Fine Beautiful Tips About Construction Industry Financial Ratios

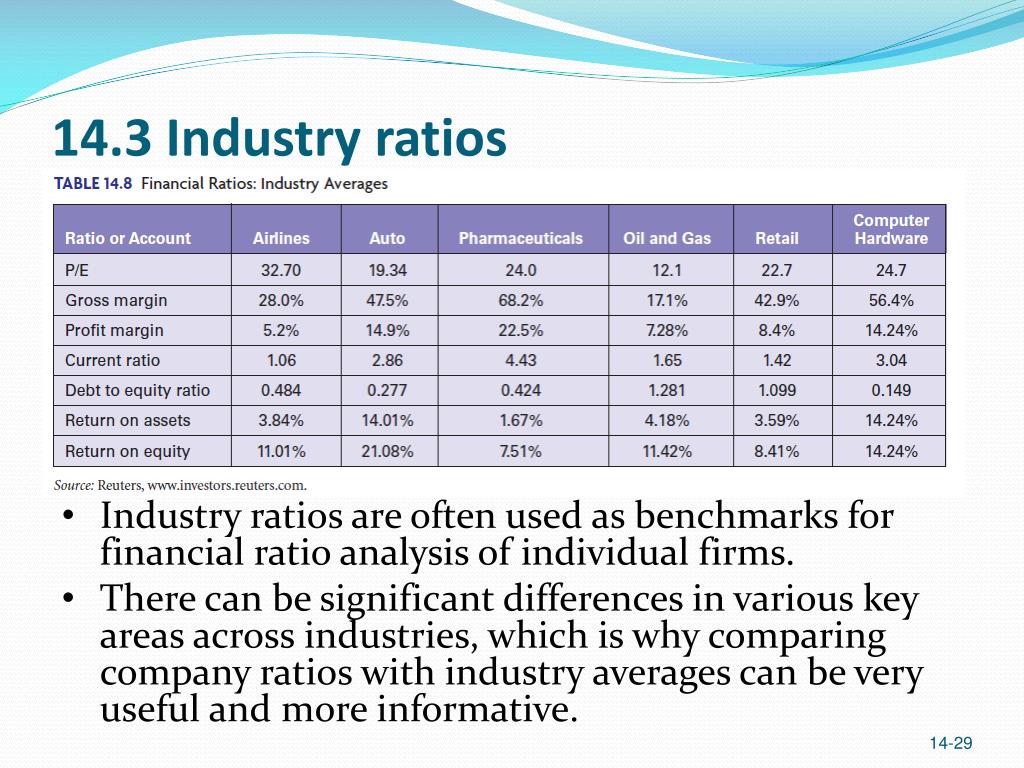

Quick ratio leverage ratios 3.

