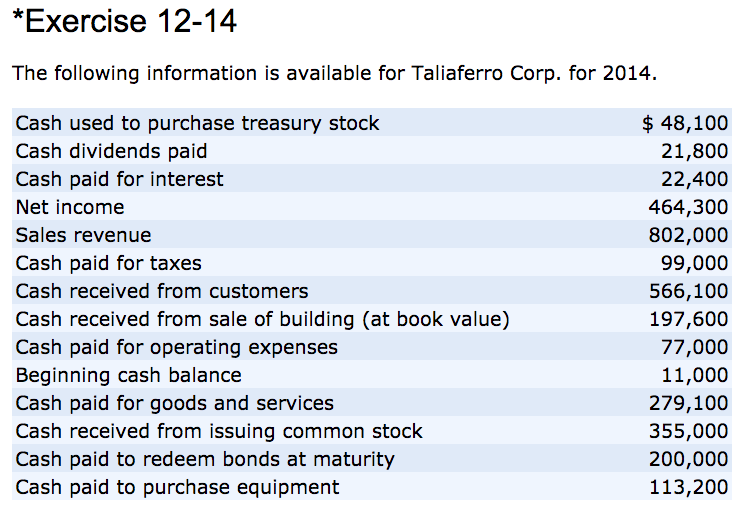

Can’t-Miss Takeaways Of Info About Purchase Of Treasury Stock Cash Flow

Effect of treasury stock on statement of cash flow:

