Awe-Inspiring Examples Of Info About Is Accounts Receivable On The Income Statement

The amount is a balance rather than a transaction.

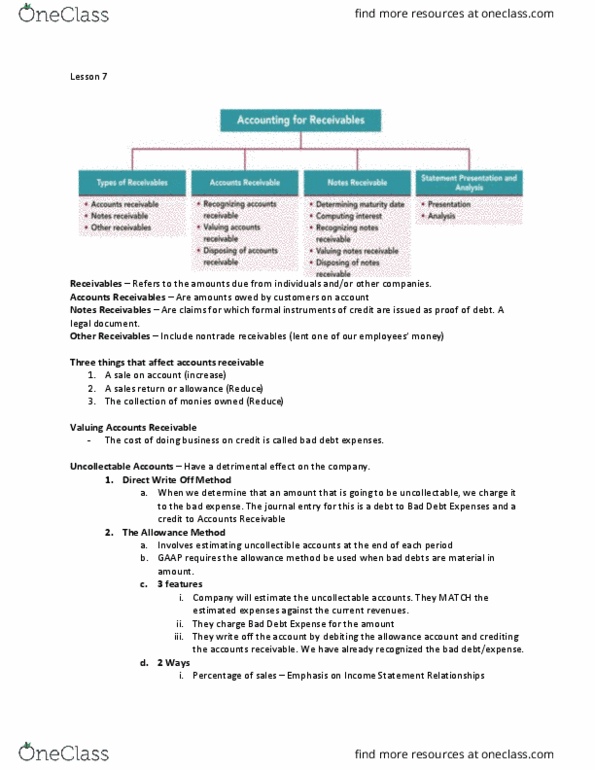

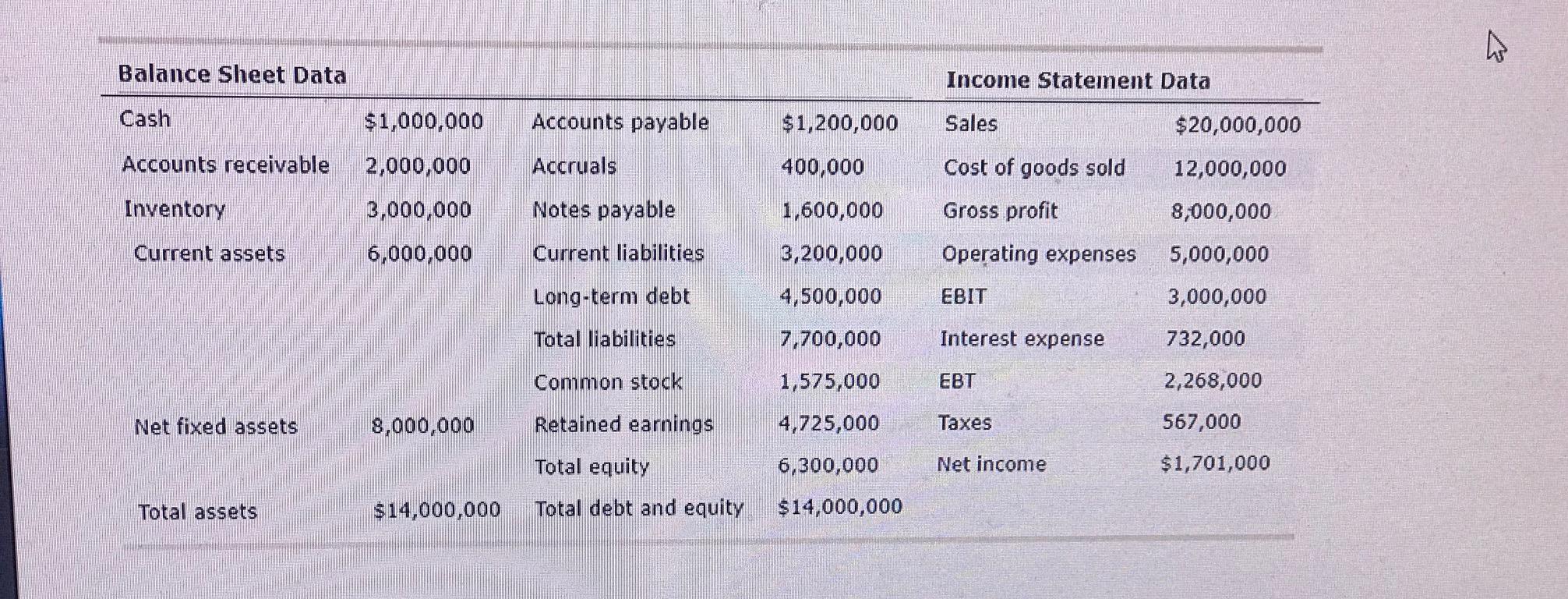

Is accounts receivable on the income statement. Yes, in accrual accounting, ar is recorded as revenue on the income statement. Increase the amount due from customers, which is reported as accounts receivable—an asset reported on the balance sheet. Including accounts receivable on the income statement provides valuable information about a company’s cash flow and overall financial health.