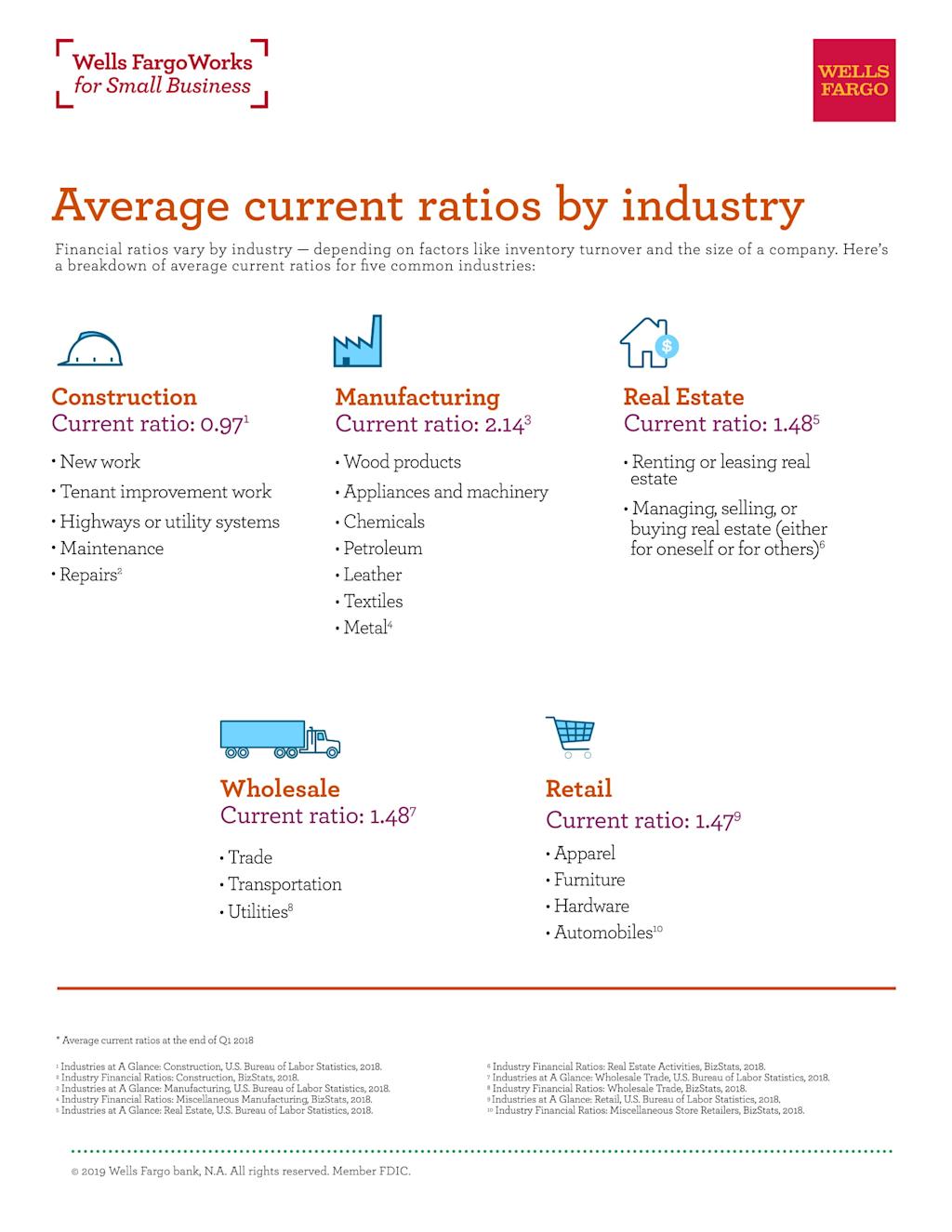

Construction industry financial ratios. 3 key liquidity ratios: Average industry financial ratios for u.s. Key financial ratios in the construction business.

