Matchless Tips About Types Of Financial Statements

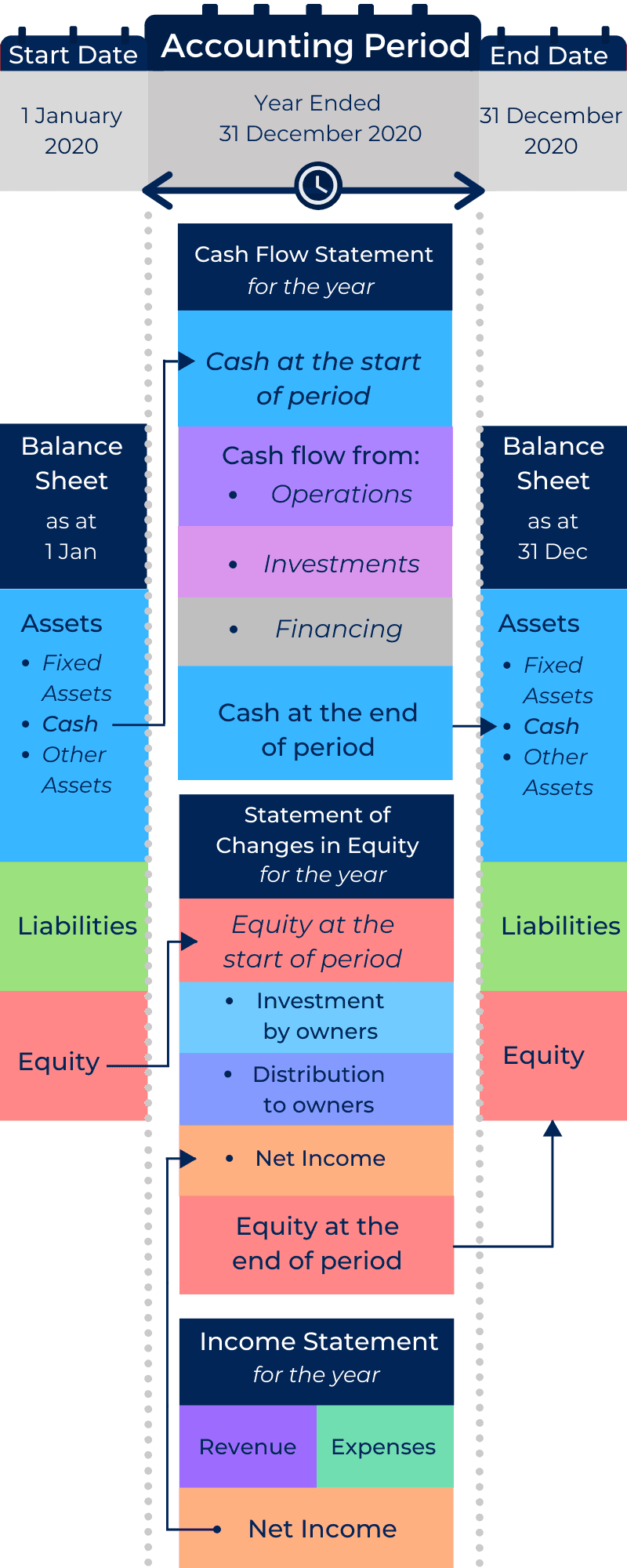

Financial statements provide a picture of the performance, financial position, and cash flows of a business.

