Simple Tips About Difference Between Cash Flow And Free

Operating cash flow has its limitations because it doesn’t take into account the cost of.

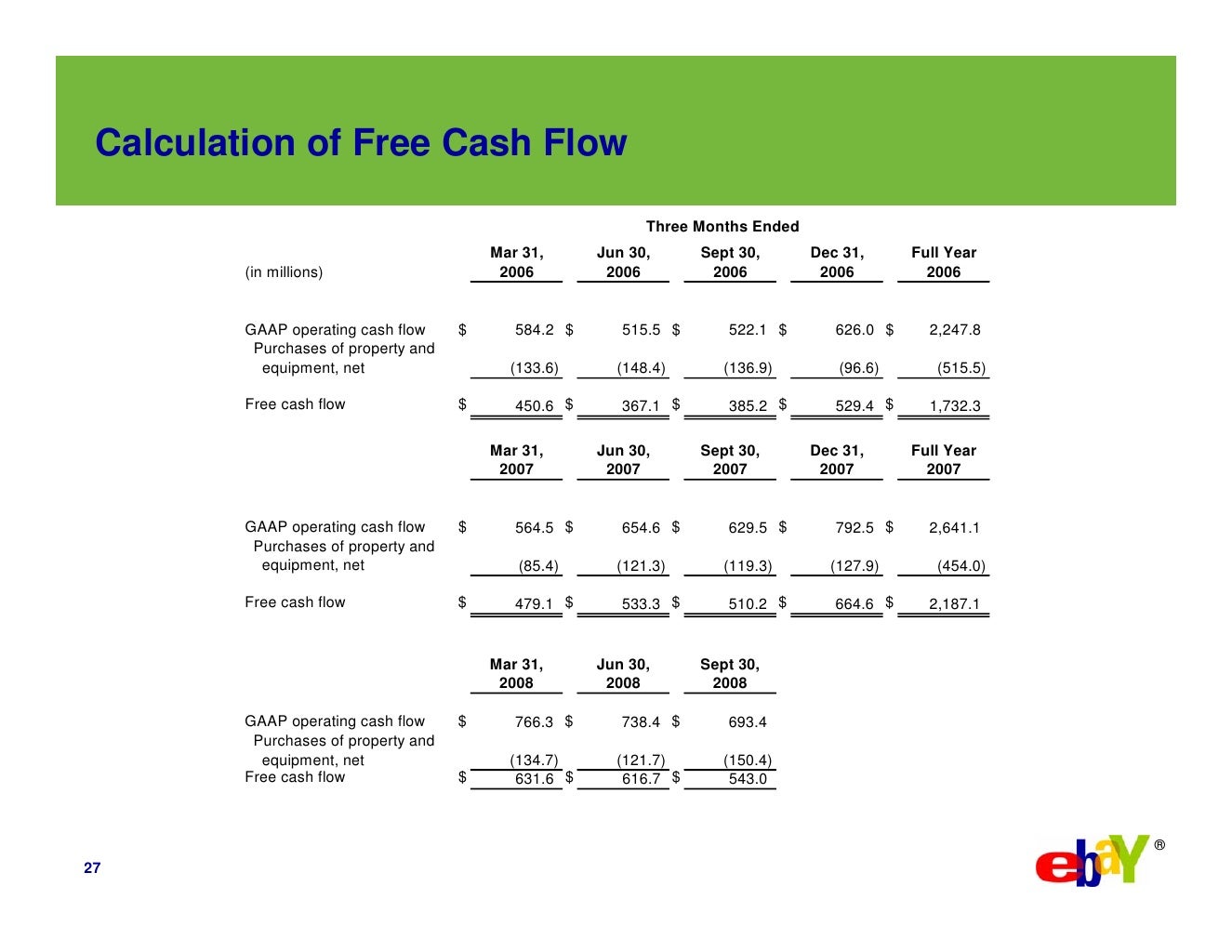

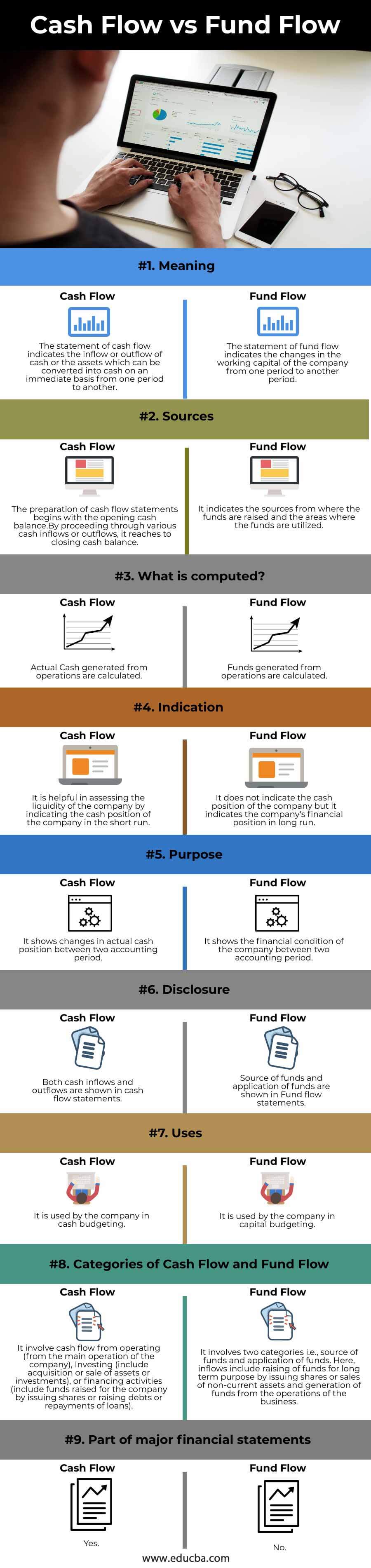

Difference between cash flow and free cash flow. The key difference between unlevered free cash flow and levered free cash flow is that unlevered free cash flow excludes the impact of interest expense and net debt. The definitions of free cash flow vs. Of the two concepts, free cash flow is the more refined measure, because it is a strong indicator of the ability of an.

Comparing cash flow vs. Free cash flow (fcf) is the cash a company produces through its operations after subtracting any outlays. Comparing cash flow and free cash flow.

To learn more, see the related topics listed below: Cash is constantly moving into and out of a business. Indeed editorial team updated february 3, 2023 cash flow is an important metric businesses use to gauge the amount of money flowing in and out of their.

