Spectacular Tips About Equity Multiplier Interpretation

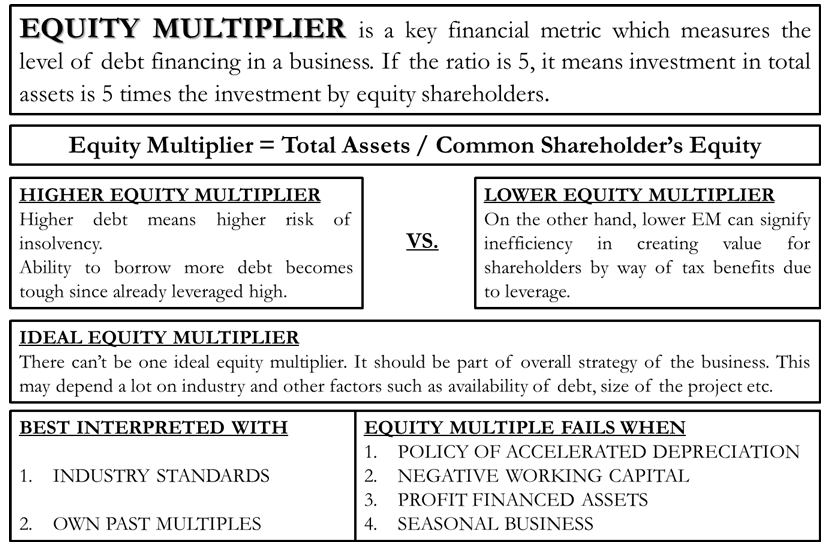

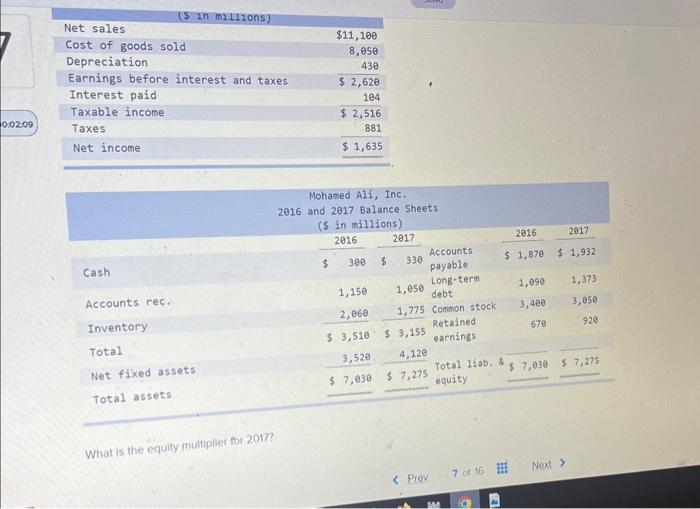

The equity multiplier is the ratio of a company's total assets to its stockholders' equity.

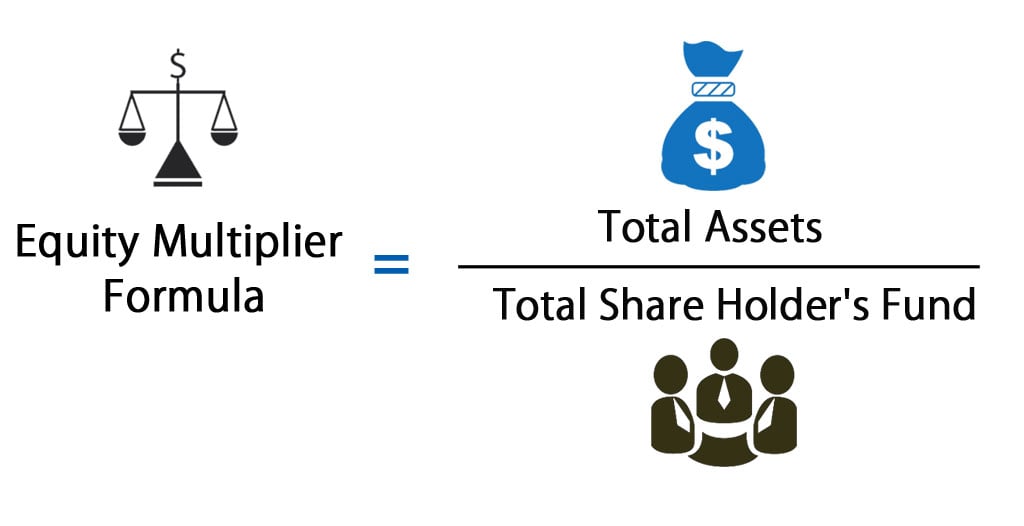

Equity multiplier interpretation. The equity multiplier is calculated by dividing a company's total asset value by the total equity held in the company's stock. The ratio is intended to measure the extent to which equity is used. Equity multiplier is a financial leverage ratio that evaluates a company's use of debt to.