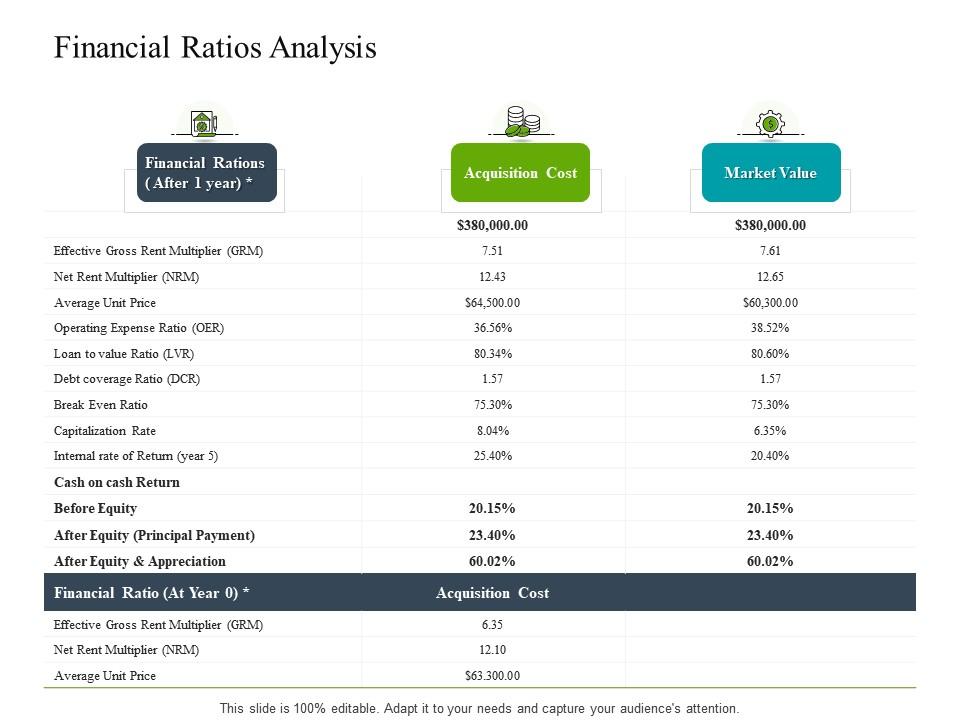

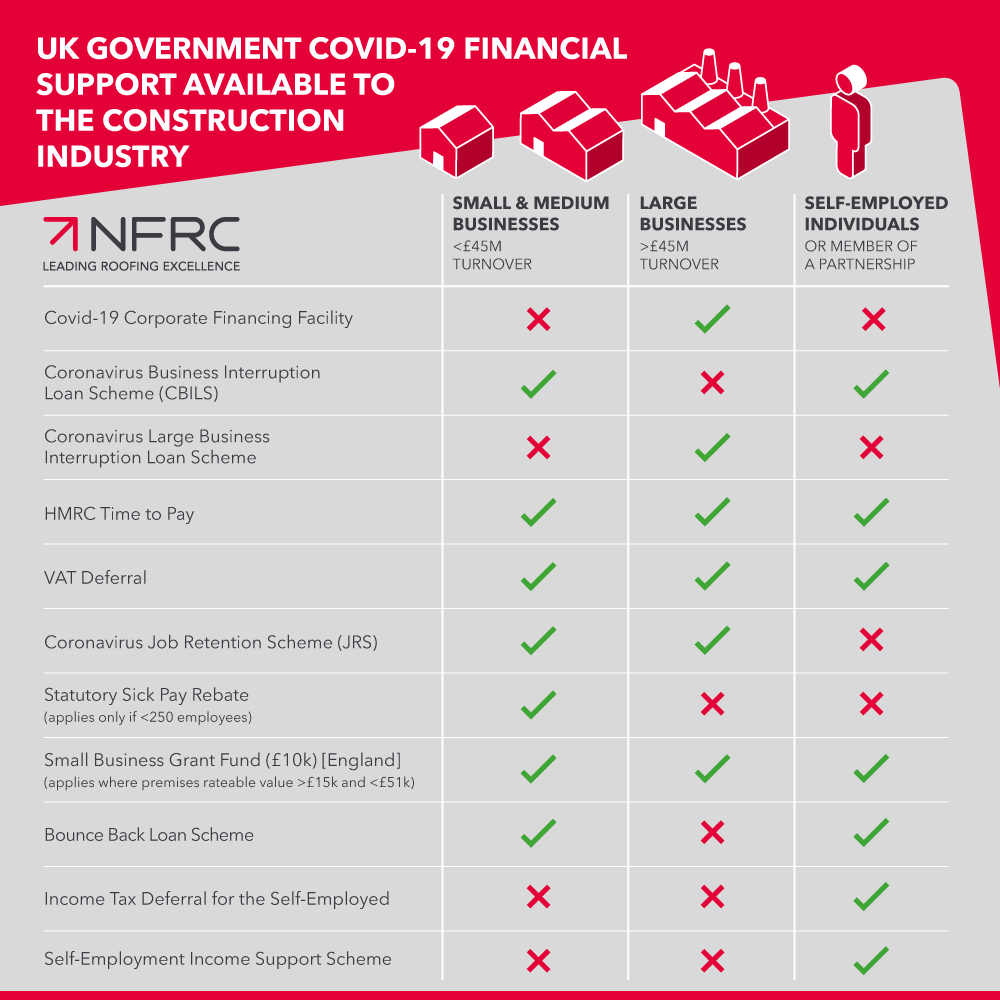

Financial ratios and key performance indicators analysis of financial ratios and key performance indicators can help assess a contractor’s financial health, operating. Financial ratios and key performance indicators (kpis), which are a measure of employee performance, can be used to gauge your company's overall financial health. Despite a.6 percentage point decline in gross profitability in.

