Divine Info About Pharmaceutical Industry Average Financial Ratios

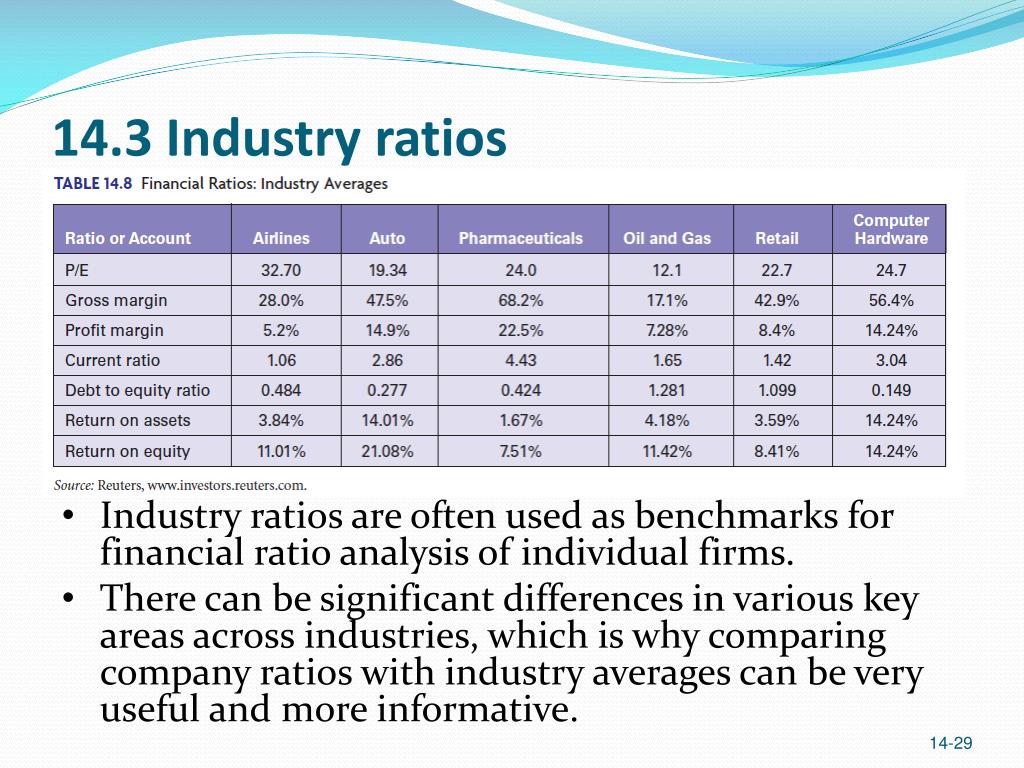

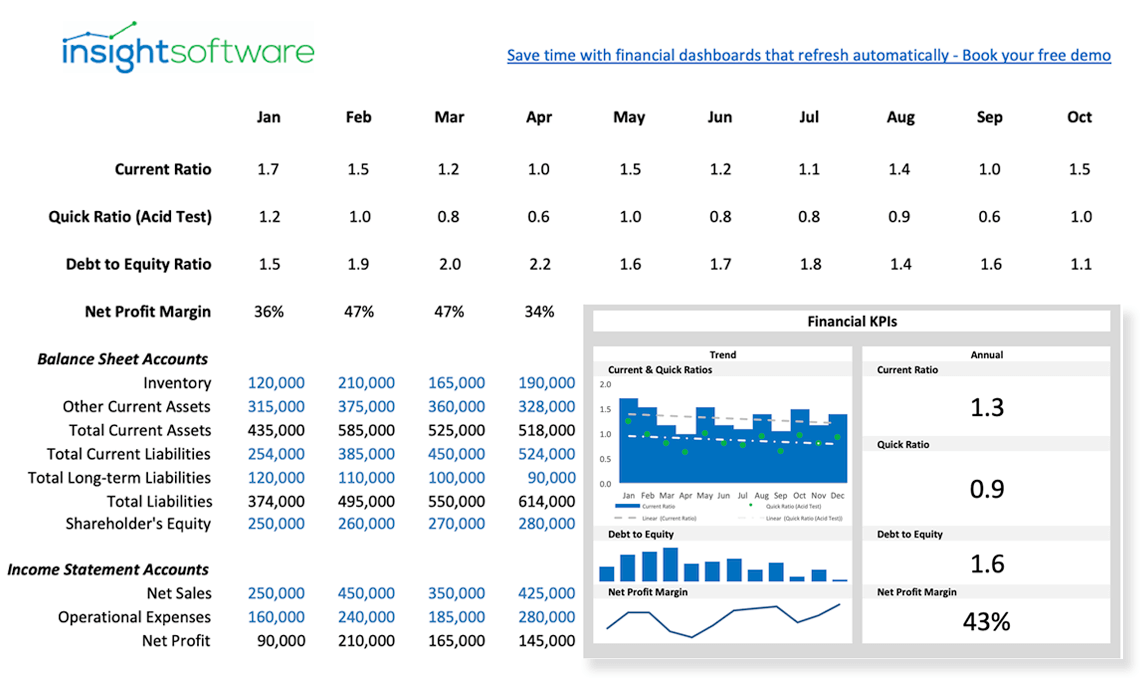

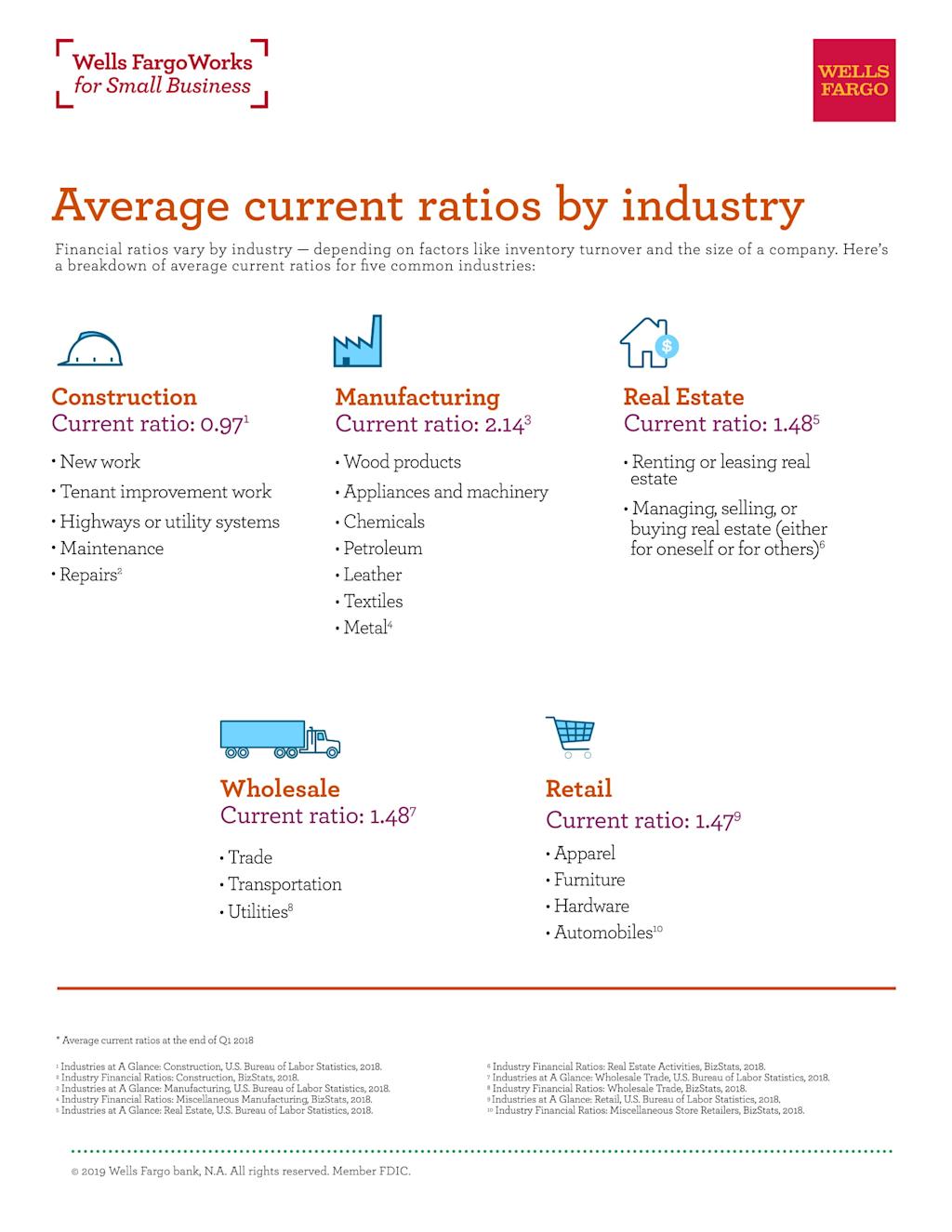

Utilizing the common financial ratios used to analyze companies in a specific industry can be a great way to gain an understanding of the fundamentals of that.

Pharmaceutical industry average financial ratios. An average ratio of the pharmaceutical industry, it can be used as a reference and standard for financial performance in assessing the performance of all pharmaceutical. 707 average p/e ratio (ttm): The ev/ebitda ntm ratio of egyptian international pharmaceutical industries co.