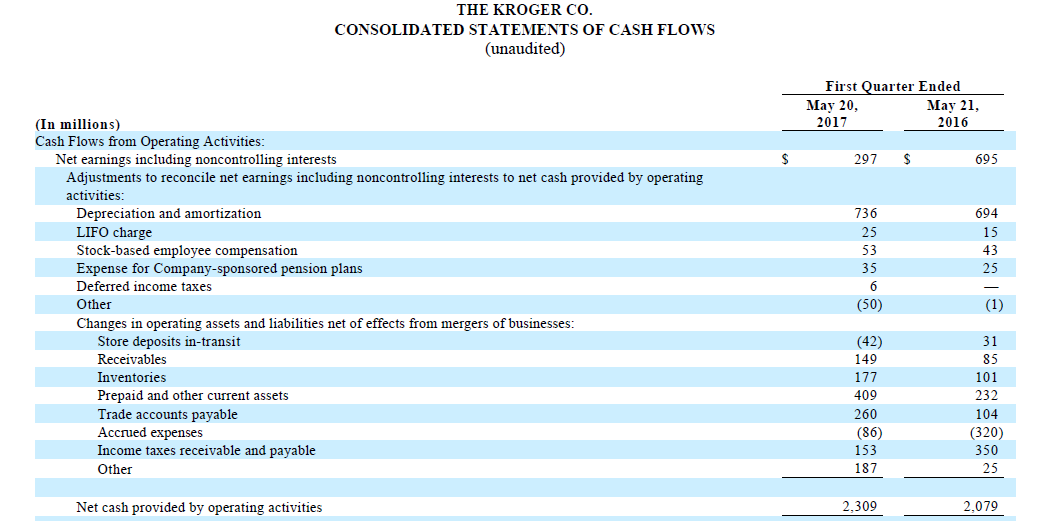

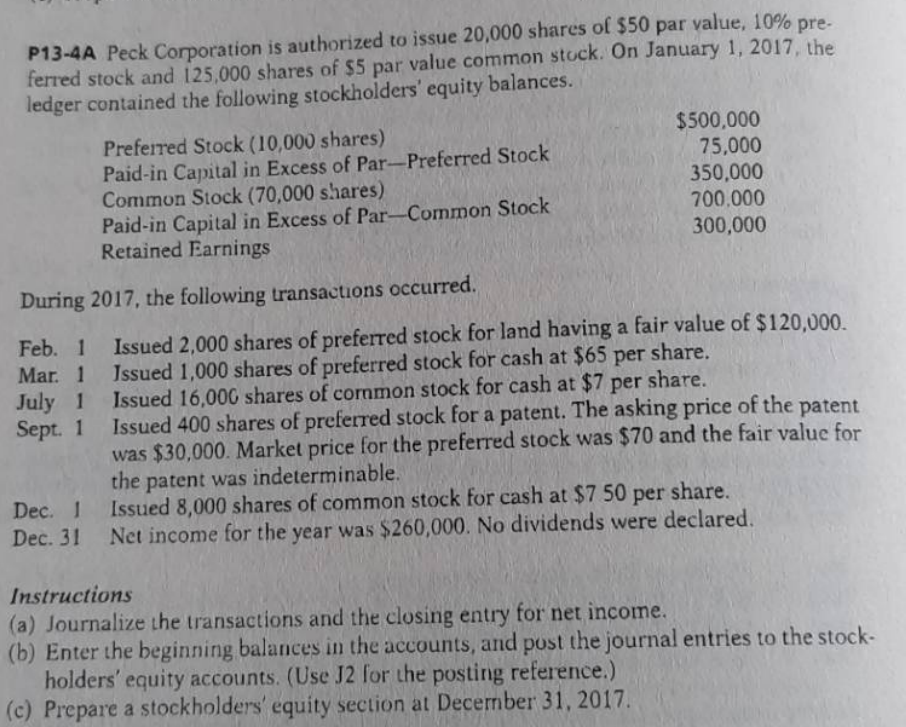

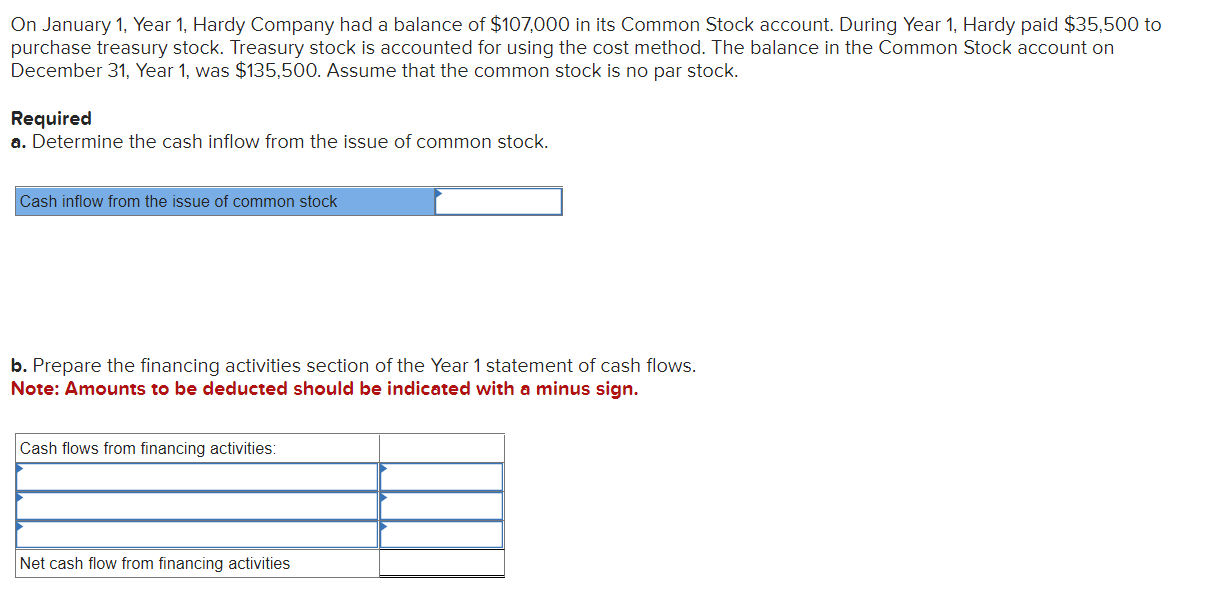

Purchase of treasury stock cash flow. The reacquired shares are then held by the company for its own disposition. On the other hand, the. A large corporation often has 10 or more adjustments to convert the amount of net income to the amount of cash.

