Neat Info About Ifrs 1 Summary

Seeking feedback on proposed topics for the ifrs accounting taxonomy update 2024.

Ifrs 1 summary. Summary of ifrs 1 objective. Ifrs s1 sets out overall requirements with the objective to require an entity to disclose infor. A statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when.

Most recently, ifrs 1 was A comprehensive project on insurance contracts is under way. Feedback on ifrs accounting taxonomy 2023 proposed update 2.

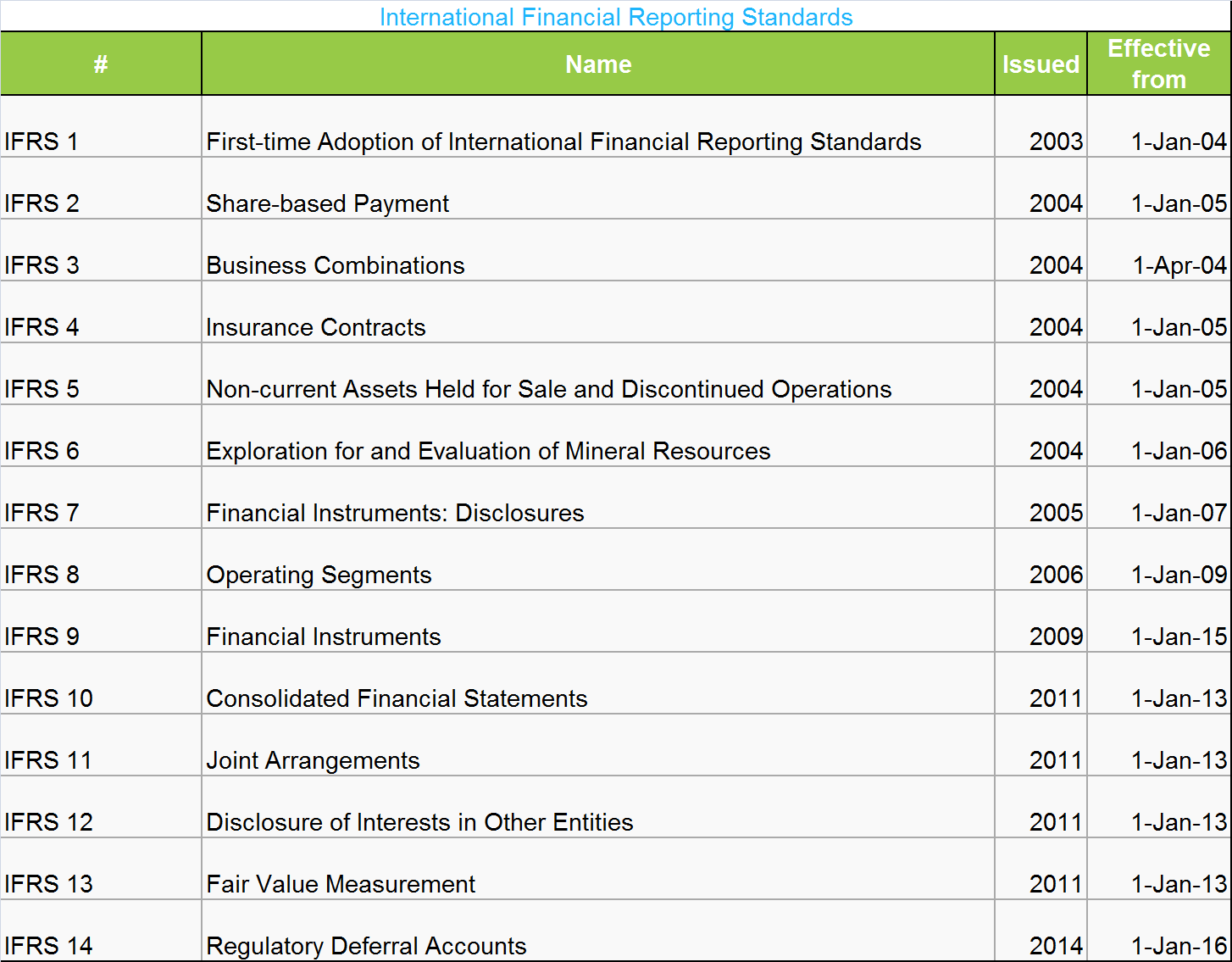

A free 'basic' registration will give you access to issued standards in html or pdf. The information included in this edition of ifrs in your pocket reflects developments until 30 september 2022. Ifrs s1 and ifrs s2 must always be applied together.

