Fine Beautiful Info About Wages Income Statement

Published on 26 sep 2017.

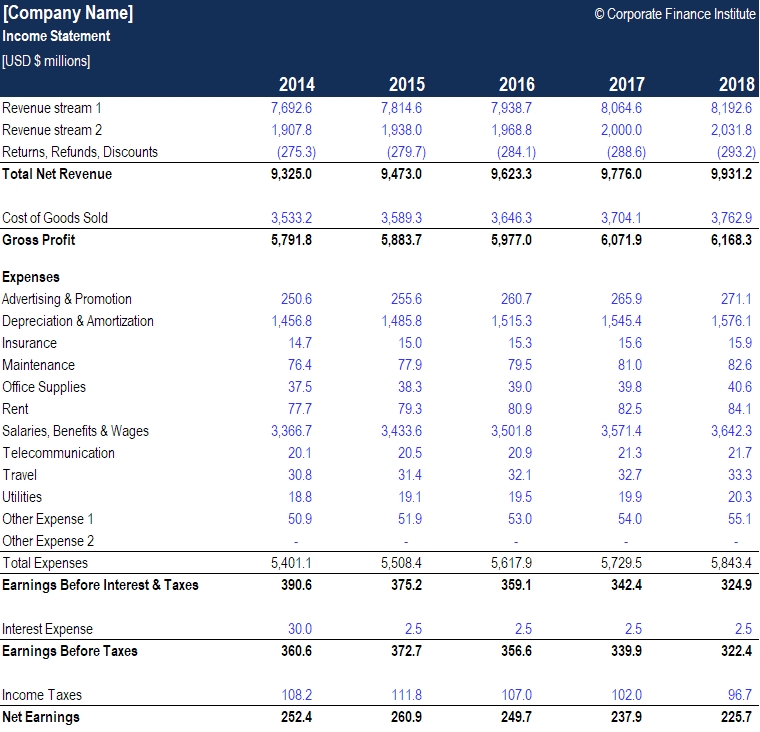

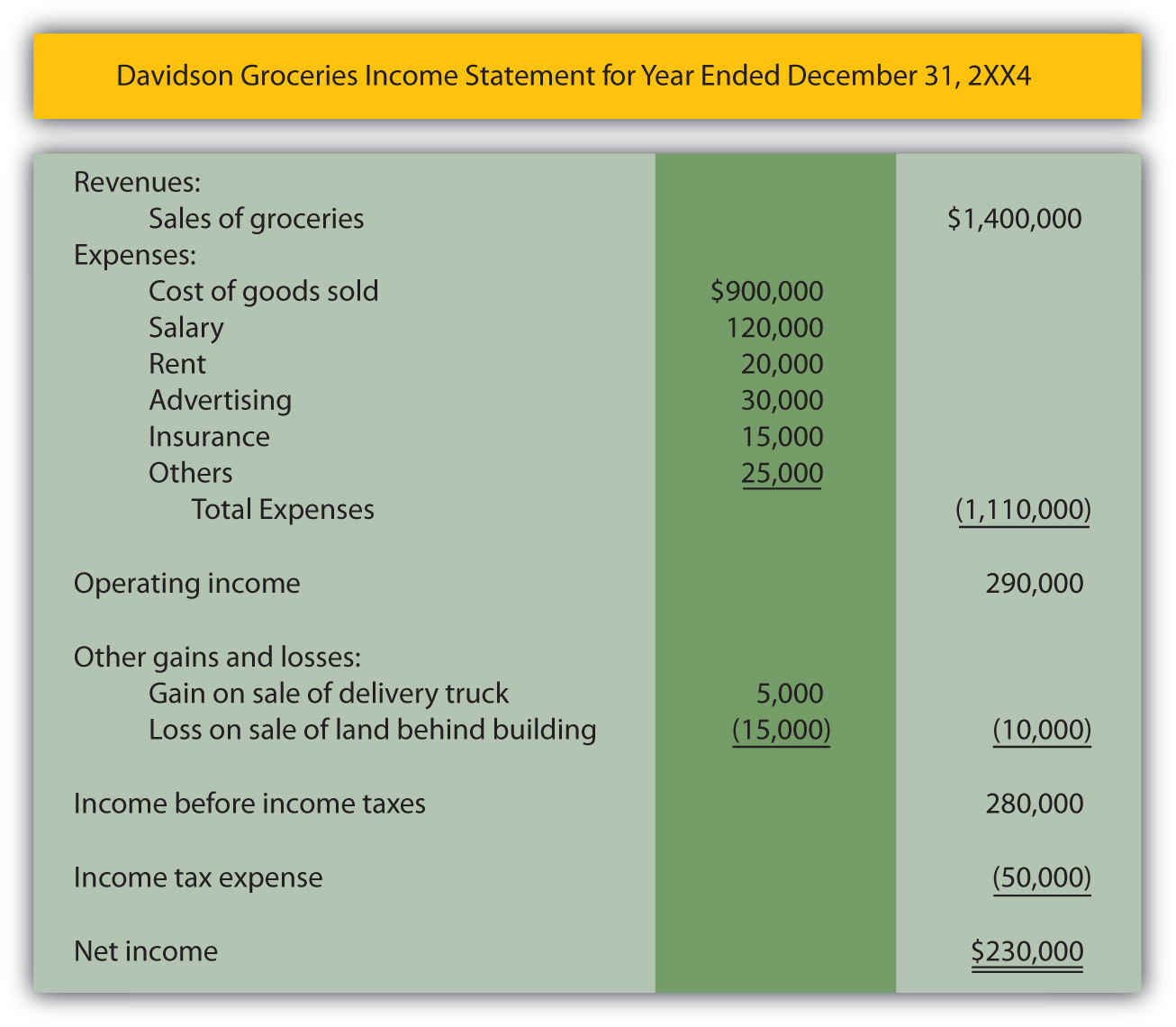

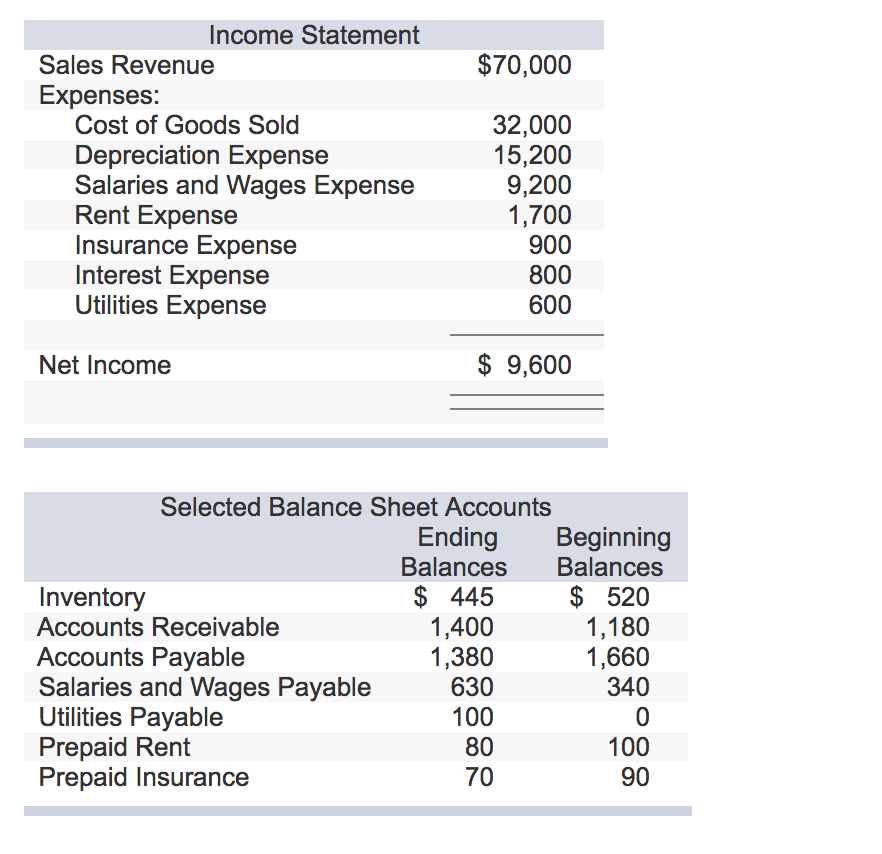

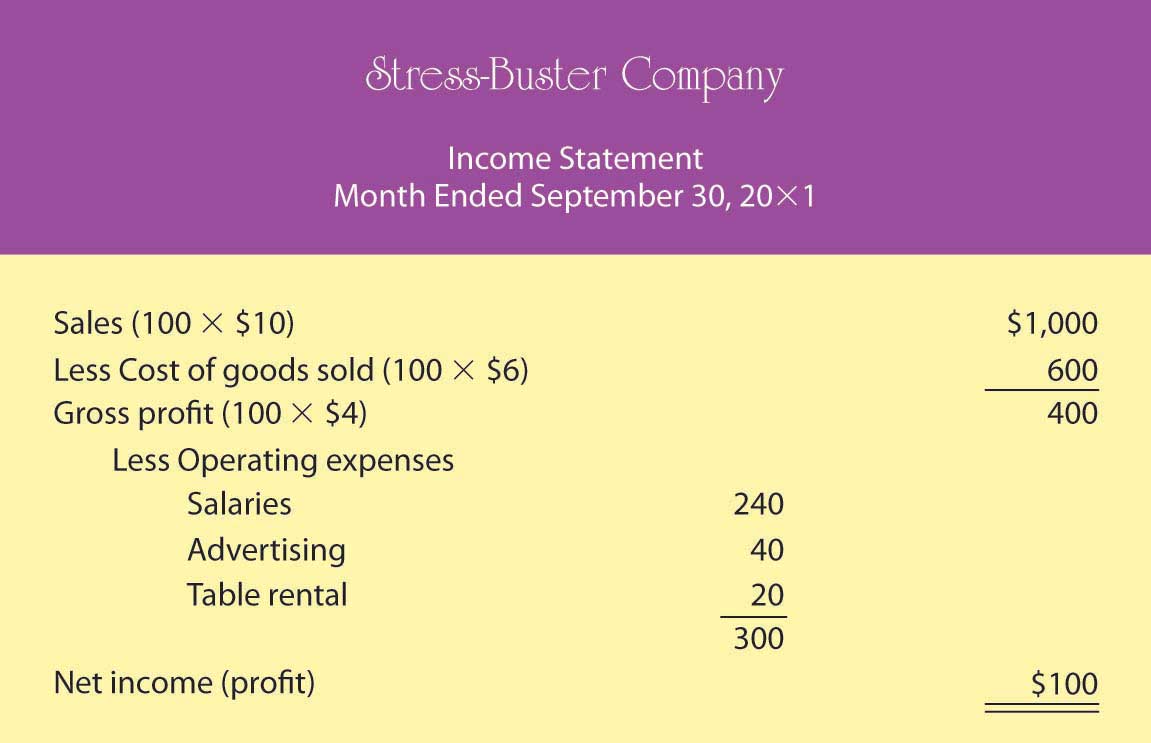

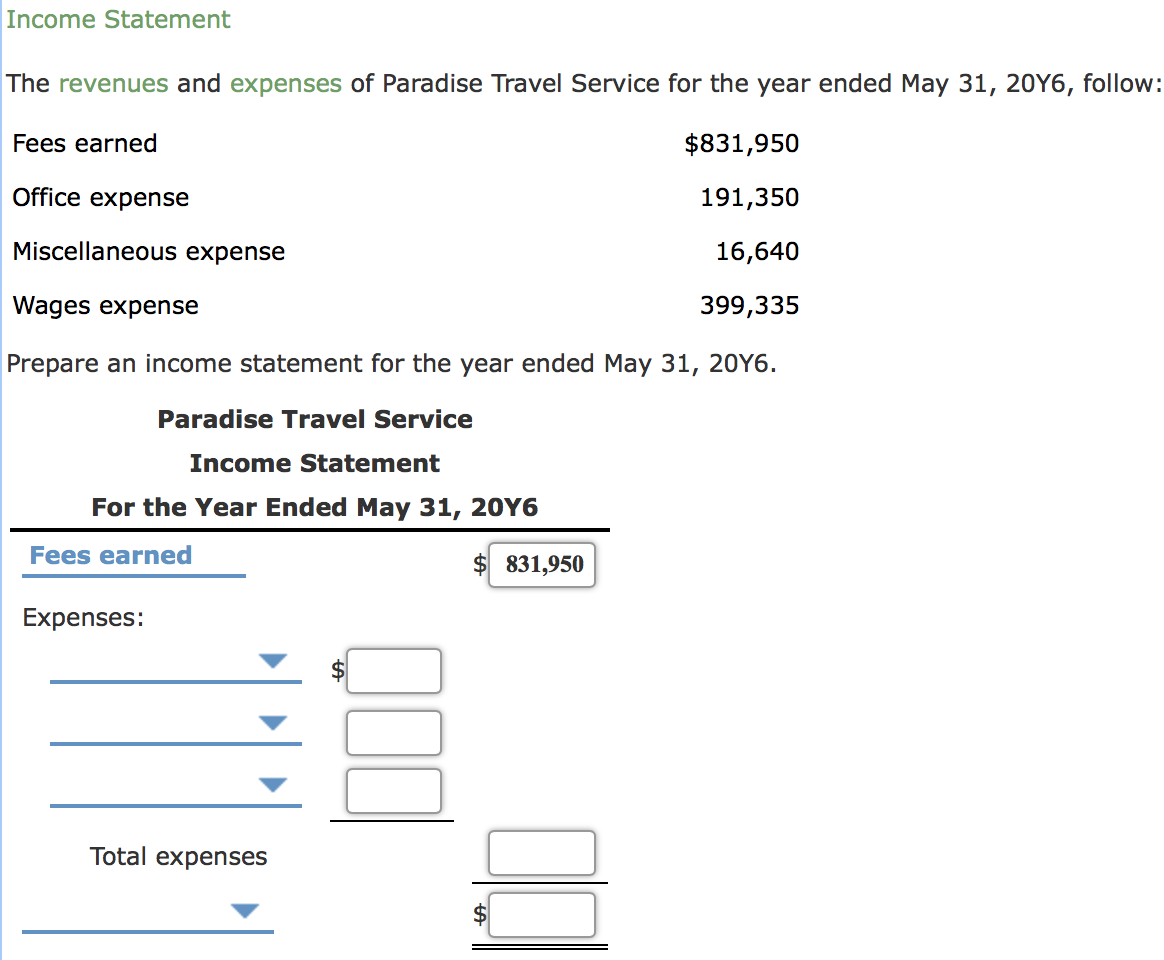

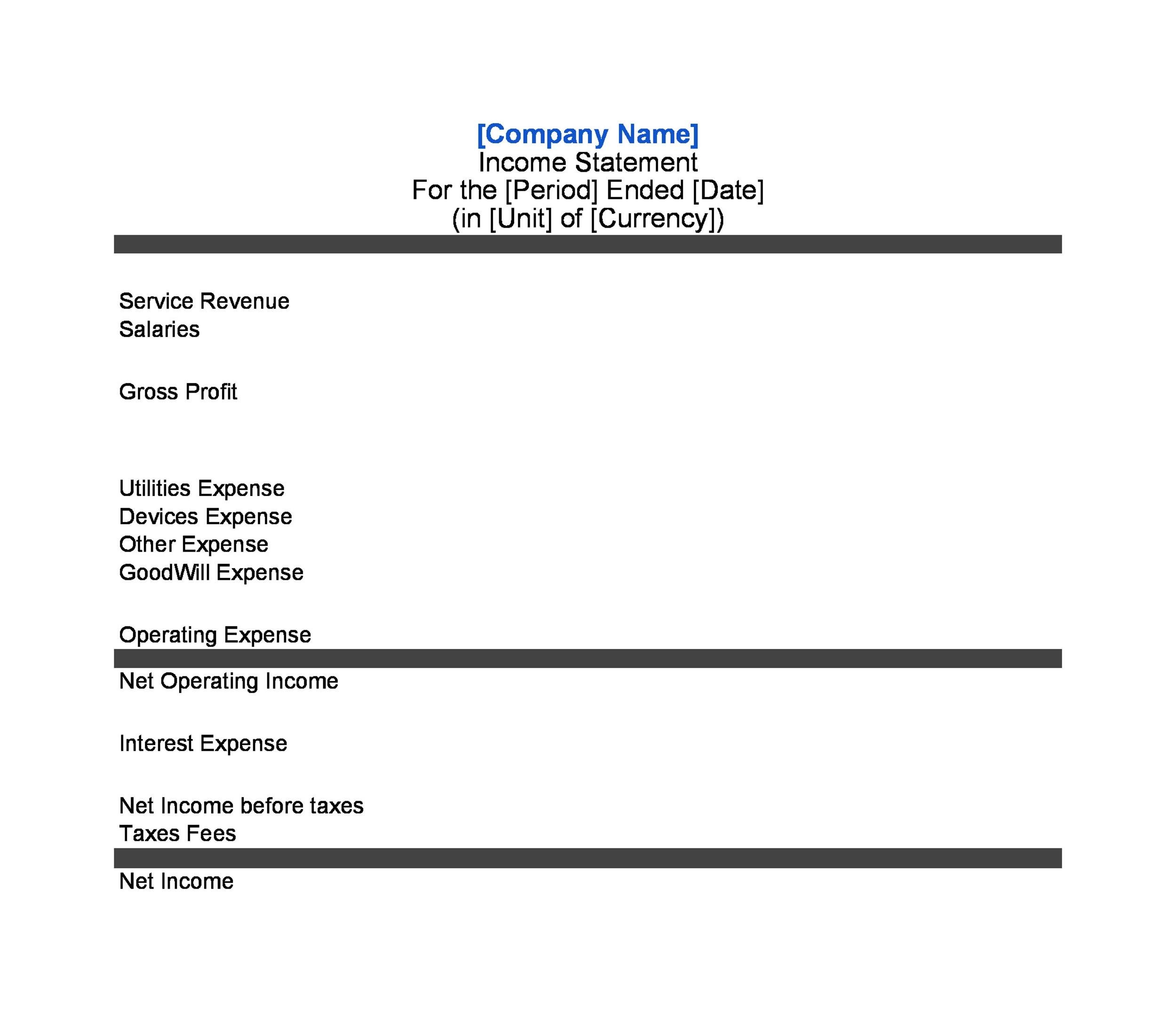

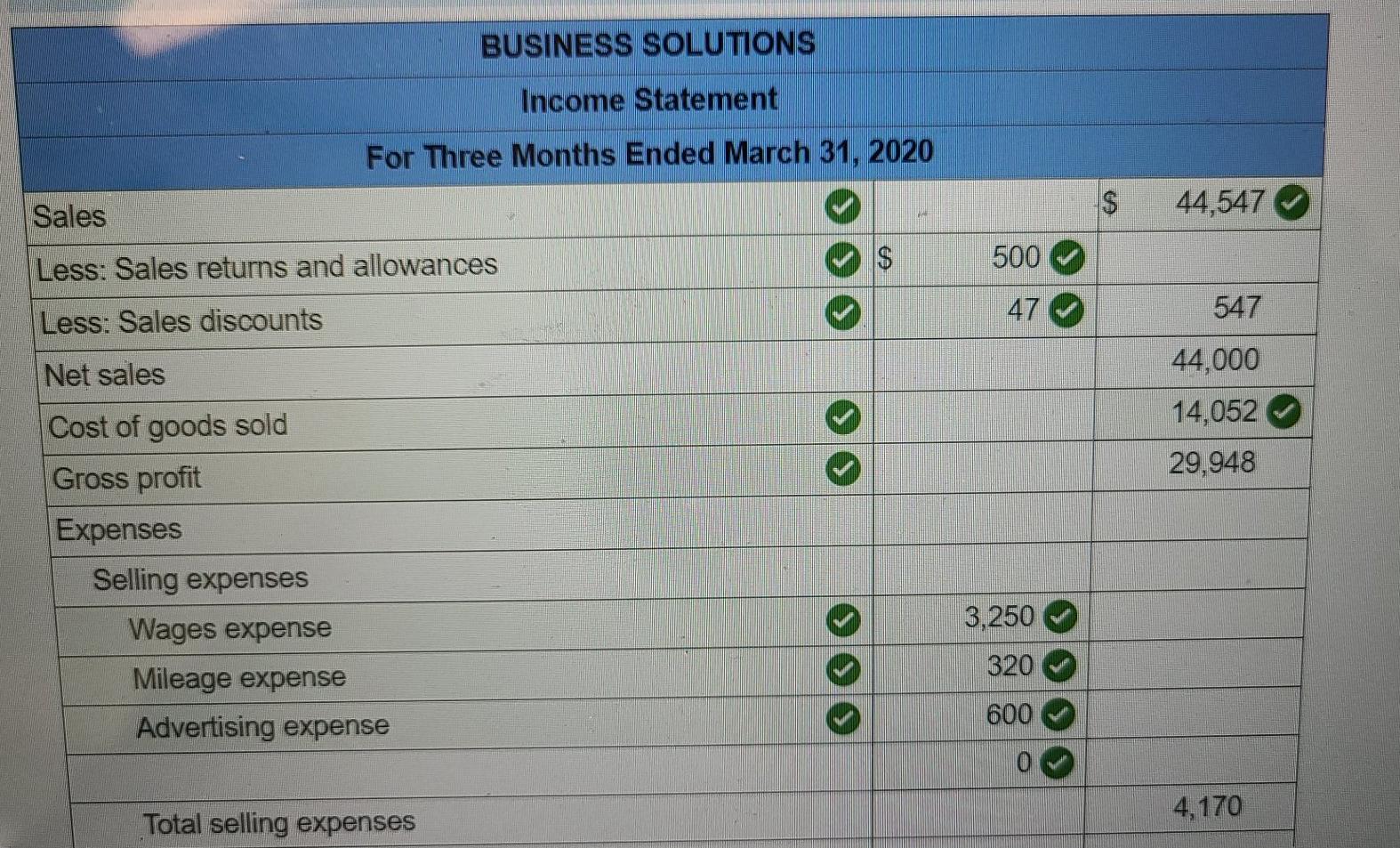

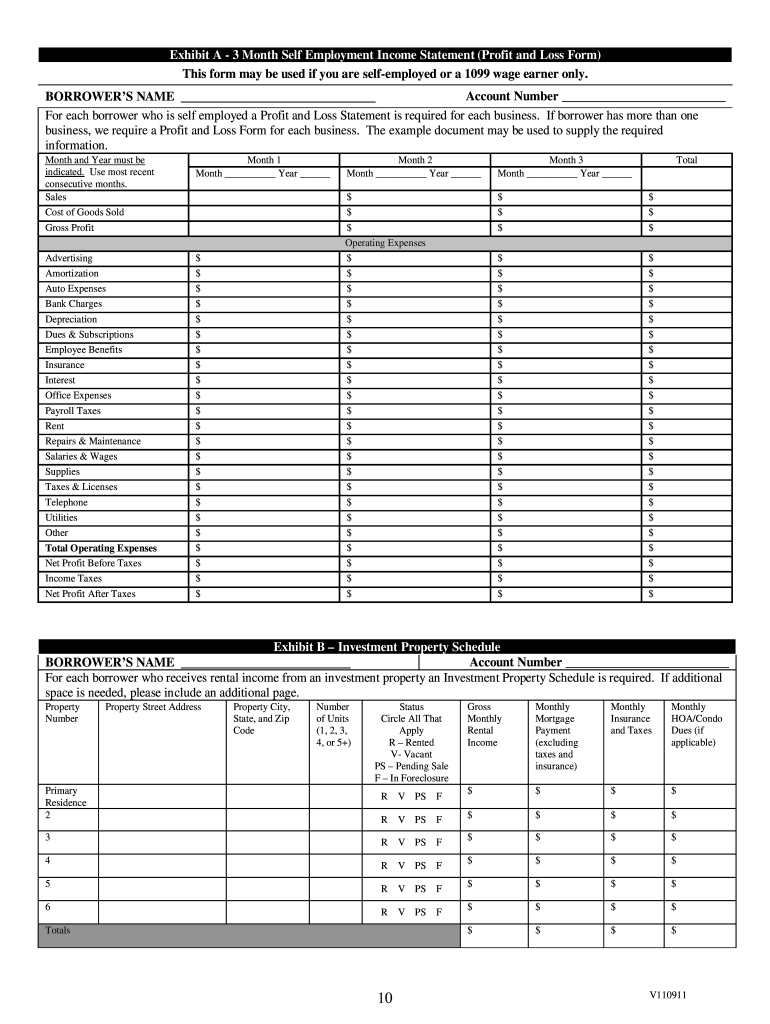