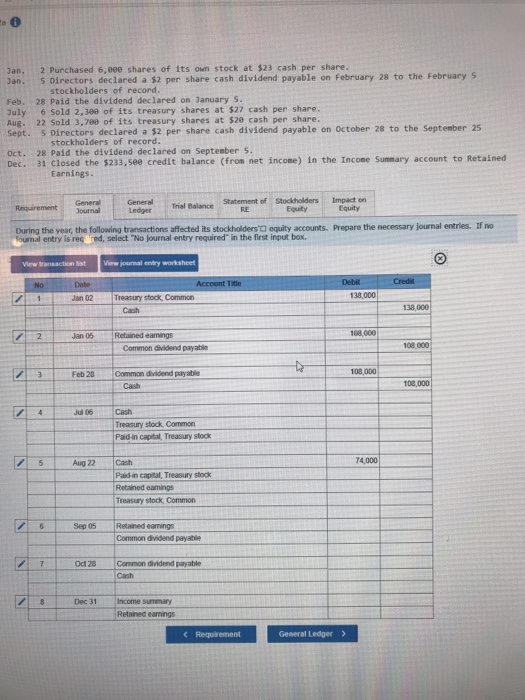

That stock would now be considered treasury stock since the company owns their own stock (reduces the equity owned by shareholders). The company needs to spend 2 million dollars to buy back the shares. The underlying principles in topic 230 (statement of cash.

