Exemplary Info About Sole Trader Financial Statements

A sole trader has no legal obligation to file financial statements with a public body, however, it is strongly recommended that they maintain reports in some capacity.

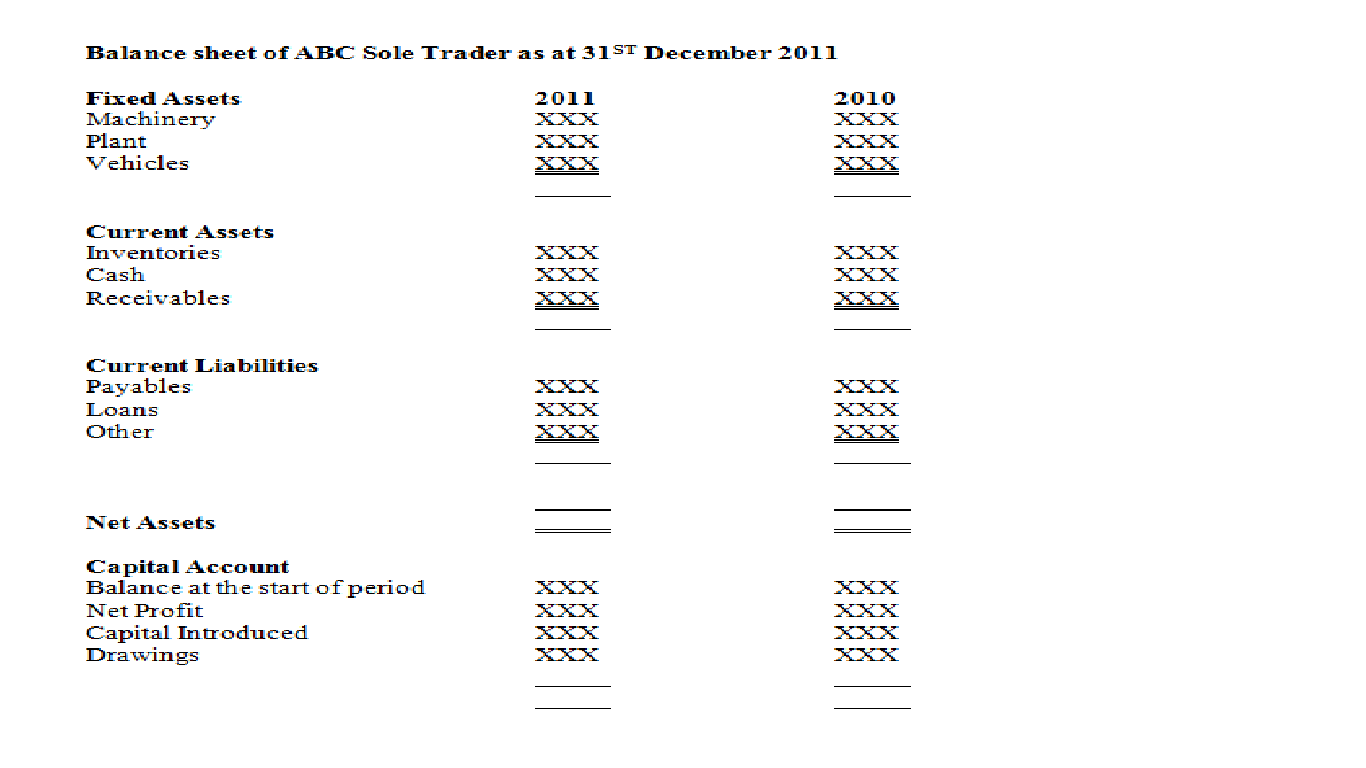

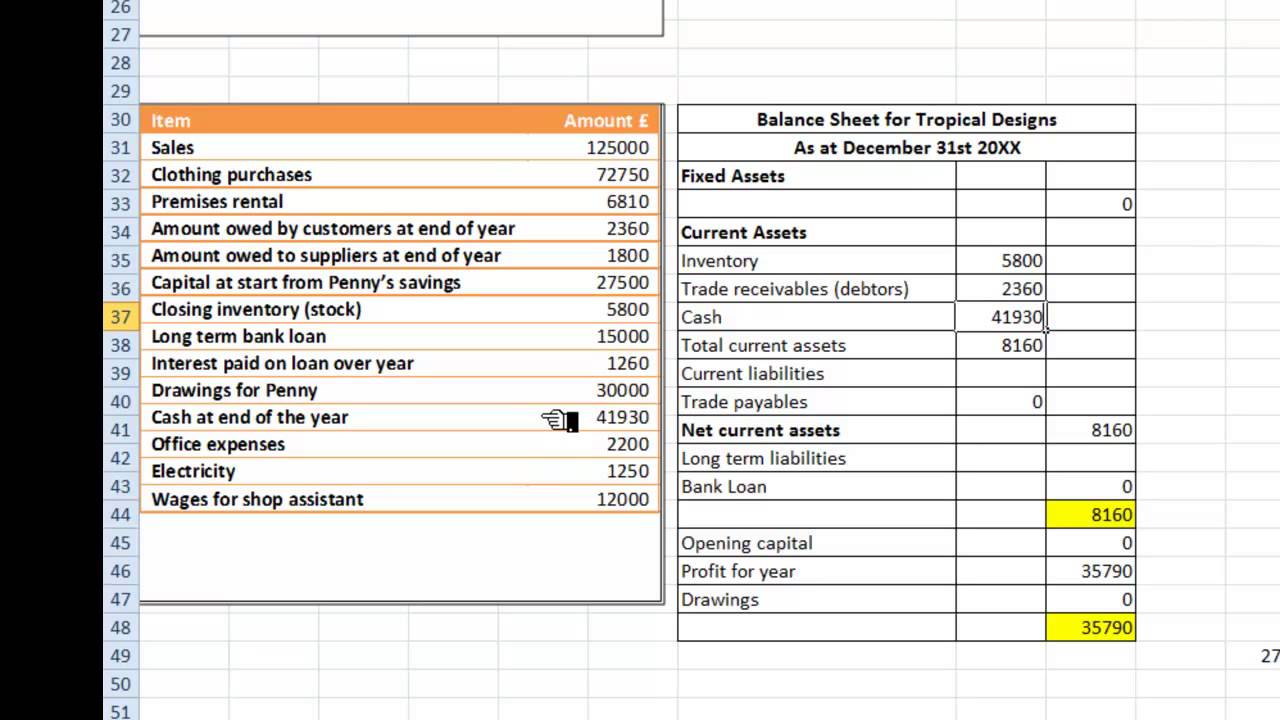

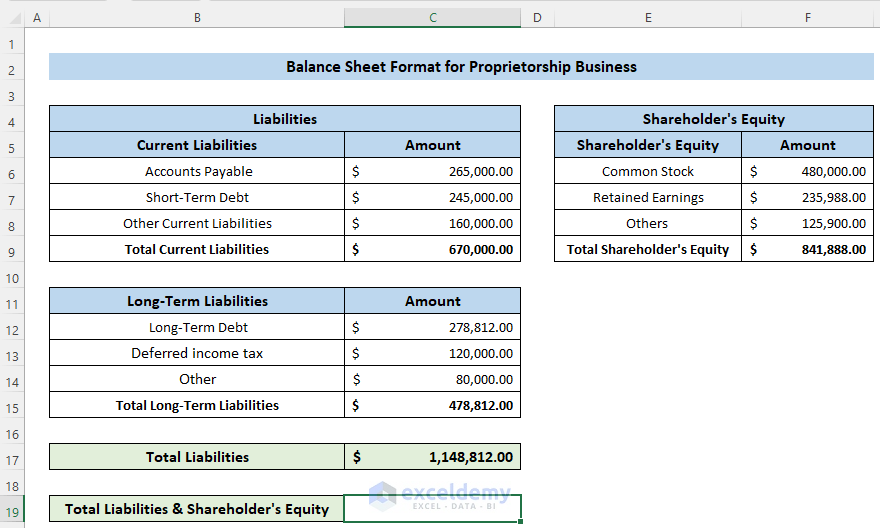

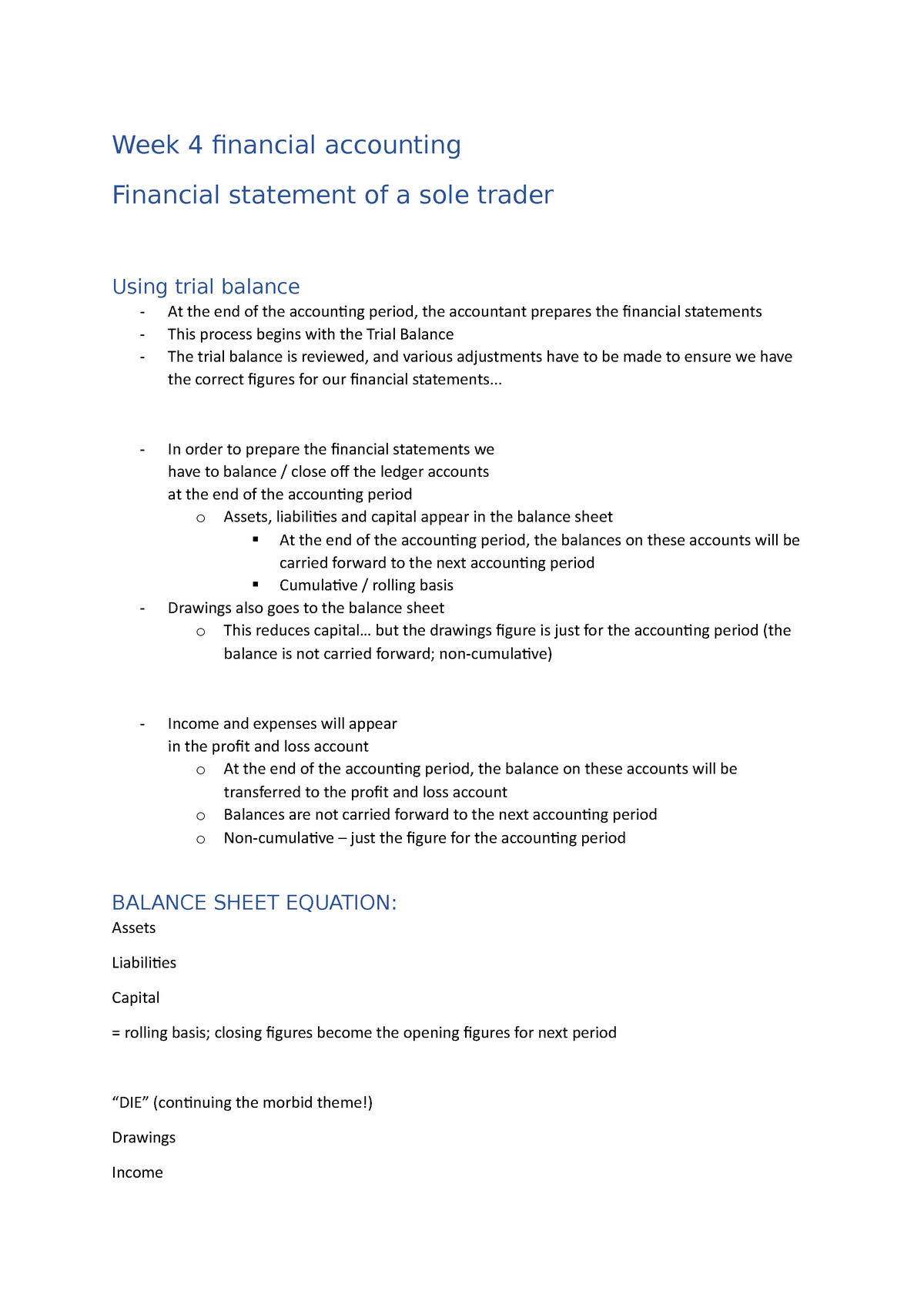

