Divine Info About Common Size Statement Of Comprehensive Income

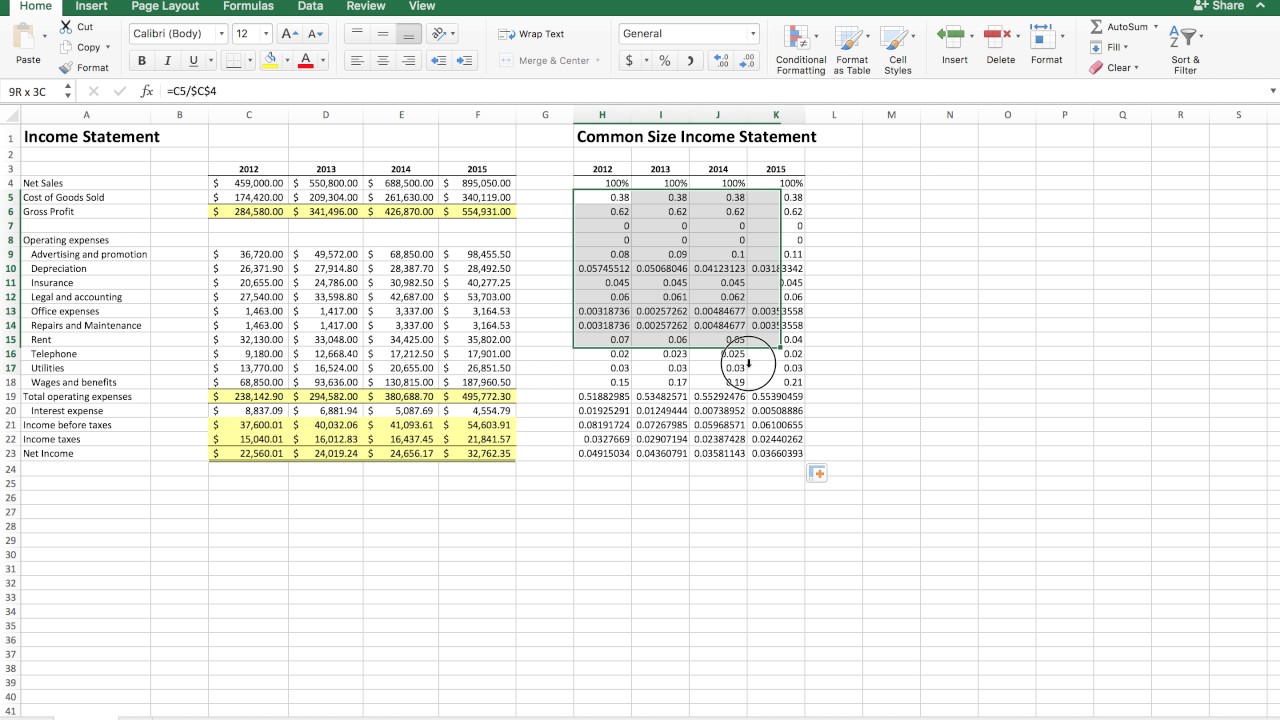

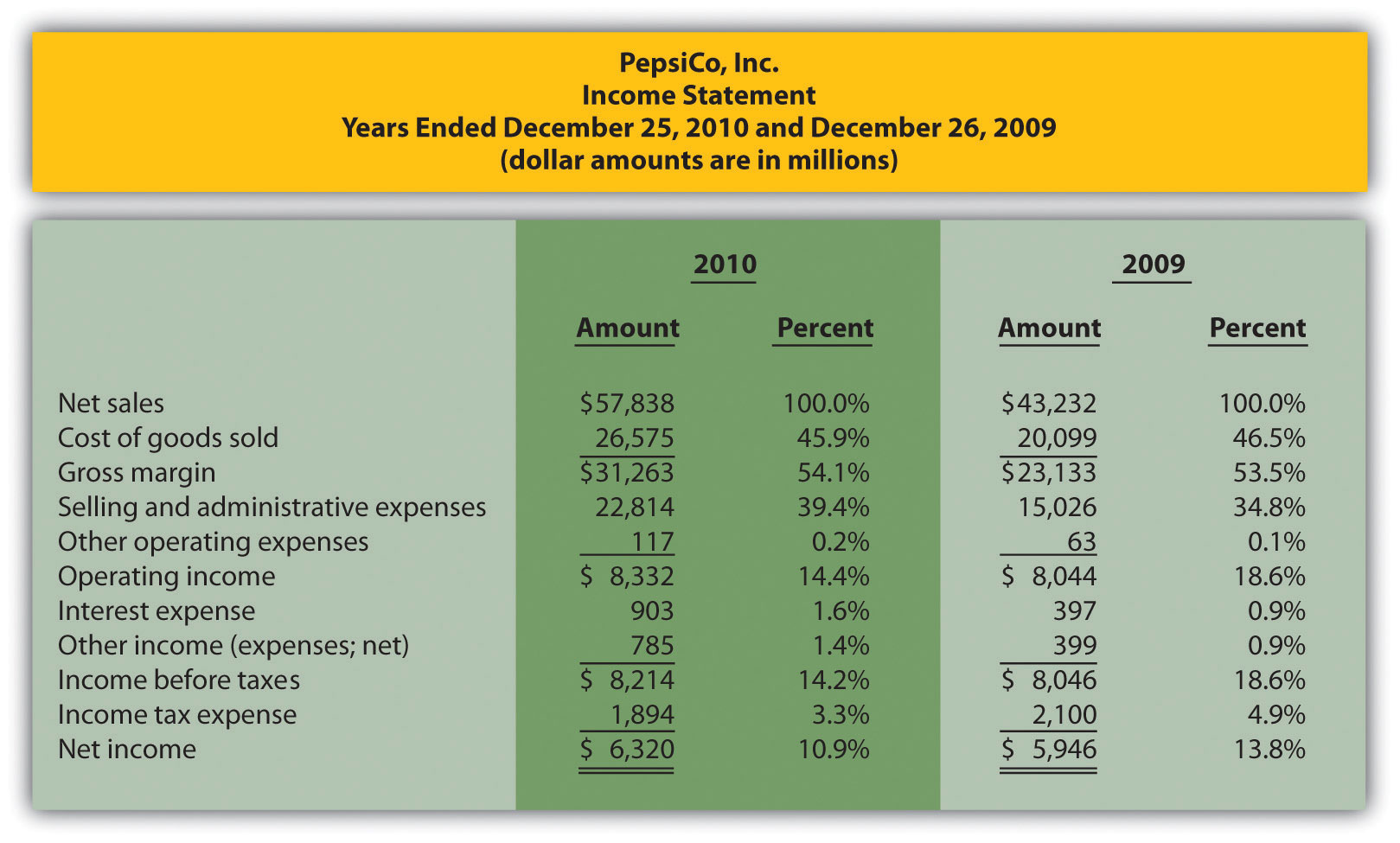

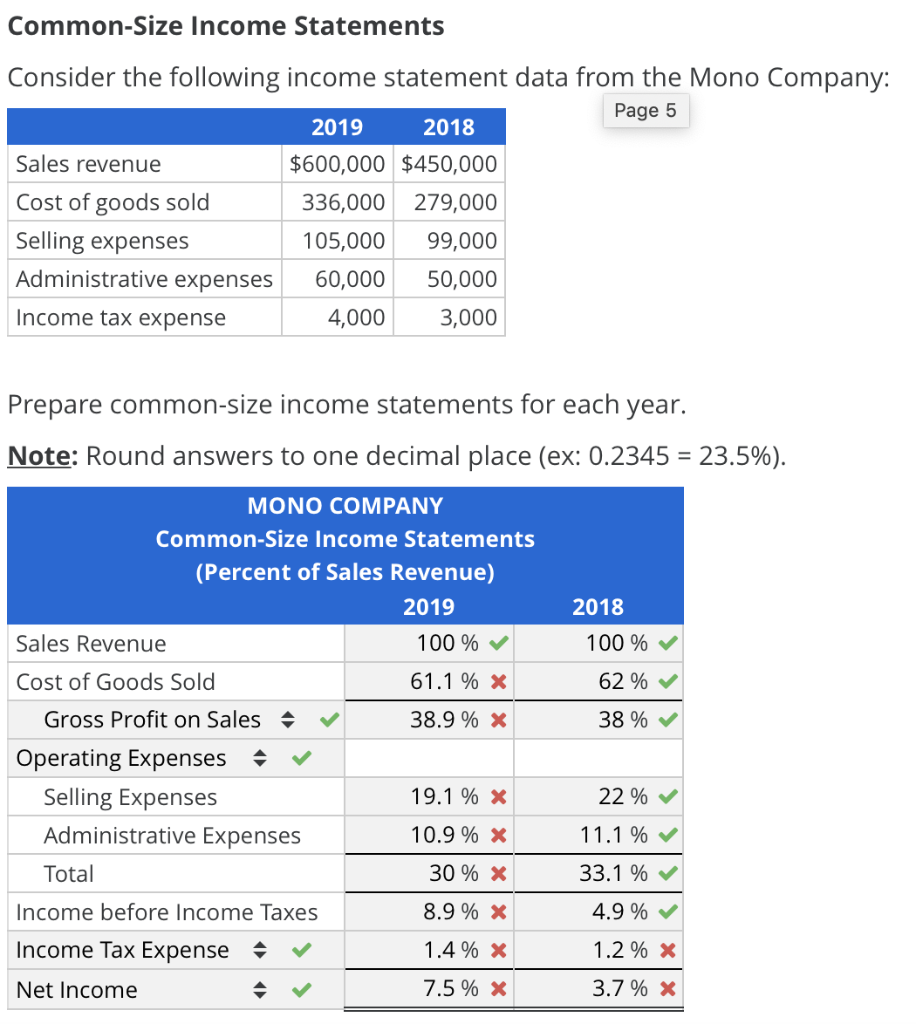

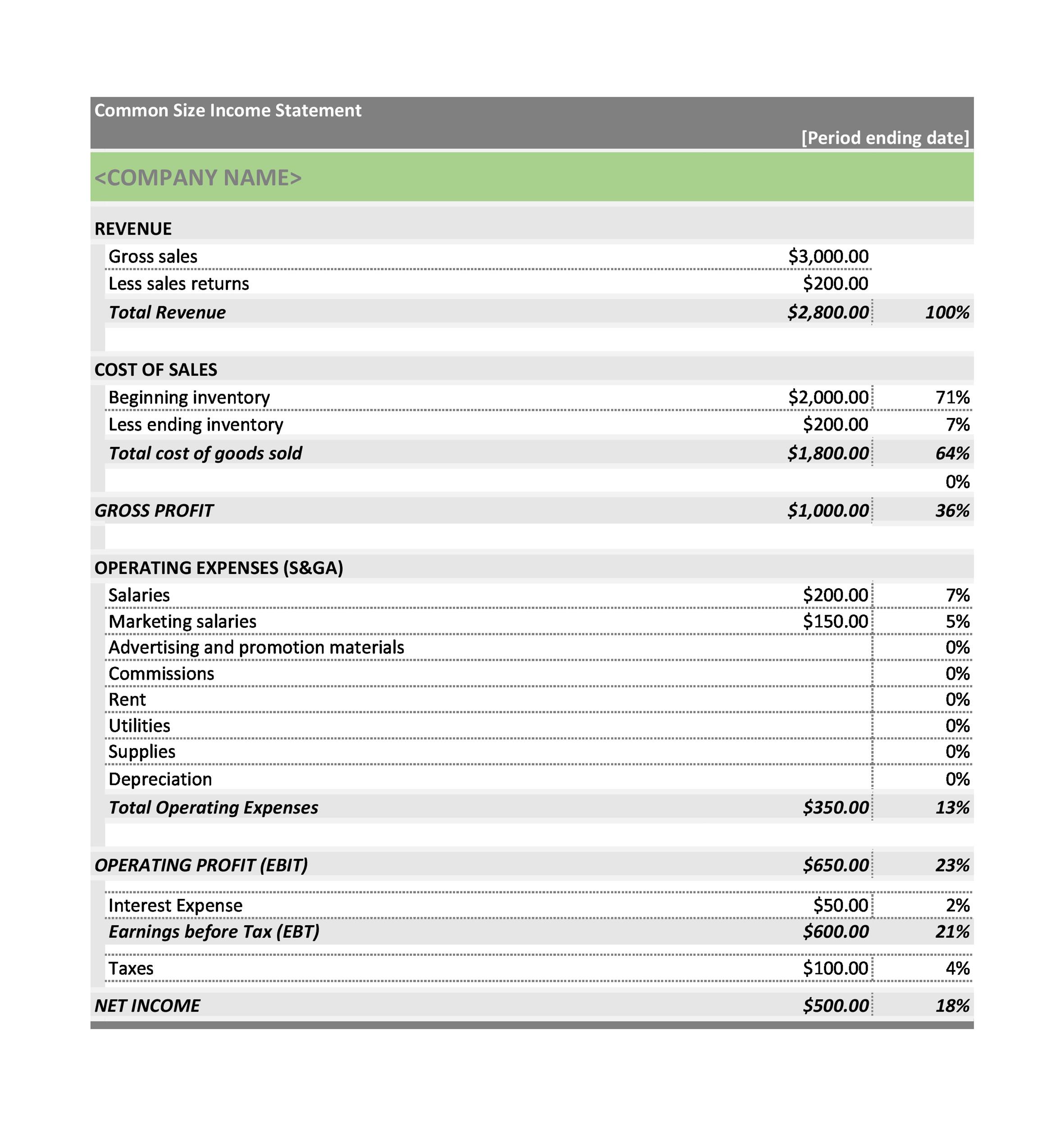

One of the most effective tools to accurately analyze your financial statements is common size analysis.

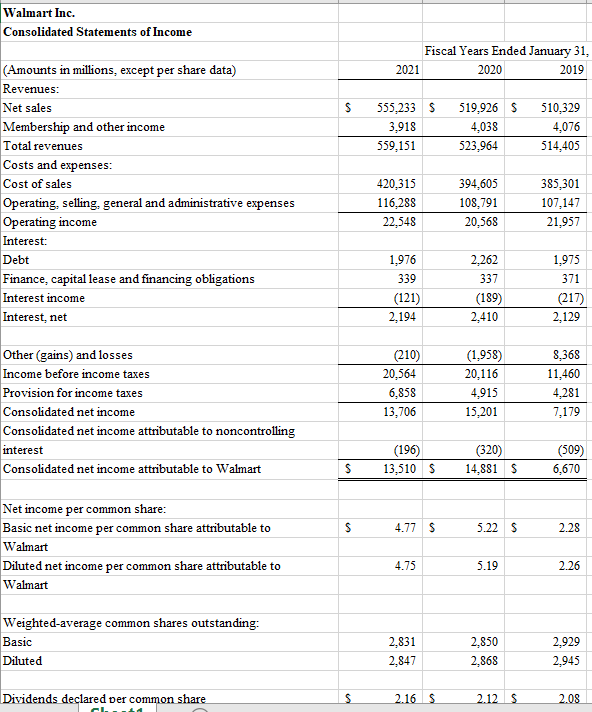

Common size statement of comprehensive income. The net result for the period of deducting operating expenses from operating revenues. This type of analysis helps you see how revenue. Assuming sales are $100 million and gross profits are $50 million,.

Common size analysis, also referred to as vertical analysis, is a tool that financial managers use to analyze financial statements. The ratios tell investors and finance managers how the company is doing in terms of revenues, and can be used to make. 7,346 (2,519) (2,130) other comprehensive income/(loss) for the period.

Each item is then expressed as a percentage of sales. Pages available for free this week: Selected items operating income income before pro… net income dec 31, 2018 dec.

For companies, comprehensive income sheds light on changes in equity. Here's how to perform common size analysis. To common size an income statement, analysts divide each line item (e.g.

A common size income statement, also known as vertical analysis, serves as a crucial financial tool. Common size income statement is calculated as similarly, calculate for the years 2017 and 2016. Common size analysis is used to calculate net profit margin, as well as gross and operating margins.

Understanding the common size income statement. The base item in the income statementis usually the total sales or total revenues. In the above table, it can be seen that the.

Share of other comprehensive income of joint ventures and associates. For example, gross margin is calculated by dividing gross profit by sales. Common size income statement explained.

Comprehensive income is the sum of a company's net income and other comprehensive income. This is not a separate. Gross profit, operating income, marketing expenses) by revenue or sales.

It evaluates financial statements by expressing.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)