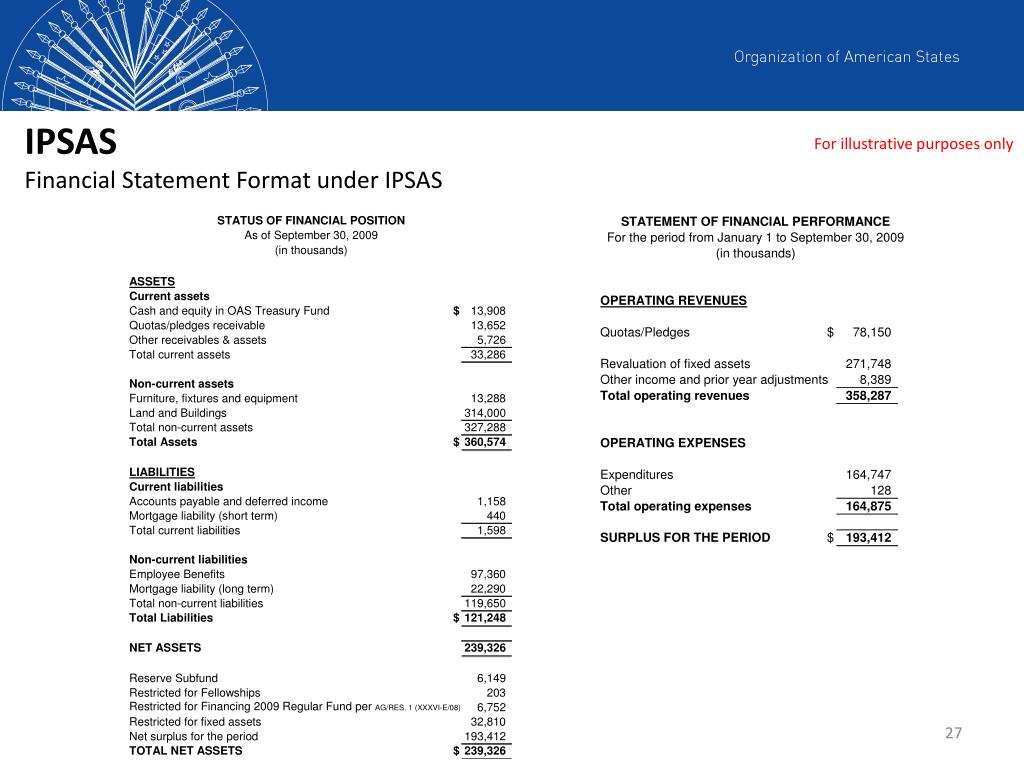

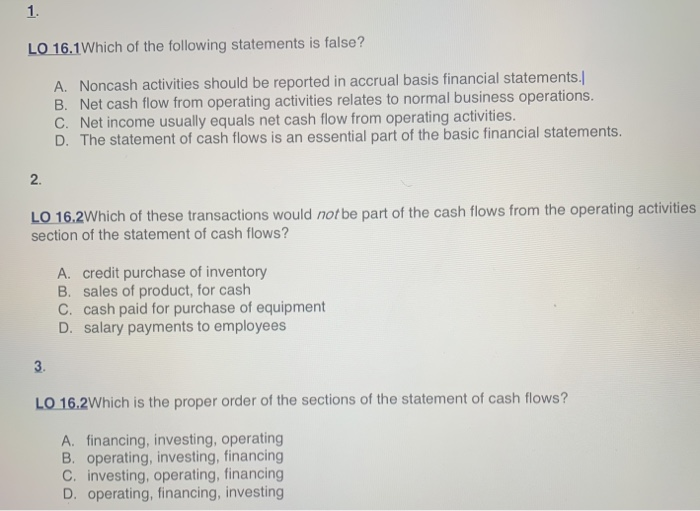

Simple Info About Ipsas Accrual Basis Financial Statements

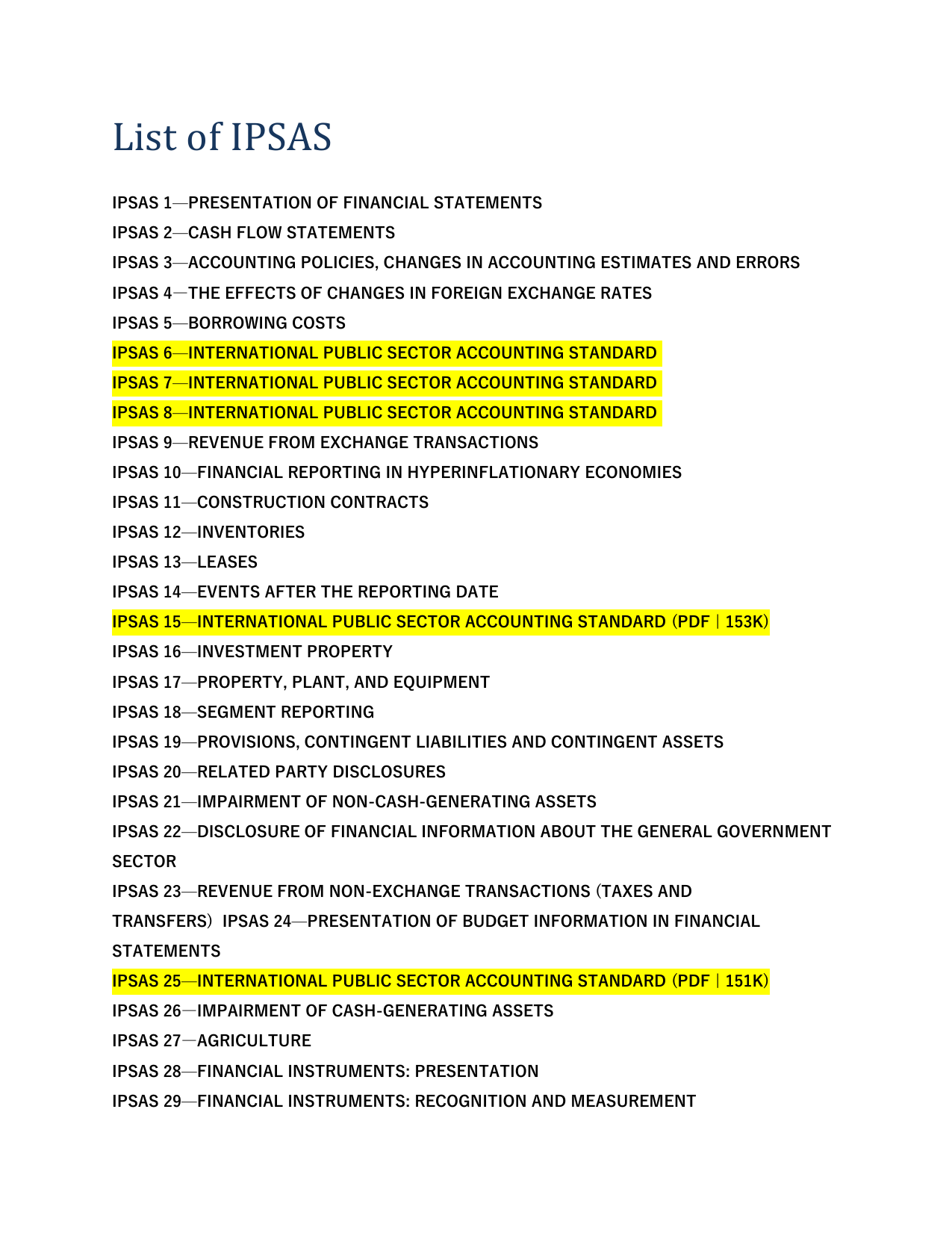

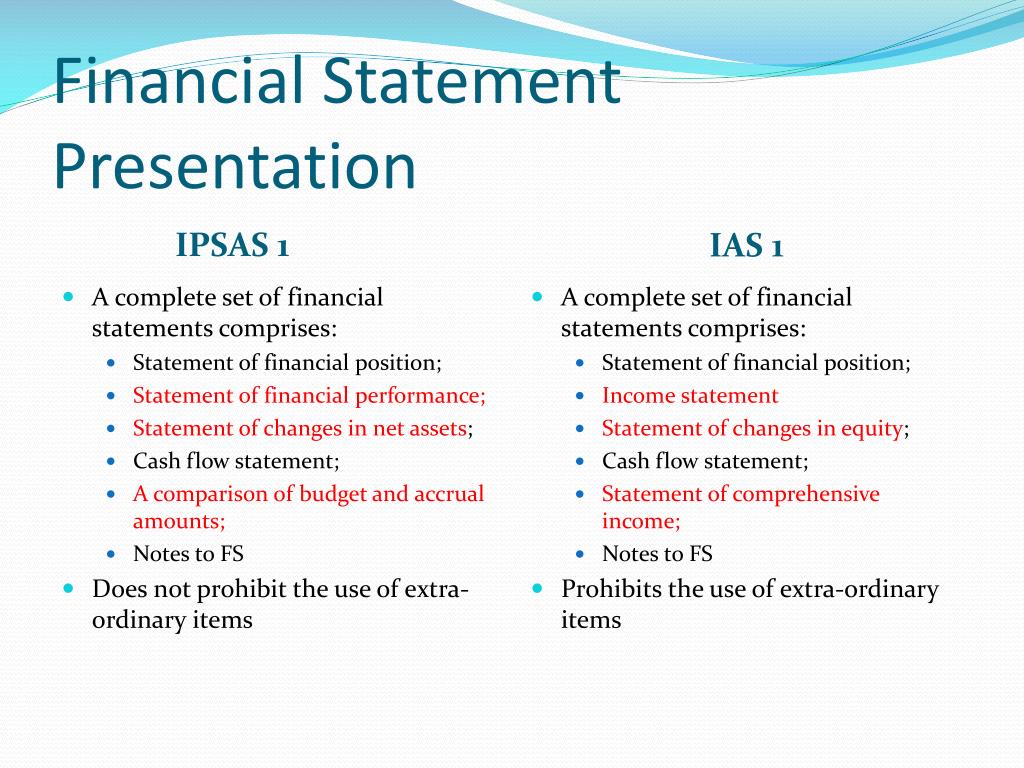

43 rows ipsas 1:

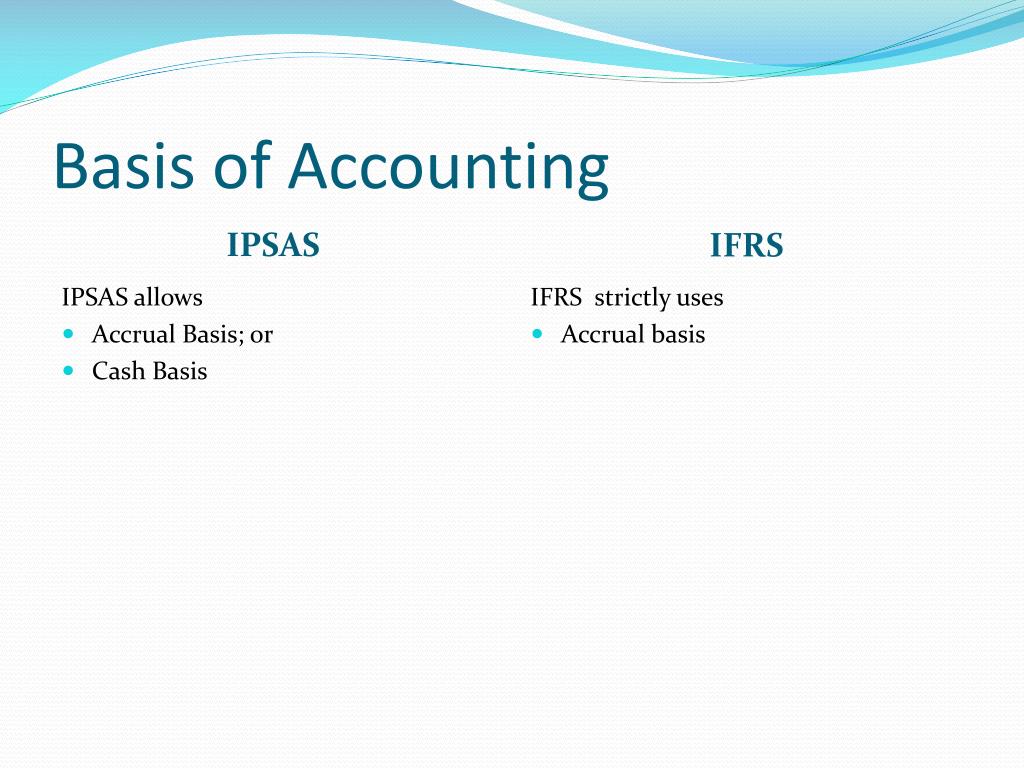

Ipsas accrual basis financial statements. Kpmg's cash to accrual and ipsas services look to provide member firms' clients with a broad range of methodologies. Sector accounting standards (ipsas) based on the requirements of ipsas for the financial year ended 31 december 2015. It is the beginning of the earliest period for which the entity presents its first.

Accrual accounting improves the quality of general. International public sector accounting standards (ipsas) are the international financial reporting standards for public sector government activities. Public sector entity (pse) is an existing preparer of.

