What Everybody Ought To Know About Variable Cost On Income Statement

The formula of variable costing.

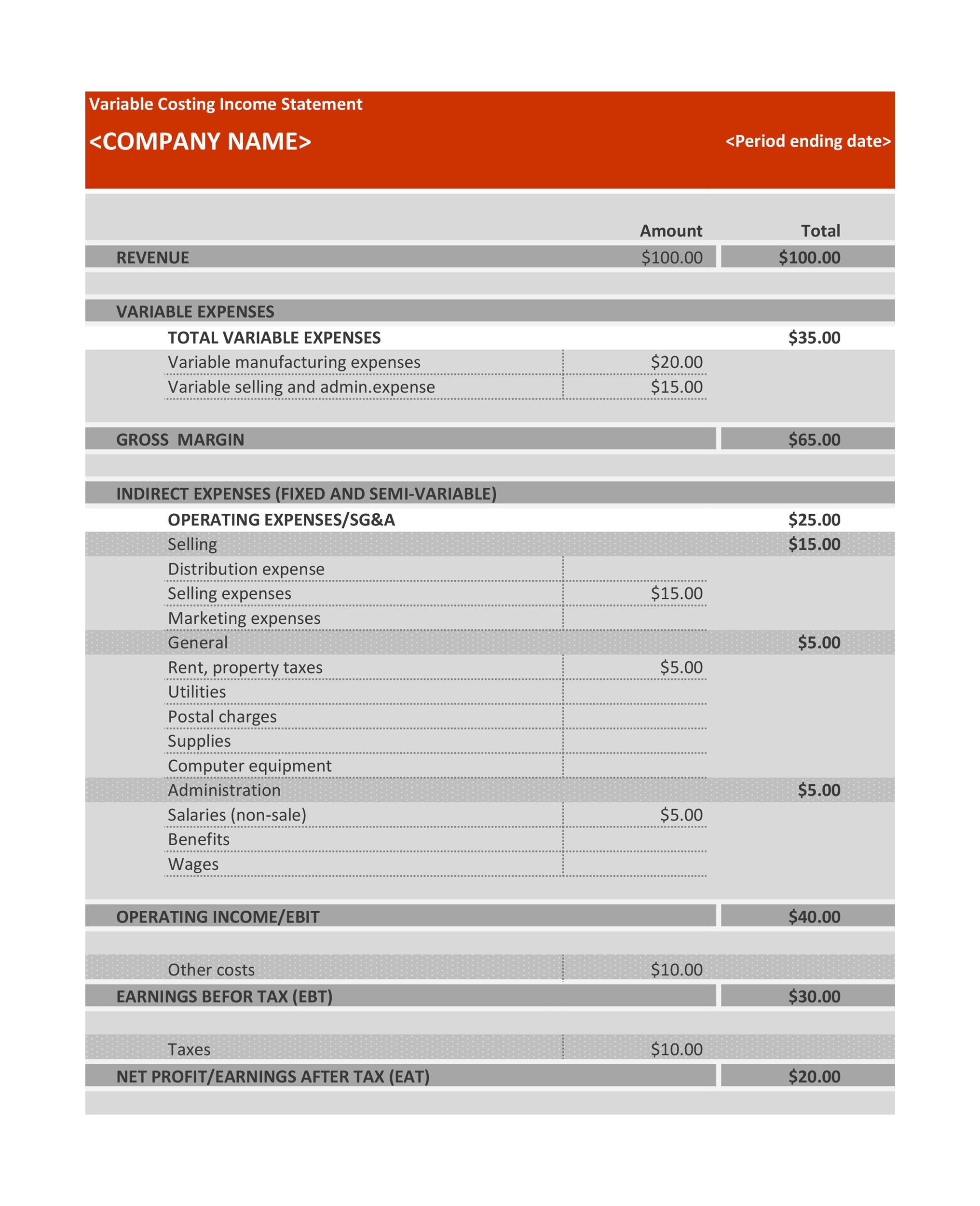

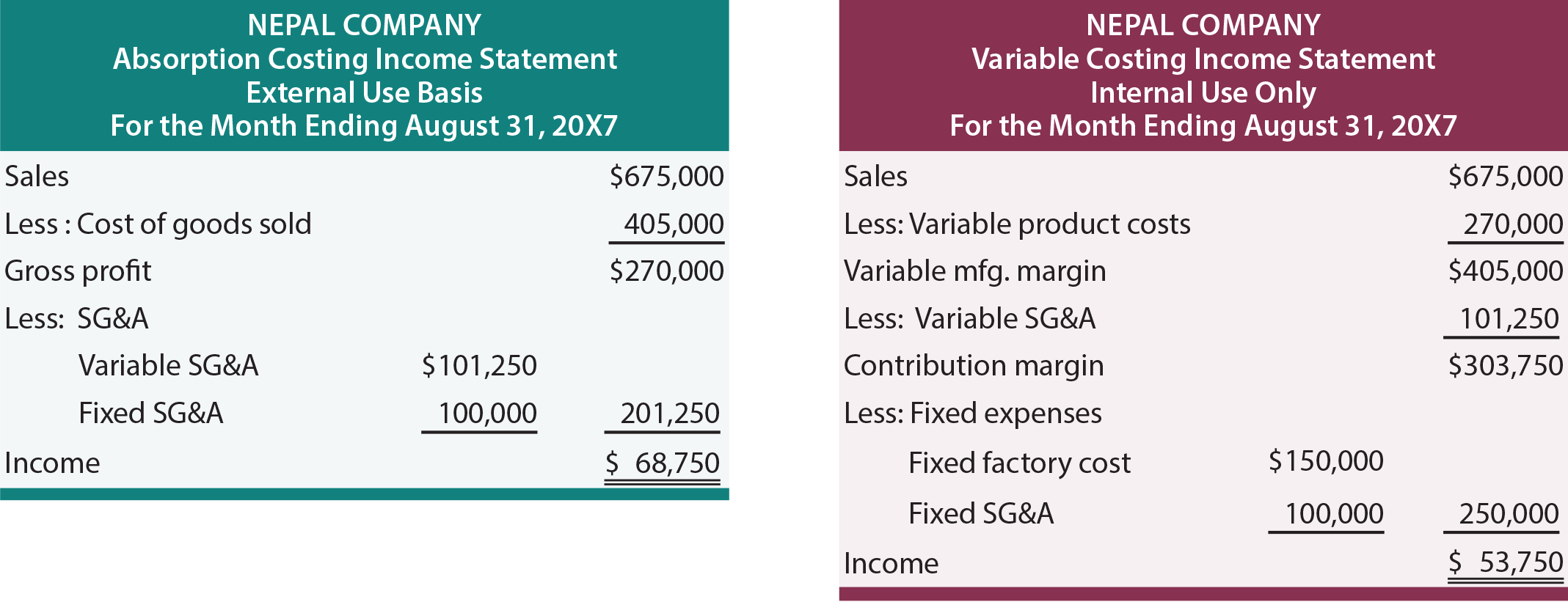

