Real Tips About Free Cash Flow Financing Activities

This, in turn, allows you to estimate the future requirements to service this debt, or provide returns to shareholders.

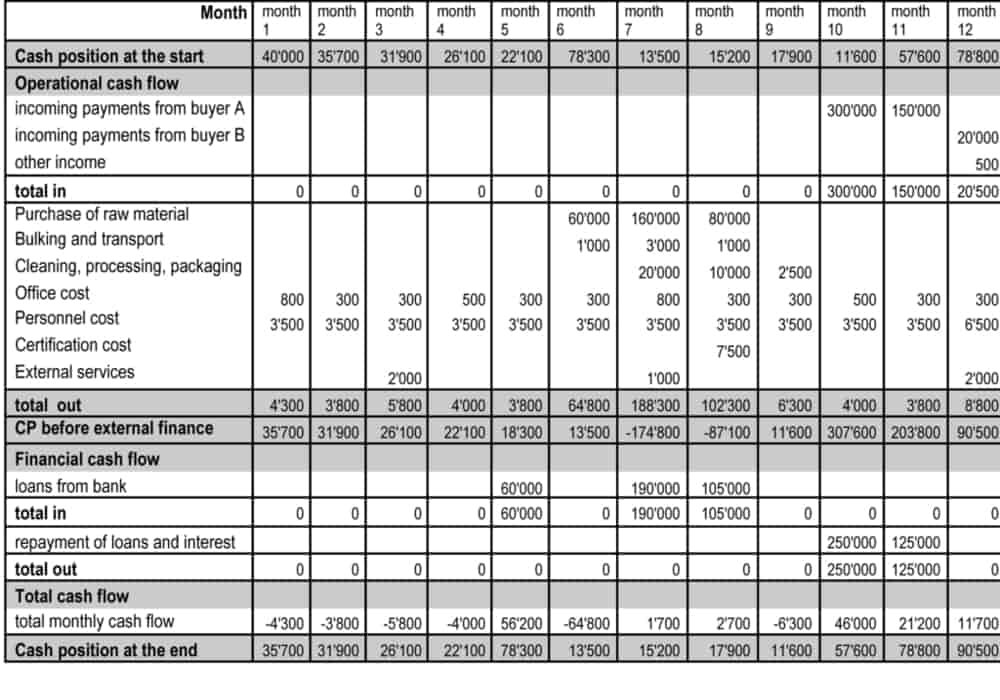

Free cash flow financing activities. During the three months ended december 31, 2023, net cash provided by operating activities was $543.3mm and net income was $301.6mm ($6.93 /diluted share). Net debt and financing as of december 31, 2023, safran’s balance sheet exhibits a €374 million net cash position (vs. Cash flow from financing activities (cff):

Free cash flow (fcf) is a metric business owners and investors use to measure a company’s financial health. Best for line of credit: Cash outflows from buying back equity/shares.