Wages income statement. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss. Subtract the cost of goods sold from sales revenue to find the gross profit. The balance of unfulfilled payroll expenses.

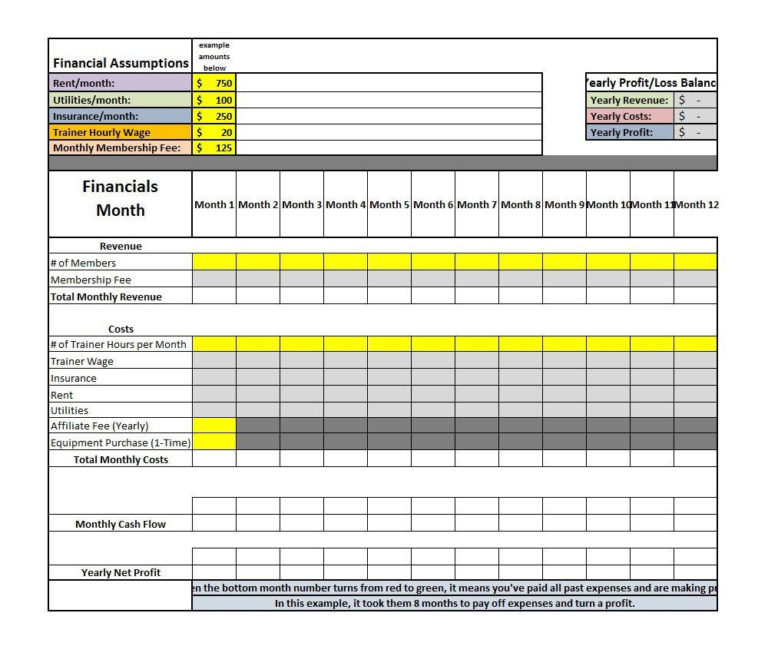

Calculate the revenue earned from the sale of goods and services. An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period. Some examples of common