Unique Info About Operating Expenses Balance Sheet

These include operating expenses like:

Operating expenses balance sheet. Different business models and industries require different operating expenses. Data on the ecb’s balance sheet and profit and loss account since 1999 can be downloaded from the annual accounts page on the ecb’s website (see links in the “download data” section at the bottom of the page). Those types of purchases are considered investments and are listed separately on the balance sheet.

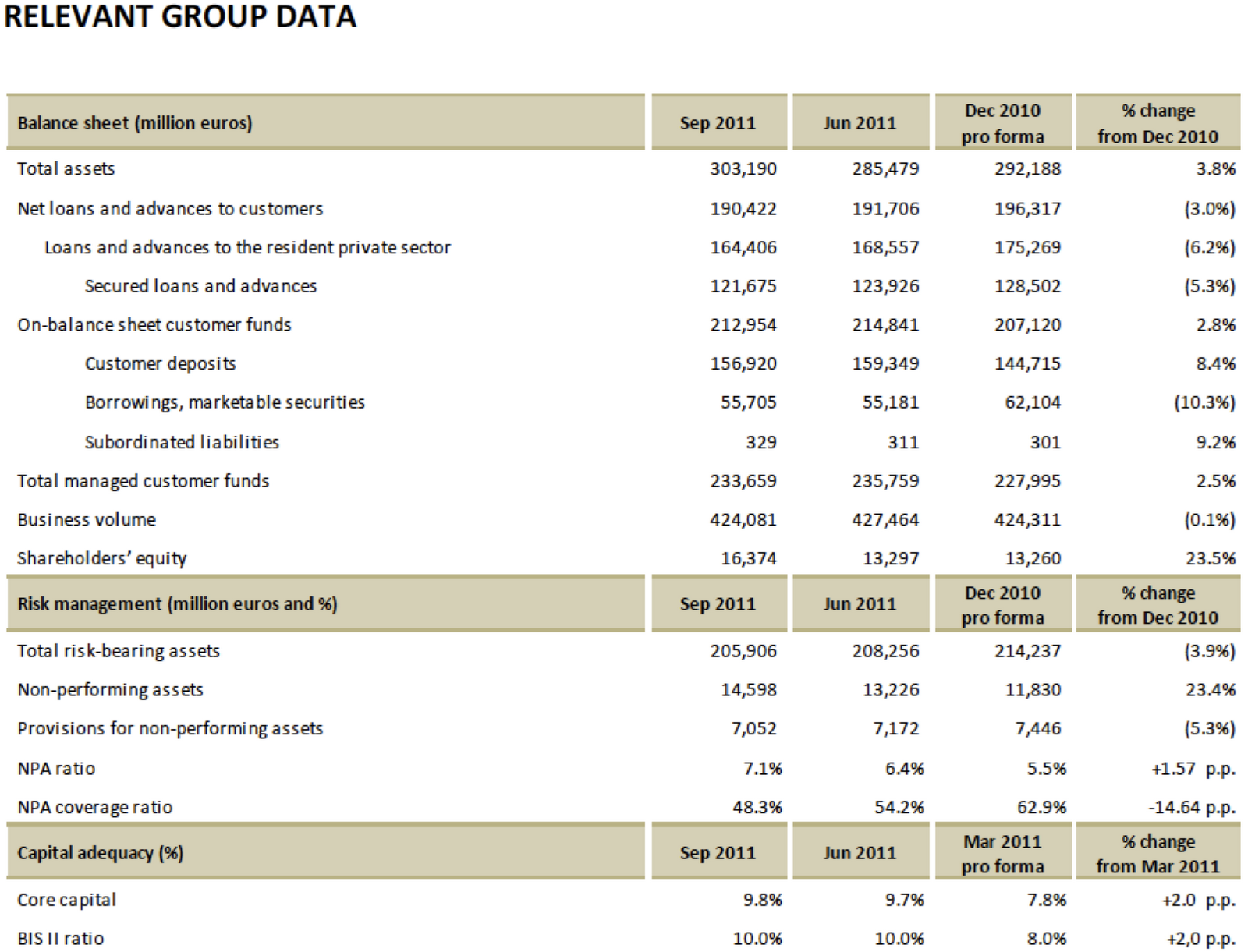

For data on the annual consolidated balance sheet of the eurosystem, see annual consolidated balance sheet of the. Understanding operating expenses and how they impact your business are crucial skills. Accounting january 9, 2024 one of the responsibilities of management is determining how to reduce operating expenses without affecting the ability to compete with competitors.