It's considered revenue as soon as your business has delivered products or. As such, it is an asset, since it is convertible to cash on a future date. Yes, accounts receivable should be listed as an asset on the balance sheet.

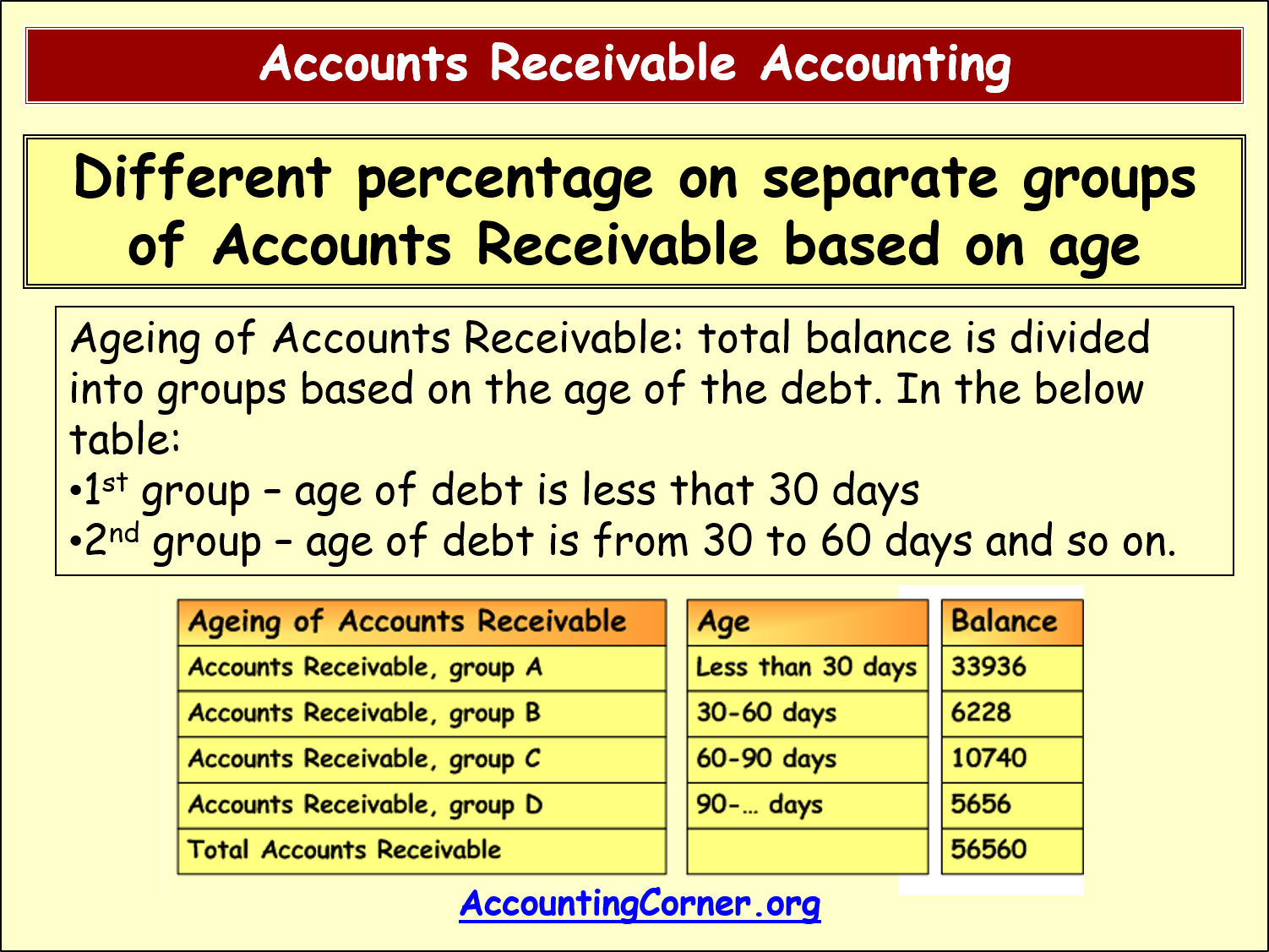

Any adjustment to the allowance account will also affect uncollectible accounts expense, which is reported on the income statement. This is because income statements are only for revenue and expenses, and accounts. If a buyer does not pay the amount it owes, the.

