What Everybody Ought To Know About Unrealized Gains And Losses Income Statement

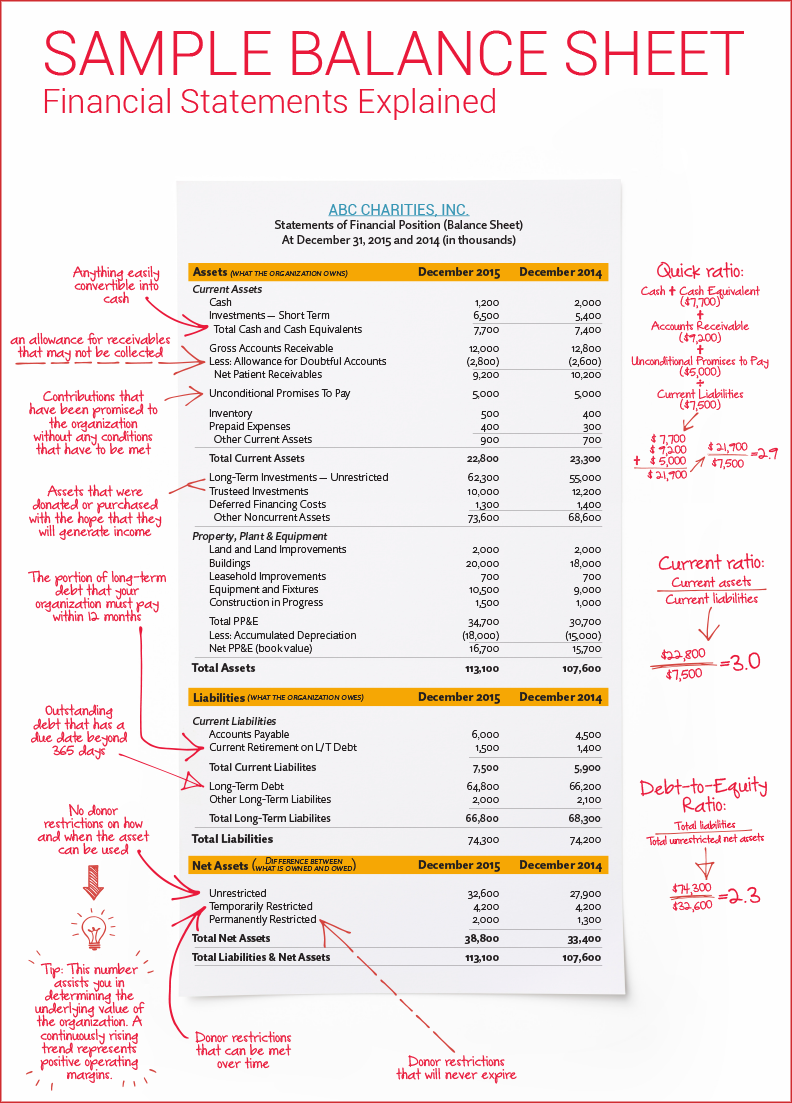

Unrealized income or losses are recorded in an account called accumulated other comprehensive income, which is found in the owner’s equity section of the balance.

