Favorite Info About Financial Income And Expenses

In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to reduce related wage or salary expenses the employer could otherwise deduct on its federal income tax return for the applicable tax year.

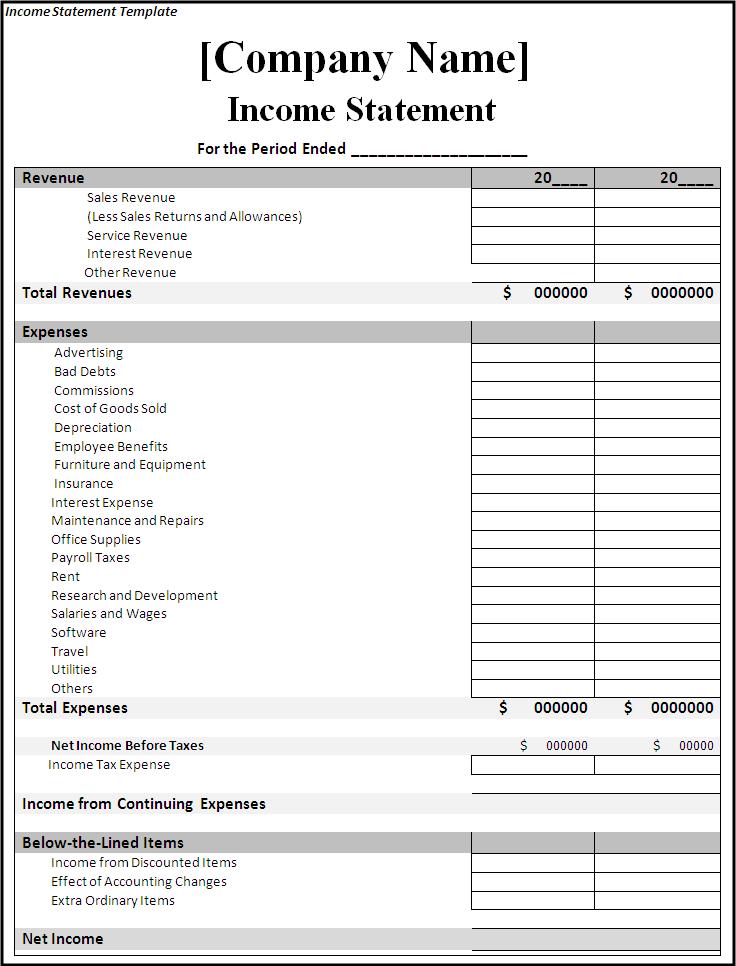

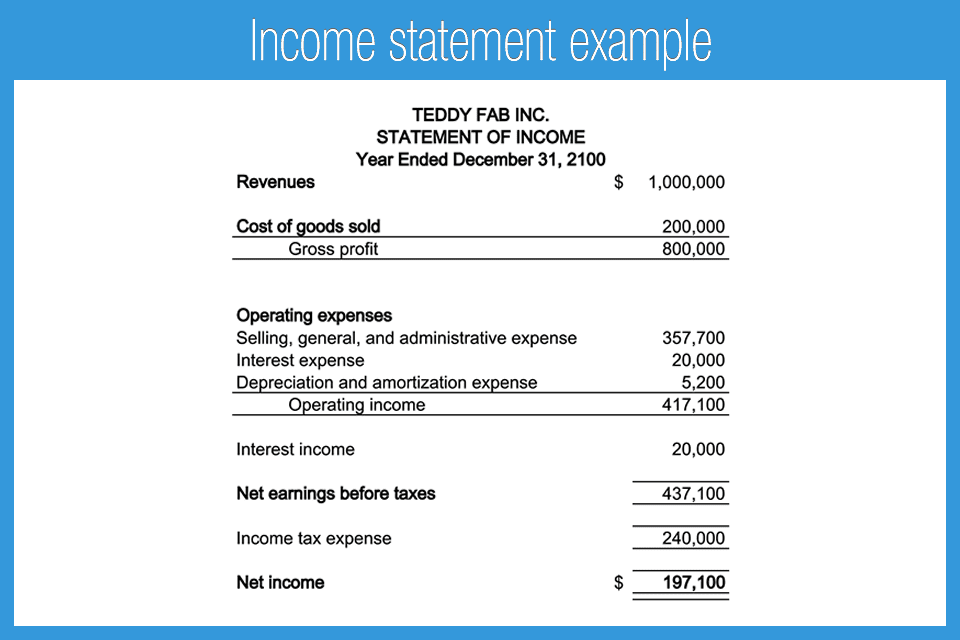

Financial income and expenses. In this article we take a look at the other elements of financial statements, which are income and expenses. Often, the first place an investor or analyst will look is the income statement. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.the income statement is the first financial statement typically prepared during the accounting cycle because the net income or loss.

Most, but not all, expenses are deductible from a company’s income (revenues) to arrive at its taxable income. Income spending debts it is used to: And the deduction only applies to spending above the cap.