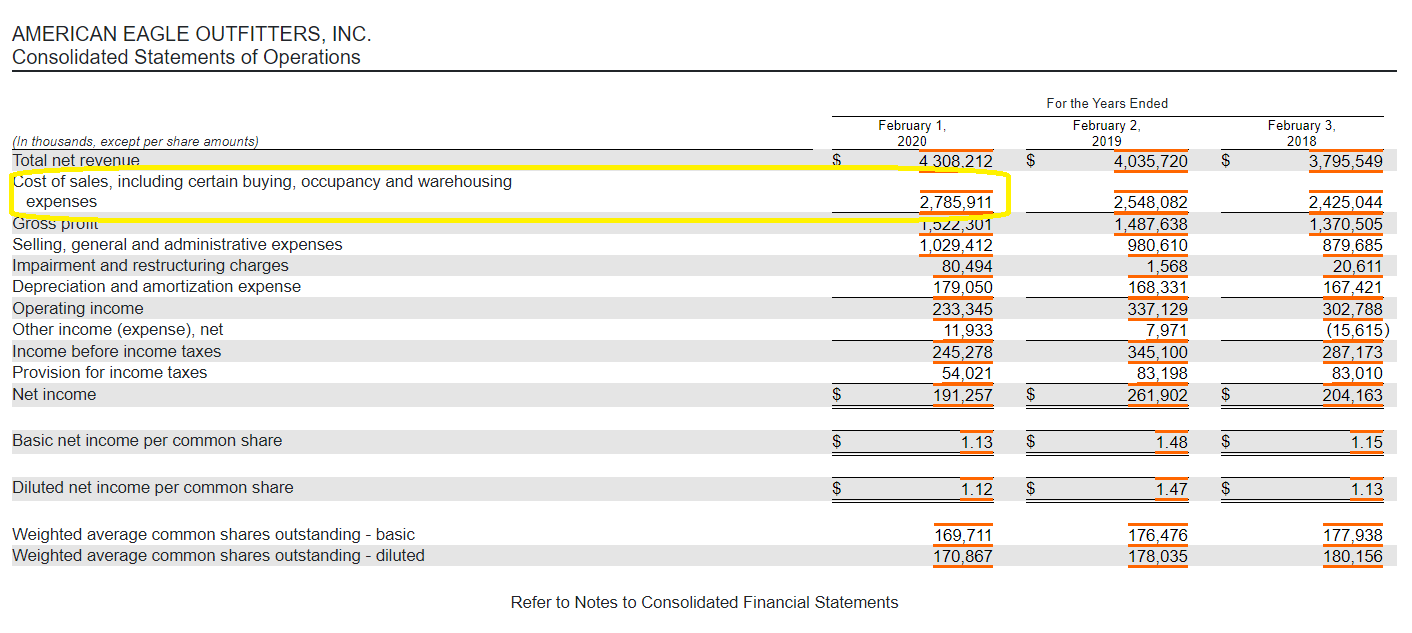

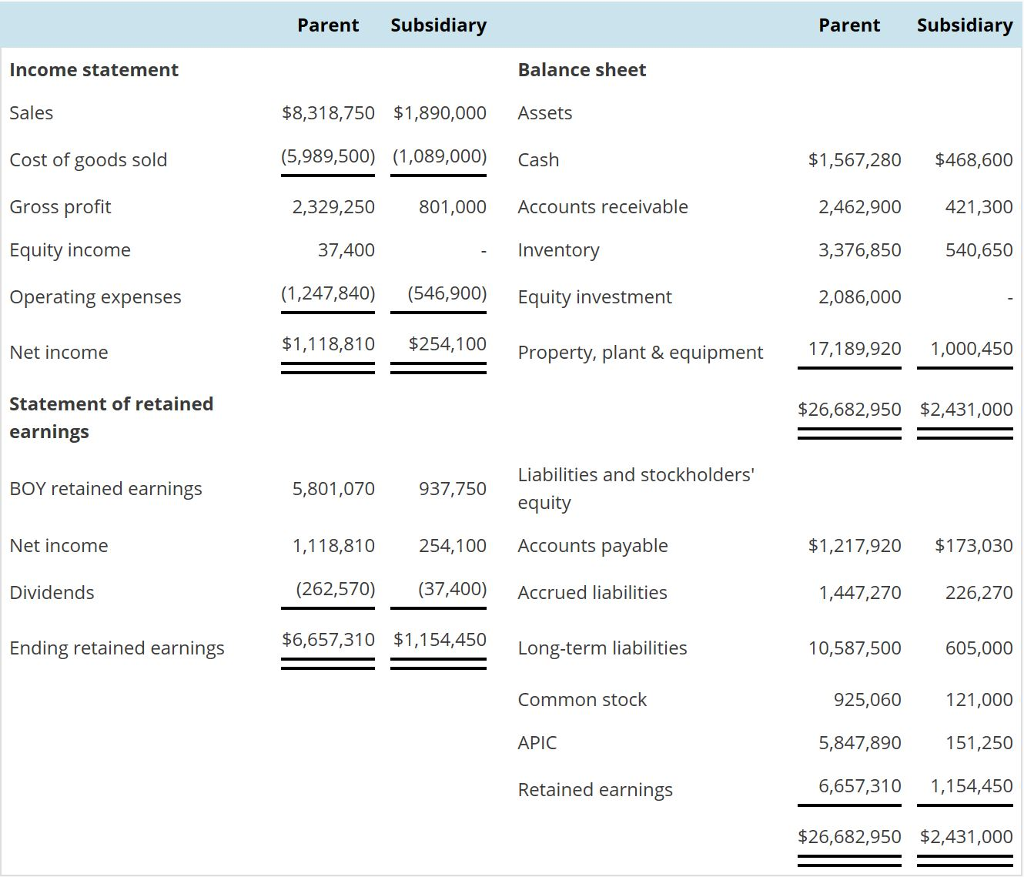

The $30 million in sg&a and r&d are the total operating expenses of our company. Operating expenses are represented on a company's balance sheet under the liabilities category. Capex is also listed in the investing activities section of the cash flow statement.