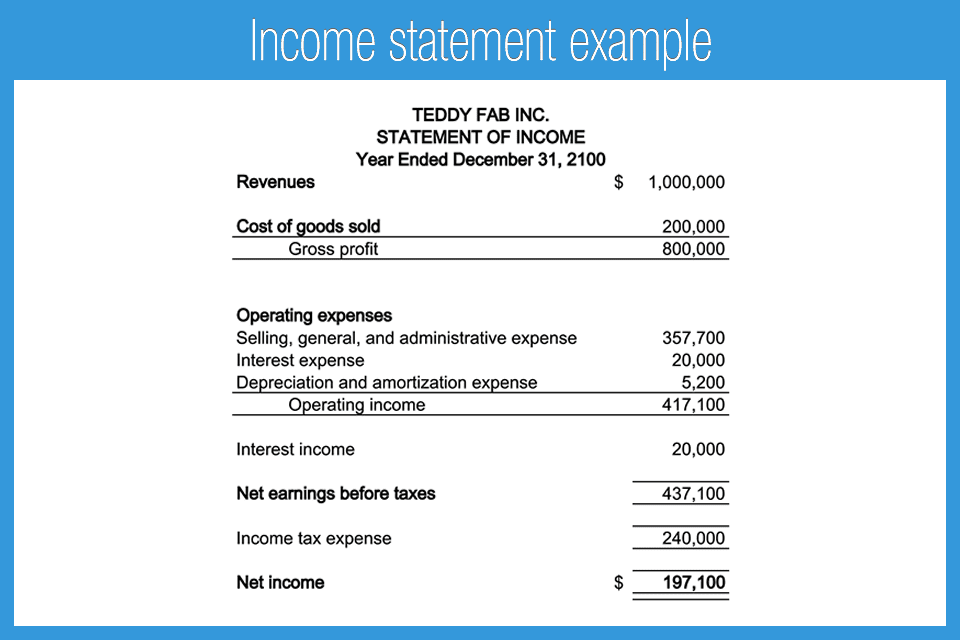

Are you wondering where accounts receivable fits into an income statement? On an income statement, accounts receivable appears as part of net sales (revenue). The purpose of the income statement is to show a company's profitability during a specific period of time.

Gst receivable occurs when the. Effective management of accounts receivable is crucial for maintaining. The accounts receivable does not go on the income statement on its own.

Therefore, it becomes a part of the balance sheet and falls under assets. As a business owner , it’s crucial to understand. Is accounts payable an asset?

Inventory consists of the products you sell to customers. Your accounts payable is accounts receivable for the other company. On top of that, accounts receivable.

