What Everybody Ought To Know About Statement Of Changes In Financial Position Balance Sheet Loan Example

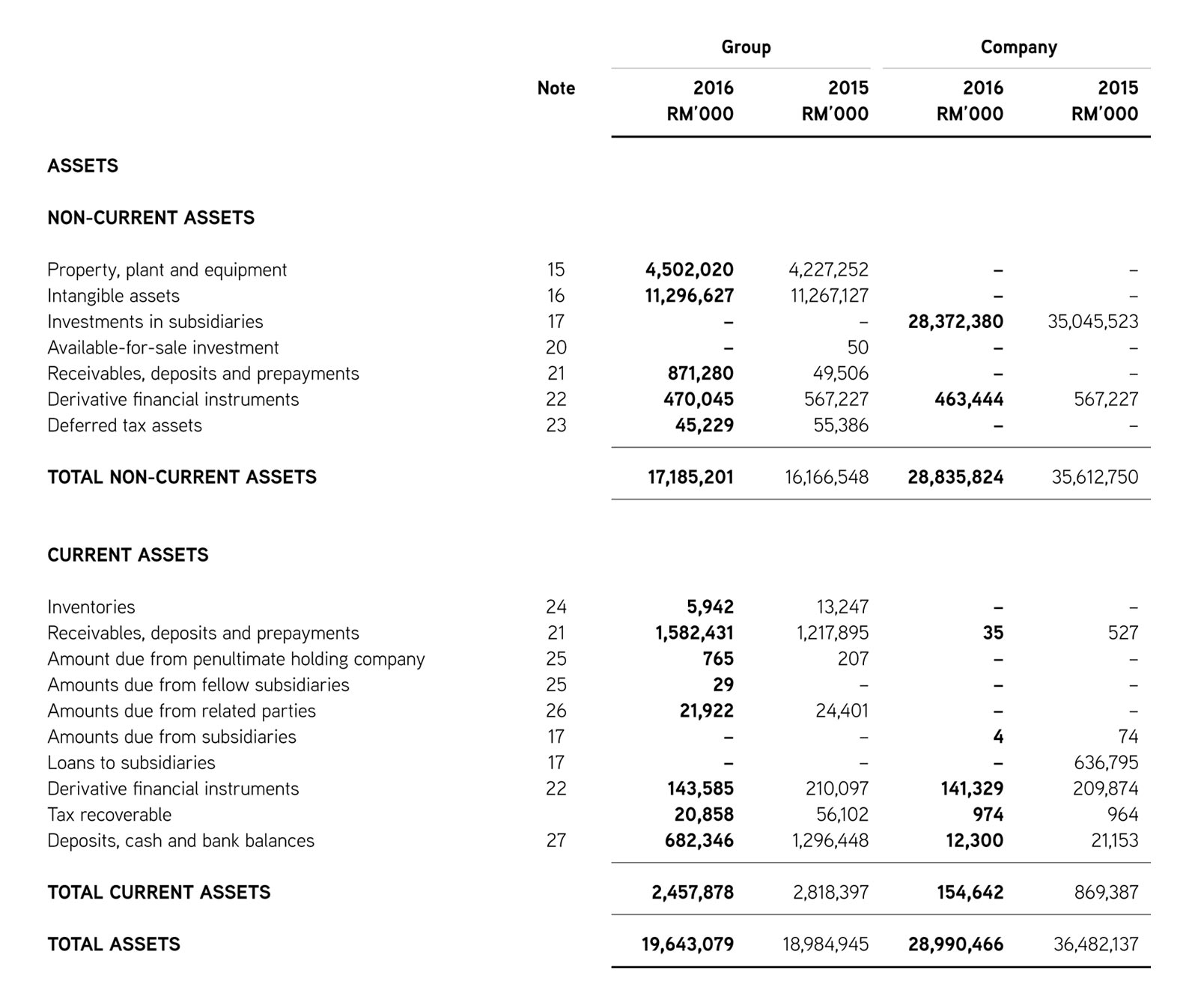

Loans and receivables that are held for sale should be presented separately on the face of the balance sheet.

Statement of changes in financial position balance sheet loan example. As a result of the changes in terminology used throughout the ifrs standards arising from requirements in ias 1 presentation of financial statements (issued in 2007), the title of ias 7 was changed to statement of cash flows. Accounting equation for balance sheet : This version shows how expense totals from the income statement are adjusted to represent real cash flow.

