Inspirating Info About The Balance Sheet Lists Format Of Trading Profit And Loss Account &

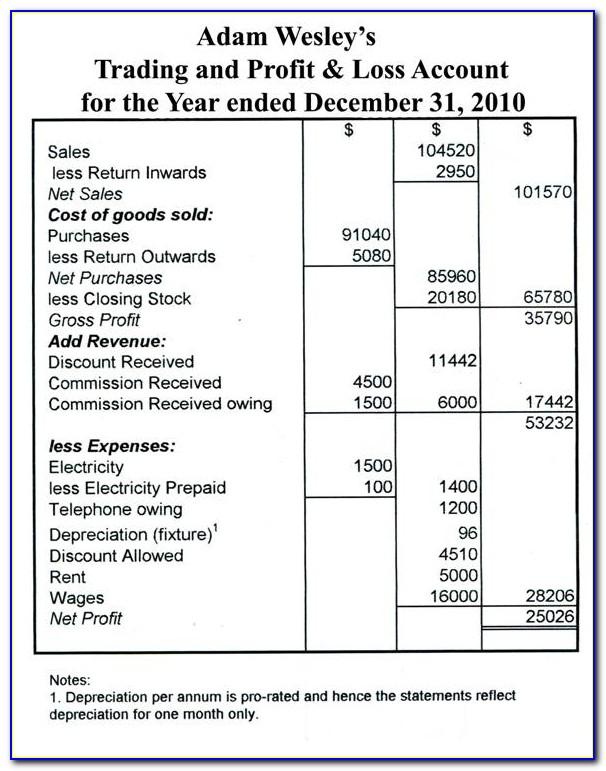

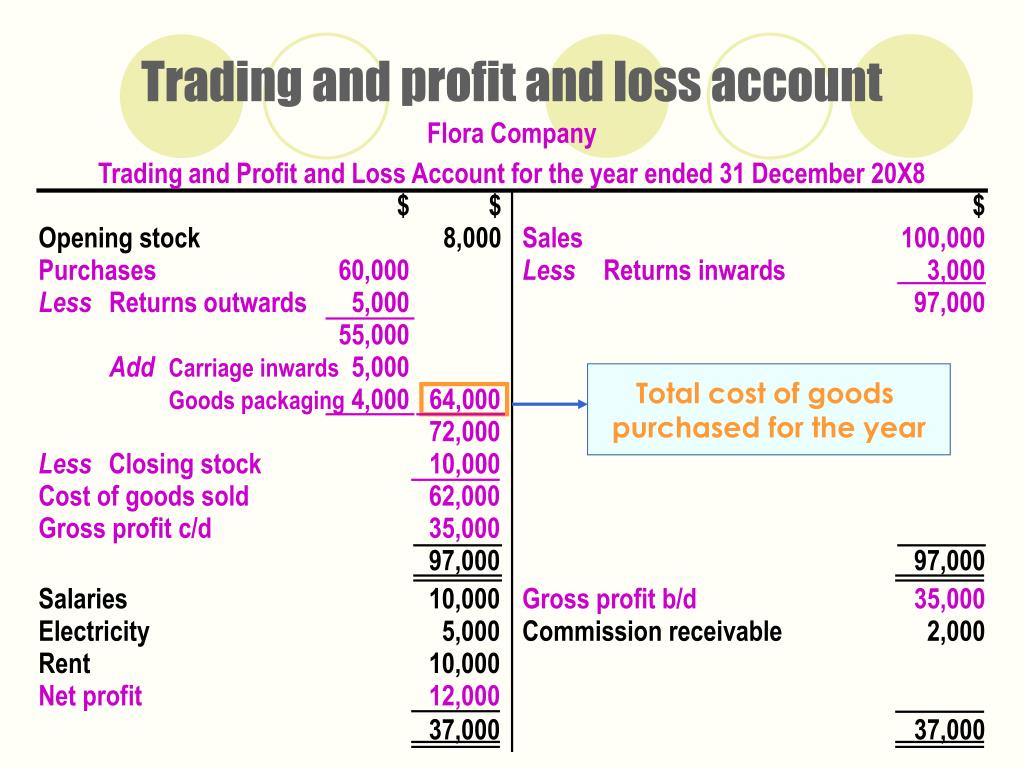

It is used to calculate the gross profit or loss of a business that is engaged in buying and selling goods.

