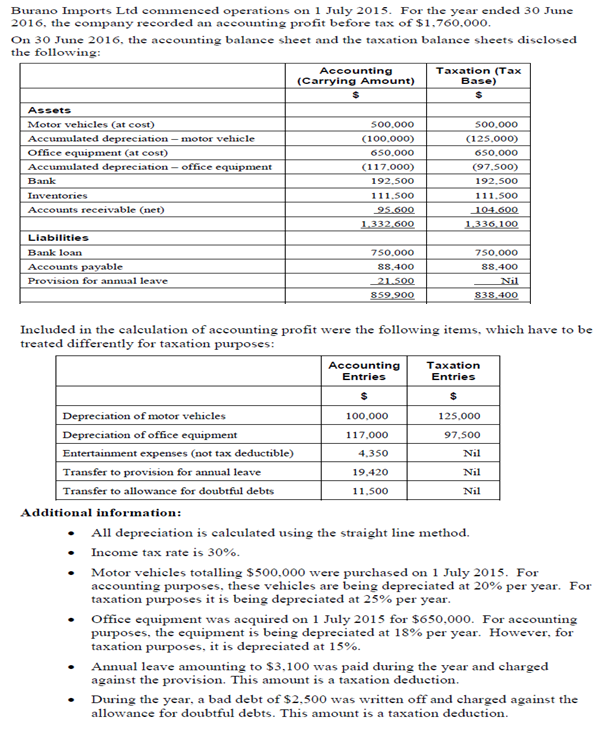

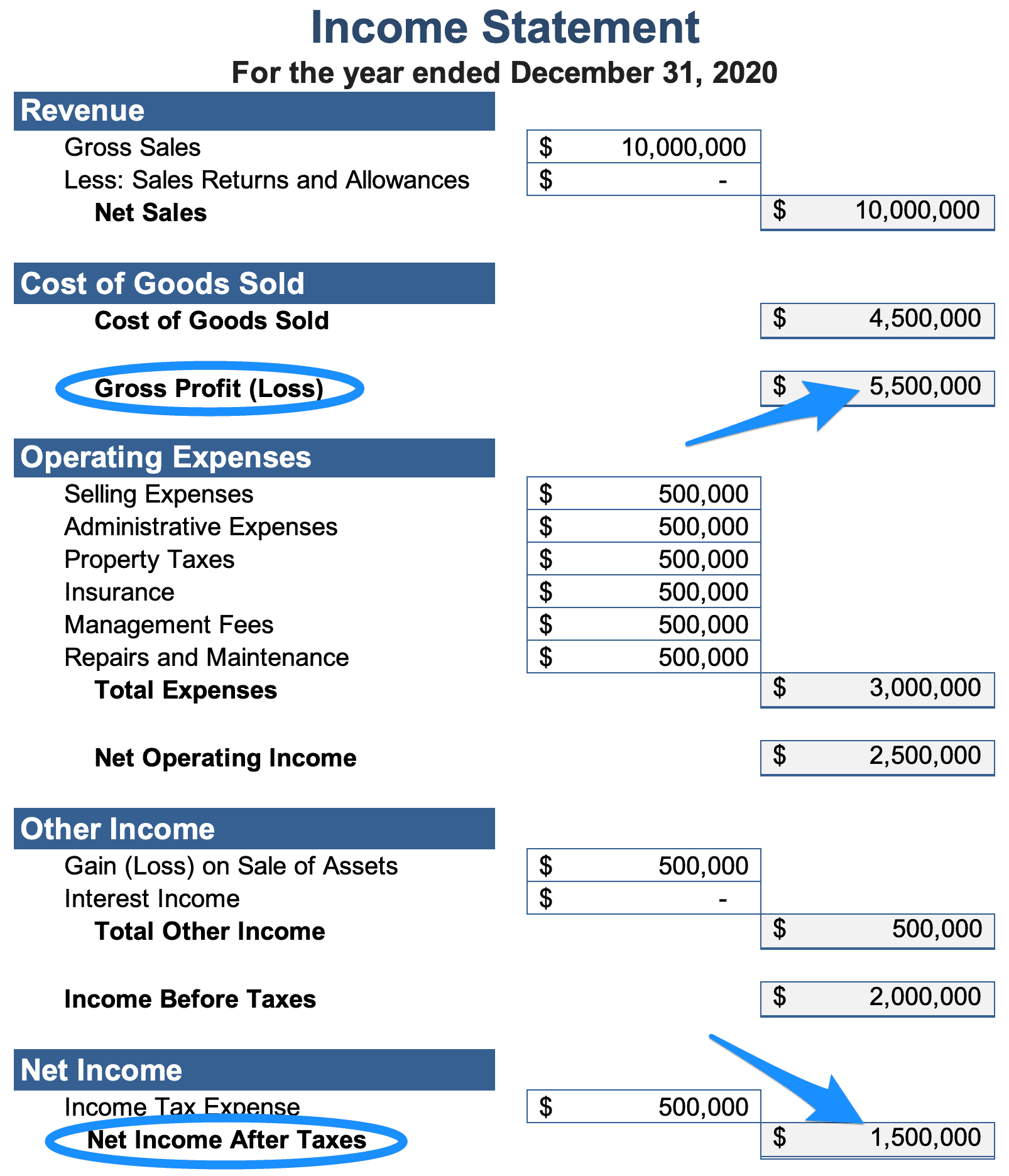

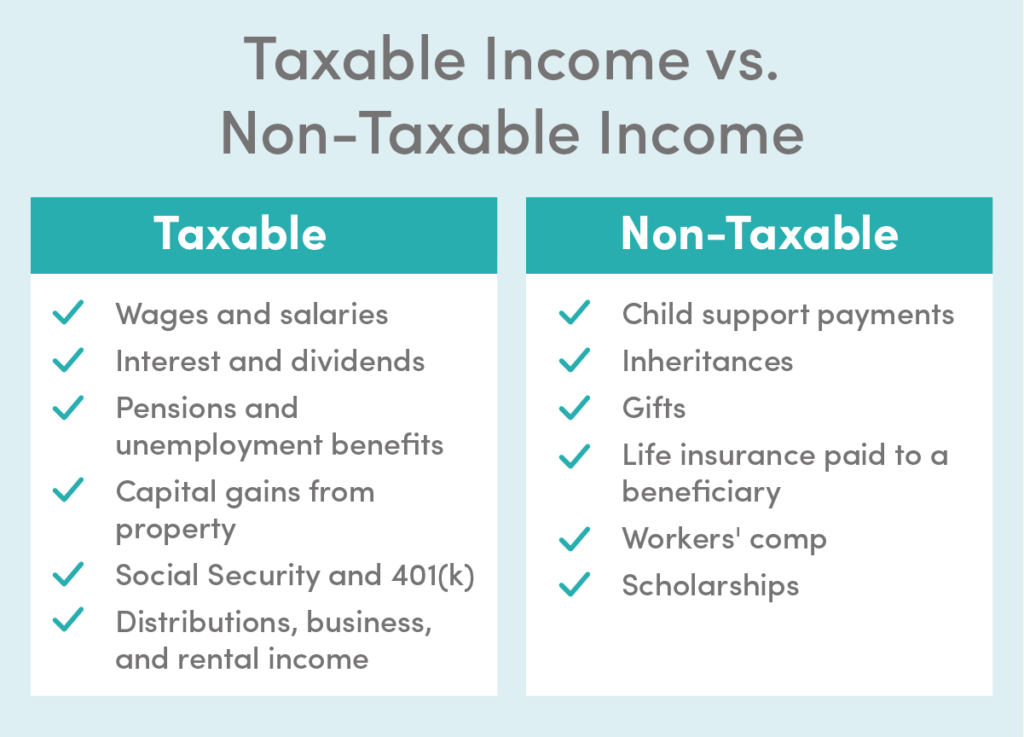

Statement of taxable income. Grant cardone, a motivational speaker, social media influencer and real estate investor known for his bold statements, recently stirred controversy with his views on income. Income that is taxable must be reported on your return. On the