Construction special trade contractors: Both of these amounts are found on. Performance analysis of construction enterprises using financial ratios’ groupings:

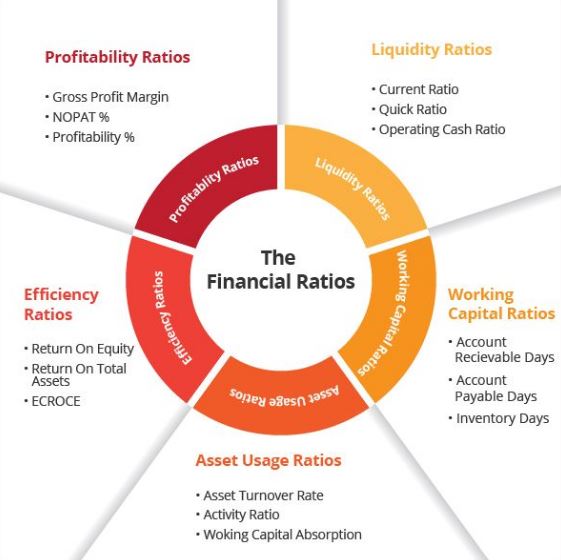

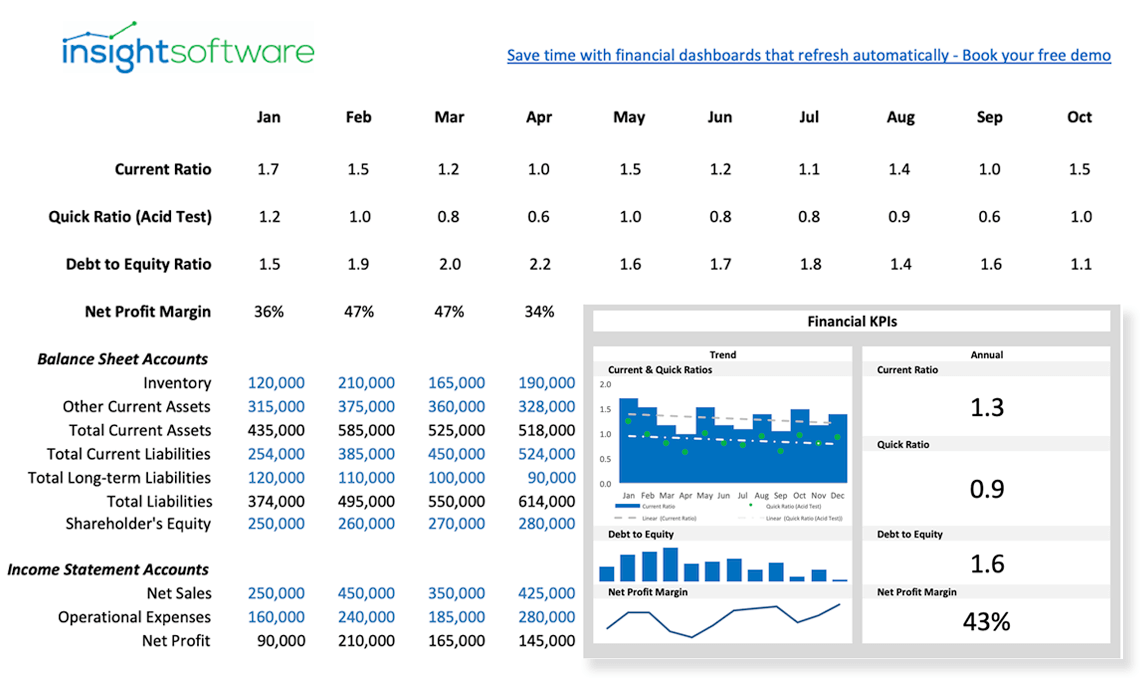

In this article, we'll explore some of the more common sets of financial ratios and how you can use them to measure the performance of your business within the construction. Credit management days in accounts receivable is calculated by dividing average net accounts. Roe (return on equity), after tax :

The vital role of financial ratios in the construction industry; Generally, a ratio of 15 or lower is considered acceptable. 5 rows the main financial key ratios that stand out are the current ratio, quick ratio,.