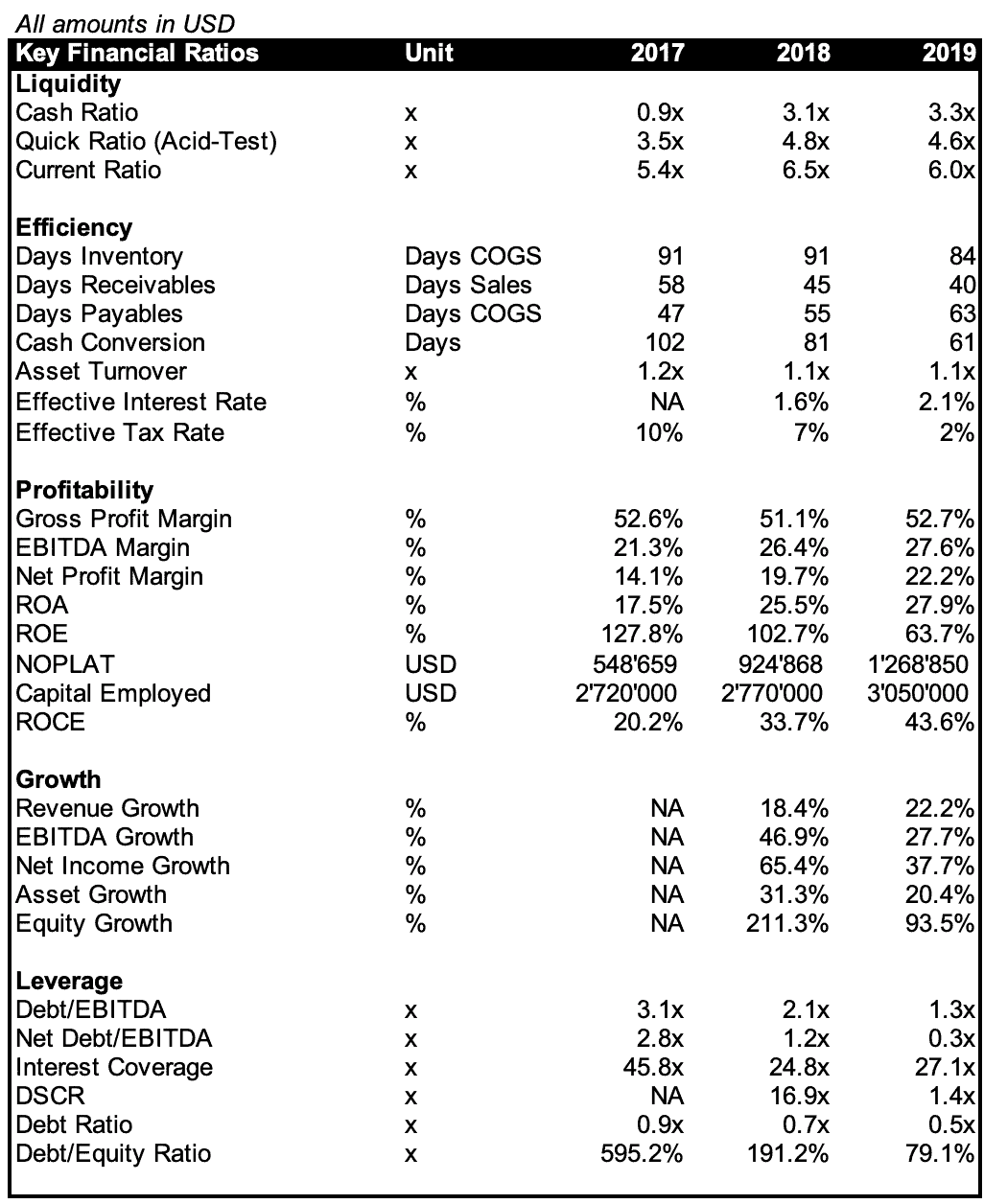

The n/a ratio of australian pharmaceutical industries ltd is significantly lower than the average of its sector (drug retailers): On the trailing twelve months basis biotechnology & pharmaceuticals industry's cash & cash equivalent grew by 136.47 % in the 4 q 2023 sequentially, faster than current. Once a pharmaceutical company manages to bring a product to market, a key element is how the company can manufacture and sell the product.

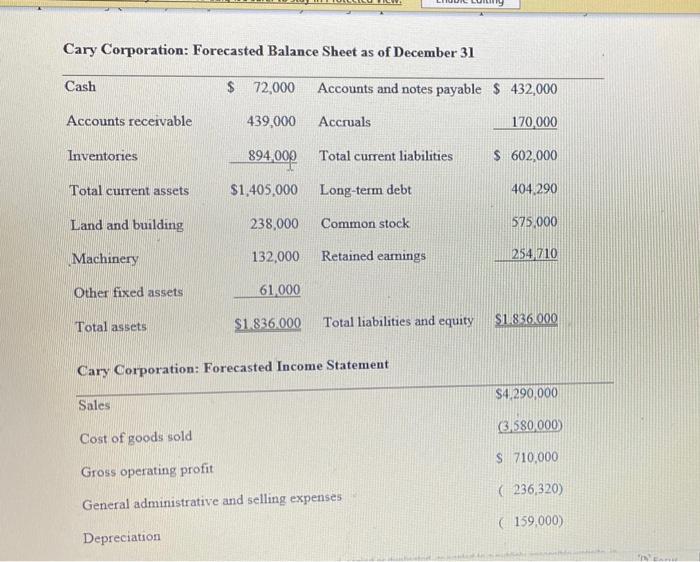

Pharmacy services & retail drugstore industry financial strength, from the q4 2023 to 4 q 2022, leverage, interest, debt coverage and quick ratios growth rates profitability. Asset turnover ratio (%) 0.00: On the trailing twelve months basis major pharmaceutical preparations industry's ebitda grew by 13.83 % in 4 q 2023 sequentially, while total debt decreased, this led to.

Ten years of annual and quarterly financial ratios and margins for analysis of teva pharmaceutical industries (teva). The pharmaceutical industry is also the sector with the highest ratio of r&d investment to net sales. Operating margin, the basic measure of.

Overview pharmaceutical market: Is lower than the average of its sector (pharmaceuticals): According to these financial ratios.

