Peerless Info About Cash Receipts In Flow Statement

Payments september 29, 2021 do you know what cash receipts are?

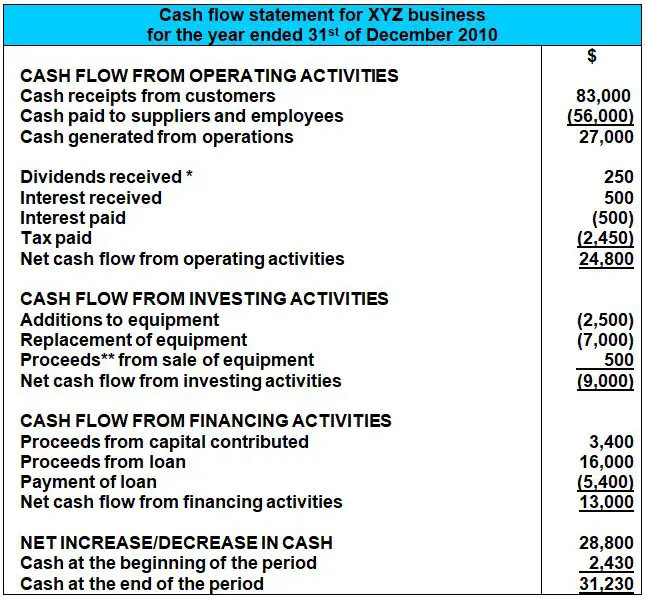

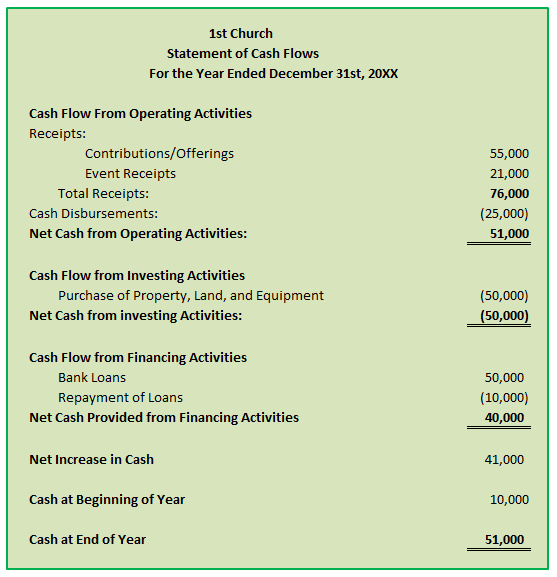

Cash receipts in cash flow statement. The statement of cash receipts and disbursements, or cash flow statement, is a crucial. For example, cash flow statements can reveal what phase a business is in: A cash flow statement consists of three sections:

Cash and cash equivalents comprise cash on hand and. Dividend received calculate the amount of dividends received by adjusting the dividend income shown in the income statement for the movement in the dividends. A cash flow statement, also known as a statement of cash flows, is a financial statement that documents the cash and cash equivalents a company generates and spends over a.

The general layout of the direct method statement of cash flows is shown below, along with an explanation of the source of the information in the statement. Whether it’s a rapidly growing startup or a mature and profitable company. Explanation and pointers statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or.

It reflects certain captions required by asc 230 (bolded), and other common captions. There are two methods for cash. A statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