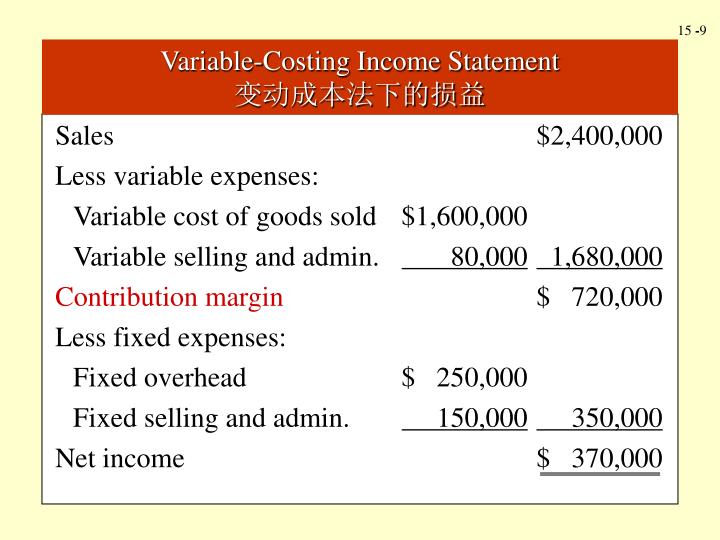

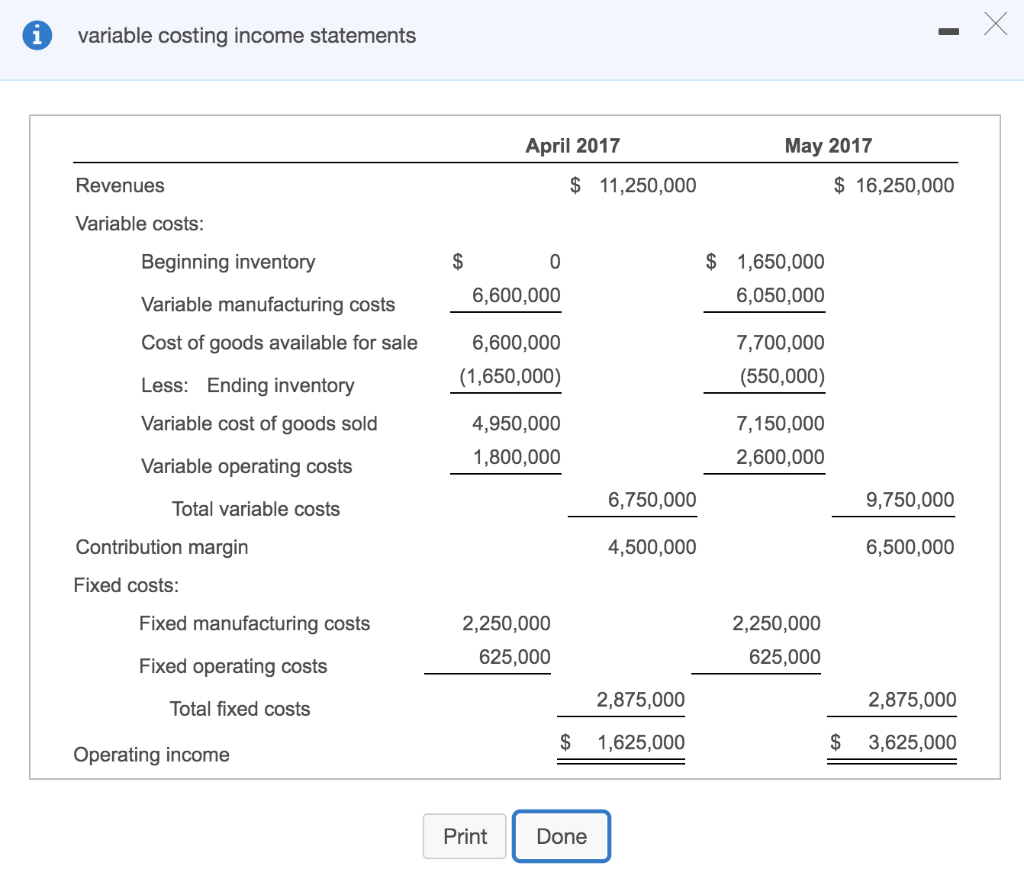

Variable cost on income statement. To make an income statement is necessary to use the calculation methods since they are. Variable production costs include direct materials, direct labor and variable manufacturing. A variable cost income statement separates costs from expenses.

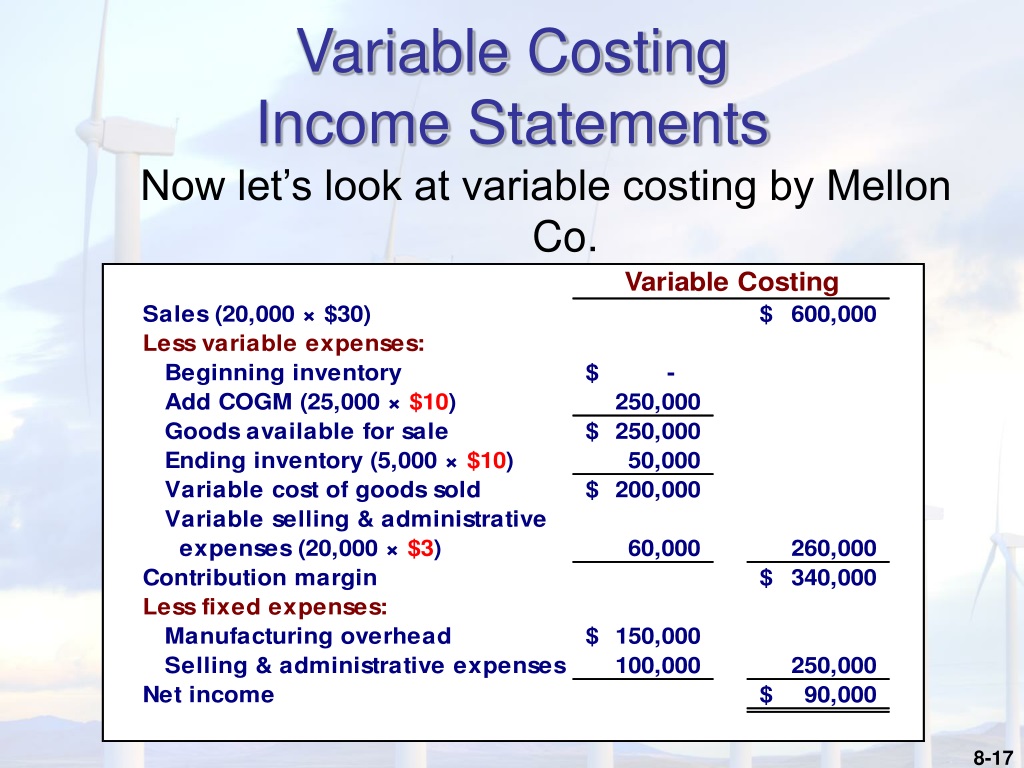

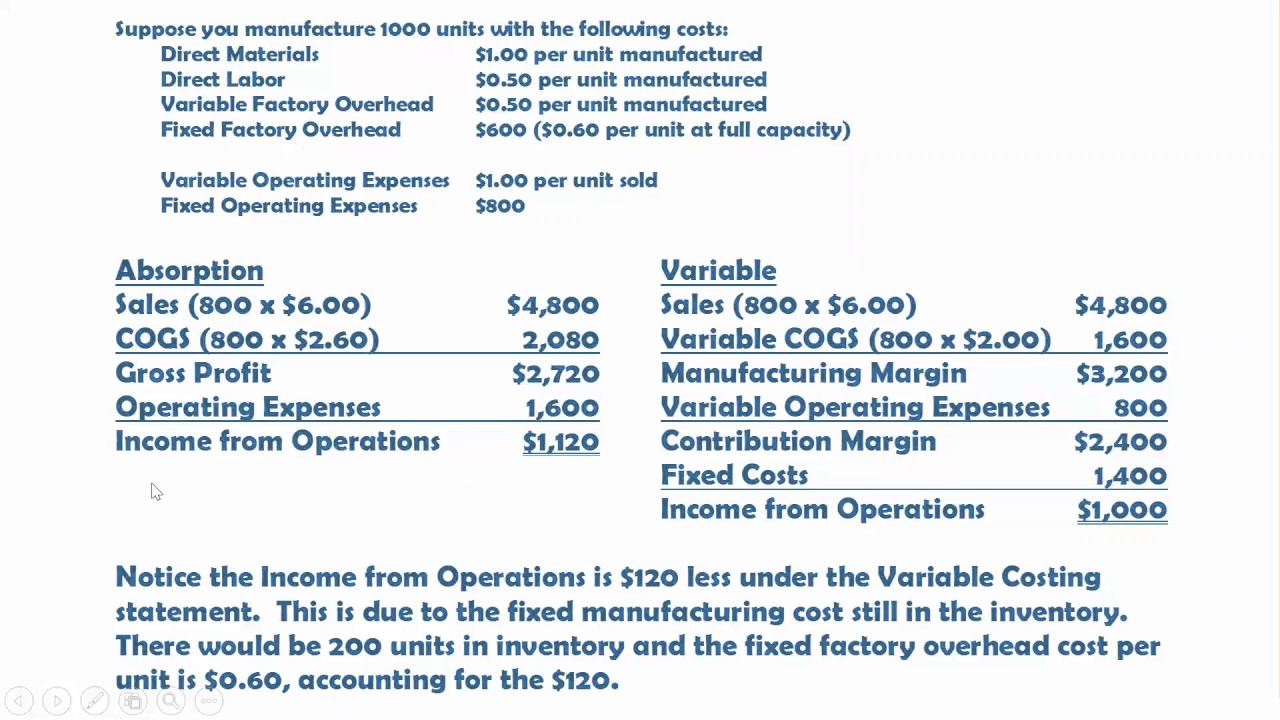

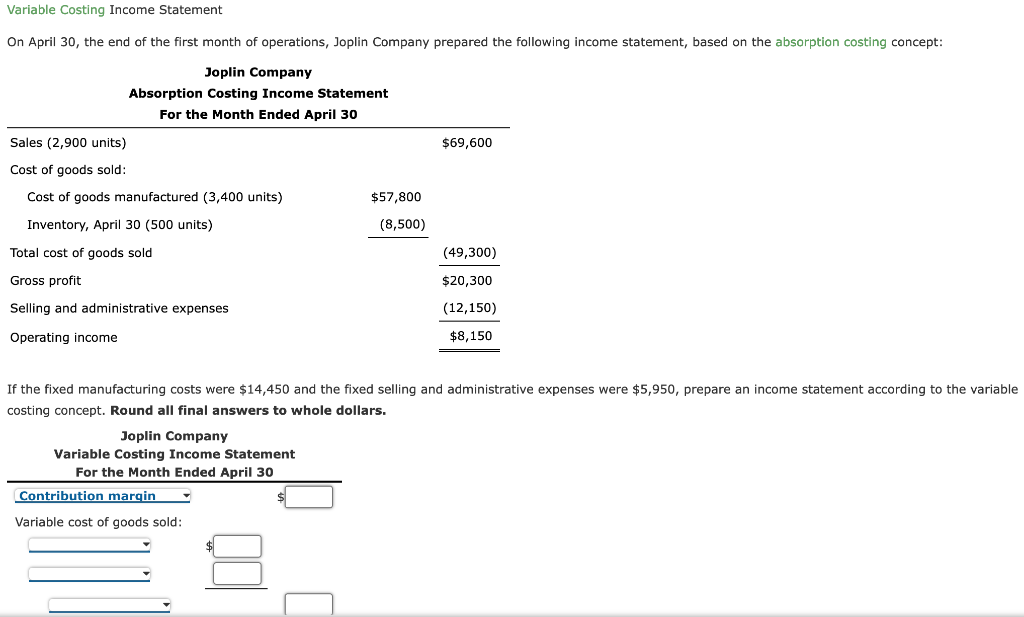

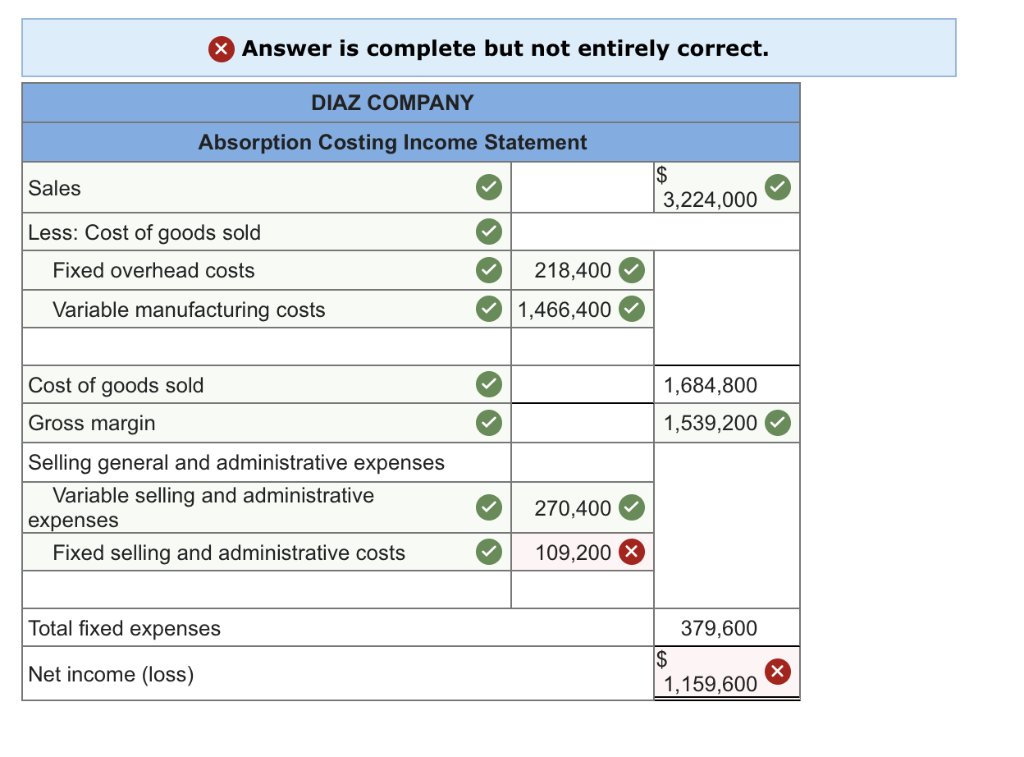

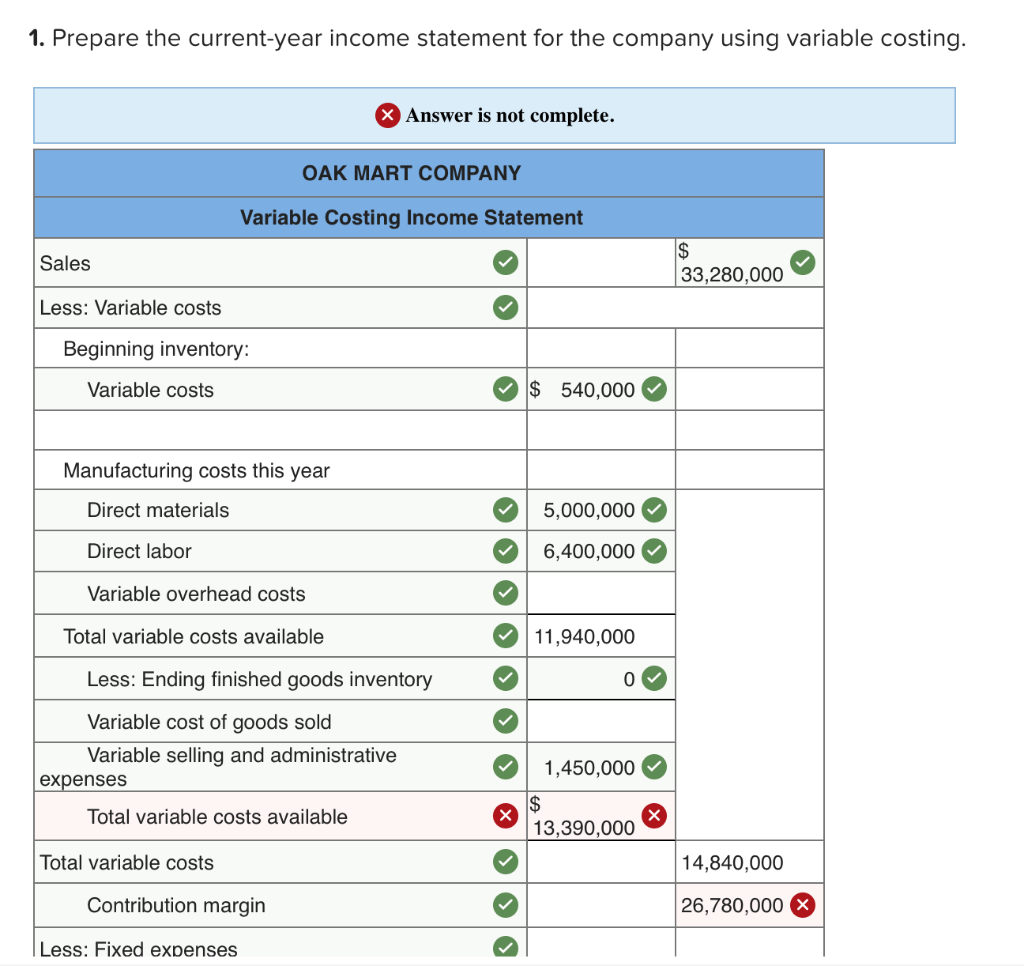