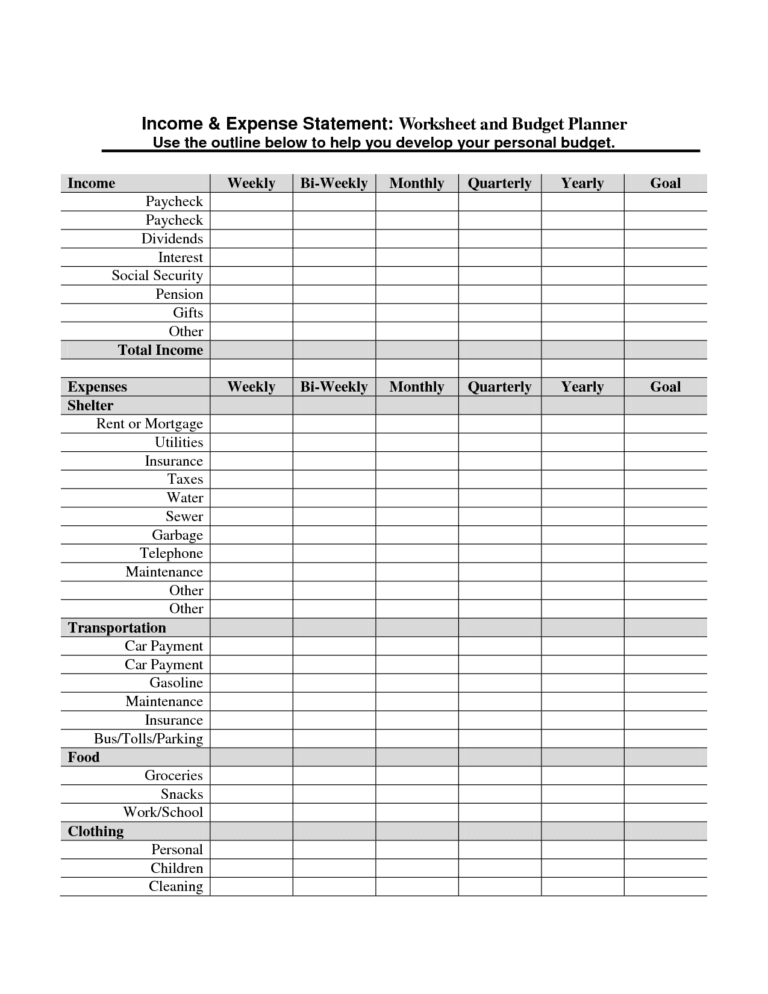

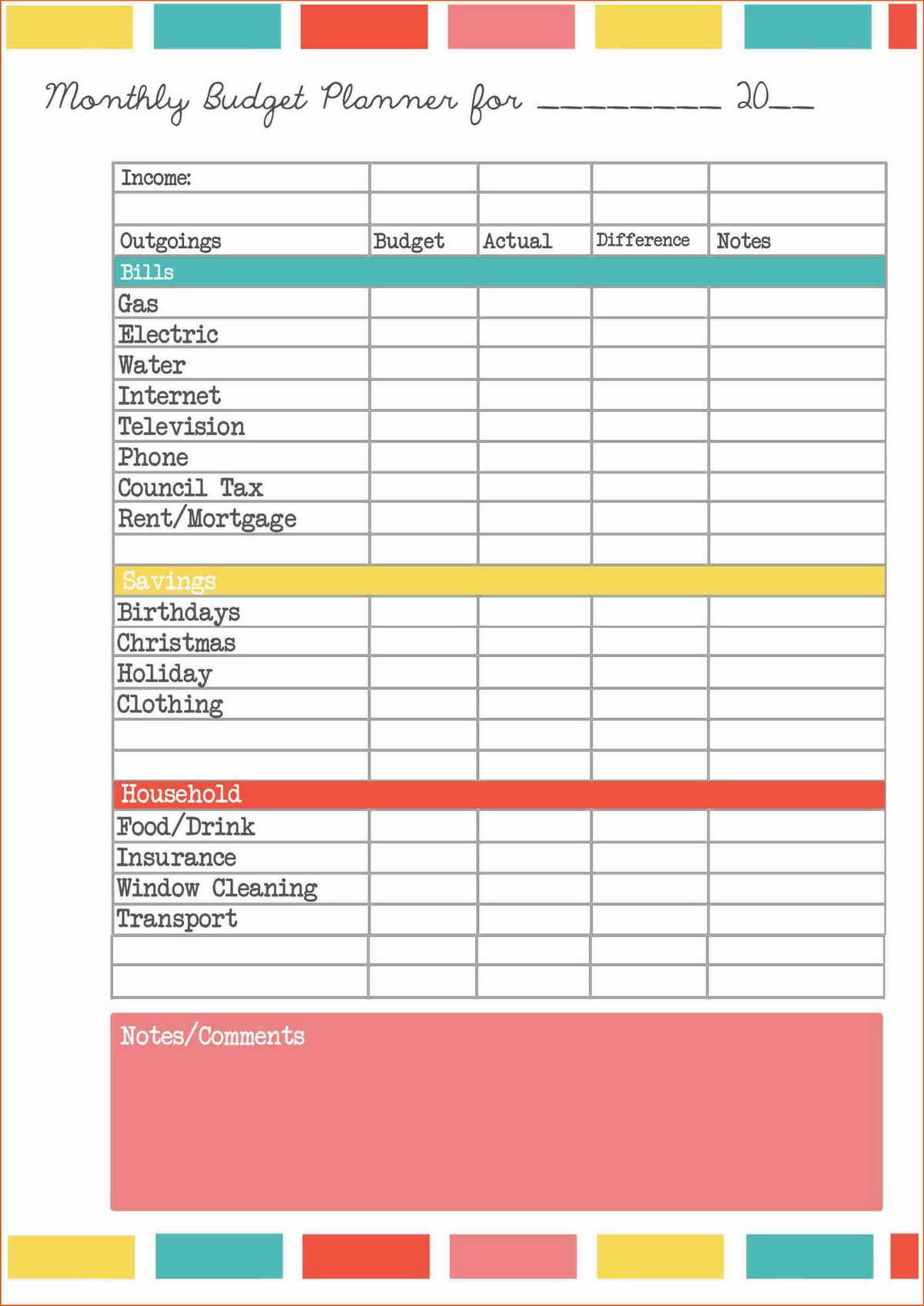

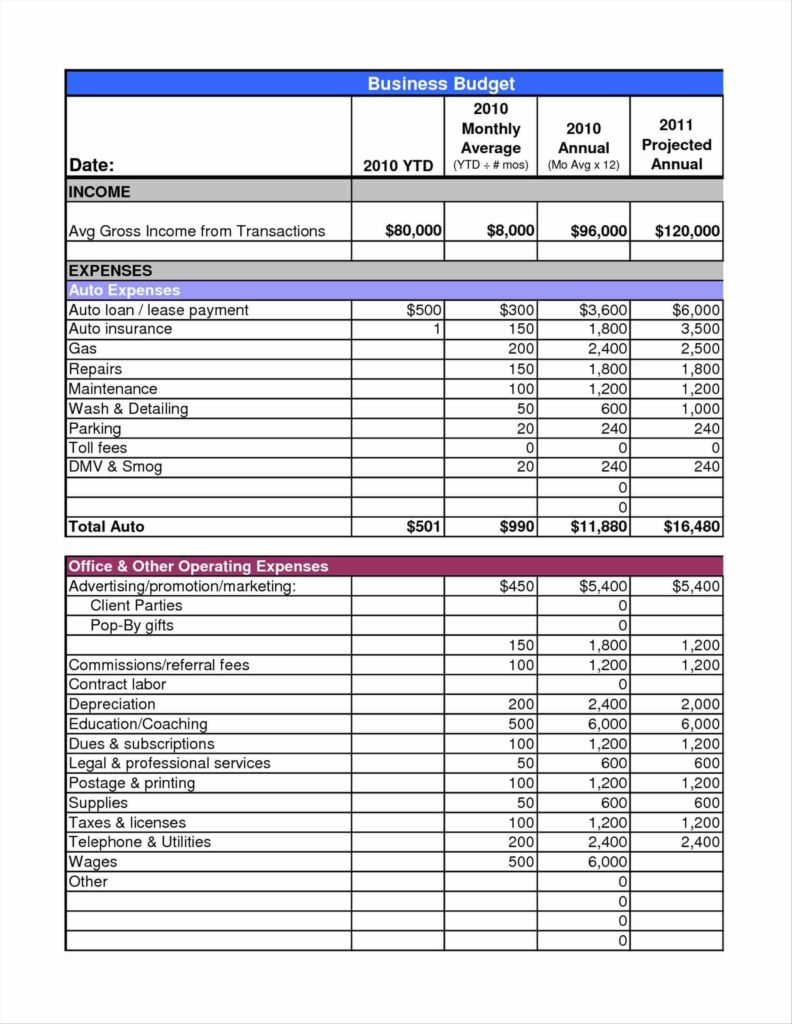

Spending more, saving, and investing are three ways to deal with budget surpluses. Creating an expense and income spreadsheet can help you manage your personal finances. Income the financial performance of an entity is measured by profit or loss.

Updated jan 26, 2024 financial statements: Taxpayers are also encouraged to read publication 17, your federal income tax (for individuals) for additional guidance. A thorough comprehension of your income, expenses, goals, and risk tolerance is crucial for making informed decisions about your finances.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. This can be a simple spreadsheet that provides an insight into your accounts and tracks your main expenses. New rules under the federal law known as secure.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. What is an income statement? In general, credits or money loans, whether directly from a bank, are financial expenses.

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The income statement primarily focuses on a company's revenues and expenses during a particular period.

Essentials to filing an accurate tax return. The personal spending requirement means that you cannot claim a deduction for payments made on your behalf. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss.

These are used to report the financial performance of an entity. Planning well to achieve financial freedom. The income statement focuses on four key items:

Revenue rose 24% to $2.1 billion during the period, beating the $2.08 billion average estimate of analysts surveyed by bloomberg. Revenue, expenses, gains, and losses. The income statement shows the performance of the business throughout each period, displaying sales revenue at the very top.