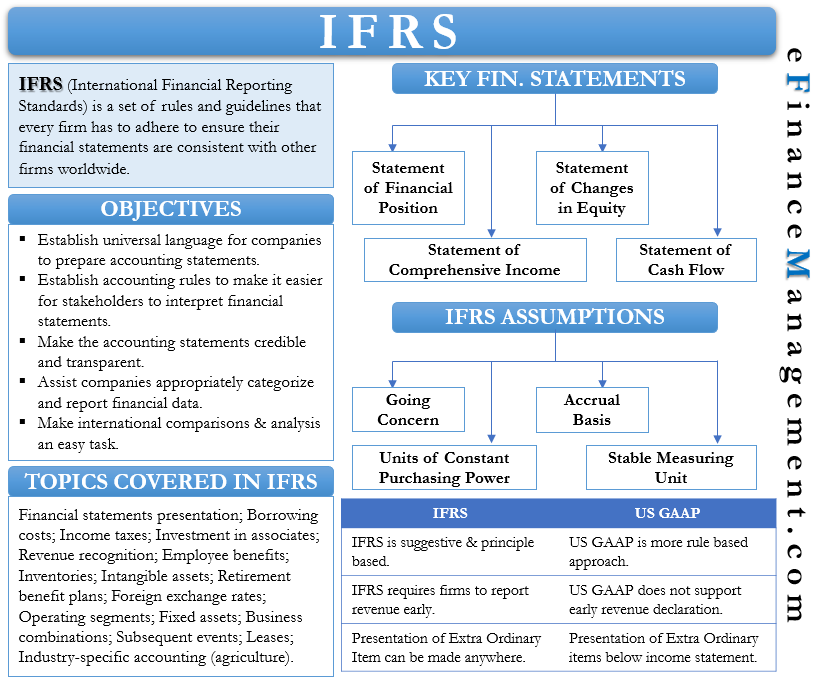

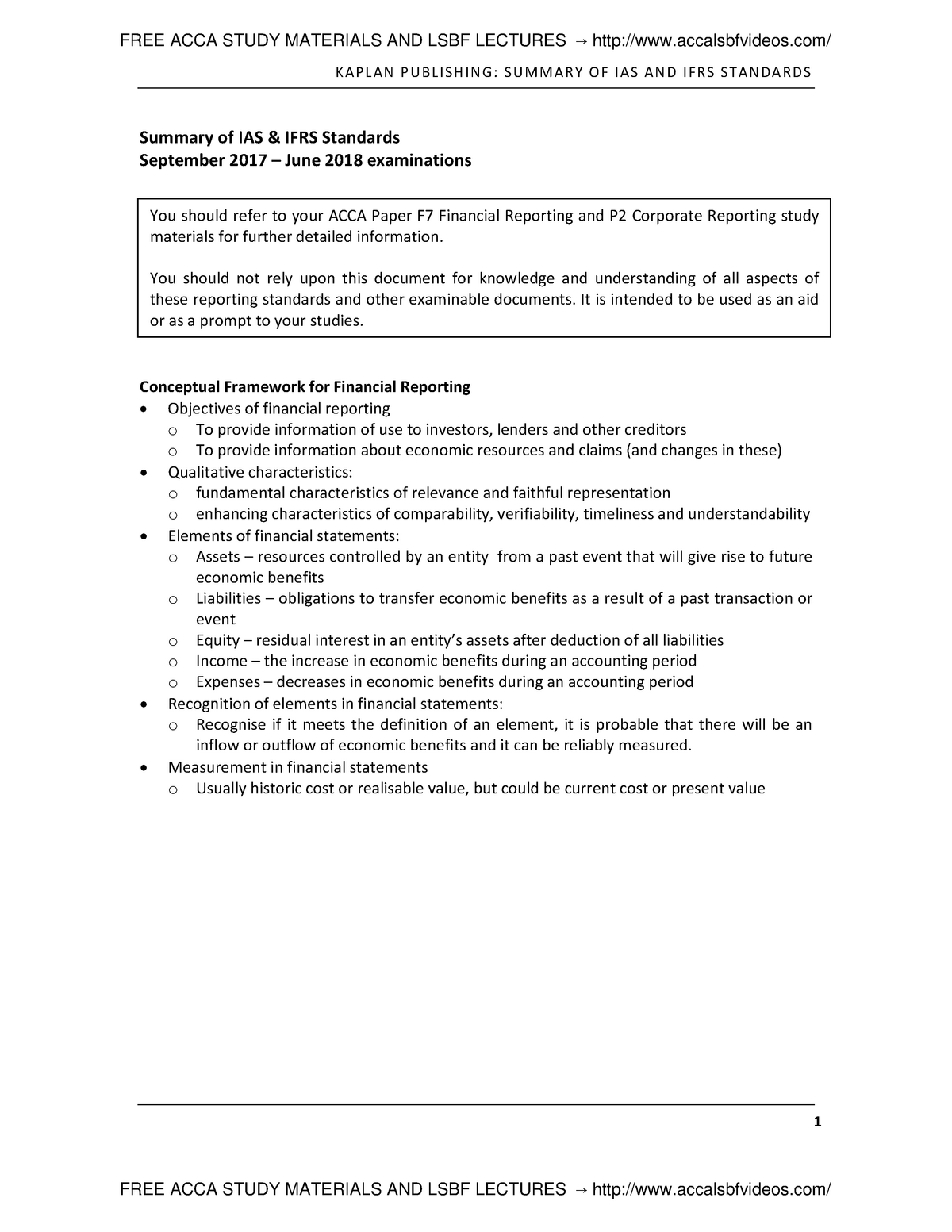

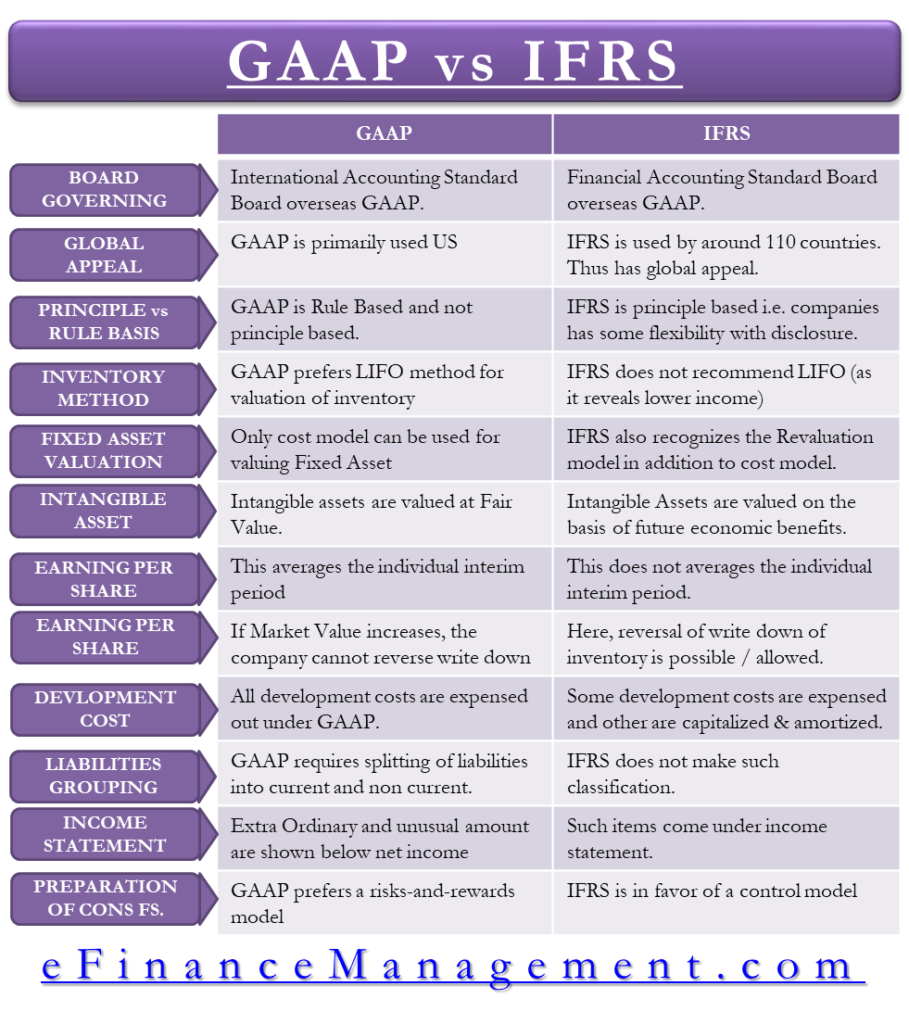

For the purposes of this checklist, the. Ias 1 explains the general features of financial statements, such as fair presentation and compliance with ifrs, going concern, accrual basis of accounting, materiality and aggregation, offsetting, frequency of reporting, comparative information. This standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities.

Ifrs 2 pagamento com base em acções ; The european endorsement mechanism for ifrss. Ifrs 1 adopção pela primeira vez das normas internacionais de relato financeiro ;