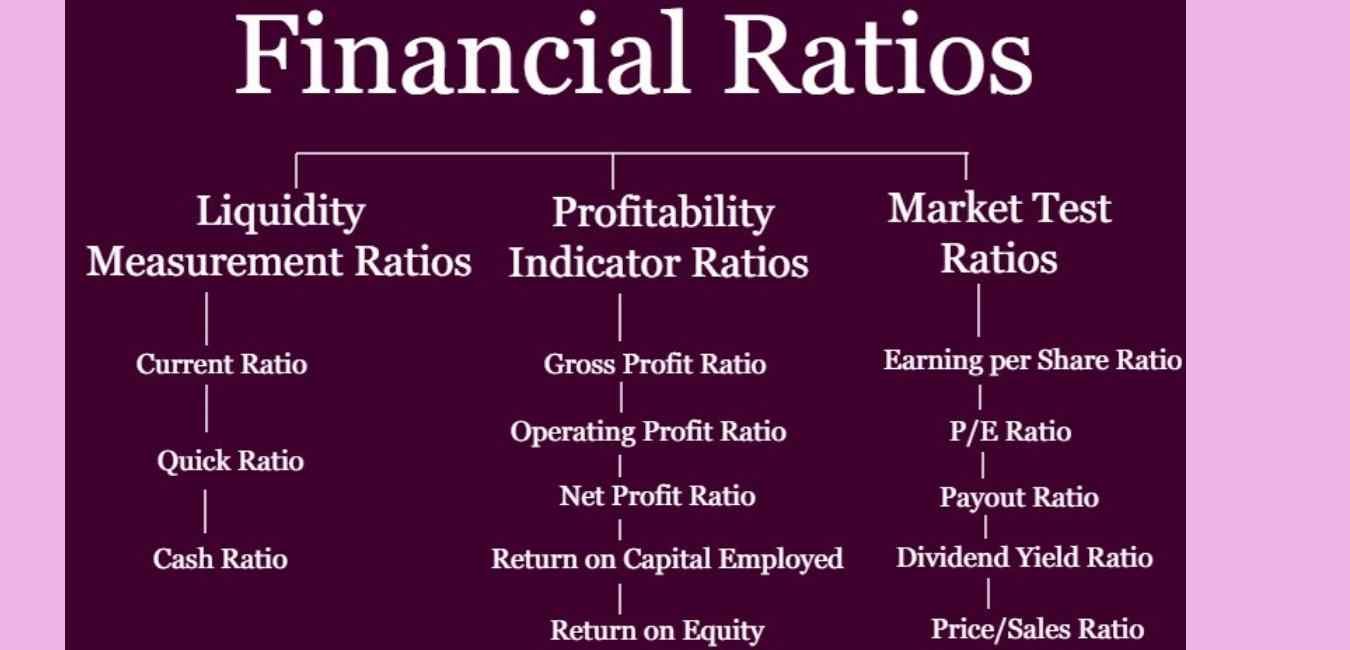

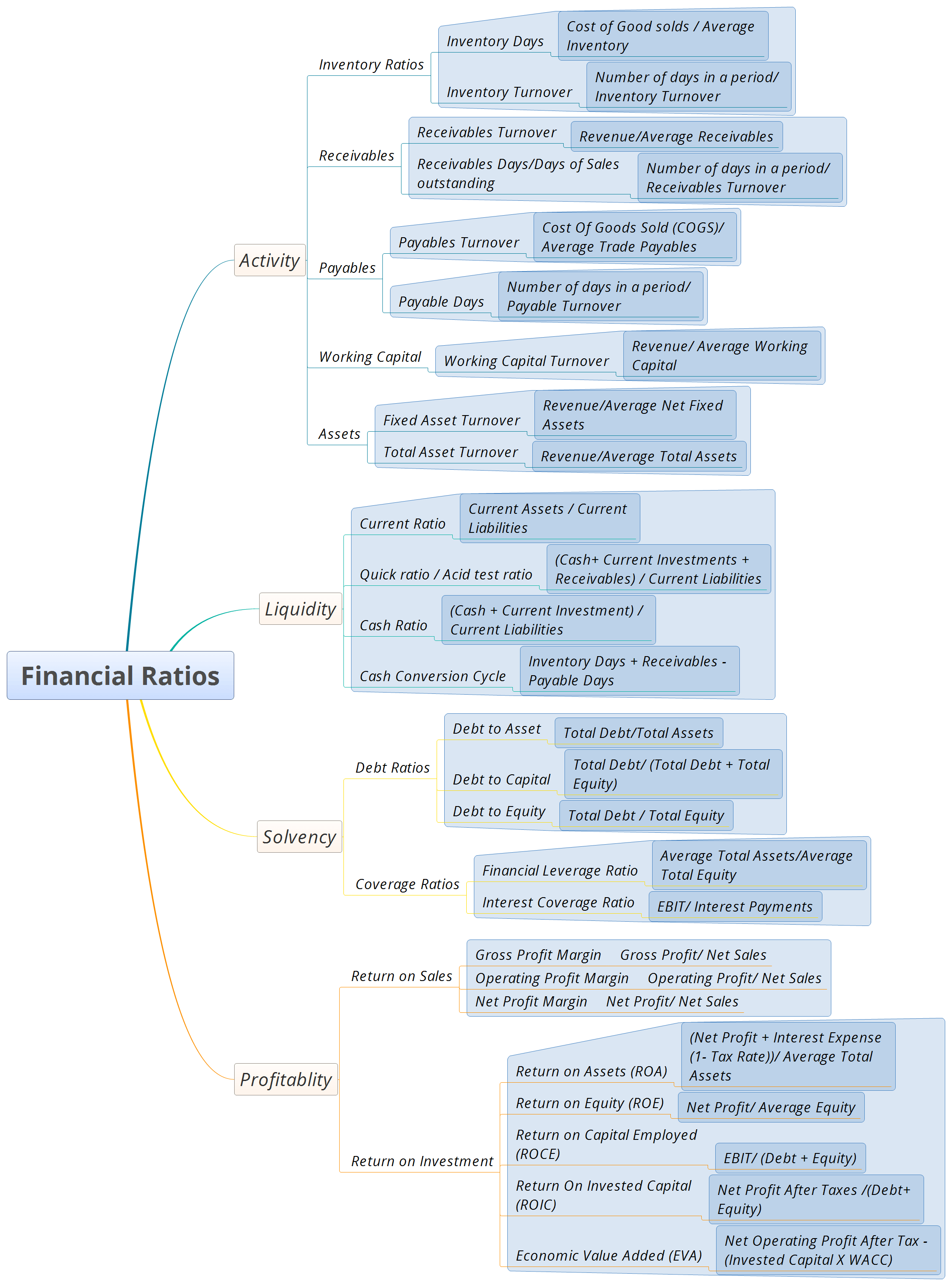

These ratios can be broadly categorized into four main categories: The construction financial benchmarker is for construction financial professionals who need to be able to evaluate their company’s performance and report on how it compares. Construction services industry financial strength, from the q4 2023 to 4 q 2022, leverage, interest, debt coverage and quick ratios growth rates profitability valuation.

