Breathtaking Info About Normal Balance Of Retained Earnings

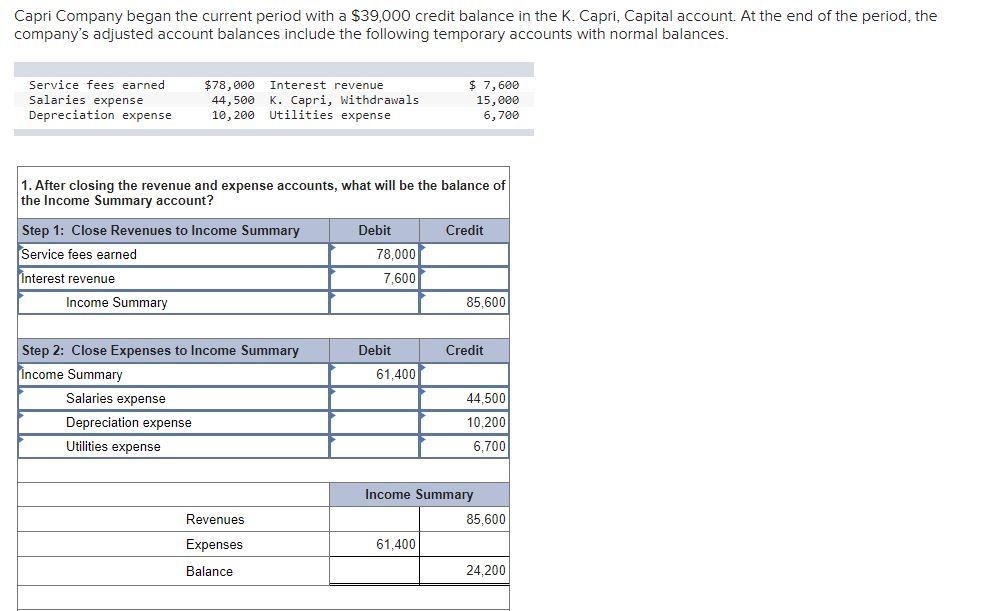

During the year, the company earned a net income of $200,000 and distributed $50,000 in dividends.