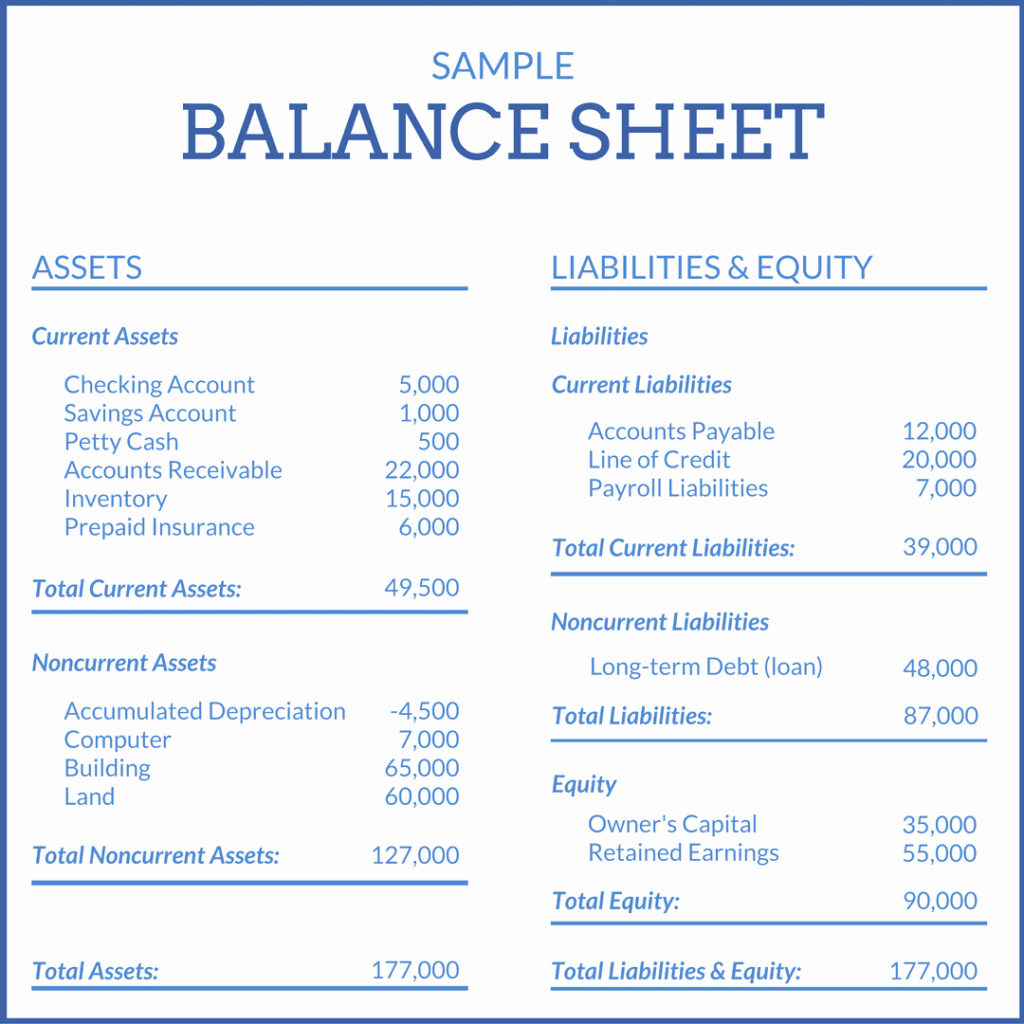

The balance sheet lists format of trading profit and loss account & balance sheet. Depreciation charged on furniture and fixture @ 5 %.3. For instance, a trader has cash in a bank account and securities in other accounts (if so, it must be mentioned). Profit and loss account profit and loss account shows the net profit and net loss of the business for the accounting period.