The statement of financial position as on 31/12/2020; Cash flow statements have a standardized structure and will normally report inflows and outflows of cash for three types of activities: Here are examples of financial items that may be recorded for each type of activity:

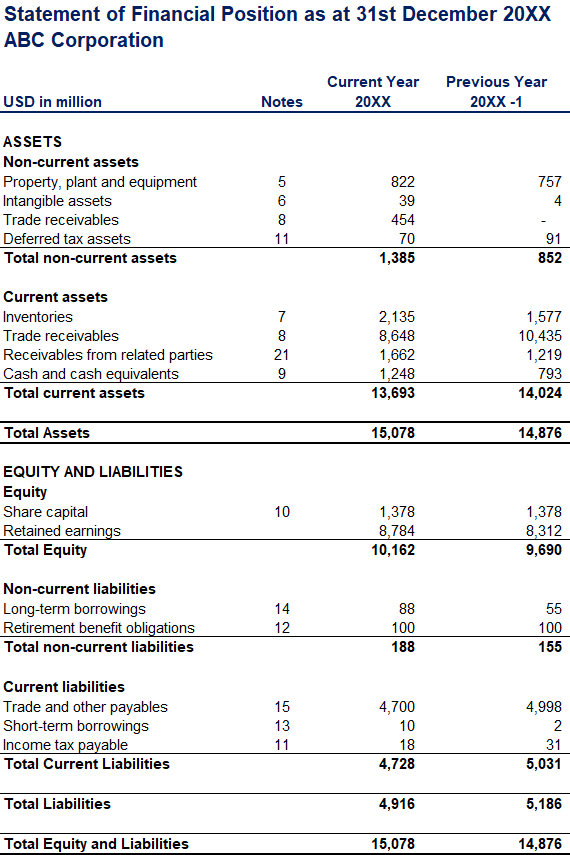

The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows. A = l + se since this statement is all about cash, we want to isolate cash as a separate item. 2.1 statement of financial position overview.

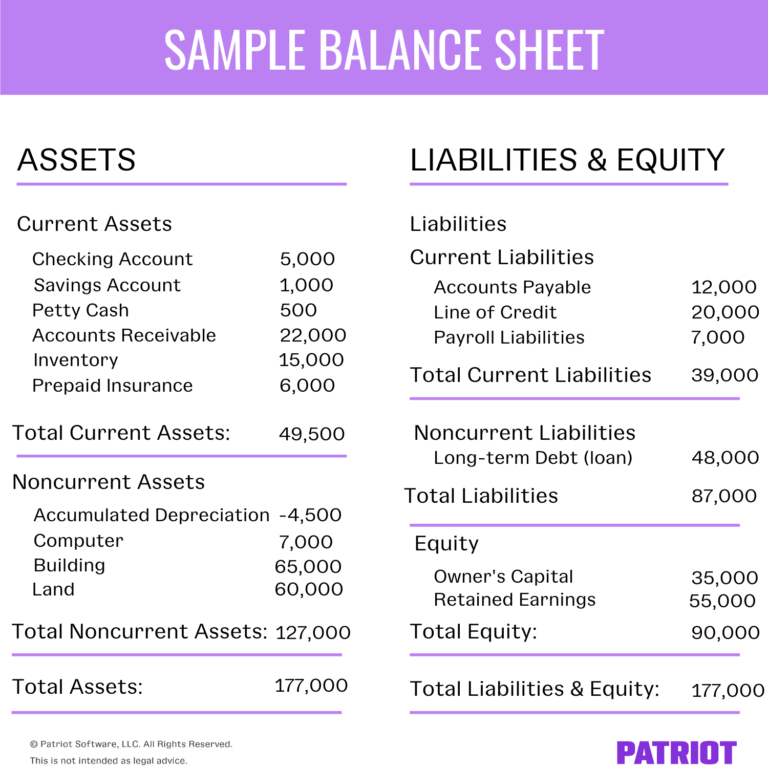

Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and common stock. Exhibit 2 below, includes more line items and detail than exhibit 1. Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009.

Statement of profit or loss and other comprehensive income. The foundation of the statement of changes in financial position is the fundamental accounting equation upon which the balance sheet is based. Statement of financial position helps users of financial statements to assess the financial soundness of an entity in terms of liquidity risk,.

V t e in business accounting, the statement of change in financial position is a financial statement that outlines the sources and uses of funds and explains any changes in cash or working capital. Although there are several financial statements that you might need to compile in any given year, the statement of financial position is not like other financial reports because. The statement of changes in financial position (scfp) is a financial report that lists the change in cash, stock, debtors, creditors, and all other assets and liabilities for a given time frame.

Assets amount liabilities and owner's equity amount ; It summarizes all the assets, liabilities and equity of a company as reported on a specific day. Statement of changes in equity.

Identification of the financial statements. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Determine the change (increase or decrease) in working capital.

In other words, it lists the resources, obligations, and ownership details of. Determine the adjustments account to be made to net income. Assets , liabilities and equity.

So if your financial statements are prepared based on ifrs, then you should use statement of financial position instead of balance sheet. It is comprised of three main components: What are the 3 types of cash flow?

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)