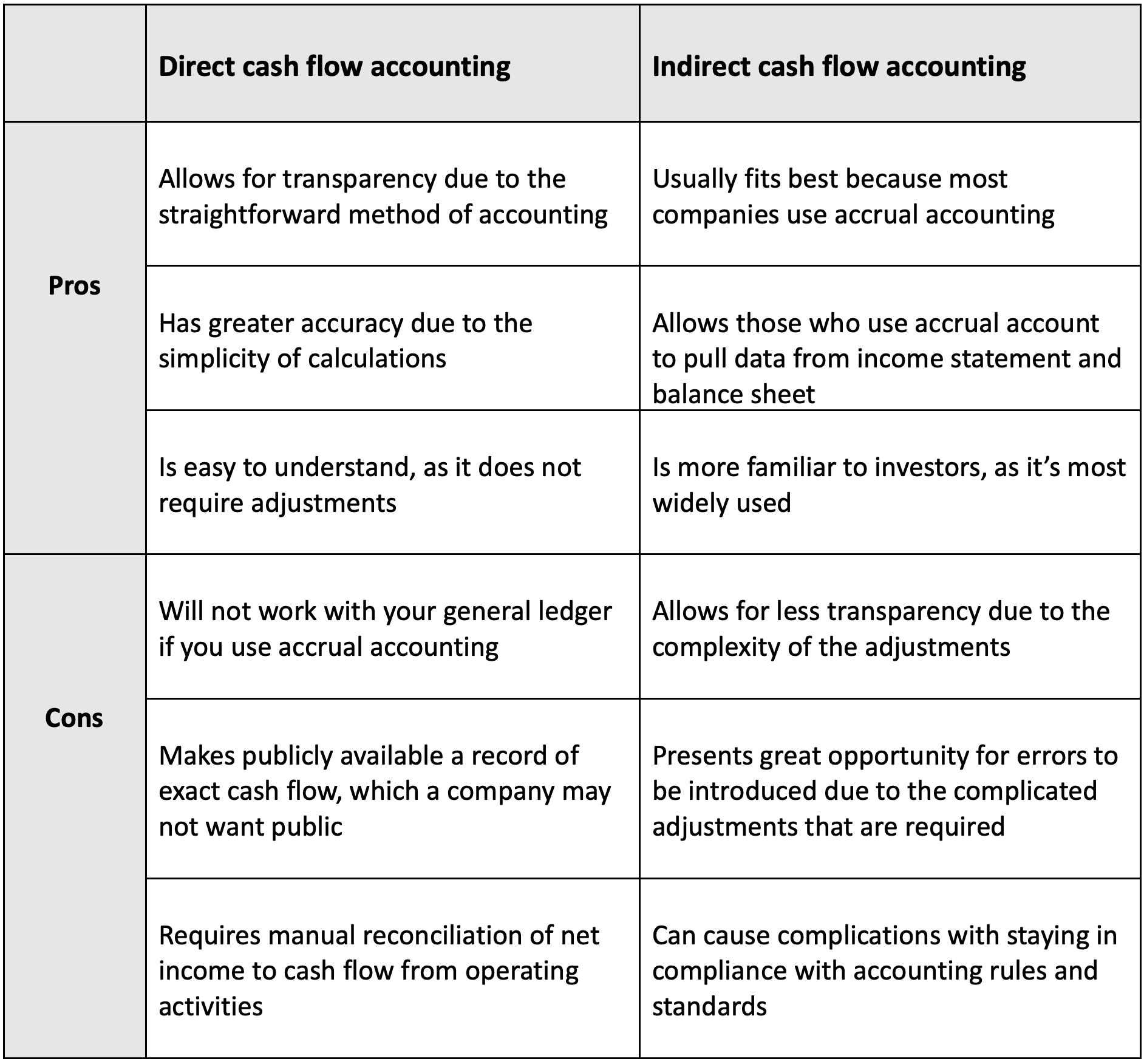

The indirect method is a lot more complicated, but it gives more information. Net income is a measure of a company’s profitability. It’s essential because it mirrors your financial health and is the.