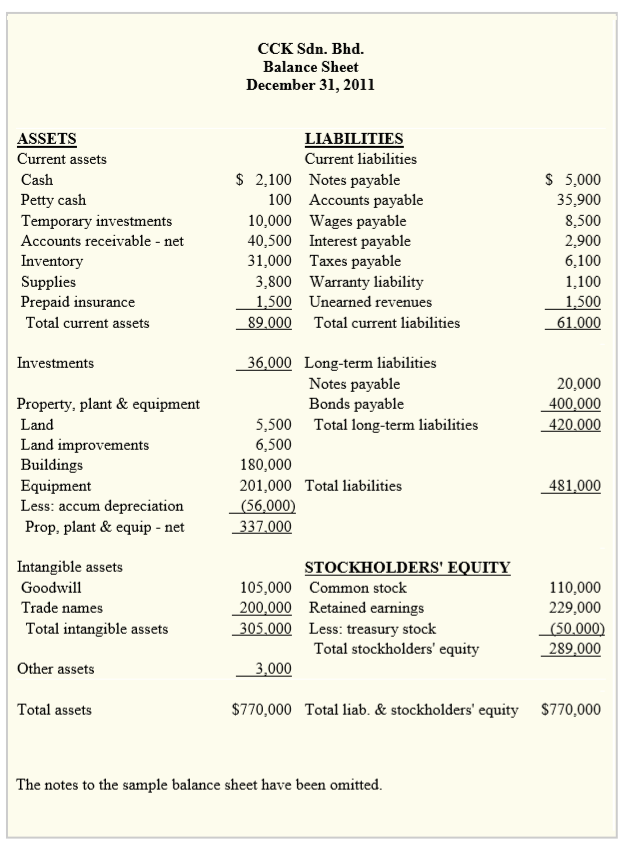

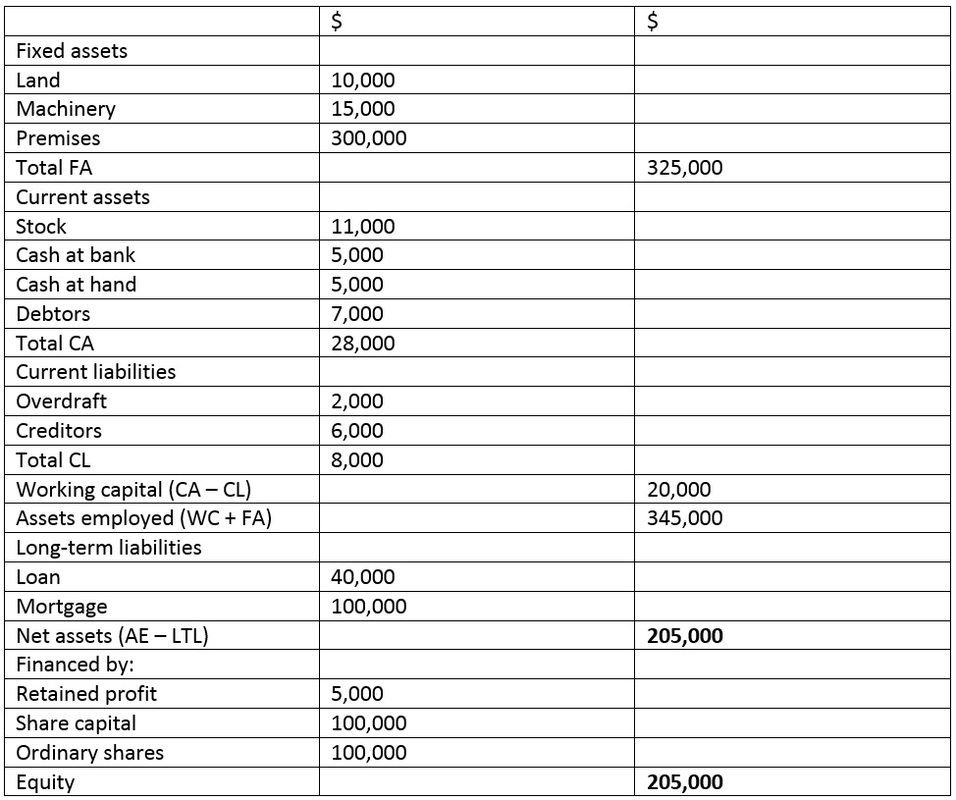

Note that the closing stock figure would appear in the balance sheet under stock. The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements. Balance sheet vs profit & loss account