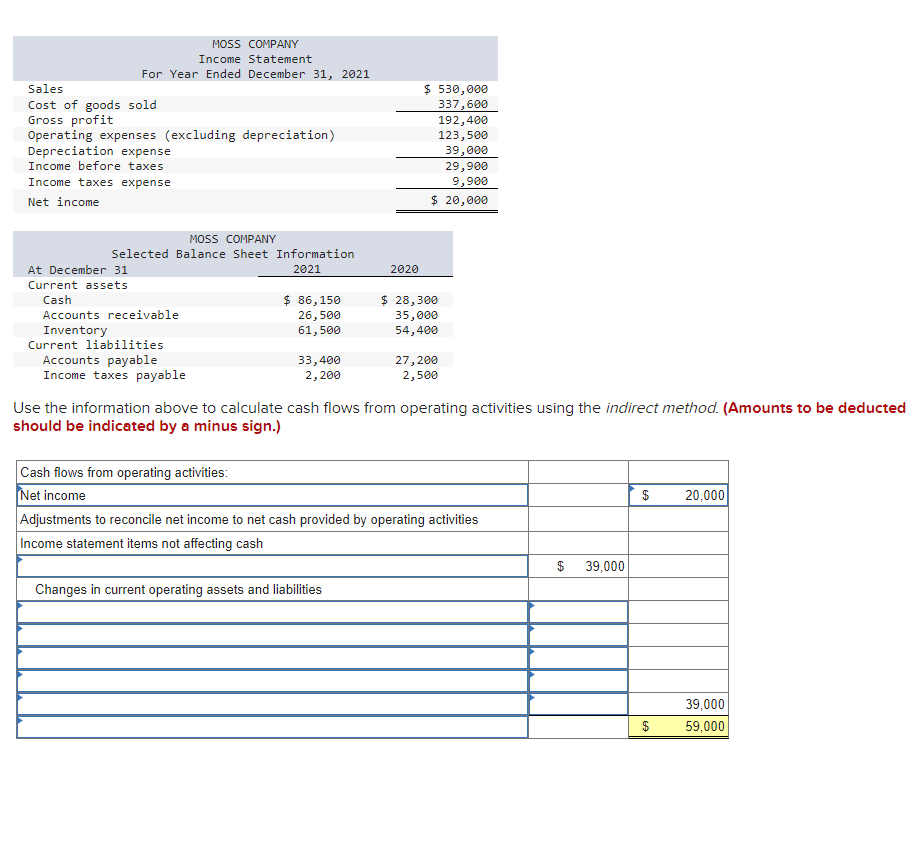

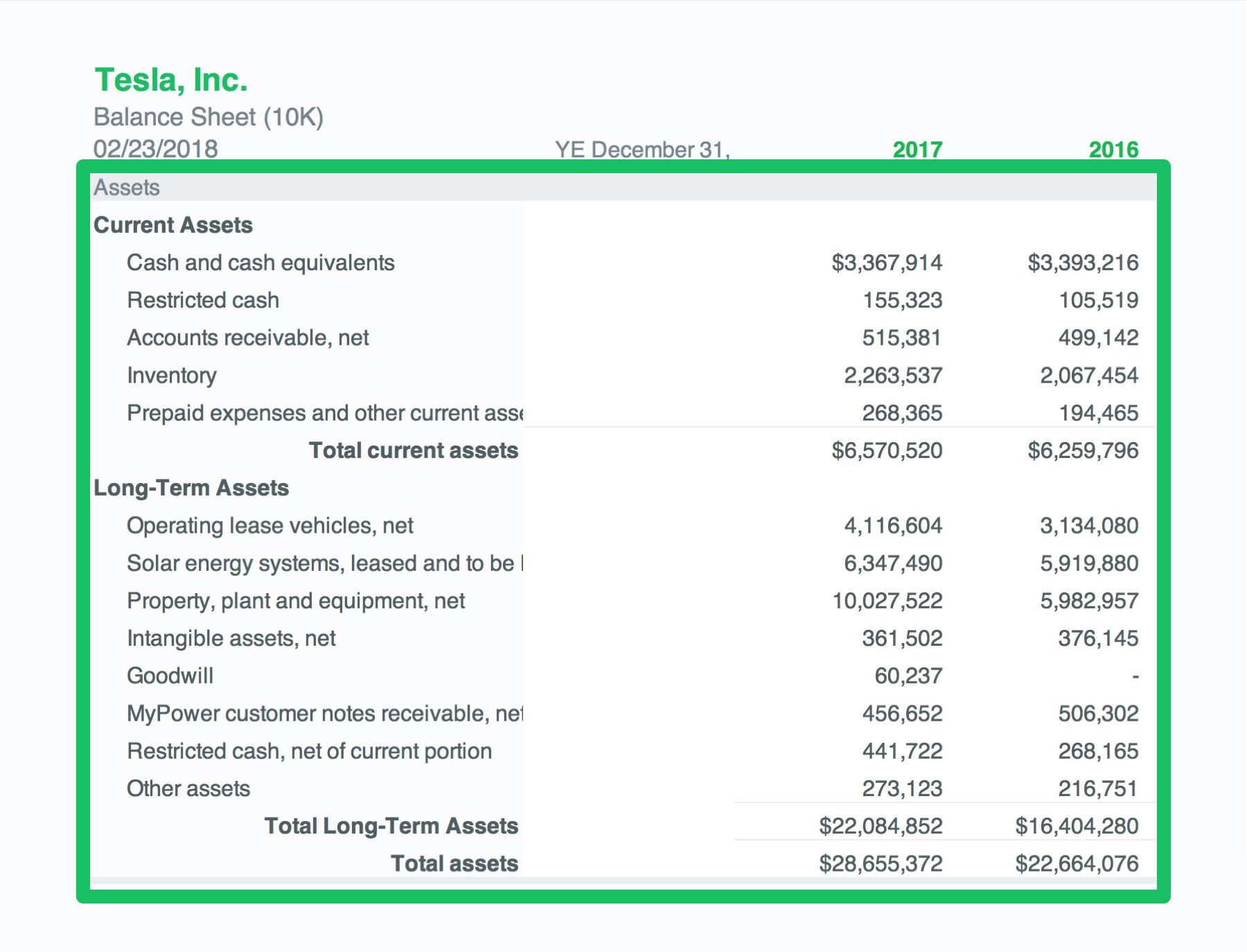

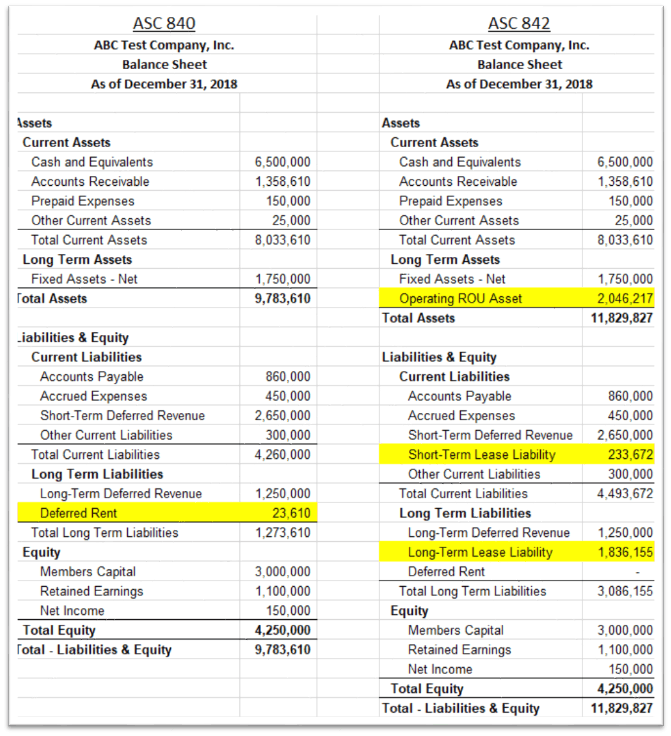

This results in a liability appearing on the balance sheet at the end of the accounting period. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Sg&a is defined as the costs of operating the main business (not involved with producing the goods) during the accounting period.

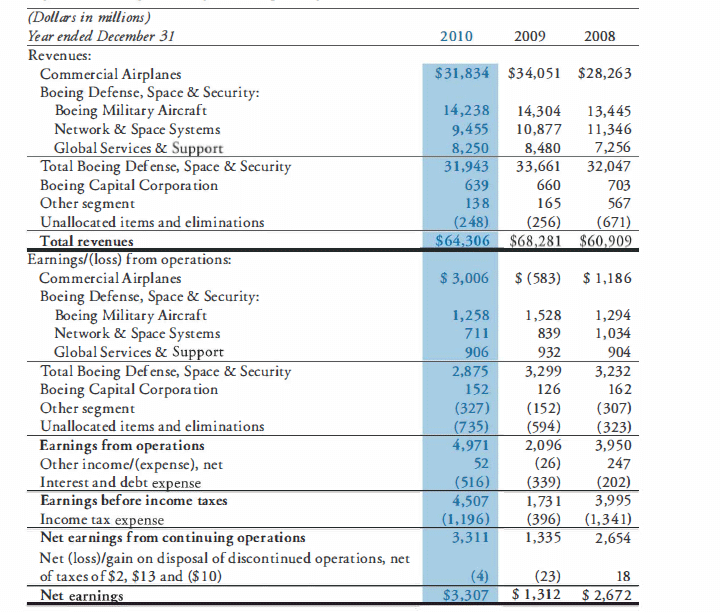

The balance sheet is one of the three core financial statements that are used to evaluate a business. Operating expenses are essential for analyzing a company’s operational performance. Understanding the three different categories of operating expenses and where you place each type of expense on a company's balance sheet helps the management team and operations employees.