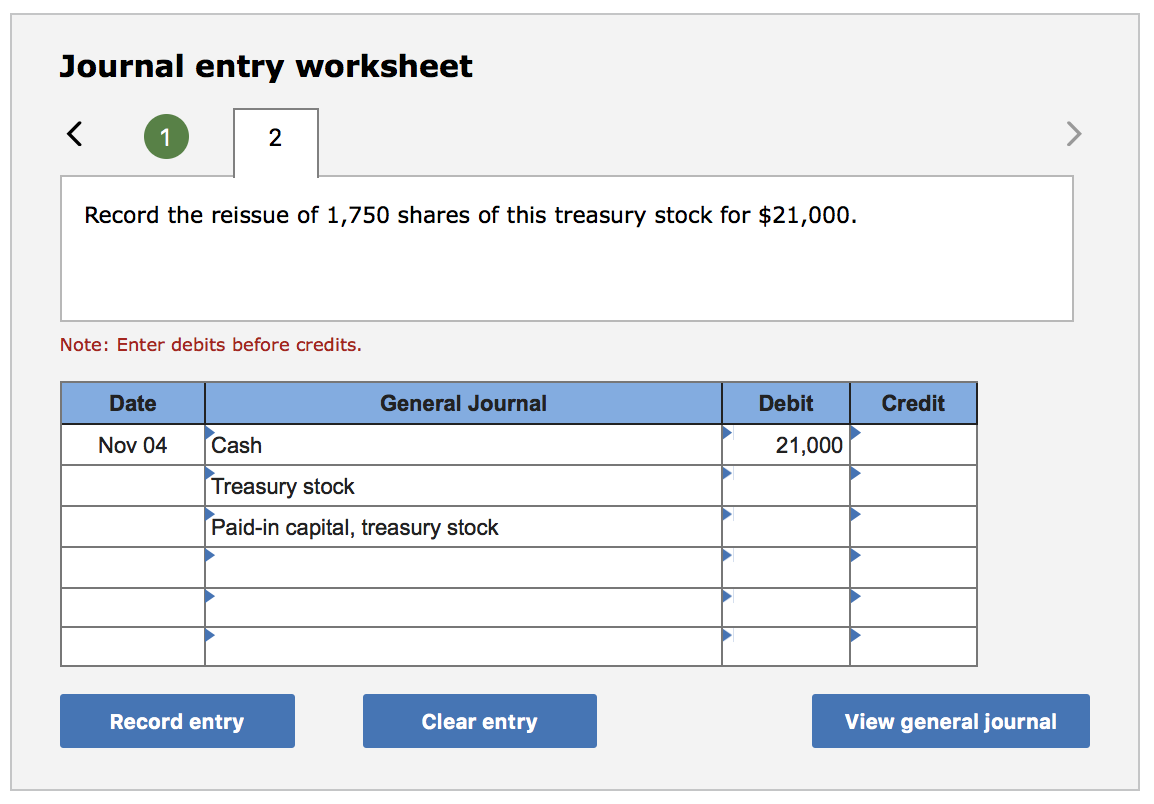

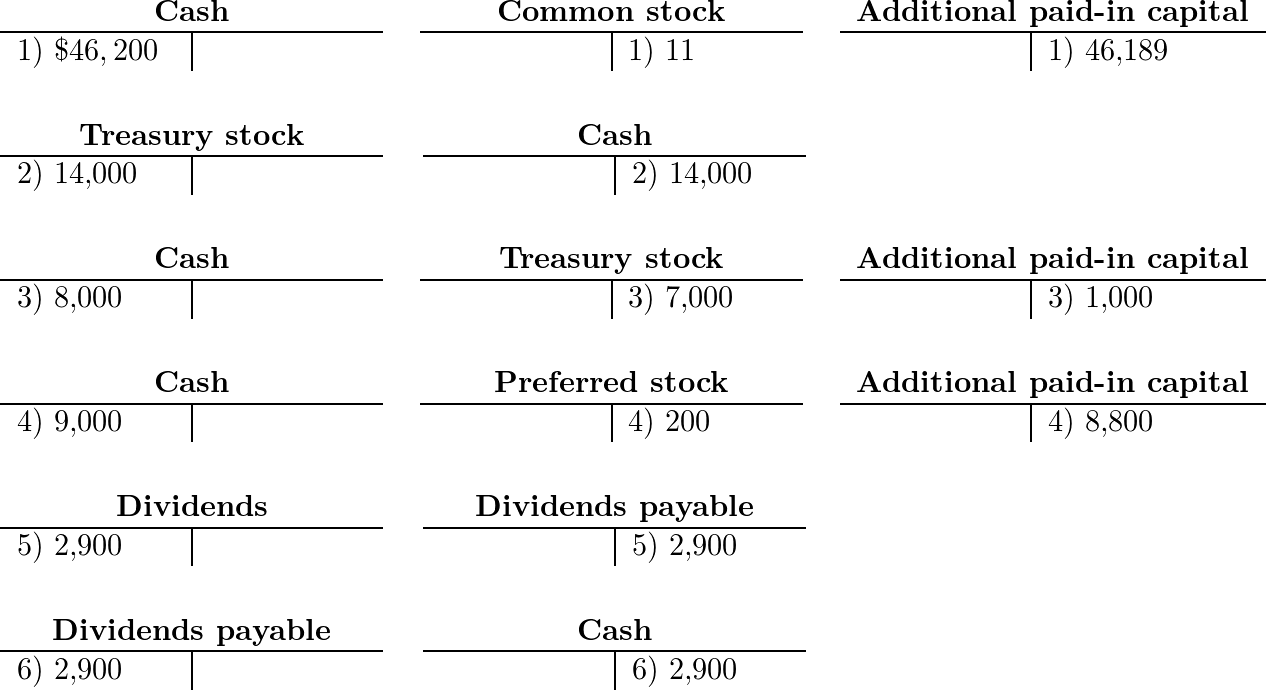

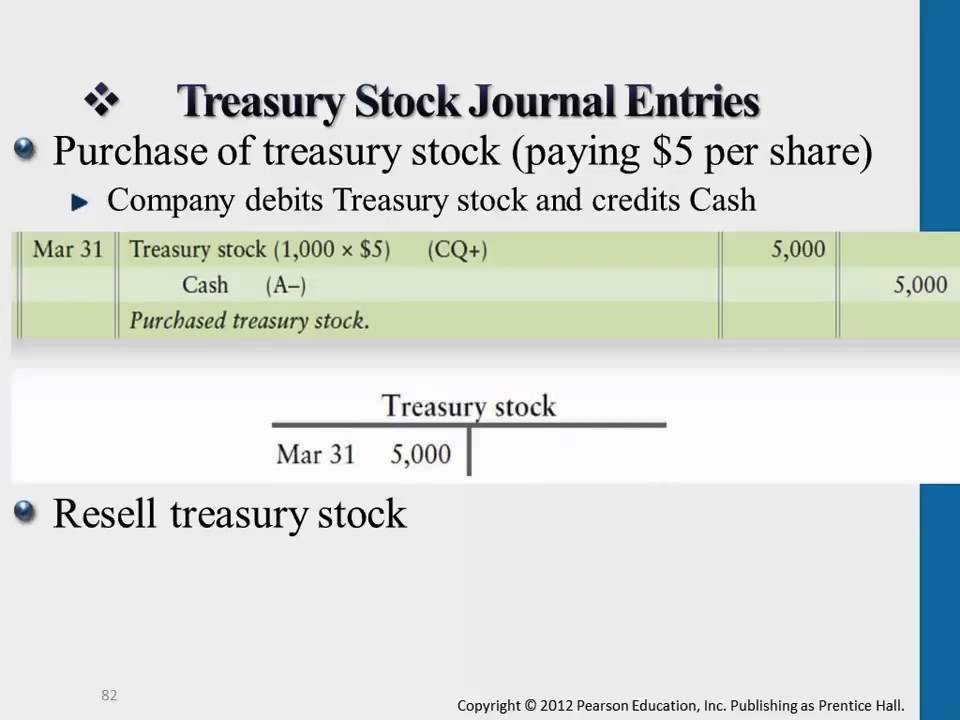

As such, the decision to buy back stock is seen as a. Cash flow from financing activities: They need to record the following journal by debiting treasury stock and credit cash.