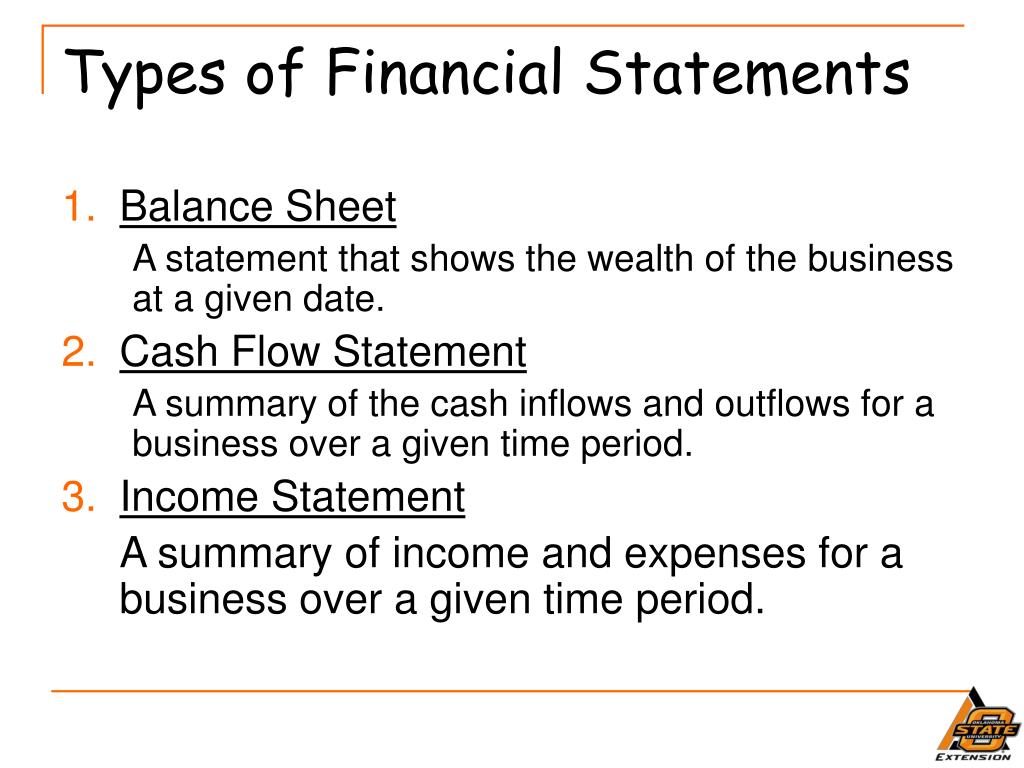

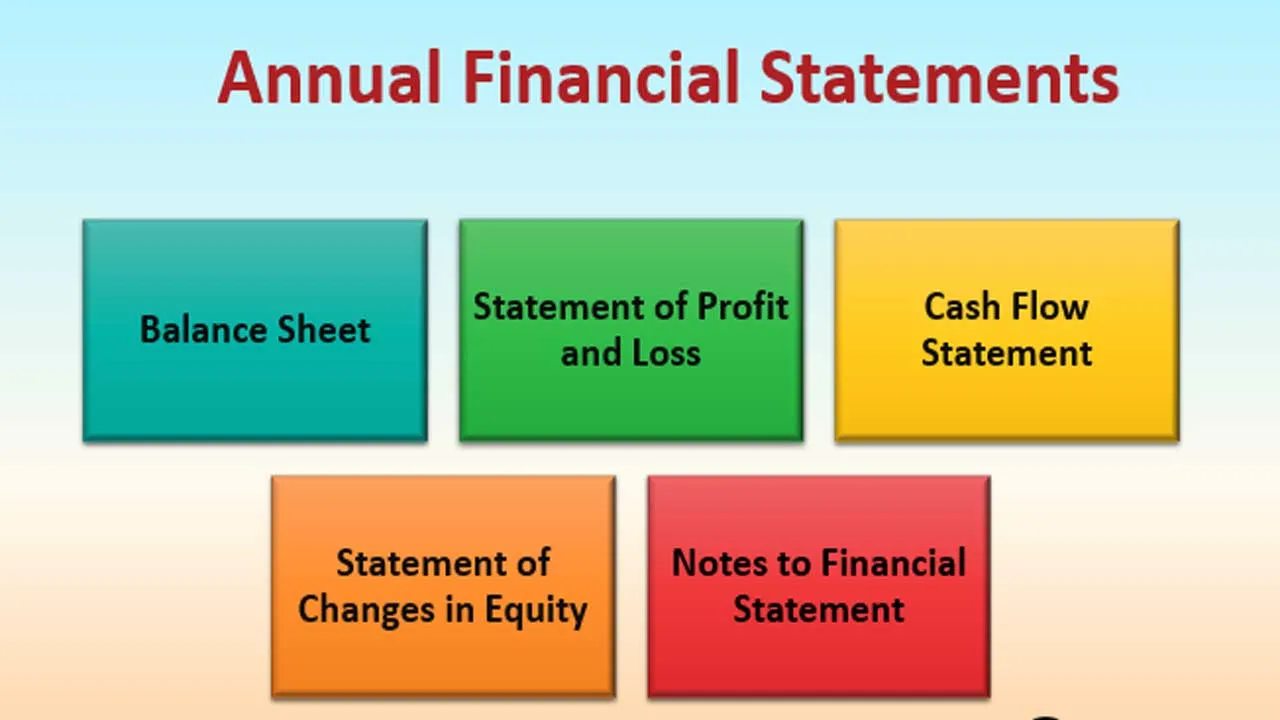

Types of financial statements. Balance sheets show what a company owns and what it owes at a fixed point in time. And (4) statements of shareholders’ equity. Read on to explore each one and the information it conveys.