It is important to note that operating expenses do not include capital expenditures like buying equipment or property. It can also be referred to as a statement of net worth or a statement of financial position. Operating expenses can be both fixed (e.g., rent) and variable (e.g., wages).

In other words, operating expenses are the costs that a company must make to perform its operational activities. Operating income = $10.50 million. Capital expenditures are listed on the balance sheet under the pp&e section.

Updated june 24, 2022 operating expenses are those expenses incurred during regular business operations. Operating expenses, which can also be referred to as the accounts for sg&a (selling, general, and administrative. It is useful to always read both the income statement and the balance sheet of a company, so that the full effect of an expense can be seen.

A decrease in cash, prepaid expenses, supplies on hand, inventory; Operating expenses are necessary fees for a business, such as employee salaries, rent, utilities, materials, equipment and marketing costs. Unlike cost of goods sold, operating expenses include all the regular costs associated with keeping a business running.

November 16, 2023 when a business incurs an expense, this reduces the amount of profit reported on the income statement. The formula to calculate operating expense is as below: Often abbreviated as opex, operating expenses include rent, equipment, inventory costs,.

:max_bytes(150000):strip_icc()/SampleIncomeStatement-6c65ce80044e44cea6f20a48e8072f9e.png)

:max_bytes(150000):strip_icc()/Apple10K2021-f845adaeca254e728a75fa5af5c7eff1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)