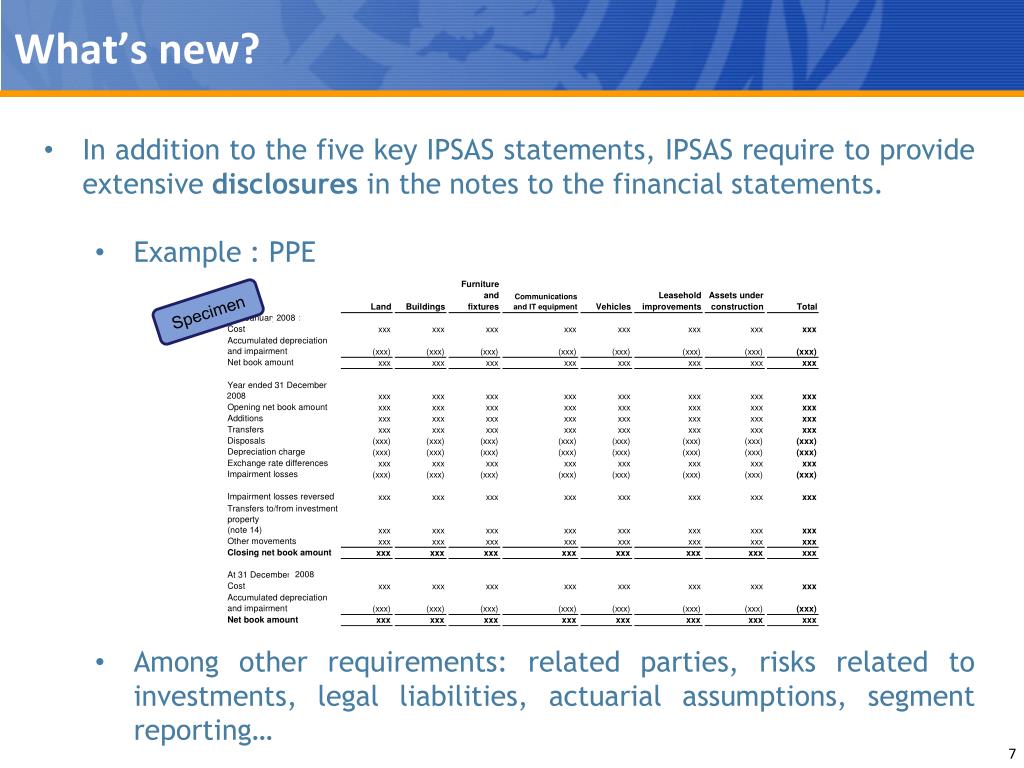

Allows for transparent fi nancial reporting of cash receipts, payments and balances, under the cash basis of accounting. Ipsas 1 specifies minimum line items to be presented on the face of the statement of financial position, statement of financial performance, and statement of changes in net assets/equity, and includes guidance for identifying additional line items, headings, and. The international public sector accounting standards board (ipsasb) has issued a revised ipsas, financial reporting under the cash basis of accounting.