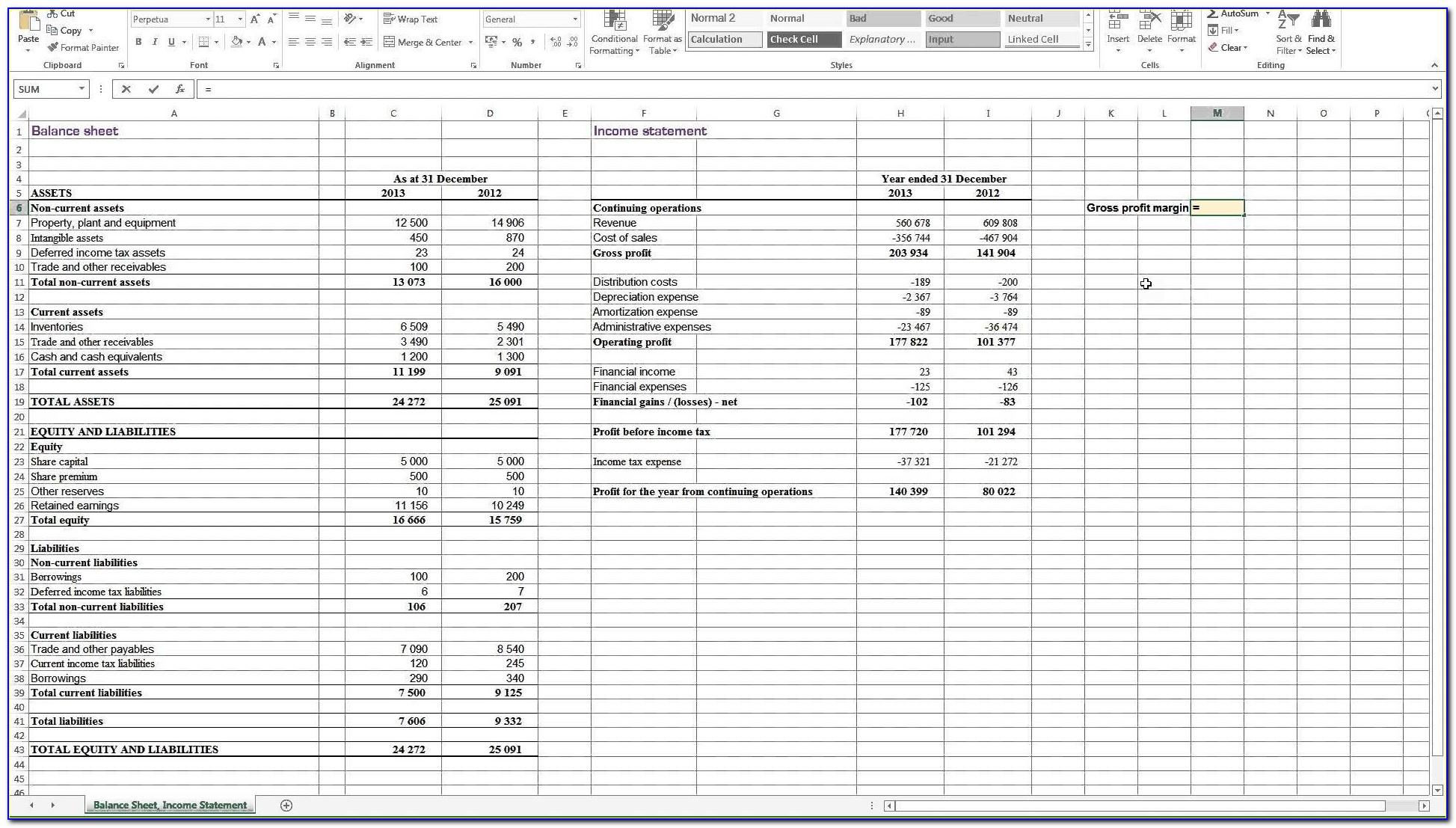

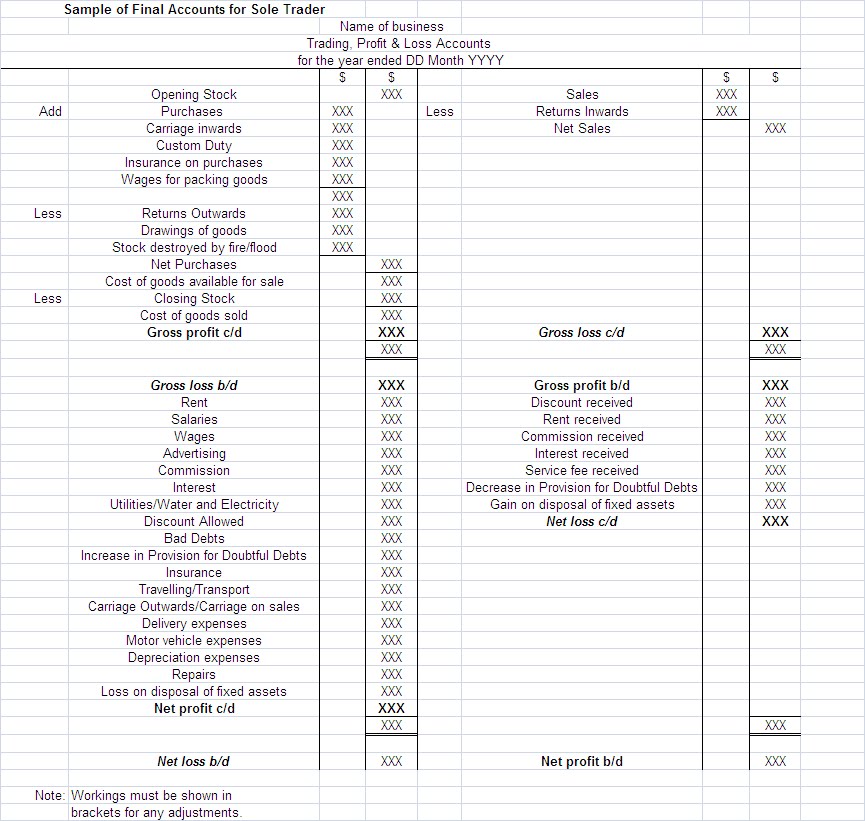

Prepare the trading and profit and loss account and a balance sheet of m / s shine ltd. Record income & expenses and the template produces a trial balance, trading profit and loss accounts, cash flow statement and balance sheet. A typical profit and loss account would look as shown in fig.

The following items usually appear on the debit and credit side of a profit and loss account. Difference between gross profit and net profit. A balance sheet is one of the financial statement reports that shows the financial situation of an entity on a specific date.

Assume that the following balance sheet information as on 8th/1/2018 for our co. Difference between trading account and profit and loss account. Trading, profit and loss account for xyz ltd for the year ended 31 march 20x5.

Make a provision for bad debts @ 5 % on sundry debtors.4. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business. Notes on the items in the profit and loss account:

As we shall see it will always balance because. 3 months, 1 year, etc. The trading account and the profit and loss account can be combined into a single summary known as a trading profit and loss account.

This account is prepared in order to determine the net profit or net loss that occurs during an accounting period for a business concern. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. In contrast, the balance sheet is like a photograph taken at an instant in time giving a picture of what the business owns and what the business owes at that moment in time.

The balance sheet is a statement that shows the financial position of the business. (final account) items appearing in different account It shows the current assets, current liabilities, and capital of an organization.

Gross loss (transferred from trading account) all indirect expenses; Includes automated calculations of gross profit amounts & percentages, inventory on hand, invoices, customer statements and customer ageing. Gross profit (transferred from trading account) all indirect revenues;