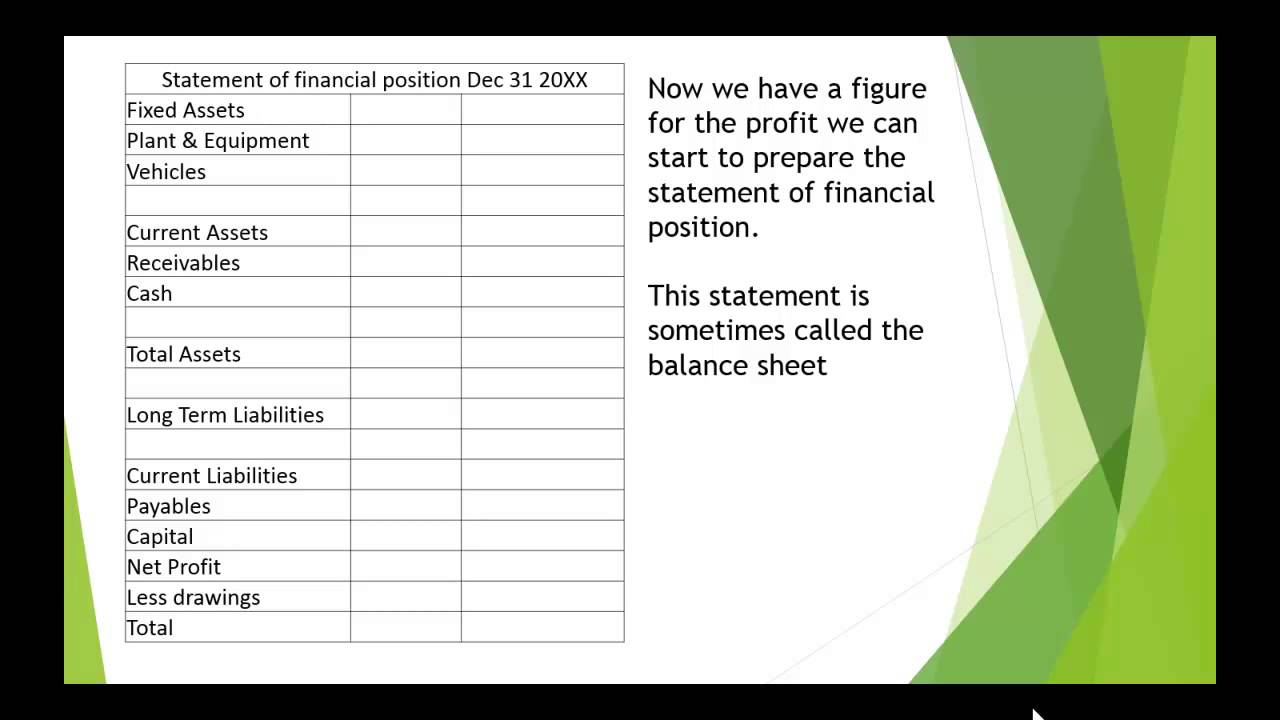

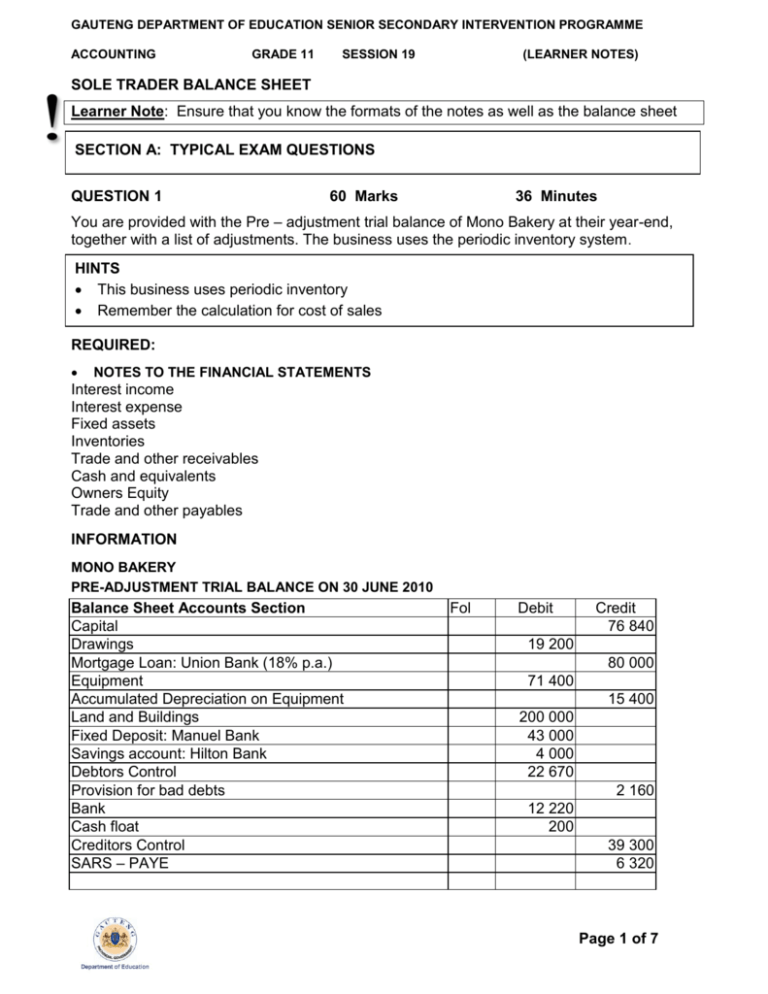

Sole trader financial statements. 5.1 sole trader financial statements. The sole trader financial statements are the balance sheet, the income statement, statement of change in owner's equity and the statement of cash flows. When compiling your balance sheet you need to keep the accounting equation in mind at all times.