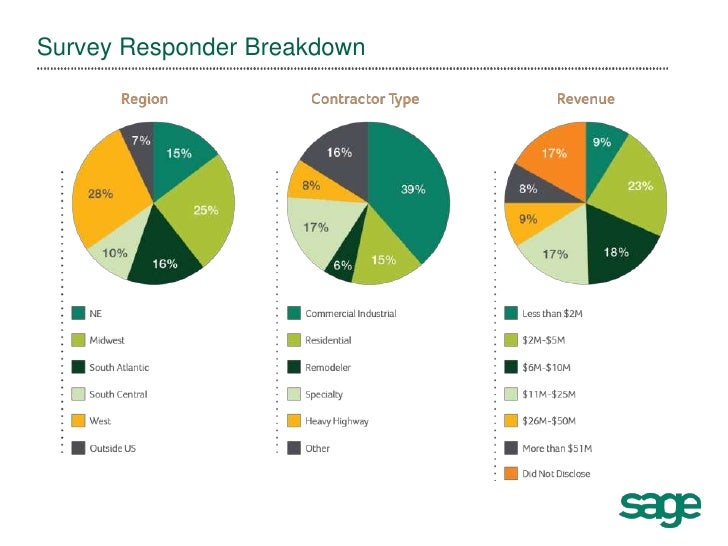

Common types include: An application in the british construction industry conference: Cfma and industry insights are pleased to present the executive summary from cfma’s 2021 construction financial benchmarker online questionnaire.

Construction companies should aim for a current ratio above 1, which would indicate a company has enough resources to cover all of their current liabilities if. Roa (return on assets) 7.4%: