Perfect Tips About Depreciation And Amortization On Income Statement

Depreciation and amortization on the income statement.

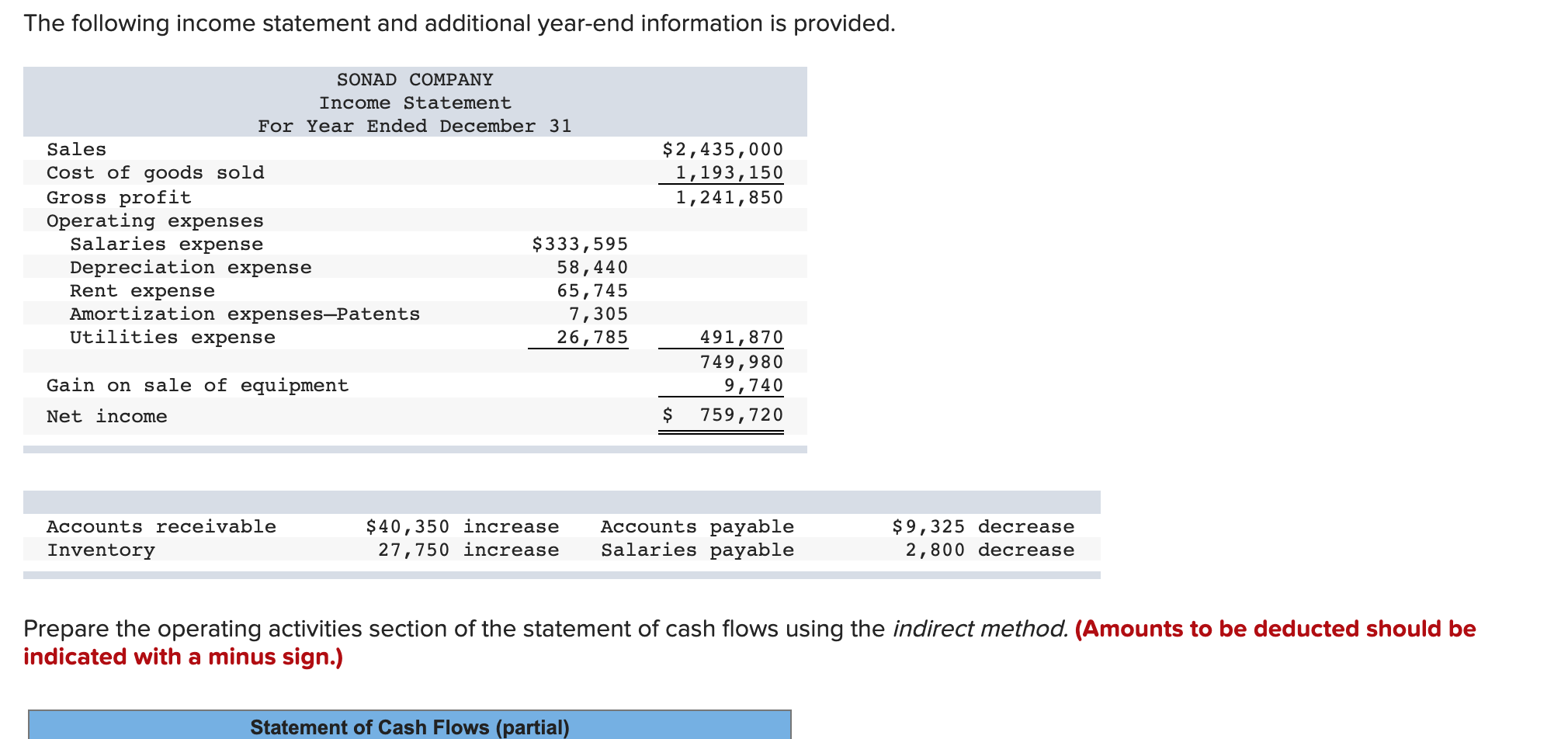

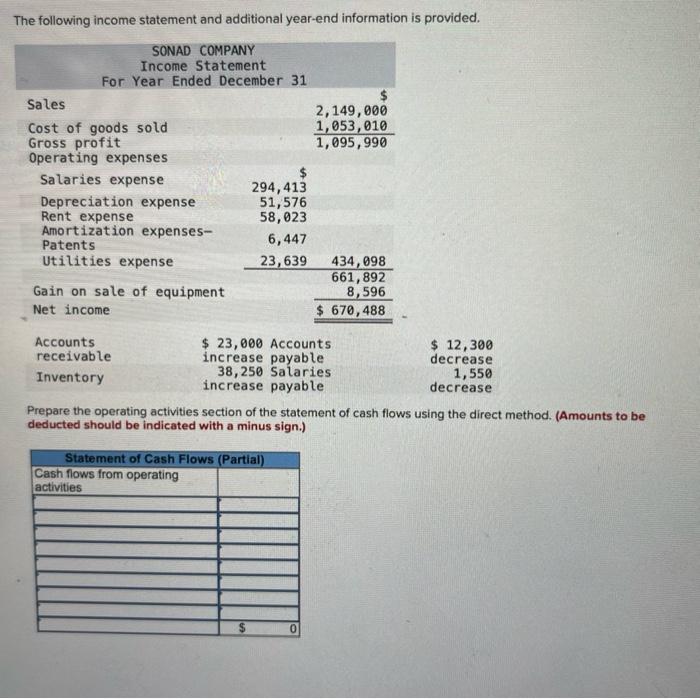

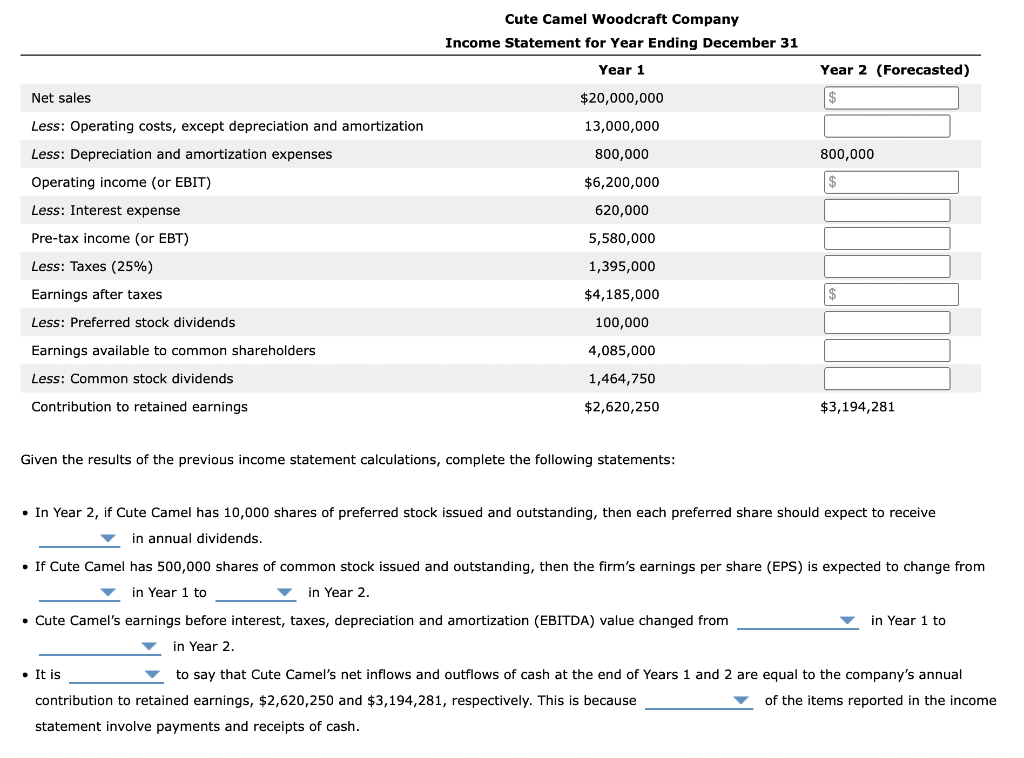

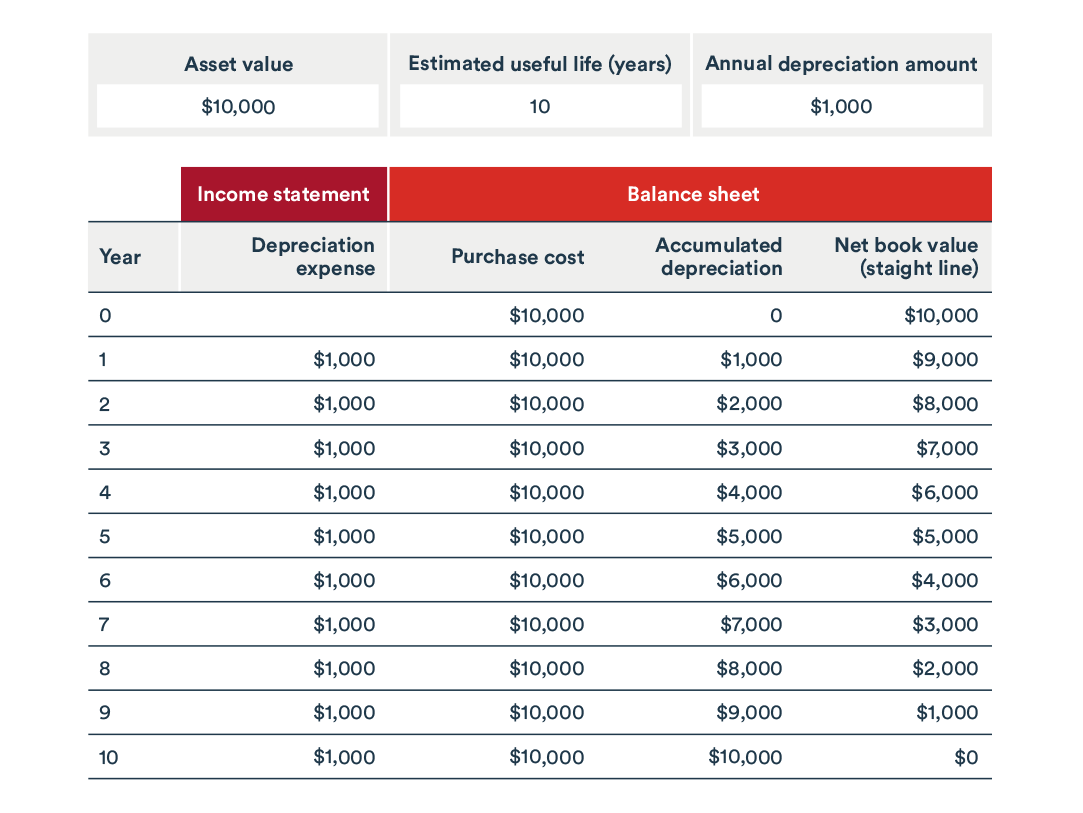

Depreciation and amortization on income statement. So, calculating ebitda using the second method is even simpler than with the first method: However, in this example, operating income is shown in the income statement. The recovery period is the number of years over which an asset may be recovered.

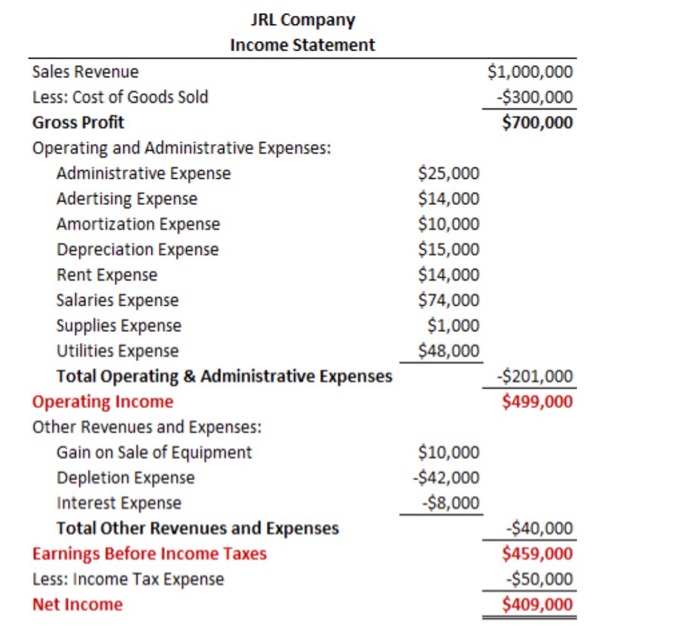

Depreciation expense and accumulated depreciation depreciation expense is an income statement item. Finance and capital markets > unit 5 lesson 3: Amortization and depreciation (video) | khan academy finance and capital markets course:

On the balance sheet, it is listed as accumulated depreciation, and refers to the cumulative amount of depreciation that has been charged against all fixed assets. It is reported on the income statement along with other normal business expenses. Total revenue reaches $9.8 million in quarter four, an increase of 35% year over year.

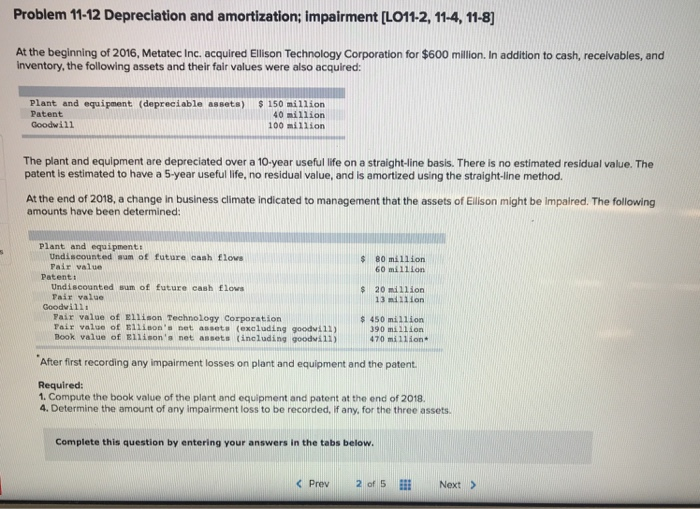

Depreciation represents the cost of capital assets on the balance sheet being used over time, and. Keeping track of accumulated amortization is important for making smart money choices and keeping clear financial records. Specifically, amortization occurs when the depreciation of an intangible asset is split up over time, and depreciation occurs when a fixed asset loses value over time.

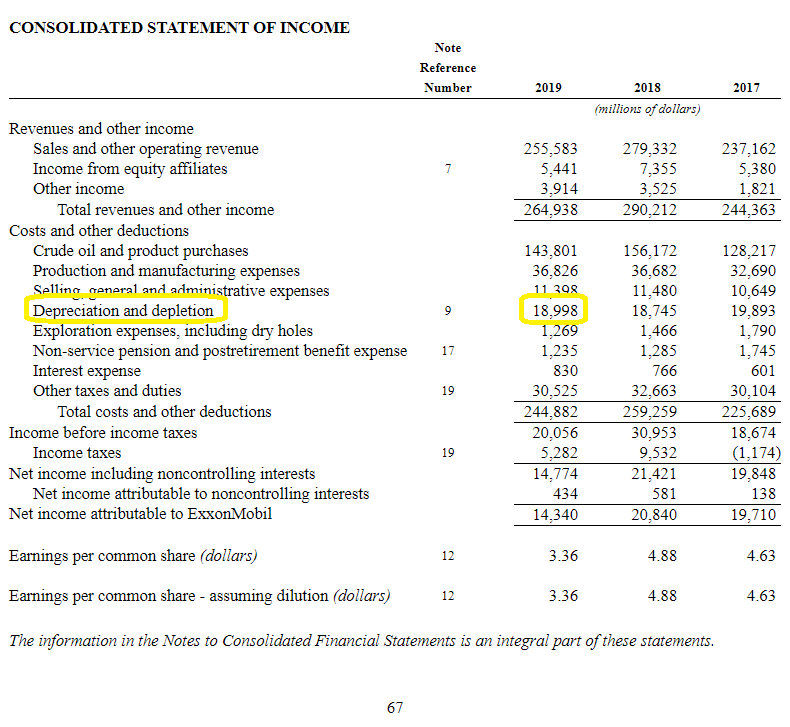

Amortization is the practice of spreading an intangible asset's cost over. Key takeaways depreciation, depletion, and amortization (dd&a) are accounting techniques that enable companies to gradually expense resources of economic value. Depreciation relates to the cost.

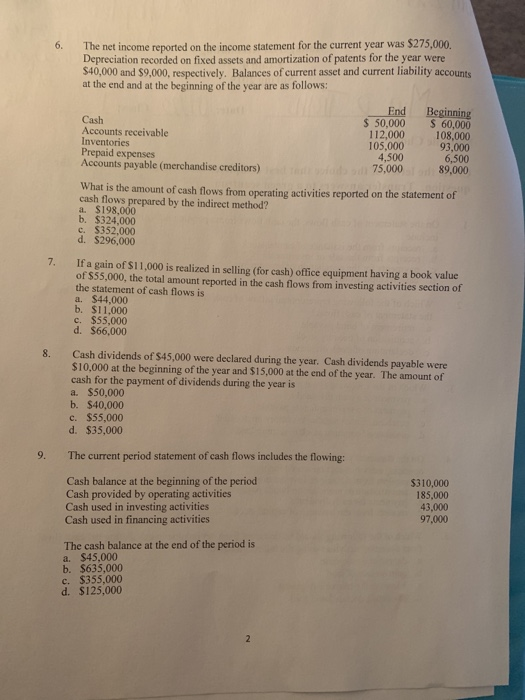

= $115,000 + $50,000 + $70,000 + $45,000. The income statement this lesson focuses on the elements and limitations of the income statement and the effects of gaap on the income statement. The displays have a useful life.

On every monthly income statement, you can report $1,000 on the depreciation expense line. Understanding this concept helps companies follow gaap rules and keep their finances in good shape. Oct 29, 2019 at 16:49.

The company said it had a loss of $24 million, or 27 cents per share. $\begingroup$ @alracoon many public companies do not have a specific line item for depreciation and/or amortization expense on the income statement. It will also discuss noncash items.

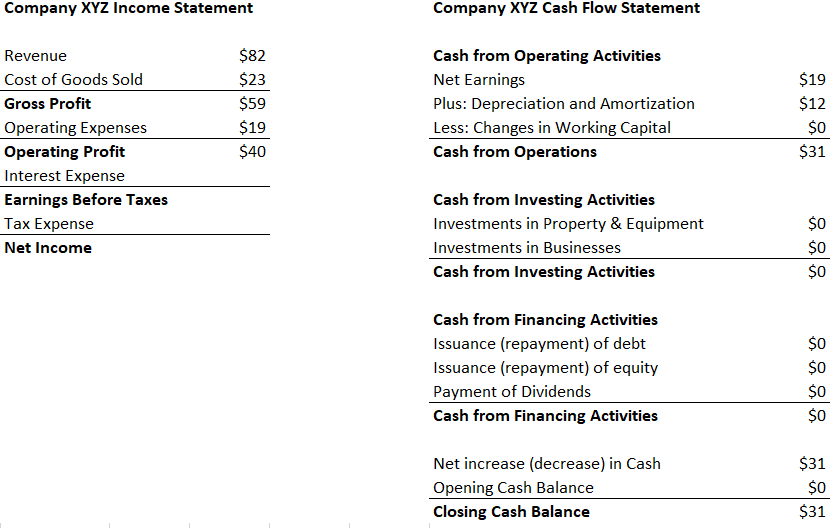

Saas revenue growth of 58% drives gross margin to 72% in quarter four. Ebitda = net income + tax paid + interest expense + depreciation & amortization. It reflects as a debit to the amortization expense account and a credit to the accumulated amortization account.

Key takeaways amortization and depreciation are two methods of calculating the value for business assets over time. Depreciation and amortization expensing a truck leads to inconsistent performance depreciating the truck depreciation in cash flow amortization and depreciation economics > finance and capital markets > It takes net income and adds back items such as depreciation and amortization.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)

:max_bytes(150000):strip_icc()/Amazon4-8ae1cf9e4d2e49f08002f3eacc6f081b.JPG)

![[Solved] Can someone please explain? The balance shee](https://media.cheggcdn.com/study/495/49565683-5152-4e24-9ac7-d3a8fb46b066/image)