other hand, the calculation of a corporation’s taxable income is done by deducting the cost of goods sold, operating expenses and interest paid on debts from the.

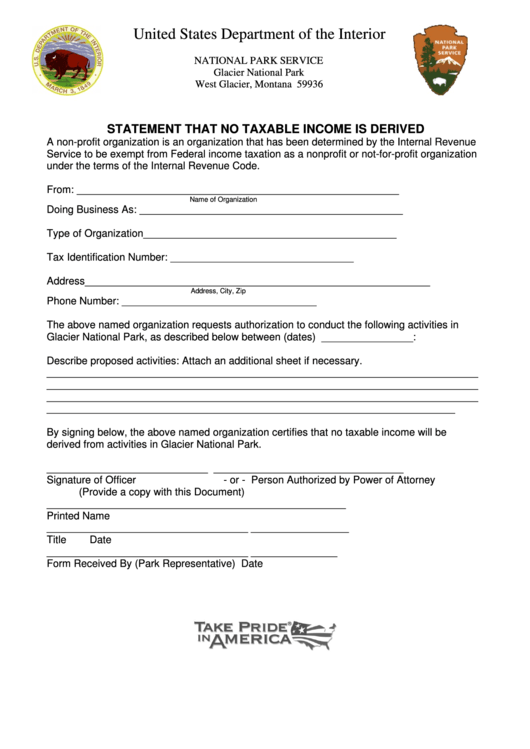

Taxable income refers to the base upon which an income tax system imposes tax. In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to. Income statements through ato online services.