expenses are equipment depreciation, employee wages, and supplier payments.

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Calculate the cost of goods sold (direct labor, materials, and overhead). Updated january 05, 2024 reviewed by david kindness investopedia / madelyn goodnight what is a wage expense?

The amount recorded as a salary expense may vary. There are two main categories for business expenses: Salaries and wages of a company's employees working in nonmanufacturing functions (e.g.

An income statement shows you the company's income & expenses. The account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the amounts earned by employees during the accounting period under the accrual basis of accounting. What are accrued wages?

An income statement provides a detailed look at how much profit a business makes in an accounting period. Each month, employees receive pay slips from their employers, detailing essential information such as the company’s name, the employee’s designation, location, and bank details. It shows all revenues and expenses of the company over a specific period of time.

(you can find this on your last paycheck of the year.) How to prepare a personal income statement. Start off by determining the amount of money that you earn from various sources.

The salary slip, also known as a payslip, serves as an official document outlining an employee’s earnings and deductions. Pick a time period for the income statement. Presentation of salaries expense.

An income statement summarizes a company's financial performance. Within the salary slip, there are key. Estimates of wages and income tax withheld.

Relied on by banks and other lenders as a reflection of business performance, an income statement accounts for sales revenue, associated expenses and any dividend distributions to reflect a net profit. Income range where 85% of your social security is taxable. An income statement is a financial report detailing a company’s income and expenses over a reporting period.