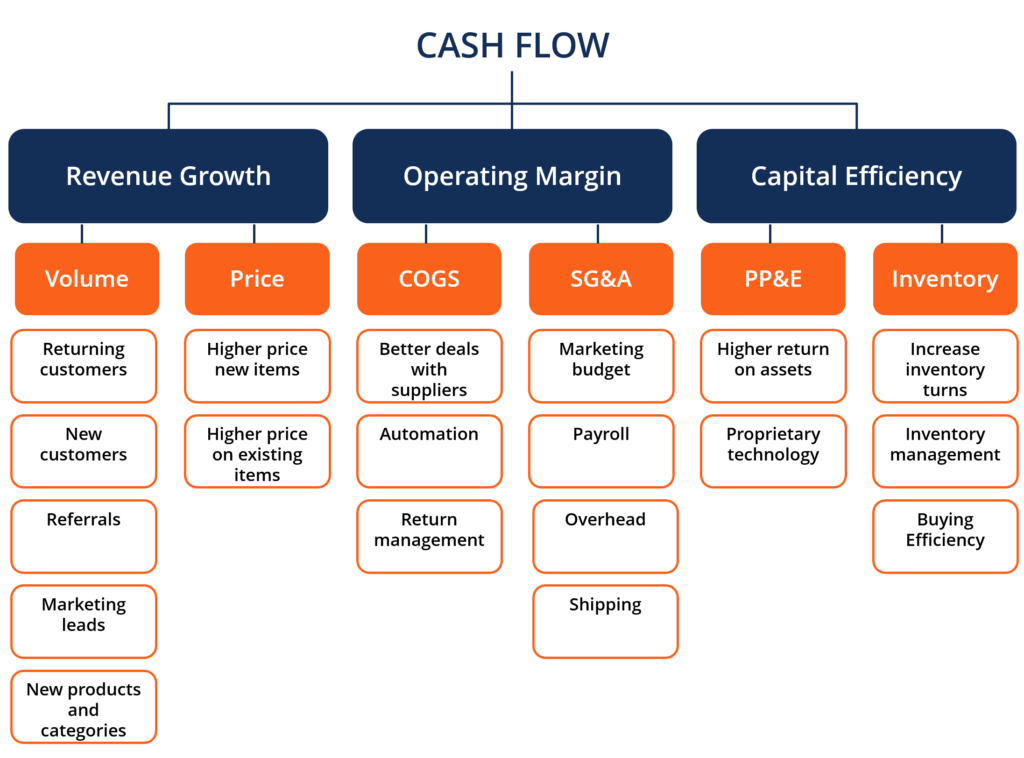

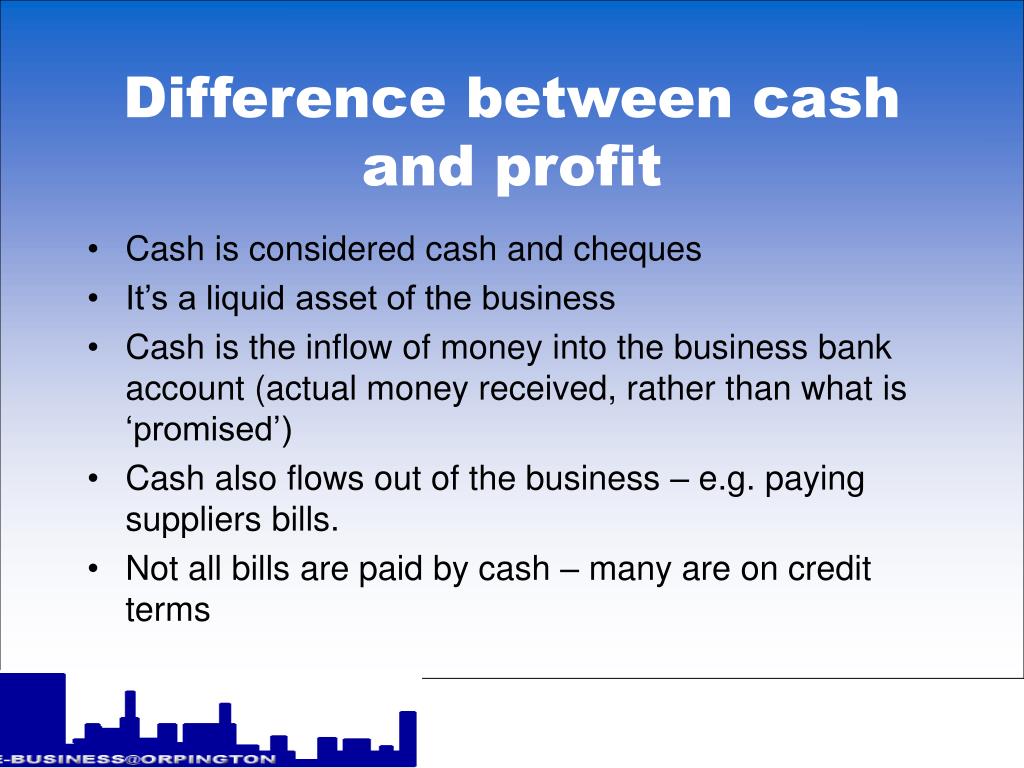

Cash flow is seen as a straightforward measure of the net cash that came into or left the business during a. Free cash flow, on the other hand, measures the actual cash flow that is available to shareholders. Cash flow is the net amount of cash and cash equivalents being transferred into and out of a company.

However, free cash flow will assist one with. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out. As a financial backer, one must really know them both.

How are cash flow and free cash flow different? Cash flow will assist one with seeing the genuine image of an association. Definition