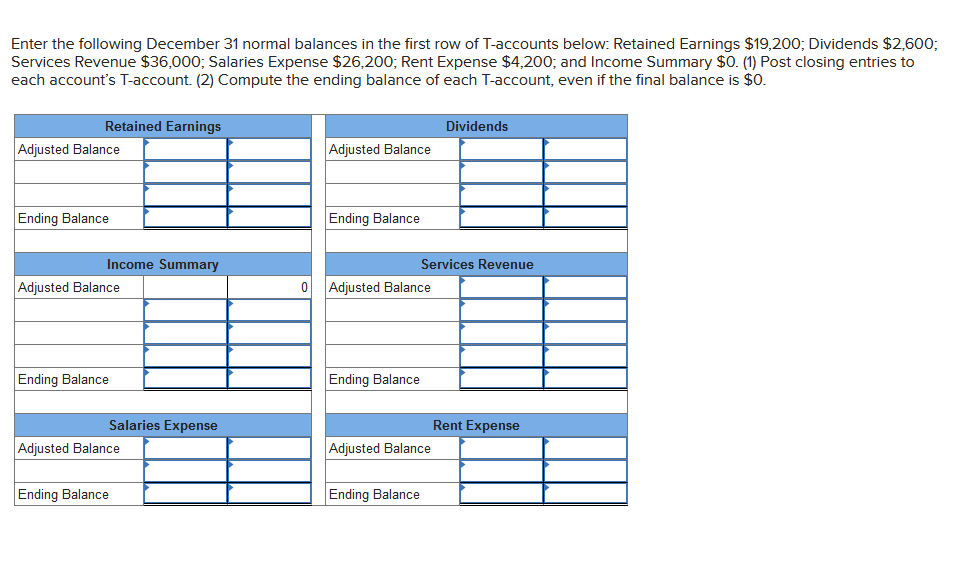

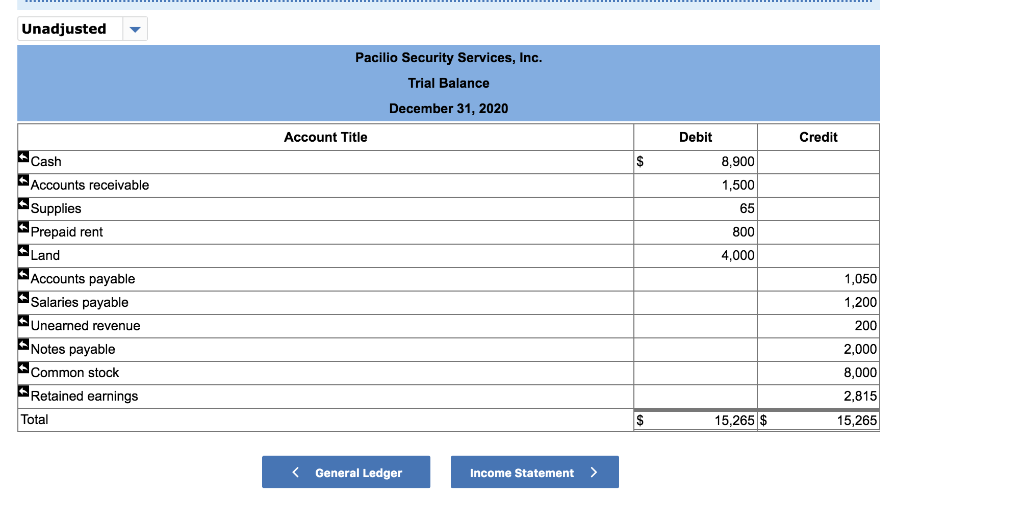

Normal balance of retained earnings. This balance signifies that a business has generated an aggregate profit over its life. Learn how to calculate them with a simple formula, find them on your. A statement of retained earnings details the changes in a company's retained earnings balance over a specific period, usually a year.

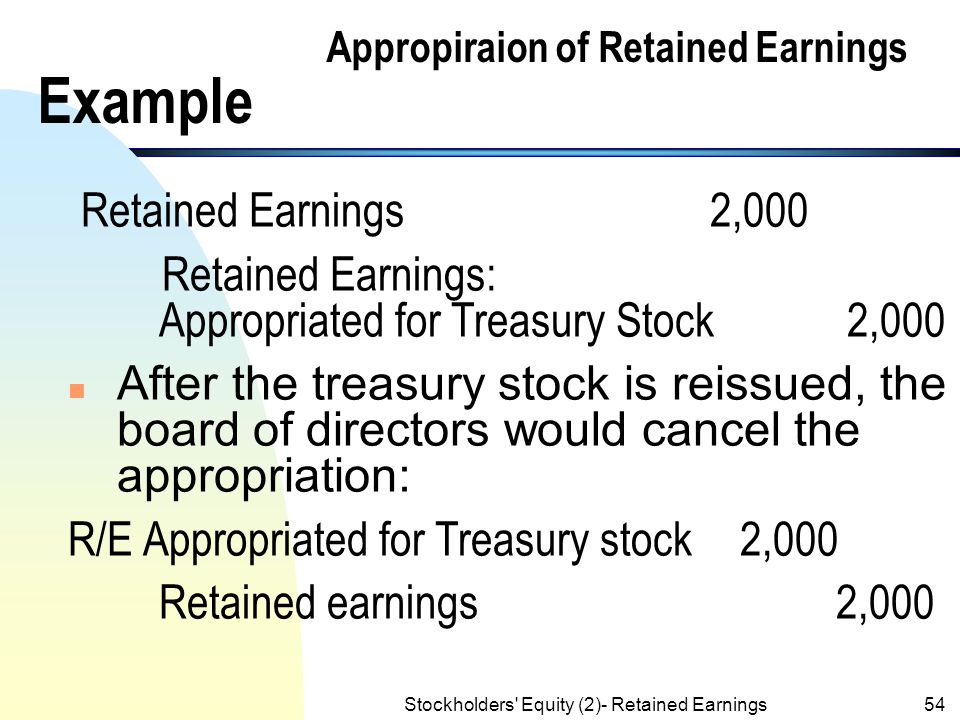

However, the amount of the retained earnings balance could be relatively low even for a. When the retained earnings account has a. Thus, the balance in retained earnings represents the corporation’s accumulated net income not distributed to stockholders.