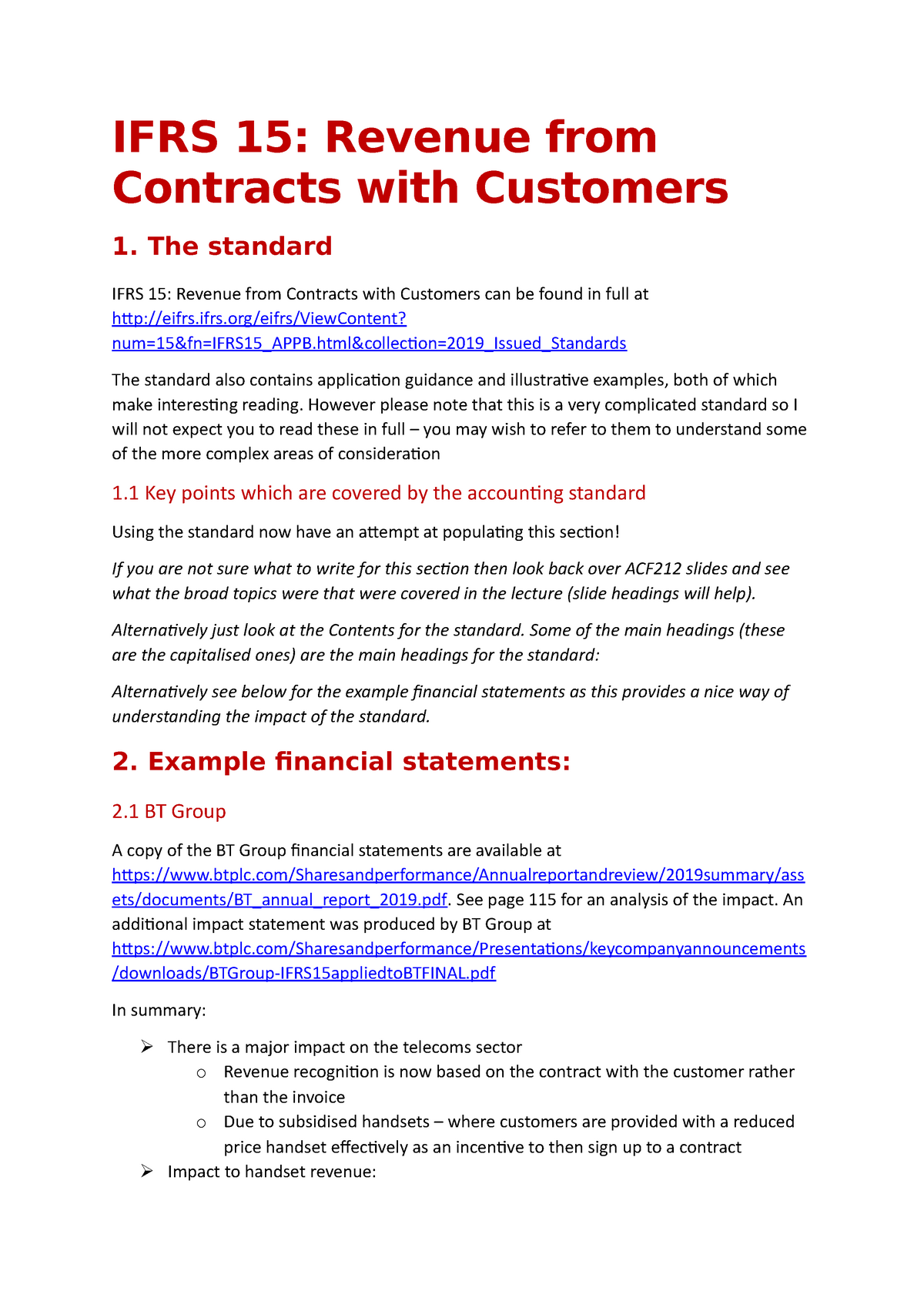

Click on an ias or ifrs number below to go to an unofficial summary of the standard. Ifrs 4 contratos de seguro ; Summary of ifrs 15 objective.

Ifrs 4 was issued in march 2004 and applies to annual periods beginning on or after 1 january 2005. 1606/2002 which required publicly traded european union (eu) incorporated companies to prepare, by 2005 at the latest, their consolidated financial statements under ifrs ‘adopted’ for application within the eu. The key principle of ifrs 1 is full retrospective application of all ifrs standards that are effective as of the closing balance sheet or reporting date of the first ifrs financial statements.

For the requirements reference must be made to international financial reporting standards. Please remember that the summaries of iass and ifrss only cover highlights and are not a substitute for reading the entire standard. The itcg discussed the following topics:

The ifrs foundation has published a summary of the ifrs taxonomy consultative group (itcg) meeting held on 1 february 2024. The entity uses the same accounting policies throughout all periods presented in its first ifrs financial statements. Summary of ifrs 1 objective.

Full retrospective adoption can be very challenging and burdensome. It starts from objective, scope, recommendation, and measurement, and ended with presentation and disclosure. Ifrs 1 requires an entity that is adopting ifrs standards for the first time to prepare a complete set of financial statements covering its first ifrs reporting period and the preceding year.

:max_bytes(150000):strip_icc()/IFRS_Final_4194858-00f3f3a4c8334cc1aa13b29e692935db.jpg)