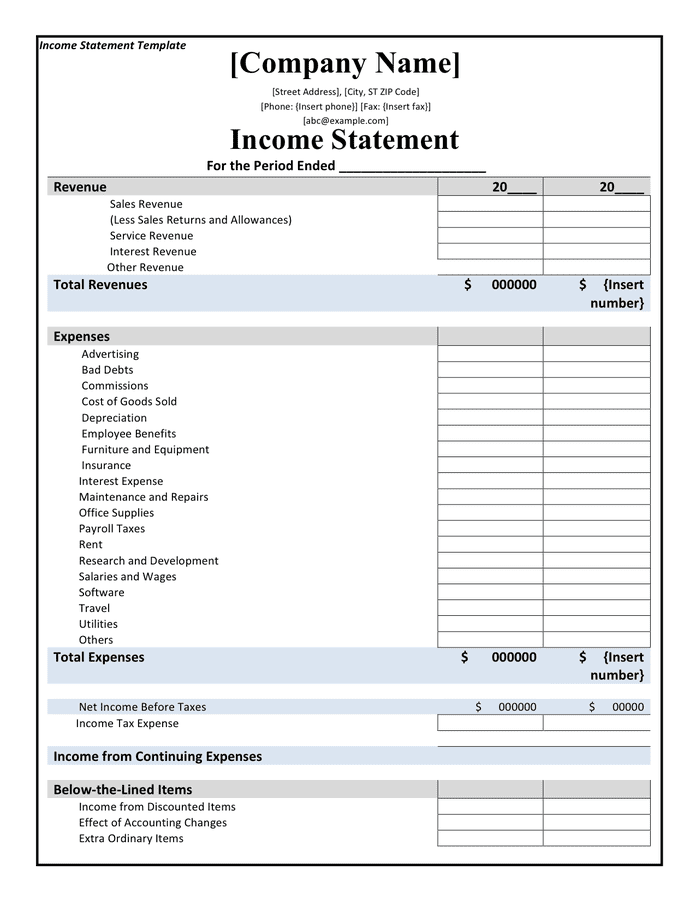

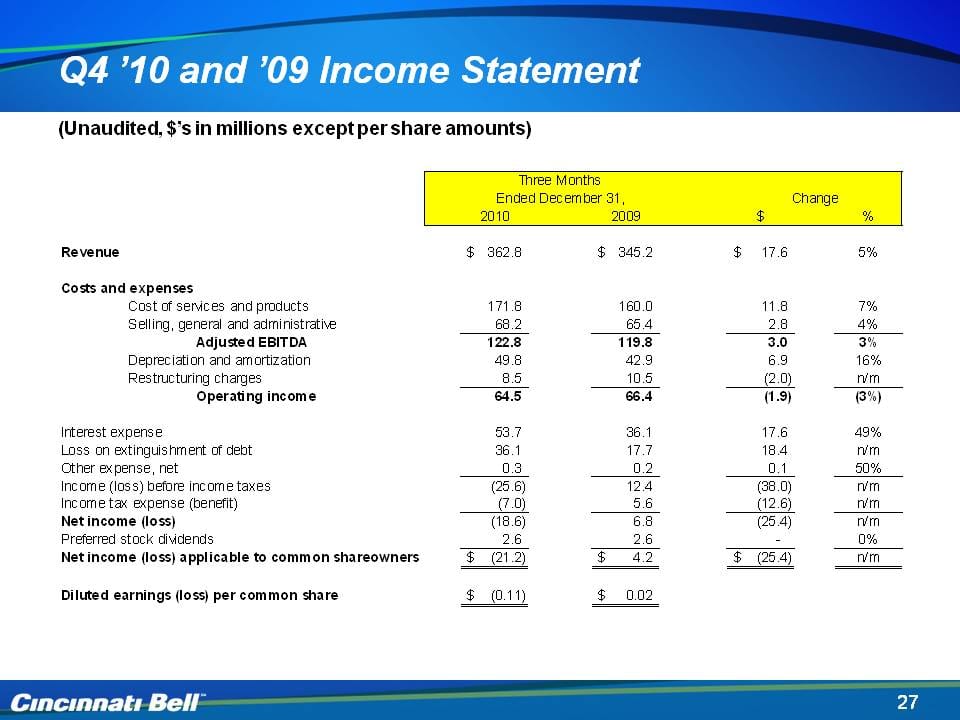

Taxable income is the basis for a company’s income tax payable or recoverable. Cd yields are taxed as interest income, not at the lower rate of capital gains. The statement displays the company’s revenue,.

We examine whether public financial statement information is incrementally useful in forecasting confidential taxable income. If you are married, your best option is usually to file jointly. You can think of it like a formula:.

The bank or credit union that issued the cd provides the owner of the account with a. Generally, an amount included in your income is taxable unless it is specifically exempted by law.

[1] in other words, the income over which the government imposed tax. Simply put, a company is taxed on the profit it makes after all allowable deductions are subtracted from its revenues.

What is taxable income? The company’s tax loss at t is the excess. Use this service to view your annual tax summary.