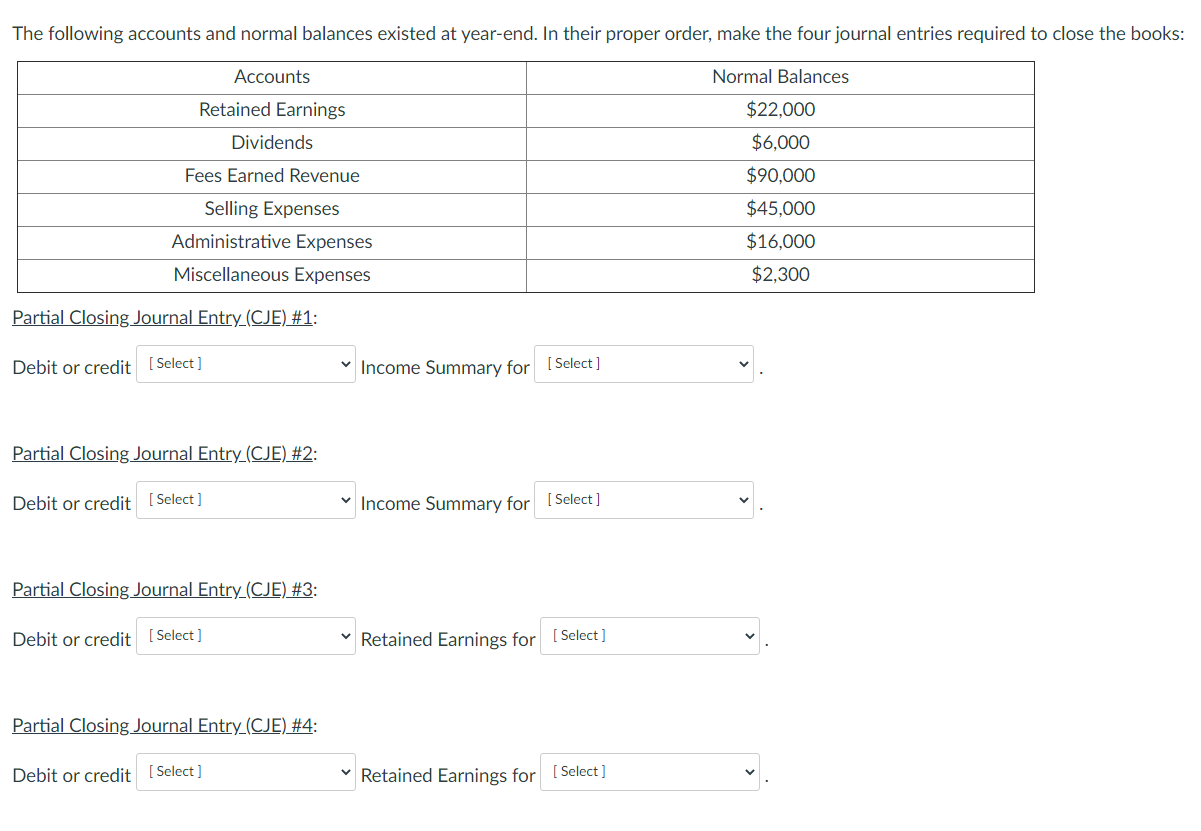

Retained earnings are the portion of profits set aside to be reinvested in your business. The normal balance for the equity category is a credit balance whereas the normal balance for dividends is a debit balance resulting in dividends reducing total equity. What is the normal balance in the retained earnings account?

This balance signifies that a business has. The retained earnings formula calculates the balance in the retained earnings account at the end of an. The normal balance in the retained earnings account is a credit.

The normal balance of retained earnings is a credit, which means it increases when a business earns or retains a profit and decreases when a business incurs a loss. Introduction to stockholders' equity, what is a corporation? 27.05.2020 | garry walton | the purpose of retained earnings a summary report called a statement of retained earnings is also maintained, outlining the changes in re for a.

Retained earnings formula and calculation. The normal balance of retained earnings. The normal balance in a profitable corporation's retained earnings account is a credit balance.

If a company has a net loss for the accounting period, a company's retained earnings statement shows a negative balance or deficit. The ultimate effect of cash dividends on the company's balance sheet is a reduction in cash for $250,000 on the asset side, and a reduction in retained earnings. Let's break down the retained earnings calculation for abc ltd:.

Retained earnings are part of the equity portion of the balance sheet.