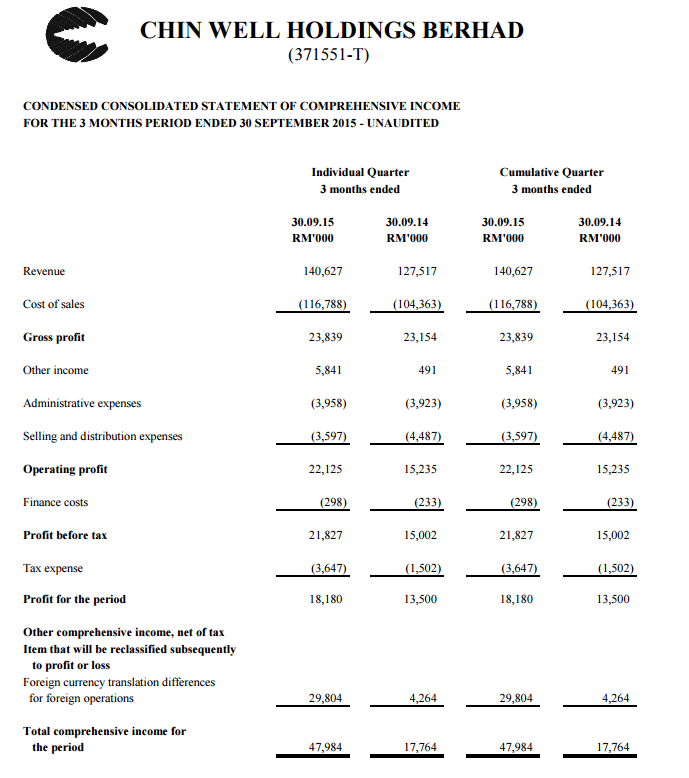

Unrealized gains and losses income statement. Investing realized vs. Unrealized gain is an income statement category reserved for investment income that a company expects to receive in the future. The unrealized gain is, however, reported on the balance sheet by:

Unrealized gains and losses on securities held for sale: You are free to use this image o your website,. When the holding is sold,.

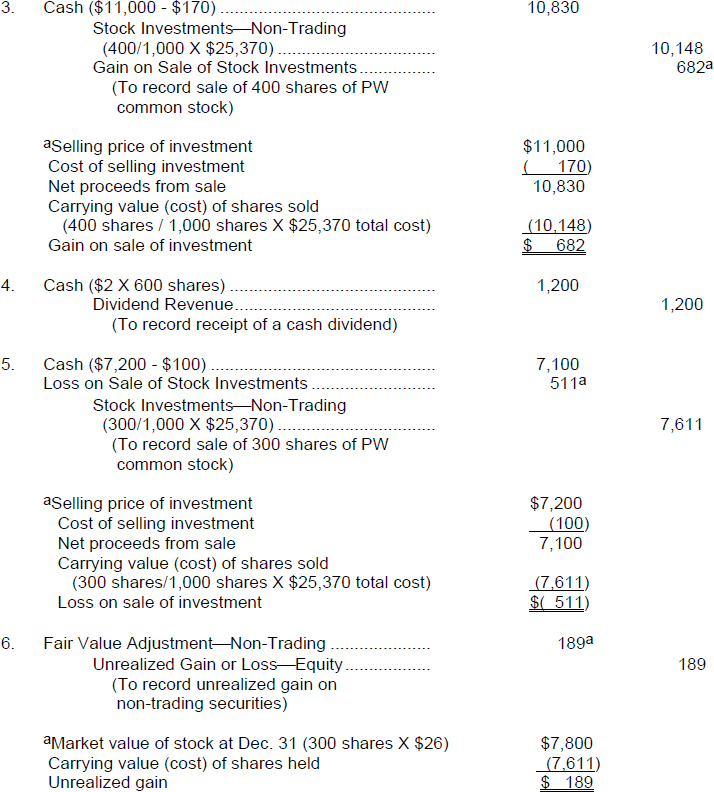

Think of it as money on paper rather than cash. A common type is unrealized gains or. The journal entry involves debiting the fair value adjustment account and.