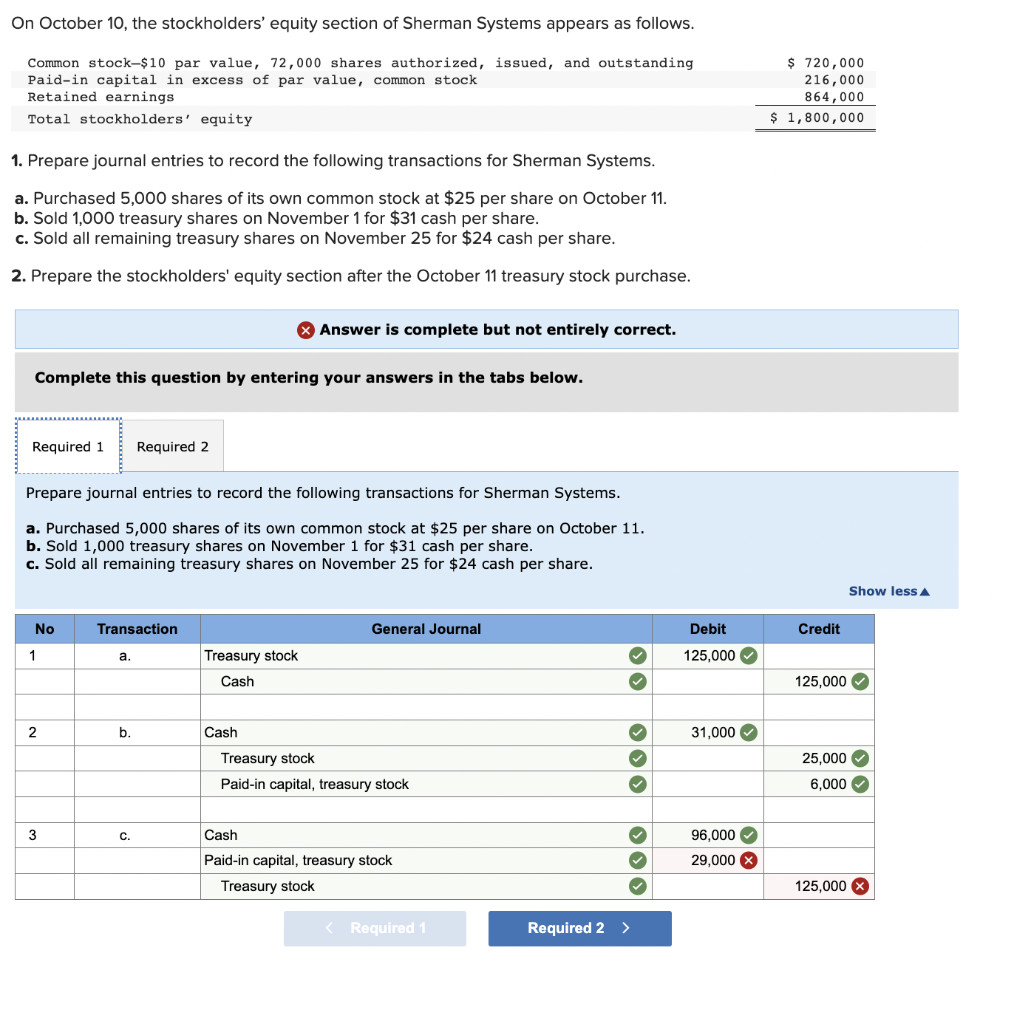

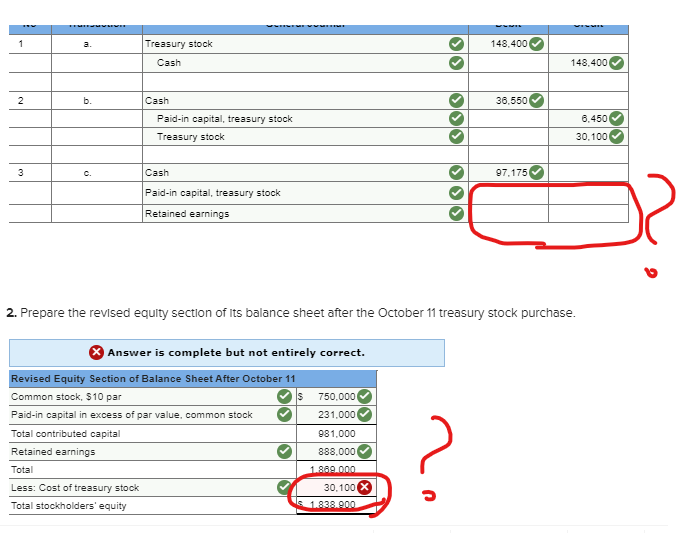

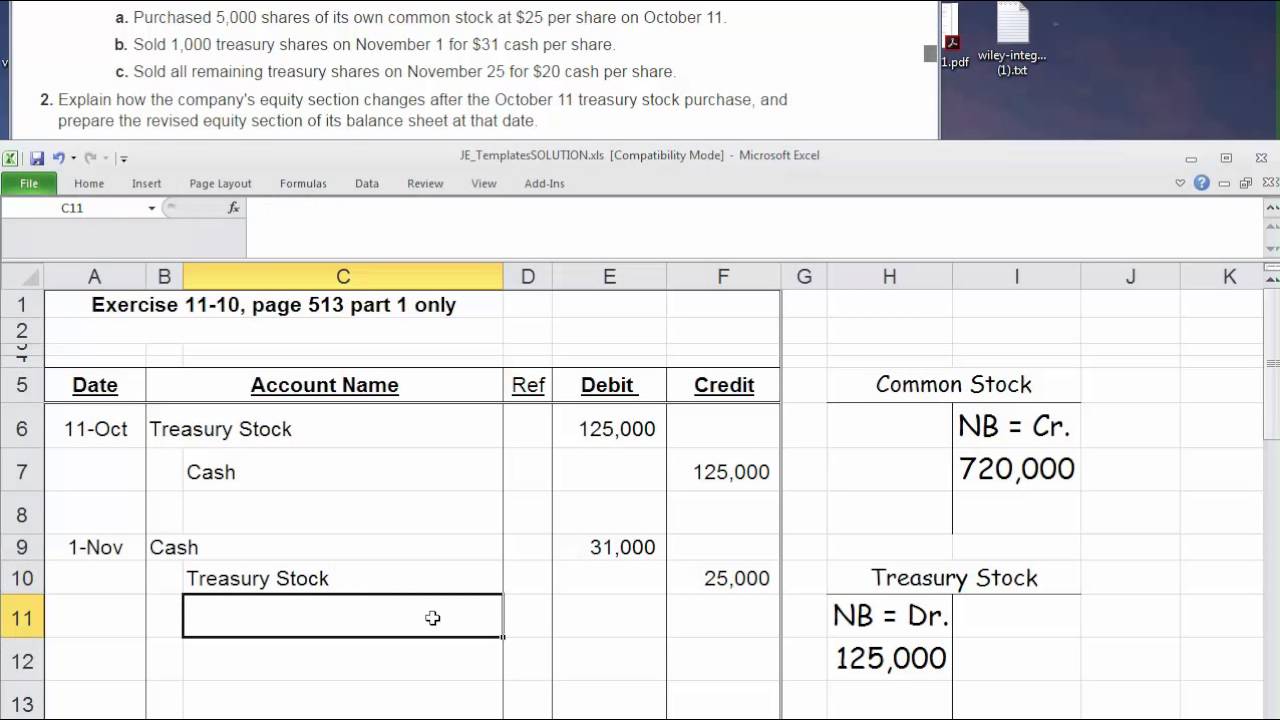

When a company repurchased or reacquires their own common stock, that represents a cash outflow. Because all the treasury stock is liquidated, the entire $120 million balance is. Analysis when fg corp executes the treasury stock purchase, it should record the treasury shares based on its cost (2,000 shares x $40) by recording the following journal entry.