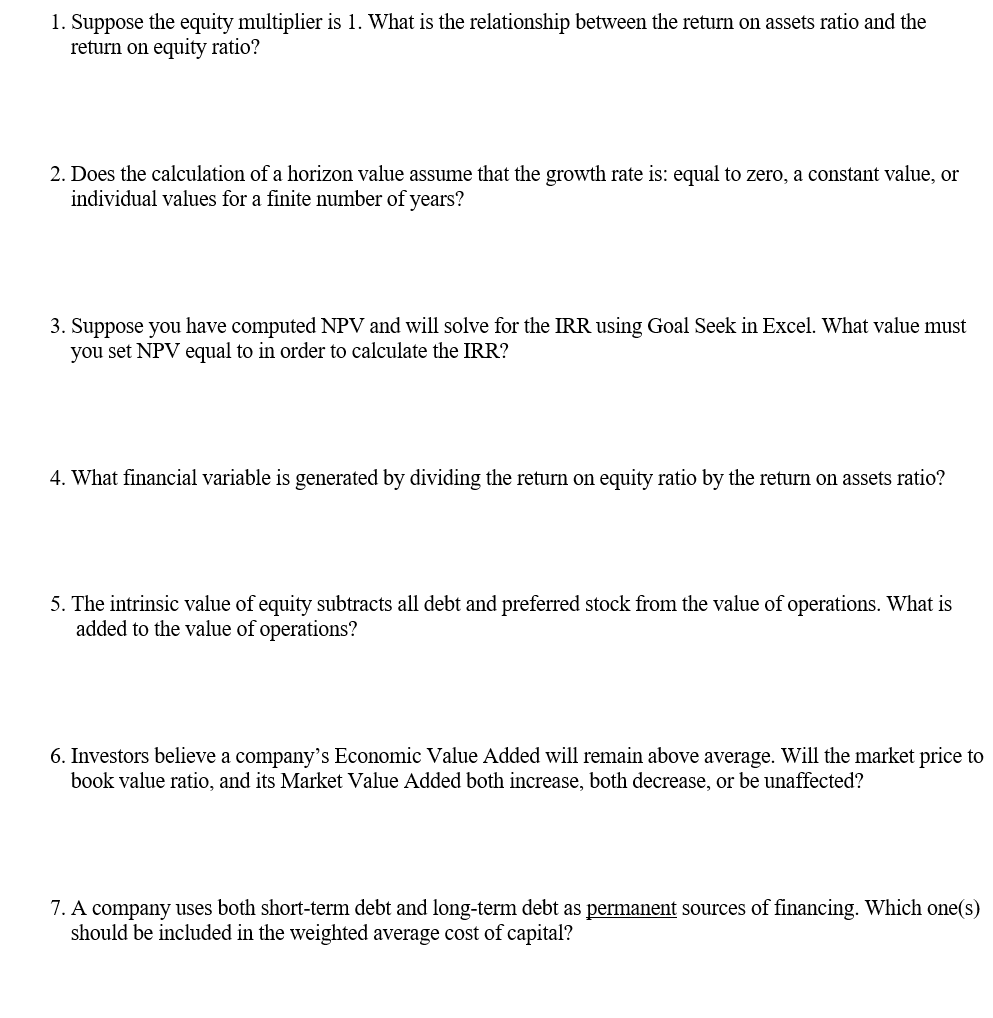

Why do equity multipliers matter? An appropriate interpretation of your calculated equity multiplier is key to accurate risk assessment in your financial endeavours. In dupont’s interpretation, the formula for calculating this indicator is the product of the following parameters:

What is the equity multiplier? The equity multiplier (also referred to as “em” or “leverage ratio”) is a financial indicator allowing you to assess the proportion of a company’s assets acquired. Commonly employed to measure the extent to which a company finances its assets with debt, the equity multiplier is an.

The interpretation of the equity multiplier levels should not be done separately from other figures that may help in understanding the financial position of a company. The equity multiplier formula is the equation that derives the ratio of total assets to total shareholders’ equity.the result is the financial leverage of a company that determines. The formula for equity multiplier is total assets divided by stockholder's equity.

In simpler words, the equity. The equity multiplier is the ratio of a company’s total assets to the equity of its stockholders. There is no ideal equity multiplier as it varies across sectors or industries.

The ratio is designed to assess how much equity is used to pay for. The equity multiplier is one of the ratios that make up the dupont analysis, which is a framework to calculate the return on equity (roe) of companies. The equity multiplier, also known as the leverage ratio or financial leverage ratio, measures the portion of a company’s assets that is financed by shareholders’ equity.

The equity multiplier is a metric used to determine a company’s financial leverage based on its assets and shareholders' equity. Equity multiplier is a leverage ratio that measures the portion of the company’s assets that are financed by equity. The term equity multiplier refers to a risk indicator that measures the portion of a company’s assets that is financed by shareholders' equity rather than by debt.

A higher ratio means that more assets were funding by debt than by equity. It is calculated by dividing the company’s total assets by the total. Equity multiplier ratio is a number that establishes the relationship between the debt and the equity portion of the finances of a company’s assets.

Equity multiplier (also called leverage ratio or financial leverage ratio) is the ratio of total assets of a company to its shareholders equity. On a company’s balance sheet,. The equity multiplier is a financial leverage ratio showing how much of a company’s assets are funded by stockholder equity.

:max_bytes(150000):strip_icc()/ccecdfbbed6a87a869f6d5b40f0e451c-fad6c8c12ebd41229fe04e45c233c2af.jpg)