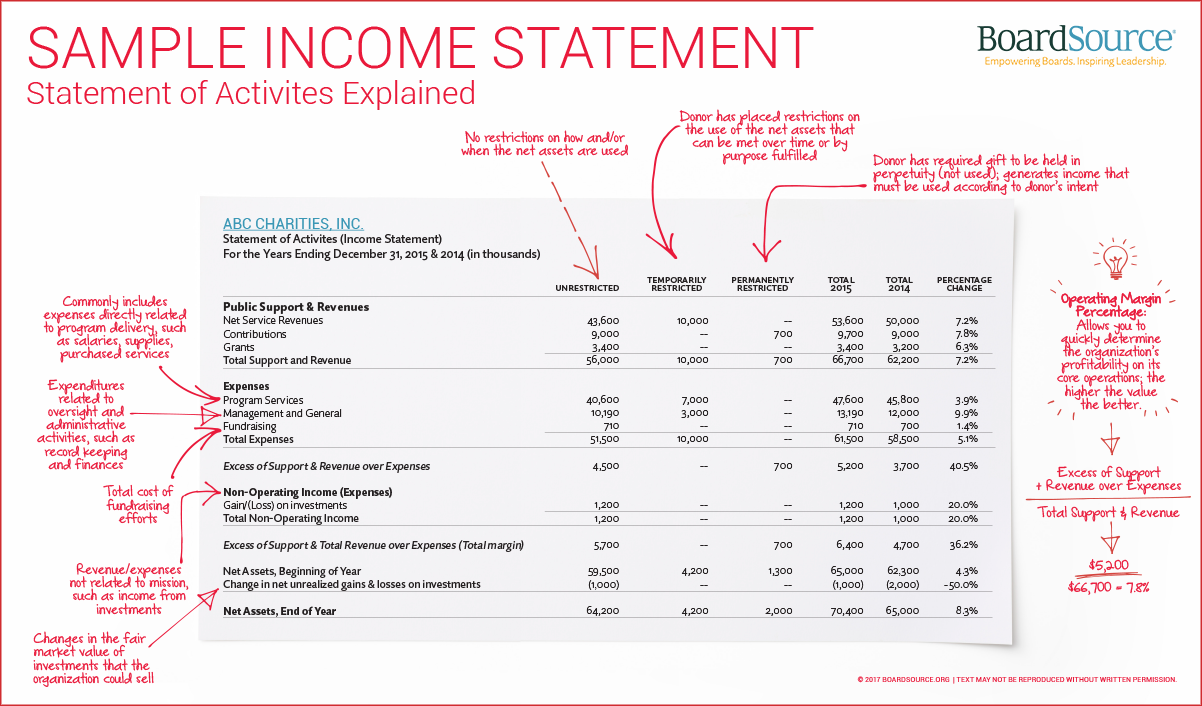

Under financial accounting standards board (fasb) summary statement no. Unrealized gains and losses accounting is a way for companies to account for their investments. January 30, 2021 what we’ll cover:

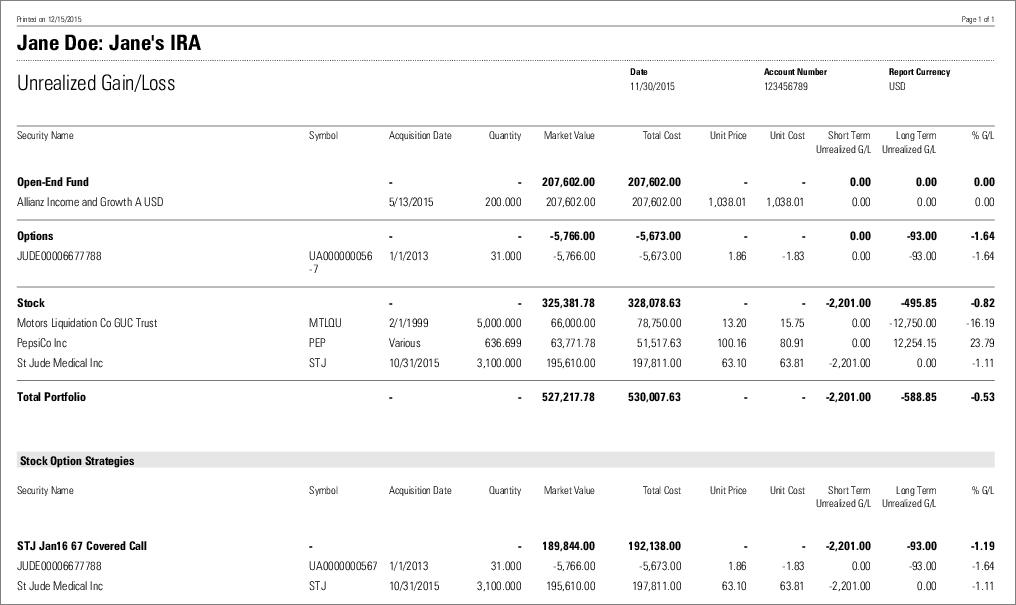

However, because you have not cashed in the investment, the gain is. Unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet. There are several different methods for achieving this under gaap,.

Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled, but the customer has failed to pay the invoice by the close of the. From security prices for the current period. Once they are sold the gain or.

