Peerless Info About Other Income P&l

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

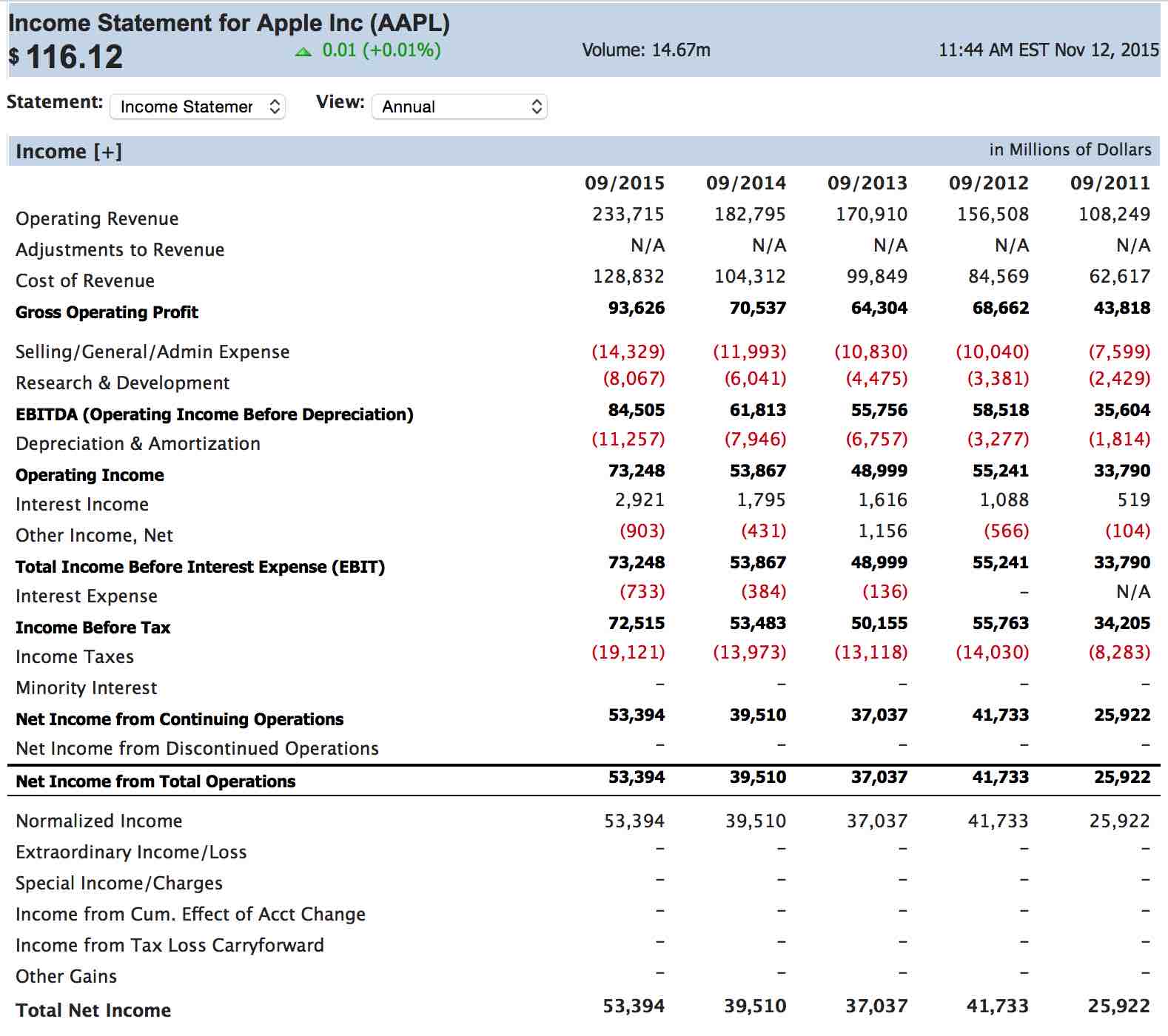

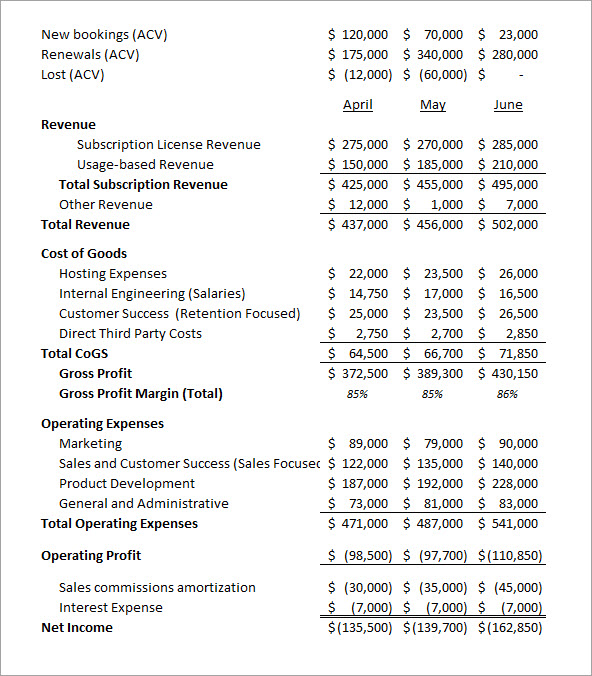

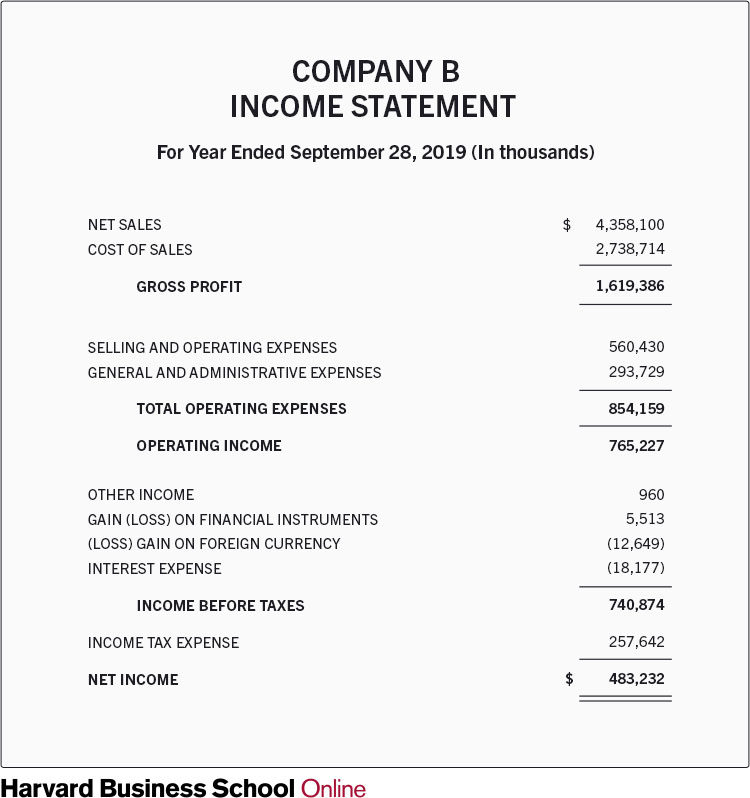

Other income is income arising from activities unrelated to a company’s core business that consist of either (1) selling activities such as interest on loans (2) contractual earnings such as legal damages, or (3) accounting adjustments such as gains on foreign exchange conversion.

Other income p&l. In new york city, the typical rental broker’s fee can range from being equal to one month’s rent to 15% of the annual rent. Let’s look first at other income and expense. A 2% rise in the higher rate of personal income tax to generate a £20m boost in health spending has been revealed in the isle of man budget.