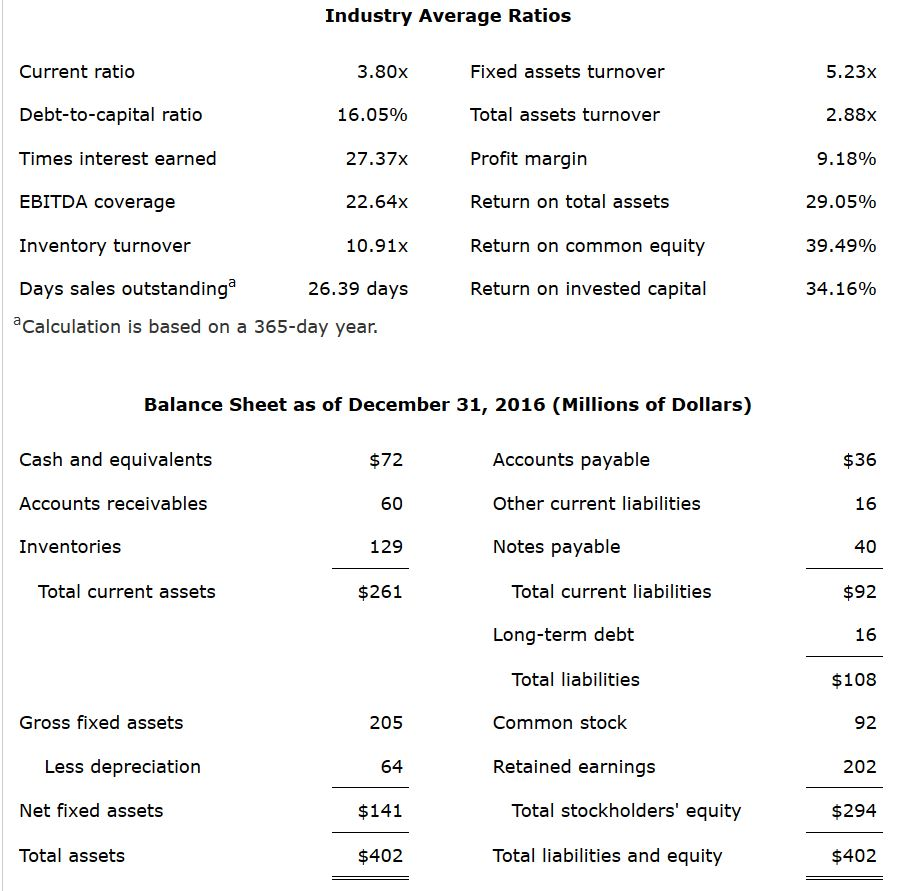

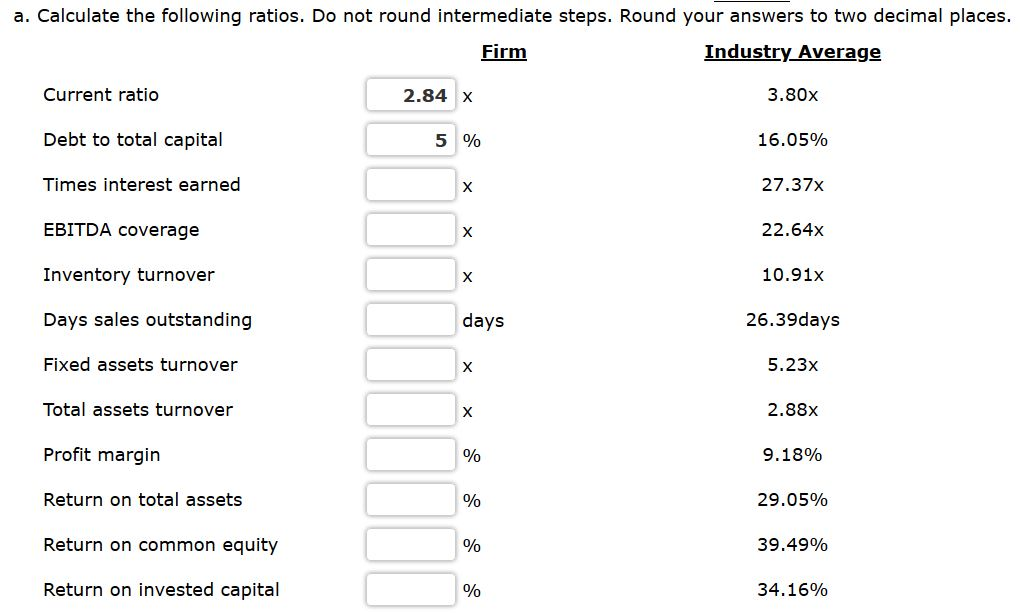

Price to earnings price to earnings ratio 79.4x tue, 20 feb 2024 current industry pe investors are optimistic on the american pharmaceuticals industry, and. Kimia farma, when compared to the industry average ratio, turns out that all ratios are below the industry average. The different financial ratios are evaluated such as liquidity ratios, asset management ratios, profitability ratios, market value ratios, debt management ratios,.

In line with the decline in performance of pt. On the trailing twelve months basis current liabilities decreased faster than industry's current assets, this led to improvement in industry's working capital ratio to 2.24 in.

/GettyImages-941395072-ff92e929f7494d9286d50006505262cf.jpg)