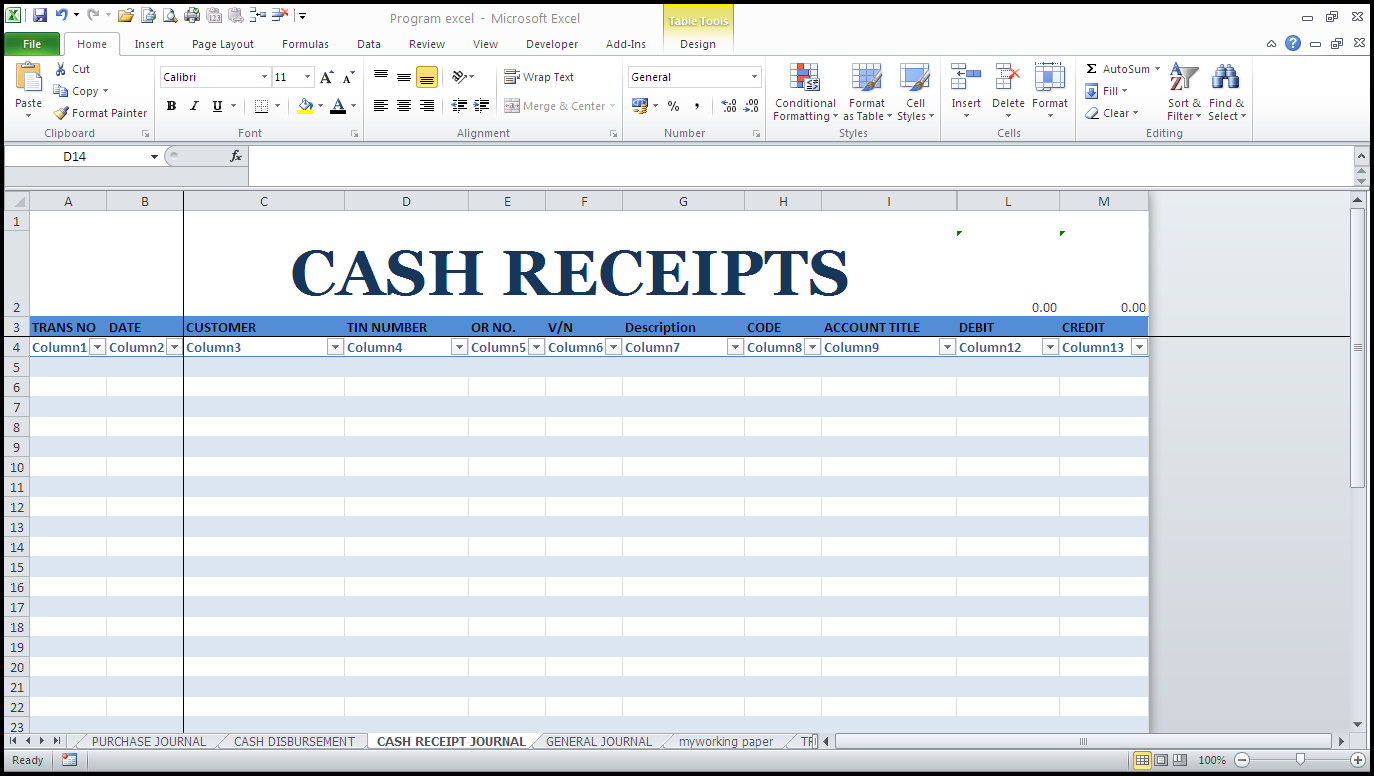

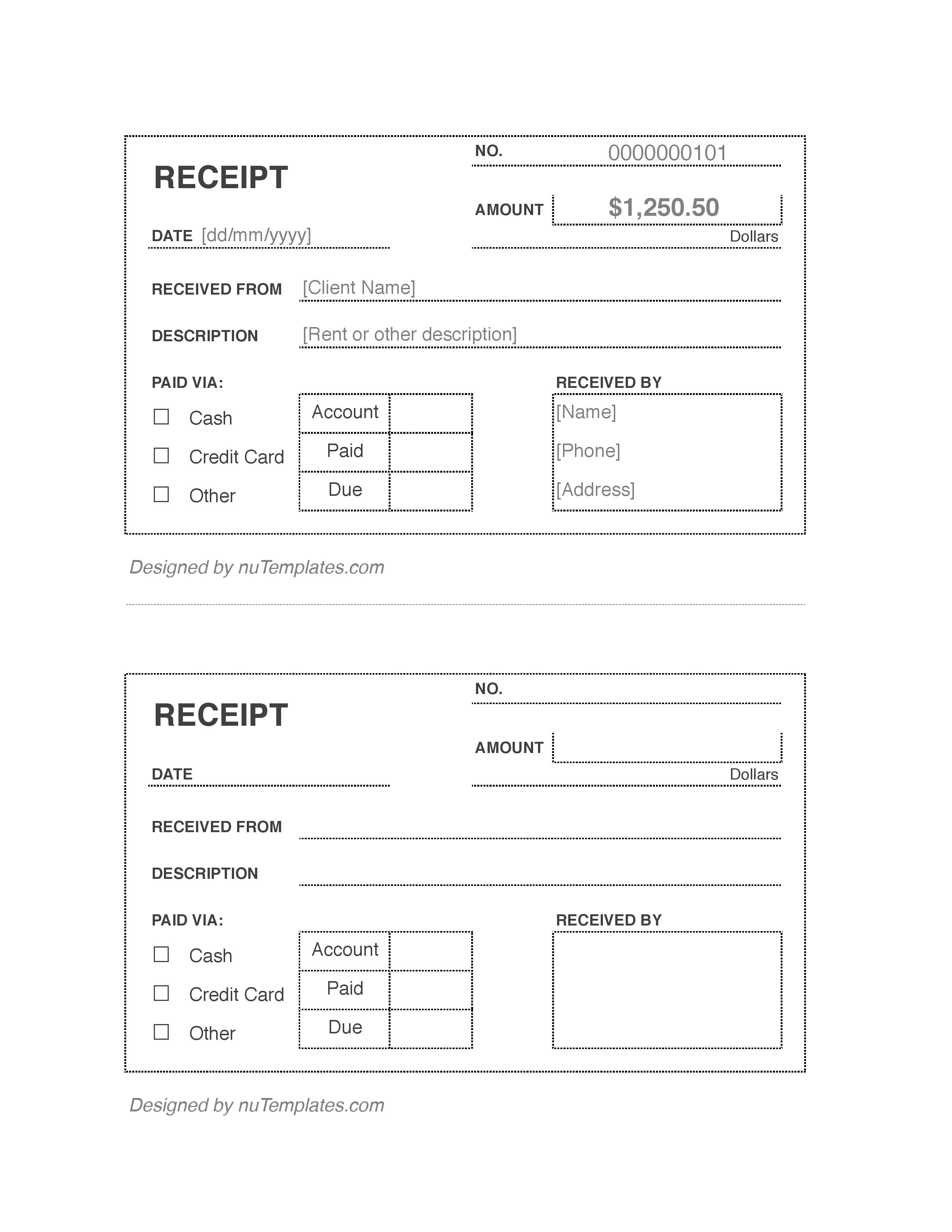

Presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating. Cash receipts are the collection of money (cash) from your customers. The statement of cash flows classifies cash receipts and disbursements as operating, investing, and financing cash flows.

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income. These increase the cash balance. Between gathering and organizing receipts, bank statements, worrying about filing deadlines and c.

The statement of cash flows analyzes cash receipts and payments to show how cash was acquired and spent during the accounting period. Cash from operating activities, cash from investing activities and cash from financing activities. Cash flows are either receipts (ie cash inflows and so are represented as a positive number in a statement of cash flows) or payments (ie cash out flows and so are.

The statement of cash flows analyses changes in cash and cash equivalents during a period. The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)