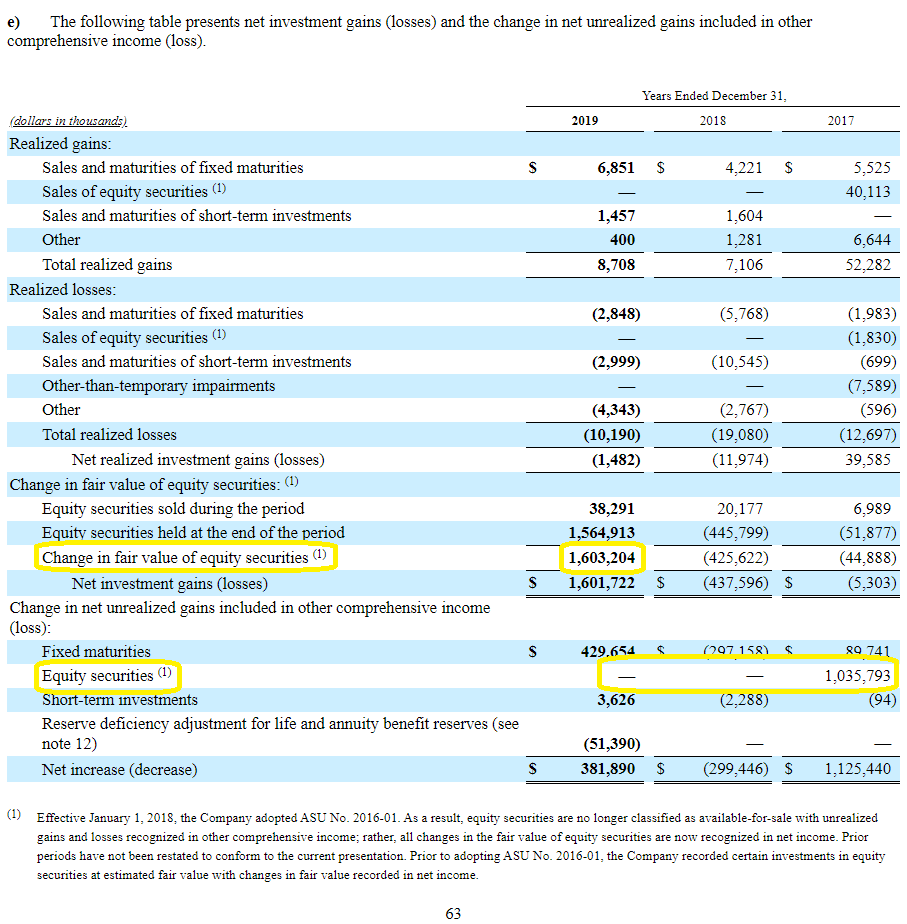

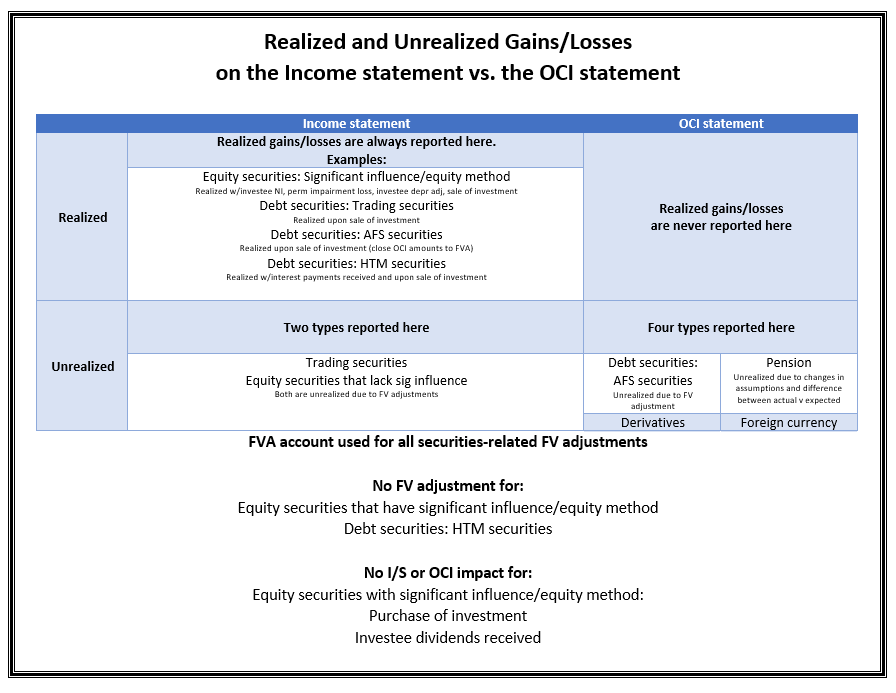

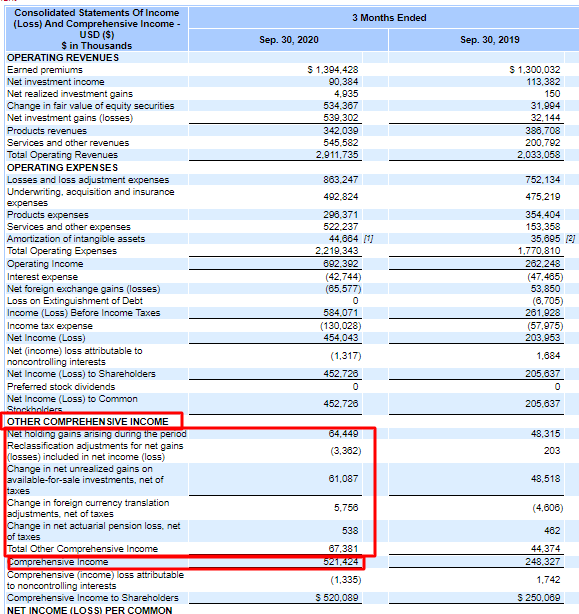

Losses recognized in the income statement in previous periods are deducted to arrive at the gain or loss. For example, unrealized holding gains and losses on equity securities, trading securities, and securities for which the fair value option has been elected are typically classified as. The gains and losses you see in your.

The line item can be referred as “unrealized gain (loss)” on the stock portfolio. Operating earnings remove the impact of realized and unrealized gains and losses that run through income statements, thus focusing on underwriting results and. Inclusion of realized gains (losses) on natural gas derivative instruments would have increased average price realizations by $0.06 per mcf for the fourth quarter.

An unrealized gain is the potential profit you could realize by cashing in the investment. Recording of unrealized gains and losses. Income statement net income (section vii) $ 309 $ 221 $ 723 $ 159 adjustments to reconcile net income to income available.

The accounting treatment depends on whether the securities are classified into three types, which are given below. Unlike realized gains and losses that are reported on the income statement, unrealized transactions are usually reported in the statement of. An unrealized loss is a paper loss that results from holding an asset that has decreased in price, but not yet selling it and realizing the loss.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

![Held for Trading HFT/AFS Securities Company Investment Portfolios [Guide]](https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2020/12/table-description-automatically-generated-9.png)