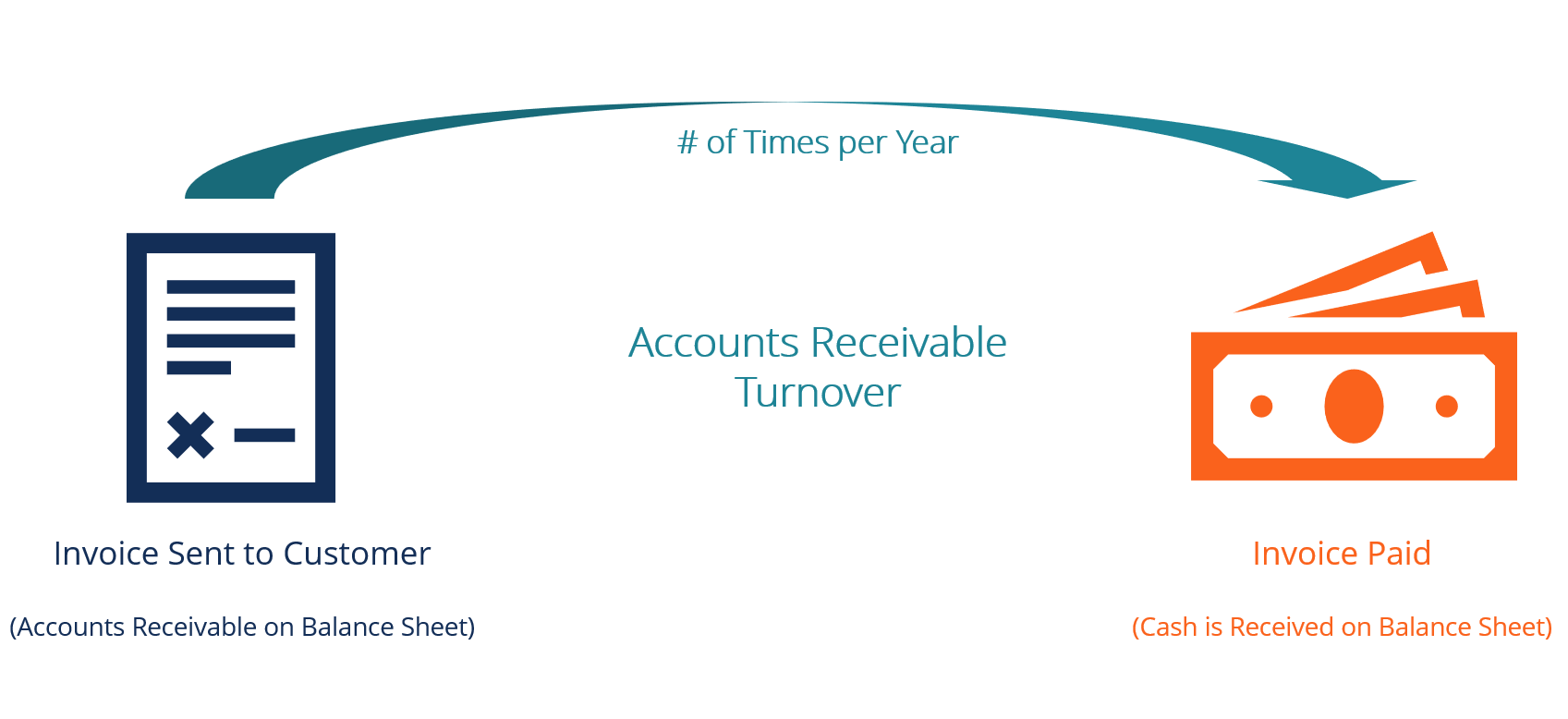

When it comes to procurement,. The difference (or net) between the revenues and expenses for direct. Accounts receivable is the amount owed to a seller by a customer.

Accounts payable (a/p) are invoices you owe to other companies. Gst receivable occurs whe. #cadeveshthakur on instagram: Prepare the schedule of cash flows from operating.

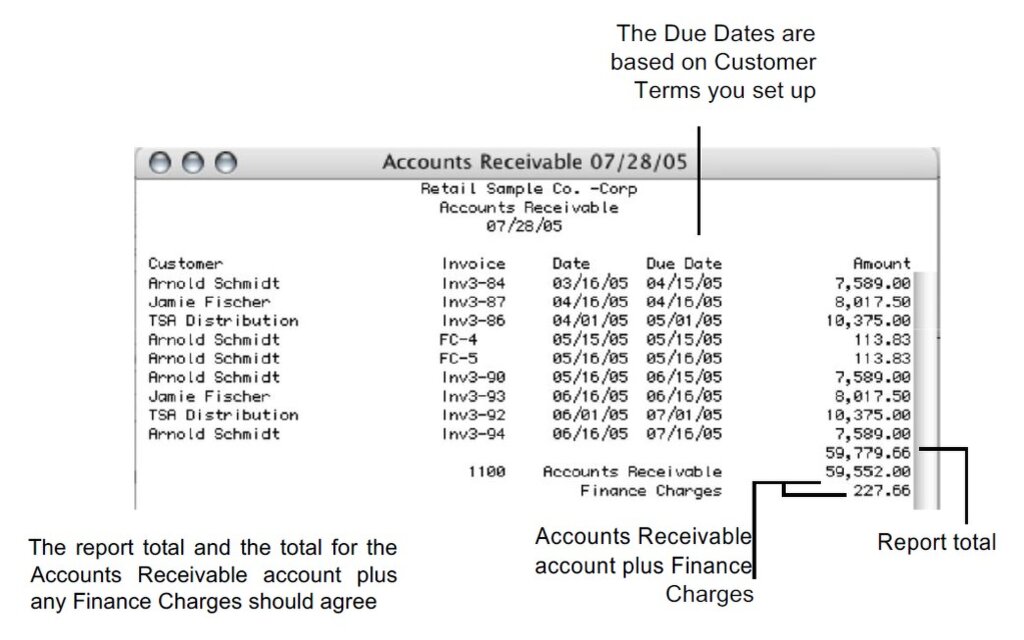

Additionally, there was a $4,100 depreciation expense charged to the income statement during the accounting period. Receivables, or accounts receivable, are the outstanding balances you have yet to collect for sales made on credit. Accounts receivable can be found on the balance sheet and not on the income statement.

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)