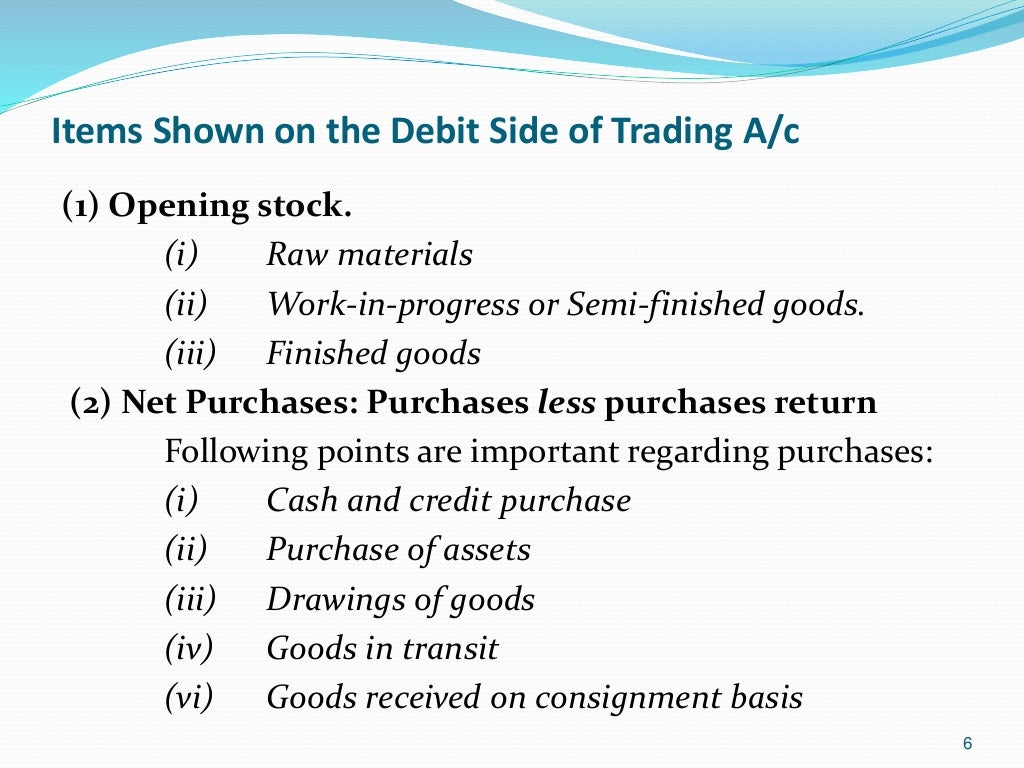

As indicated above assets = owner’s equity + liabilities example your assets were. If you can handle the financial statements of sole traders, with adjustments for accruals, prepayments, depreciation and the like, it is an easy matter to add the requirements for. Sole proprietorships are easy to establish.