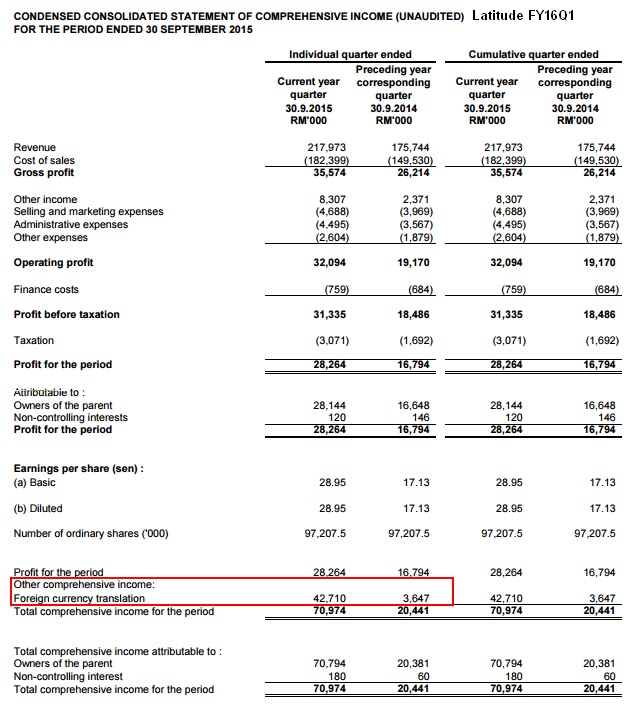

This article outlines what differentiates profit or loss from other comprehensive income and where items should be presented. For example, during the year the company makes revenue of usd500,000, cost of sales. Dividend equity research database, looking for stocks that pay.

Ias ® 1, presentation of financial statements, defines profit or loss as ‘the total of income less expenses, excluding the components of other comprehensive income’. A p&l statement, also known as an “income statement,” is a financial statement that details income and. The three major california utilities will charge far more:

It should also include a final section. They’re often a safer choice than growth stocks, but not always. Other income and other expense.