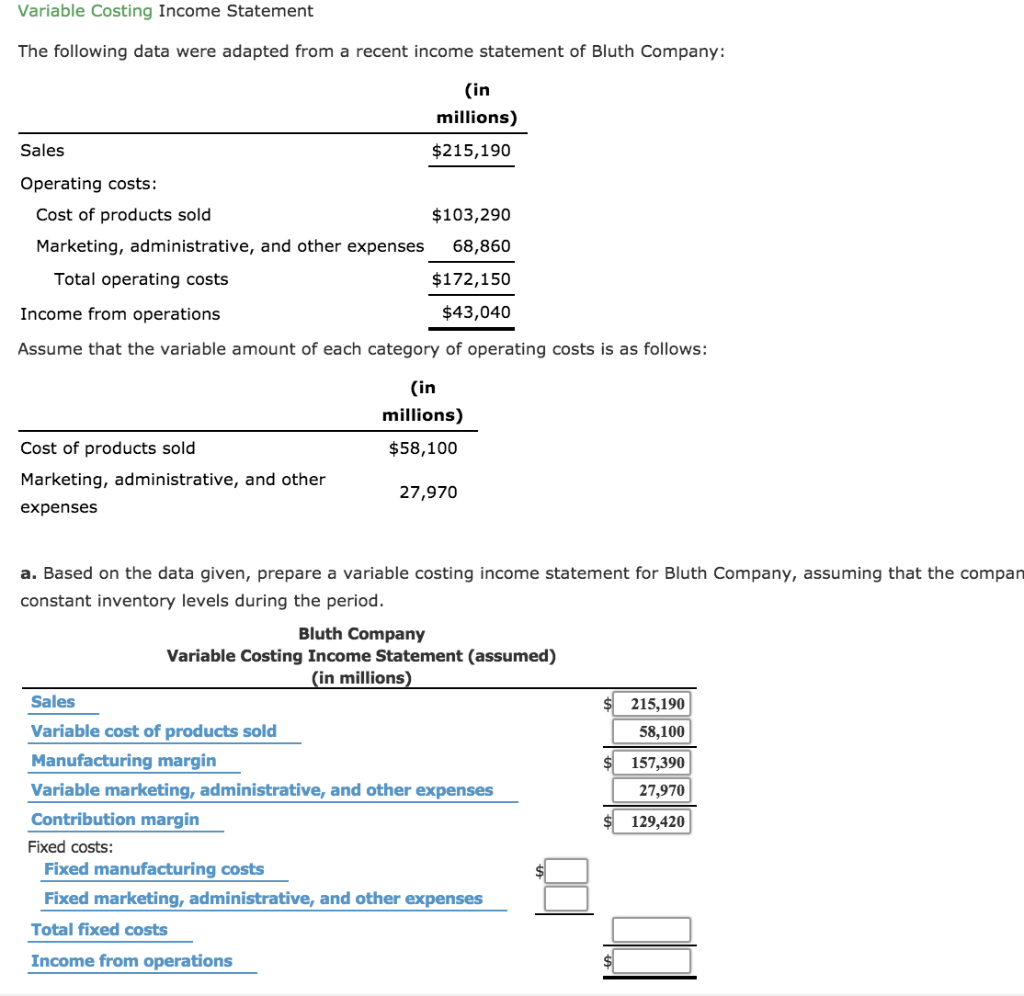

The first illustration below shows an example of. This has been a guide to variable costing income statement. Variable costing income statement has the following line items:

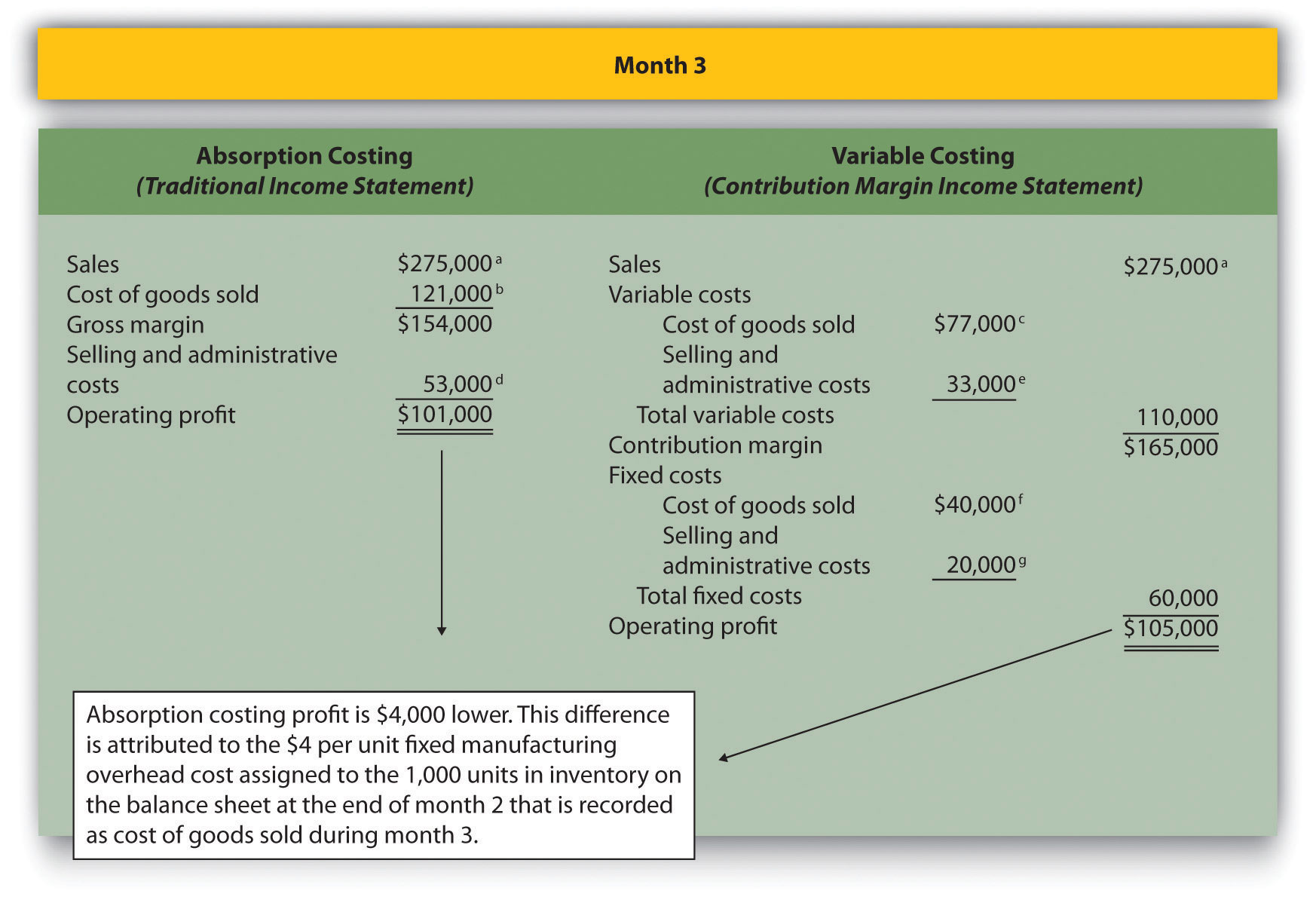

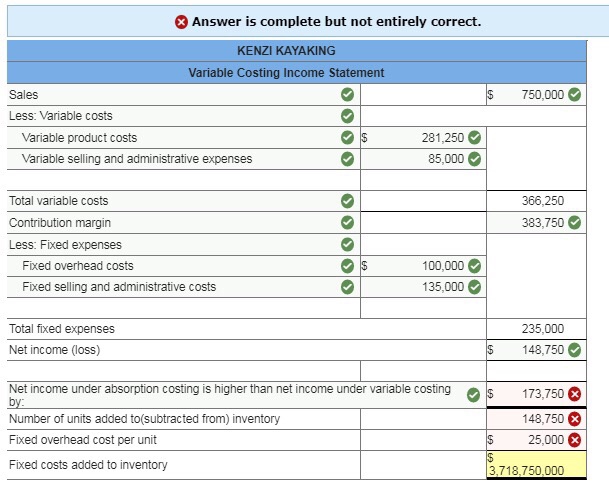

Sorts costs by product and period. Essentially, if a cost varies depending on the. Variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product cost.

Therefore, the next step within the process is including those costs. In comparing the two income statements for bradley, we notice that the cost of goods sold under absorption is $3.90 per unit and $3.30 per unit under variable. Fixed costs examples such as rent and.

The most common variable costs. Fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Since a company’s total costs (tc) equals the sum of its variable ( vc) and fixed costs (fc), the simplest formula for calculating a company’s vcs is as follows.

Variable costing will only be a factor for companies that expense costs of goods sold (cogs) on their income statement. A variable costing income statement is a financial report in which you subtract variable expenses from revenue, resulting in a contribution margin. To determine variable costs, identify and sum all variable expense line items on the company income statement.

As stated above, the variable income statement considers fixed costs as a period cost. The variable cost per unit is $22 (the total of direct material, direct labor, and variable overhead).