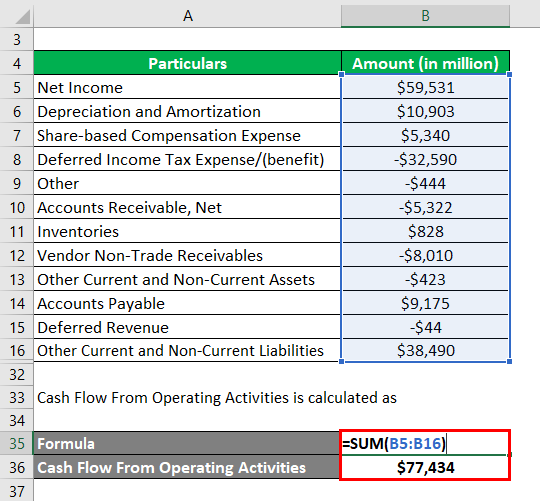

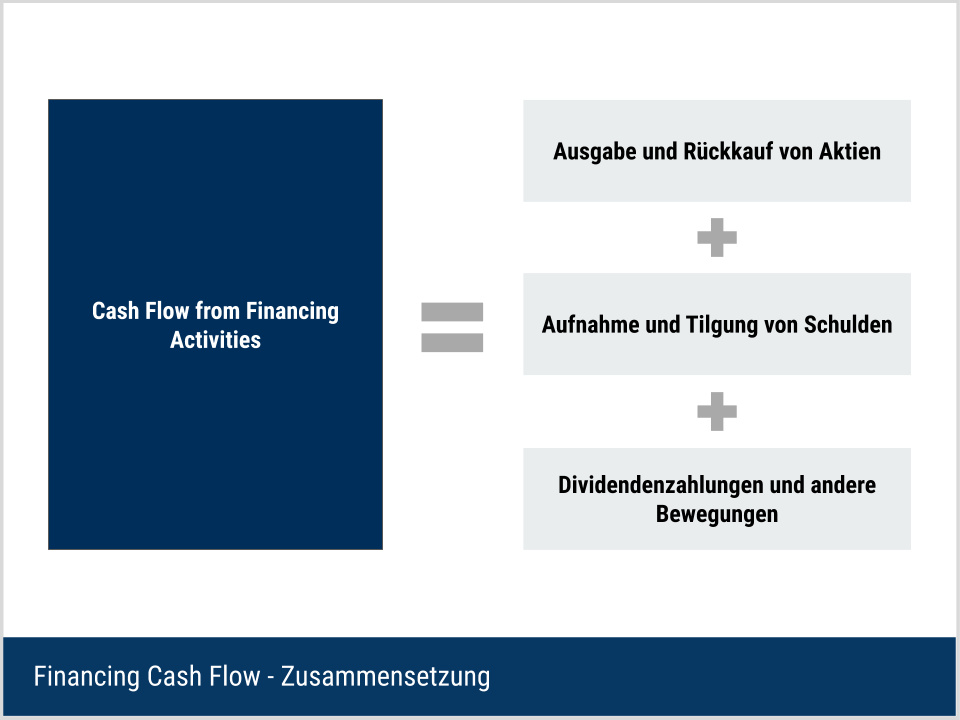

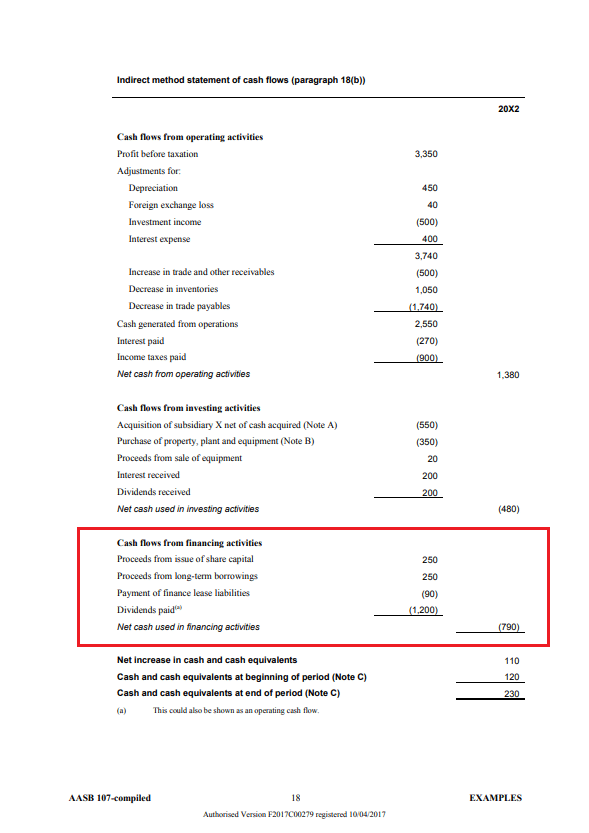

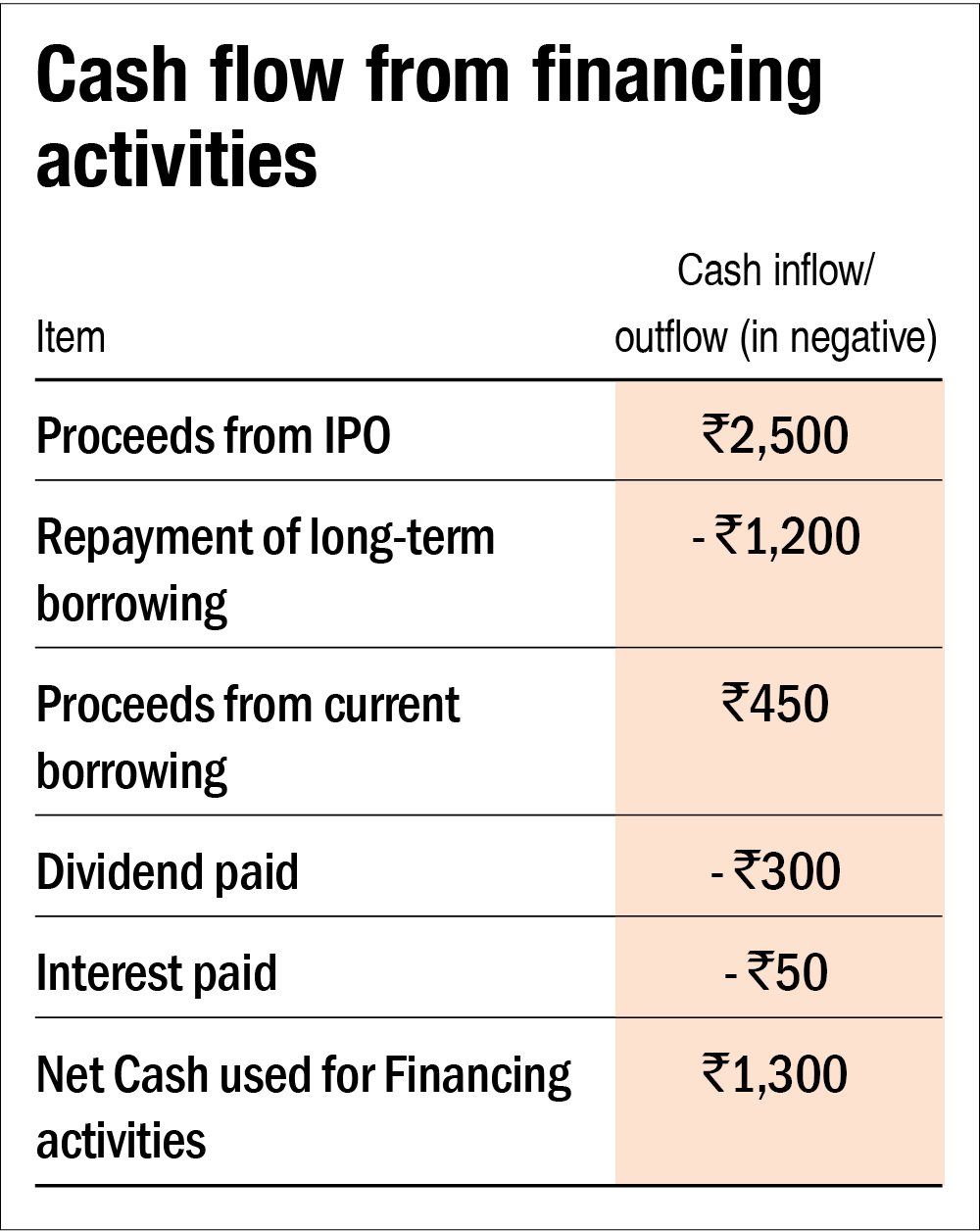

Cash flow from financing activities = issue / (repurchase equity) + issue / (repurchase debt) + (dividend payments) these are the most common items reported but there may be many more to include. The cash flow from financing activities section of the cash flow statement includes cash inflows and cash outflows for business activities related to the financing of the business. Free cash flow is the cash that a company generates from its normal business operations before interest payments and after subtracting any money spent on capital expenditures.

Lfcf is usually compared directly to the market value of equity as it considers cash available only to the equity holders of a. Adjusted ebitda was $480.9mm, adjusted. Calculate free cash flow.

The formula for free cash flow is:. These activities involve the flow of cash and cash equivalents between the company and its sources of finance i.e. A form of financing in which the loan is backed by a company's expected cash flows.

Adjusted free cash flow, which excludes capital structure transformation expenses and cash paid for repositioning and factoring costs, was $137 million in the fourth quarter of 2023 as compared to. A cash flow statement contains three types of cash flows:

Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Cash inflows from raising loans, mortgages and other borrowings. The fcfe is a measure of how much free cash flow is attributed to the shareholders after all expenses, including those related to capex, and financing activities.

Key takeaways cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Cash flow from financing activities the financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets. It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow.

Net cash (used in) provided by investing activities (152) 1. Cash flow types what is cash flow? Examples of cash inflows included in the cash flow from financing activities section are:

Net cash of €14 million as at december 31, 2022), as a result of a strong free cash flow generation, and including the dividend payment (of which €564 million to shareholders of the parent company on 2022 fiscal year. Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. Repurchase of common stock — (75) proceeds from issuance of convertible notes, net of issuance costs.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)