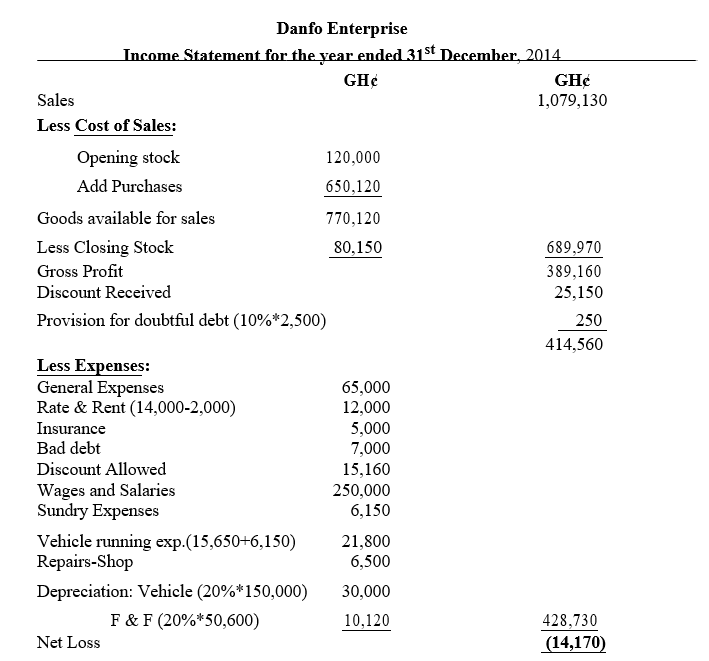

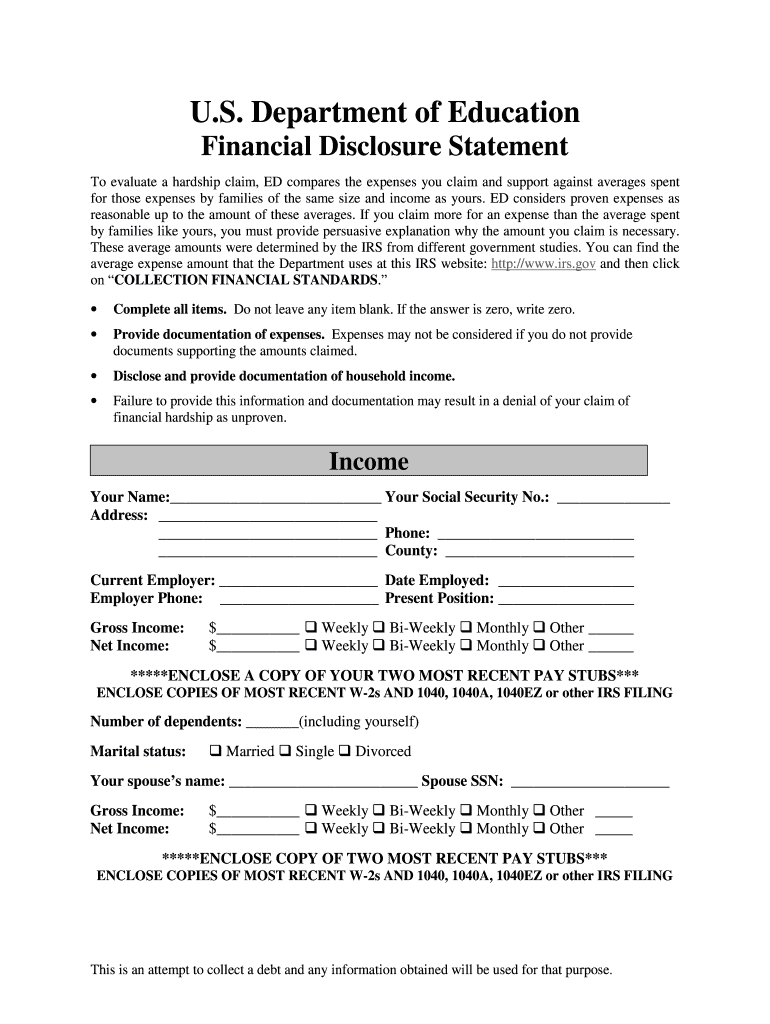

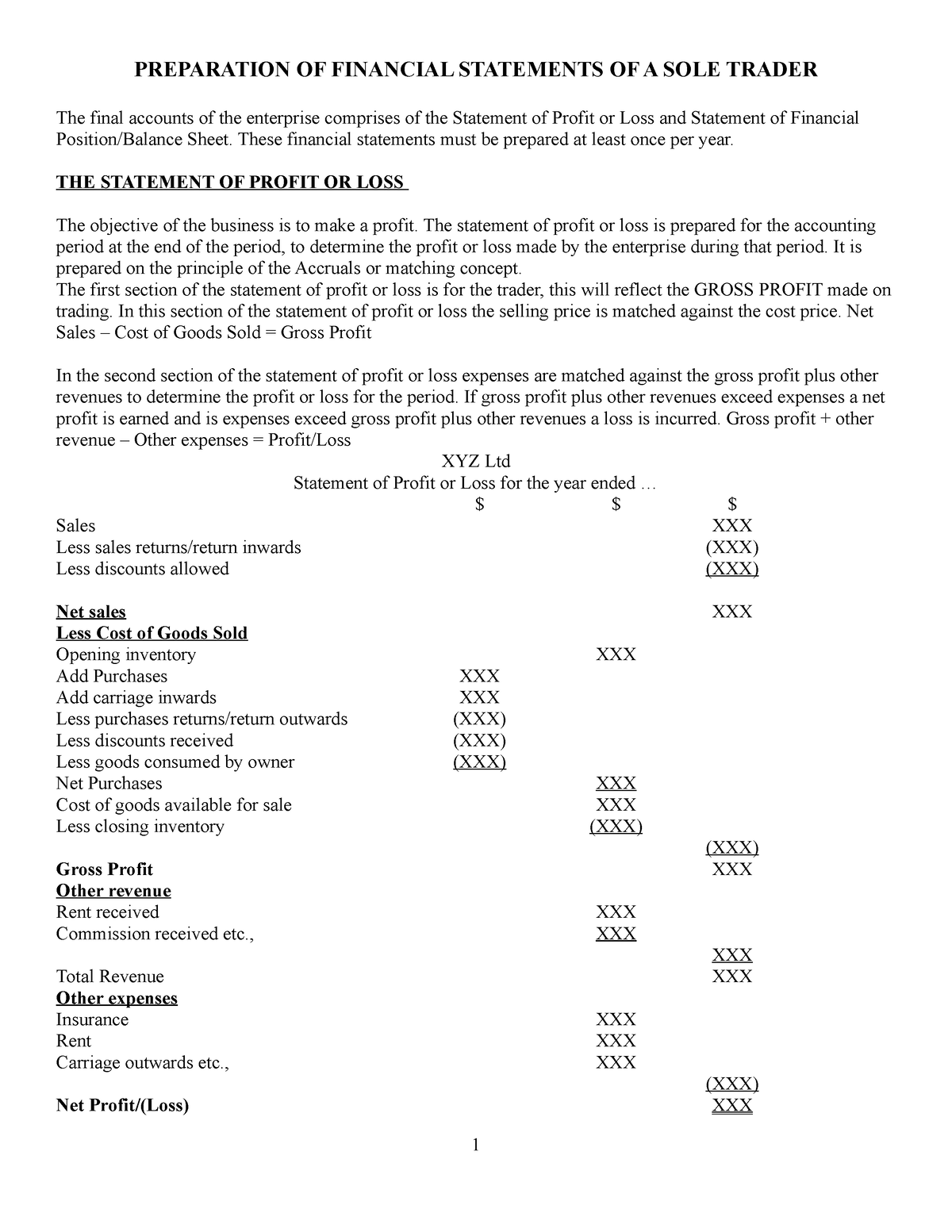

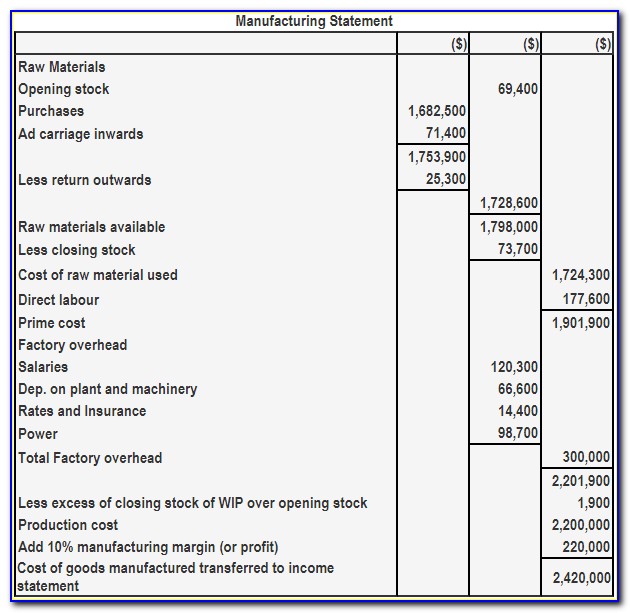

Financial statements are reports prepared by sole traders to present their financial performance and position at a given time. The profit and loss statement (p&l) is one of the most important financial documents that any small business owner or sole trader should maintain regularly. How to prepare financial statements of sole traders from ledger accounts including adjustments from the application of accounting concepts.

Accurate financial statements are crucial for assessing the financial health and performance of your sole trader business. In order to be able to compare sole trader financial statements with company financial statements this section first introduces sole trader financial statements. Our unique financial statement format for sole proprietorships in excel consists of automated reports including an income statement, balance sheet, cash flow statement,.

Sole proprietorship is a business owned and run by one individual and there is no legal distinction between the owner and the business. Use these printable documents to practise your accounting skills. Income statement (horizontal format) (pdf) income statement.

Only companies have capital invested. Below are the balance sheet and the income statement for a sole. A company’s financial statements are sent to shareholders and may be publicly filed 2.

Financial statement of a sole trader. A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned.

![Patrice Benoit Art [View 23+] 24+ Template For Business Balance](https://w7.pngwing.com/pngs/250/982/png-transparent-balance-sheet-business-service-sole-proprietorship-business-template-text-service.png)