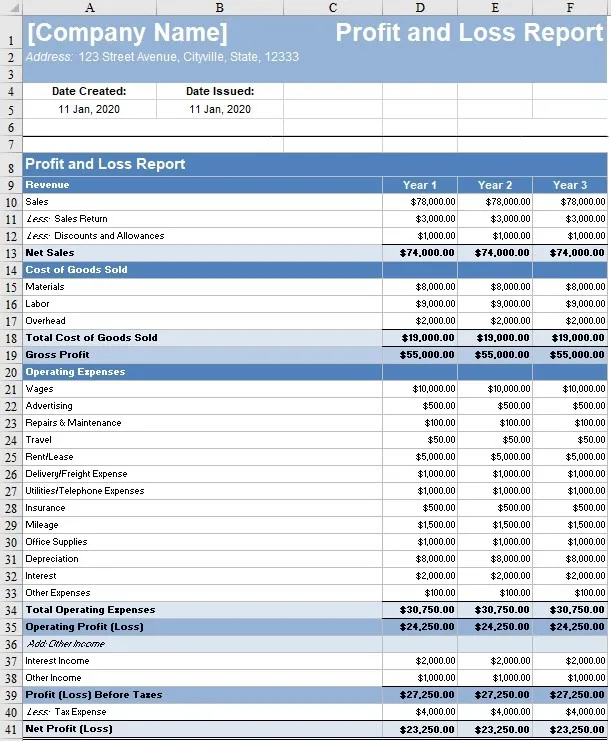

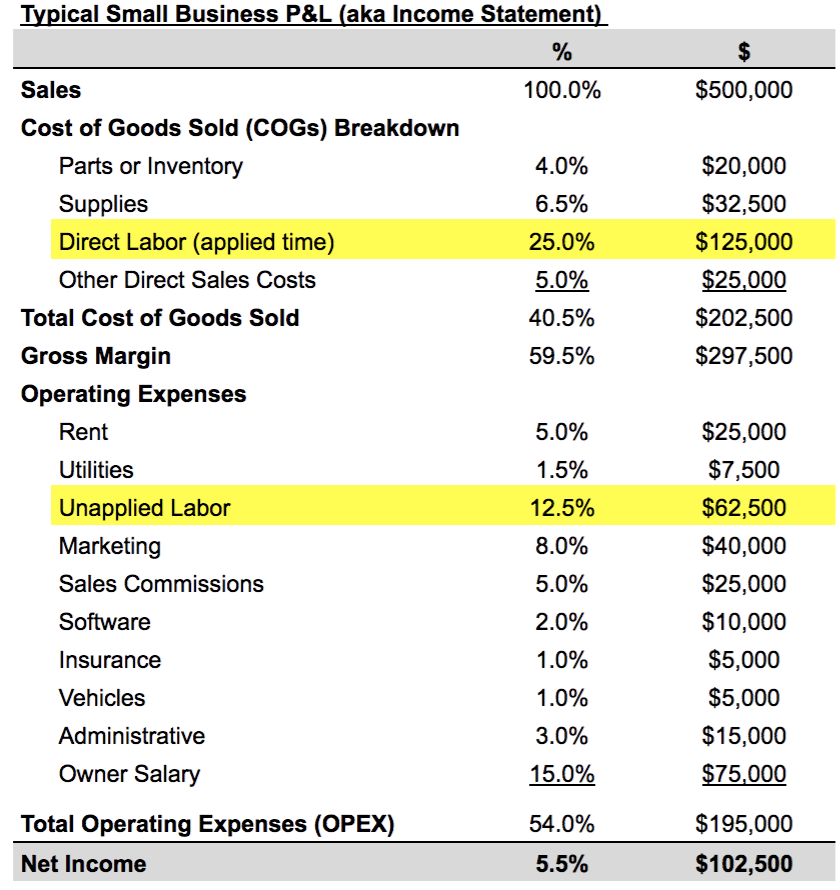

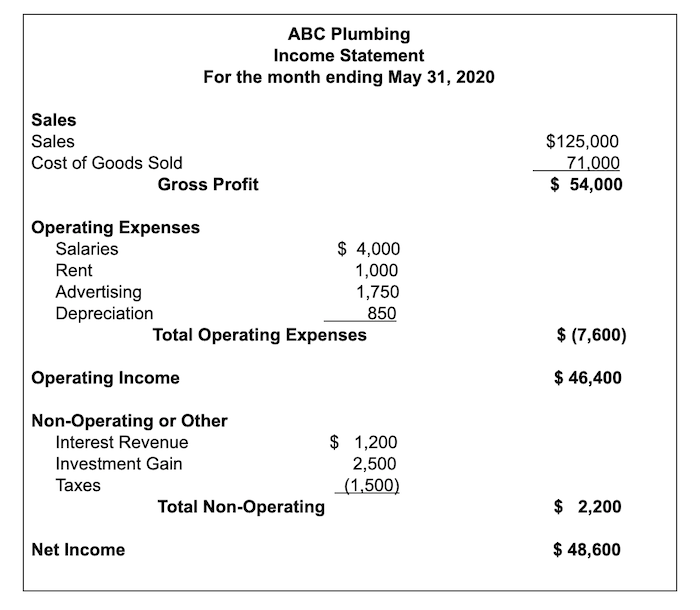

The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users. The last items on a p & l statement are: Profit and loss report (often referred as p&l report, income statement, or.

A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. In the income statement, other income is presented after the other gross profit.

Denmark (55.9 percent), france (55.4. It adds up your total revenue, then subtracts your total expenses, and gives you your net income. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year.

Other income, other expense and income taxes. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a. Updated december 21, 2020 what does p&l mean?

A p&l should include a section on operating income and net income, expenses and debts, and taxes and lease payments. We screened our 24/7 wall st. Among european oecd countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024.

Other income is income derived from activities unrelated to the main focus of a business. Profit and loss report: The exact type of transaction characterized as.

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)