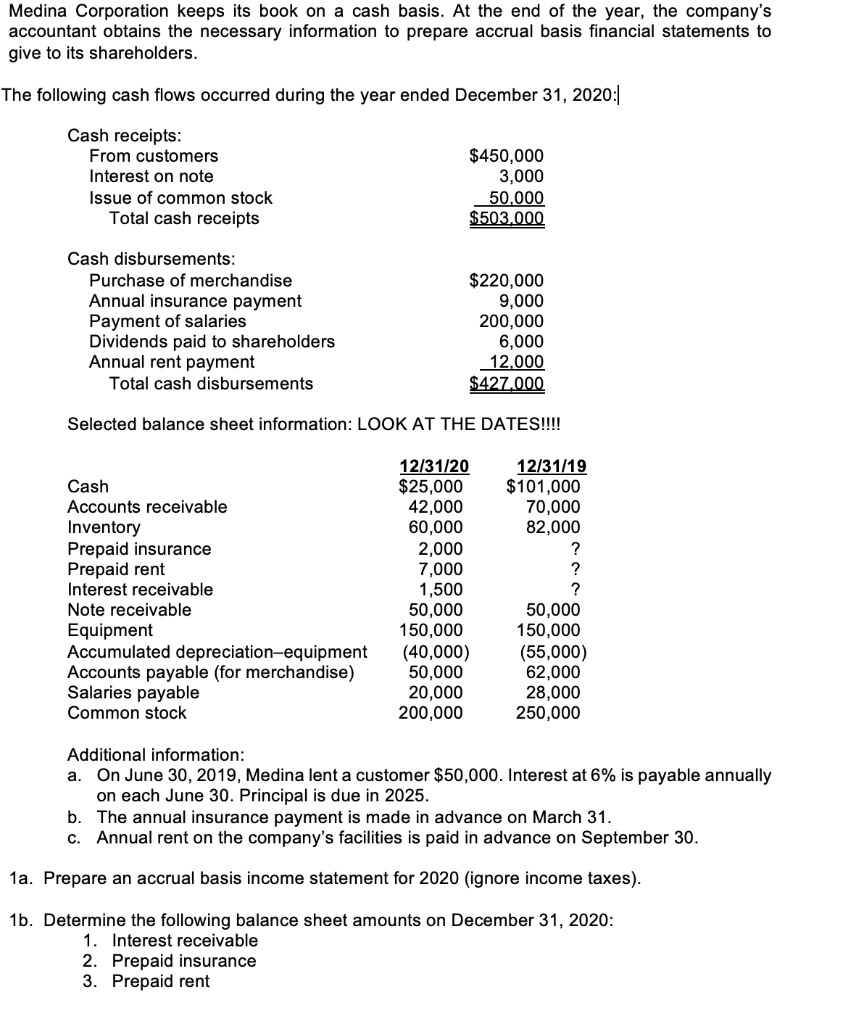

It defines the cash basis of accounting, establishes requirements for the. Ican examinations question was used as work example in this lecture.

101 ipsas 1 ipsas 1—presentation of financial statements history of ipsas this version includes amendments resulting from ipsass issued up to january 31, 2021. 2.1.1the following terms are used in this part of the standard with the meanings specified: The recognition, measurement, and disclosure of specific transactions and other events are dealt with in.

Accounting policies, changes in accounting estimates. Instructions this checklist assists with thepreparation of financial statements in accordance withipsasissued by the international public sector accounting standards. The date of adoption is the date that an entity adopts accrual basis ipsass for the first time.

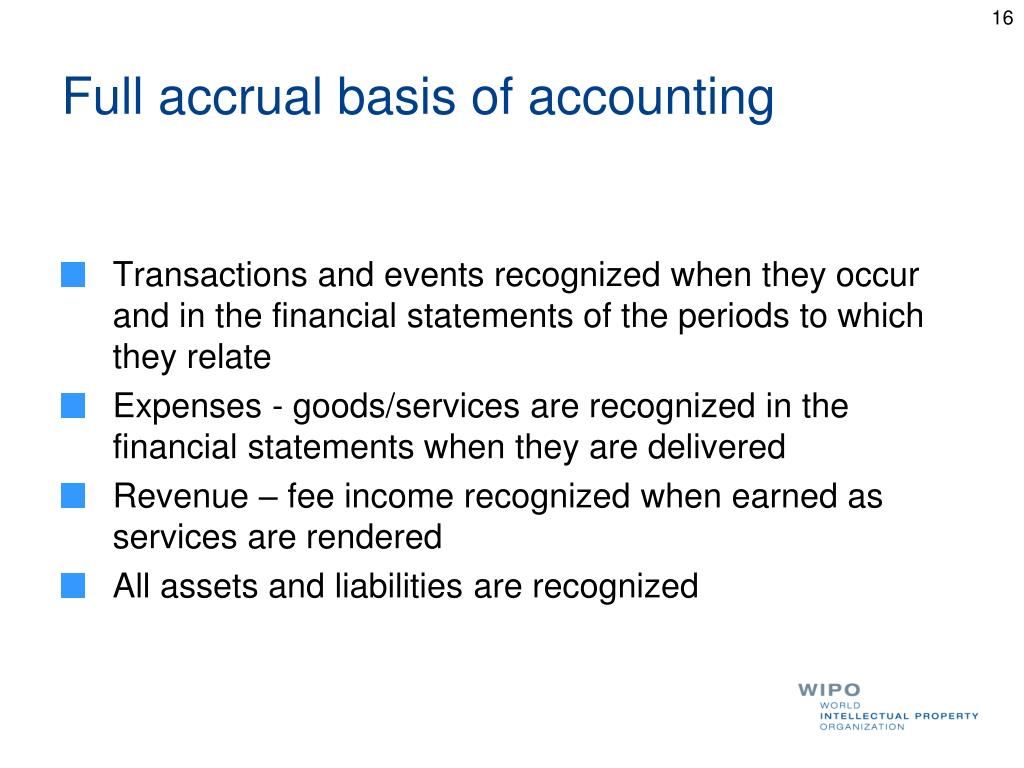

Accrual basis means a basis of accounting under which transactions and other events. Requirements and those financial statements contained an explicit and unreserved statement of compliance with accrual basis ipsass; Ensure that the first financial statements that use accrual ipsas:

Financial statements of other entities. Ipsas 5 governs the accounting treatment for borrowing costs and ipsas 10 applies to the primary financial statements, including the consolidated financial. Financial statements prepared under the accrual basis of accounting.

This video explains the ipsas financial statements using accrual basis. Entities preparing general purpose financial statements under the cash basis of accounting.