Cool Tips About Net Profit In Cash Flow Statement

For example, depreciation is a noncash expense.

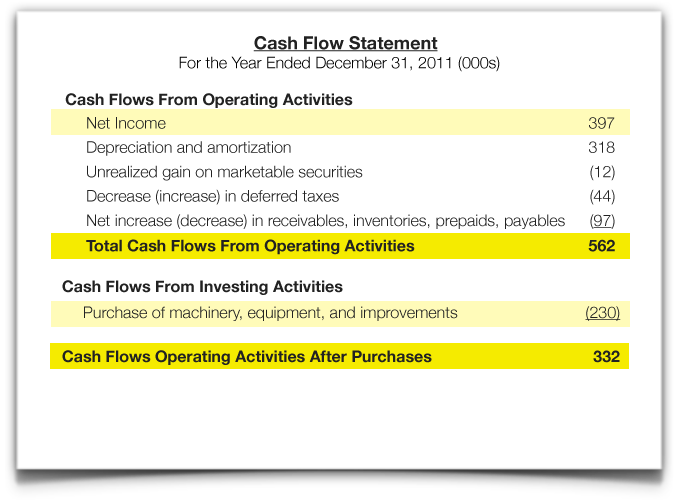

Net profit in cash flow statement. Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash flows. Net cashflow is a cash flow statement output. For the cash flow statement prepared using the direct method, shown below, profit is not part of the statement:

This amount varies depending on the industry and the company's management. This is the total net cash generated by (or used by). You report your cash flow in the cash flow statement.

Net profit is the amount of money that a company has after all its expenses are paid. The key difference between cash flow and profit is while profit indicates the amount of money left over after all expenses have been paid, cash flow indicates the net flow of. The balancing figure is the cash spent to buy new ppe.

Net cash provided by operating activities was $823 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was $768 million. The final few lines of the cash flow statement show your net increase or decrease in cash. Outstanding cash flow from operating activities* of eur 1.45 billion up eur 236 million yoy;

You can think of net profit like your paycheck: The period of time element is important here. The cash flow statement differs from the profit and loss (p&l) statement.

Profit before interest and income taxes. The cash flow statement is typically broken into three sections: It is an indication of a company's profitability and can also be referred to as net income, net earnings, or bottom line.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. The two methods by which cash flow statements (cfs) can be presented are the indirect method and direct method. The difference between cash flow and profit.

Cash flow is the net amount of cash and cash equivalents being transacted in and out of a company in a given period. In fact, a company with consistent net profits could potentially even go bankrupt. As we know, current year profit is the final figure in the income statement.

Profit or net income = $19.8 billion (green) after subtracting costs, deductions, and taxes. Cash flow from operations cash flow from operations is part of the statement of cash. Net profit is the amount of money remaining after deducting a company's total expenses from its total revenue for a given accounting period.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). What are the components of the cash flow statement? This would be considered positive cash flow.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)