of cash flow cash flow refers to the amounts of cash that a company, investment or project generates.

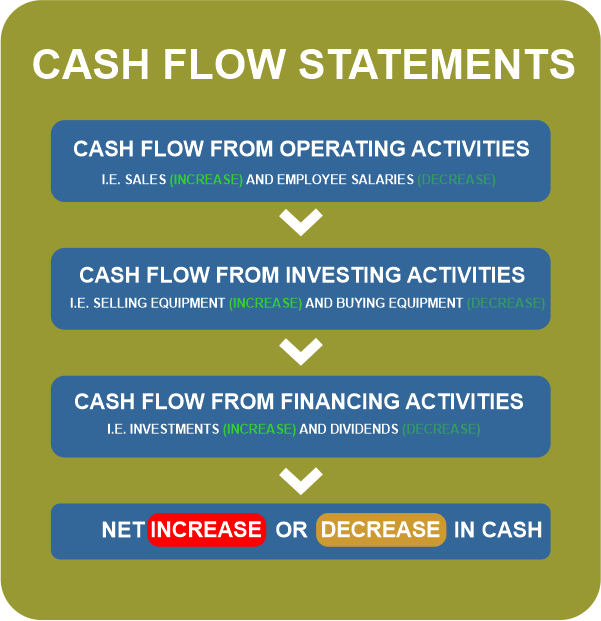

Cash flow refers to the movement of money into and out of a company, while free cash flow represents the cash generated by a company after deducting. While free cash flow represents a company’s ability to grow its business, pay dividends, or pay down debt, some firms may use different methods to assess free. In the dynamic landscape of finance, grasping the distinction between operating cash flow (ocf) and free cash flow (fcf) becomes a compass guiding me through intricate.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)