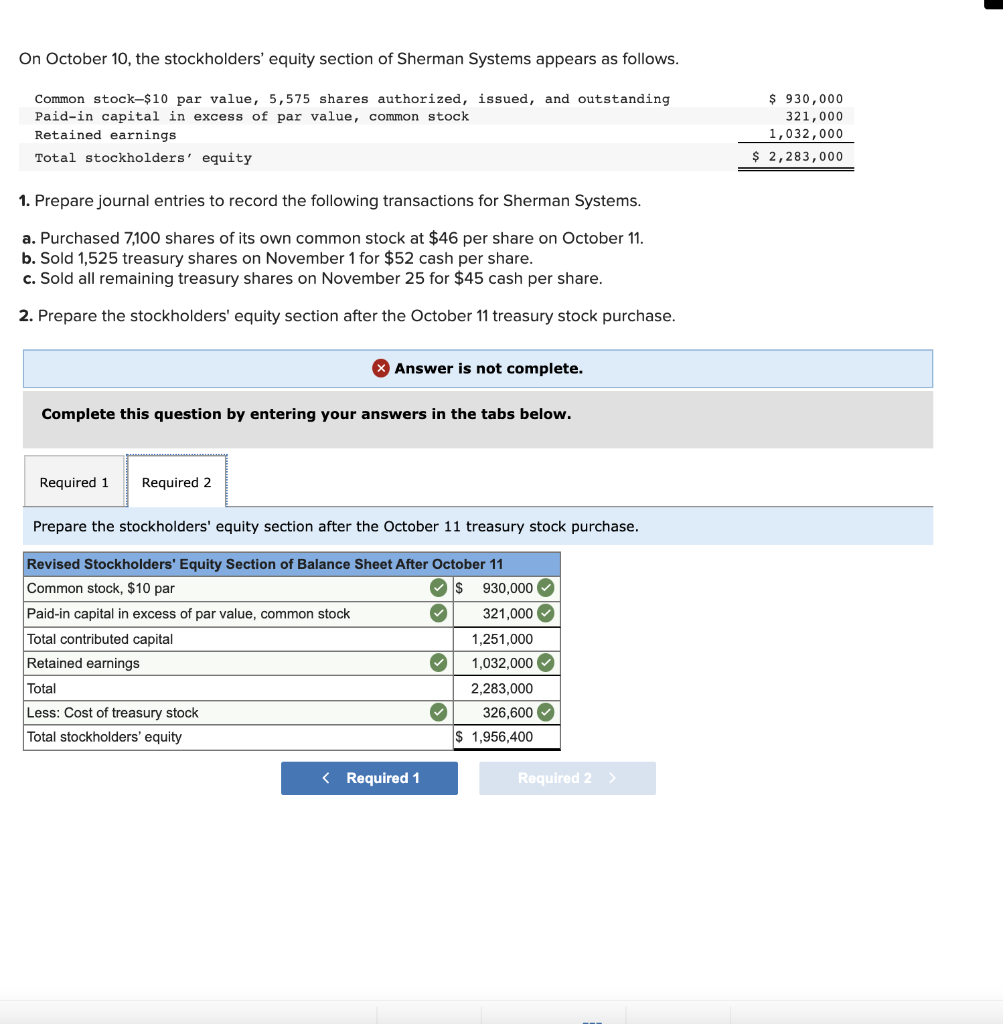

Utilities and power firms ; As mentioned above, treasury stock is a contra account of equity and involves the repurchase of the issued stock. After a repurchase, the journal entries are a debit to treasury stock and credit to the cash account.

The cash outflow will show in the cash flow statement in investing activities. Once a reporting entity has acquired its own shares it may choose to retire the reacquired shares or hold them as treasury stock. They 200,000 shares at $ 10 per share.

Opinions differ on whether treasury stock should be carried on the balance sheet at historical cost or at the current market value. Treasury stock, or reacquired stock, is the previously issued, outstanding shares of stock which a company repurchased or bought back from shareholders. Pensions and other employee benefits.

Treasury stock, also known as treasury shares or reacquired stock, refers. How to record the purchase of treasury stock overview. Uses of cash reported in the financing activities section of scf include:

The purchase of treasury stock will cause a decrease in cash from financing activities. What is cash flow from investing activities? Treasury stock is the term that is used to describe shares of a company’s own stock that it has reacquired.

Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external activities that allow a firm to raise. In the case of example corporation, the section cash flows from operating income begins with the company's net income for the year: In order to repurchase stock, the company has to make payments to the existing shareholders resulting in a cash outflow.