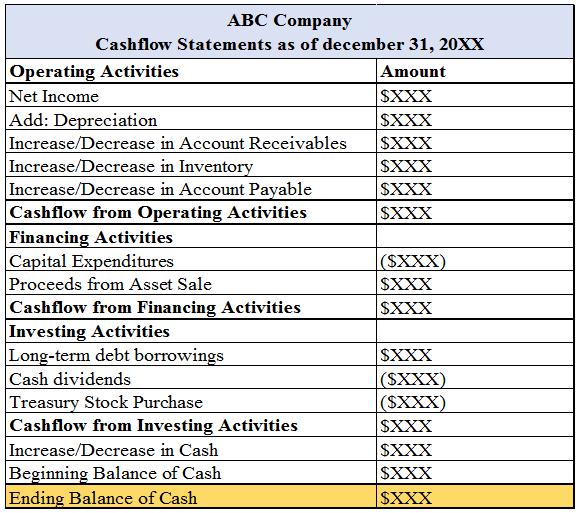

The financial statements can be broadly classified as balance sheet, income statement, cashflow statements, and statements of owner’s equity. In general, there are five types of financial statements the income statement, statement of financial position, statement of change in equity, cash flow statement, and the noted (disclosure) to financial statements. These three statements together show the assets and liabilities of a.

Historical financial statements financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Income statements show how much money a company made and spent over a period of. The four main types of financial statements are statement of financial position, income statement, cash flow statement and statement of.

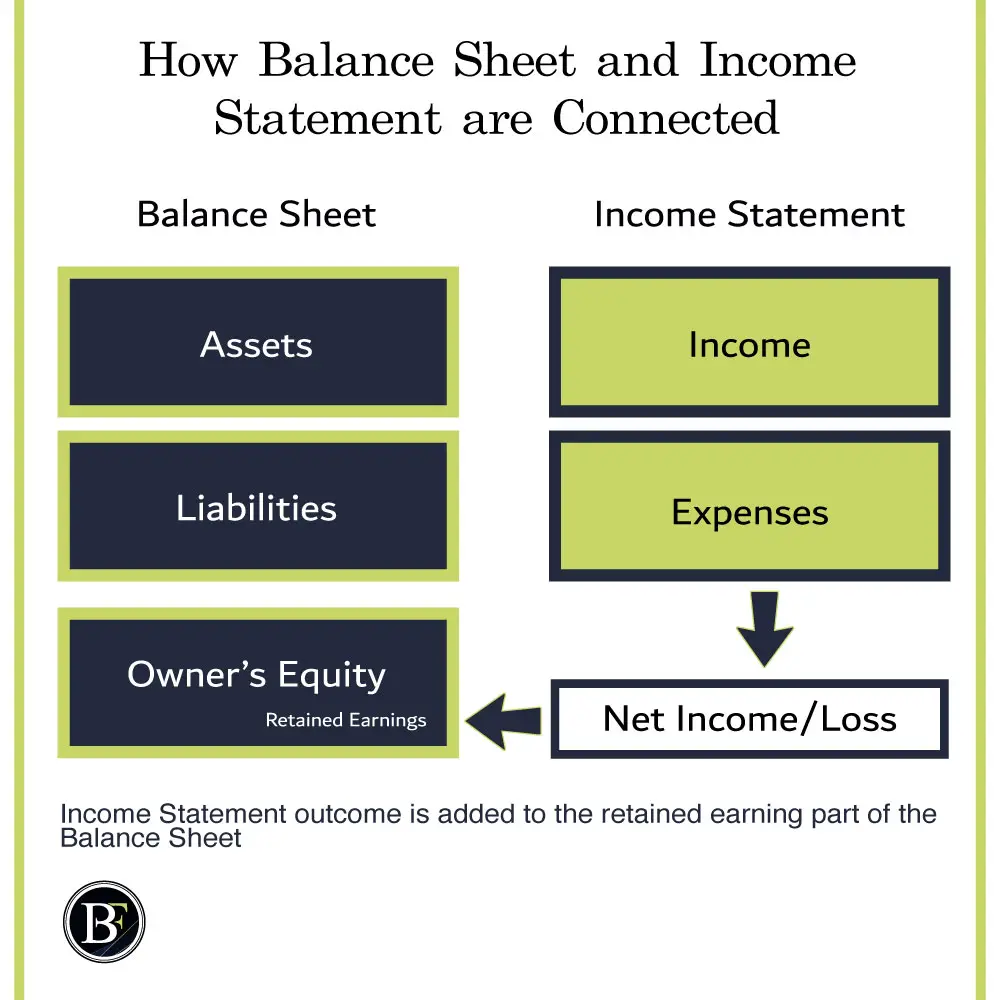

All three statements are interconnected and create different views of a. Financial statements are written reports that quantify the financial strength, performance and liquidity of a company. Companies use the balance sheet, income statement, and cash flow statement to provide transparency to their stakeholders.

These documents are used by the investment community, lenders, creditors, and management to evaluate an entity. The balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

Relevant financial information is presented in a structured manner and in a form which is easy to understand.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)