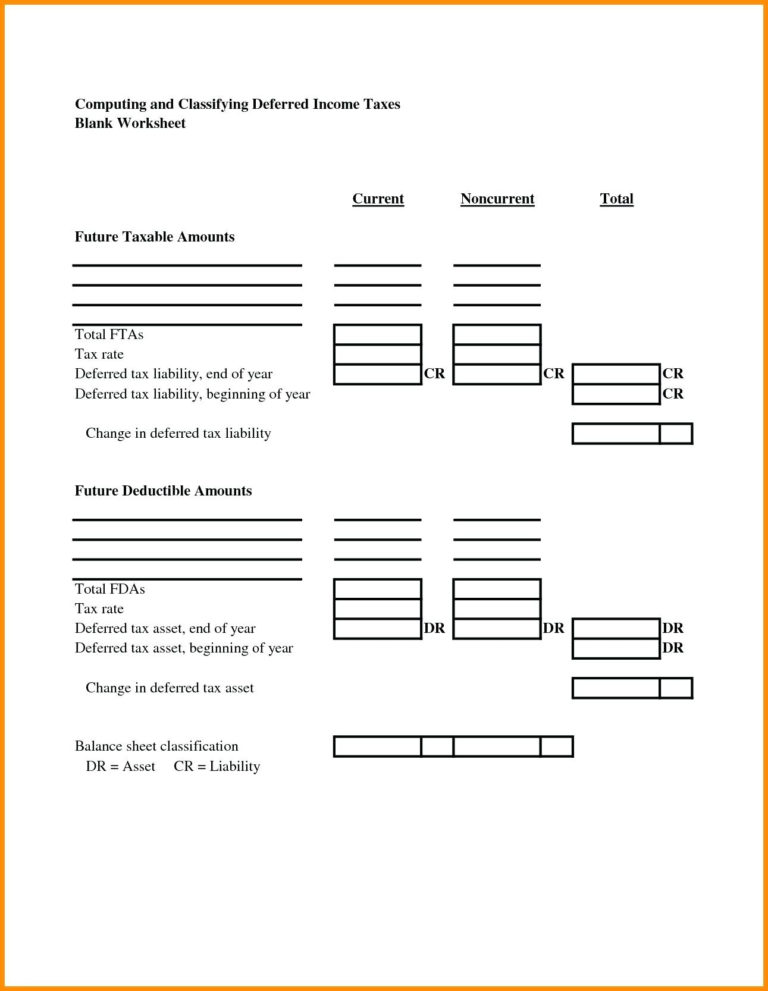

If the company has a taxable income of $1 or more, transfer the amount at t to a taxable or net income in the calculation statement. Tax losses or unused tax credits, the presentation of income taxes in the financial statements and the disclosure of information relating to income taxes. However, you won’t pay federal income tax on the first $15,000 of your taxable income because of a tax credit called the basic personal amount.

If you file your taxes jointly with your spouse, you. First, determine your filing status. 4 years ago updated support query a 100% pension fund with a fund pension policy input (actuary 100%) is showing a $1 taxable income/loss amount in the statement of.

Taxable income means the income which is chargeable to income tax, and it is calculated to decide how much tax an individual or a company owes to the. You may start filing for the year of assessment 2024 from 1 mar 2024.