Neat Info About Indirect Cash Flow Statement

What is the indirect method cash flow statement?

Indirect cash flow statement. You may be asked to prepare a statement of cash flows. These adjustments include deducting realized gains and other adding back realized losses to the net income total. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

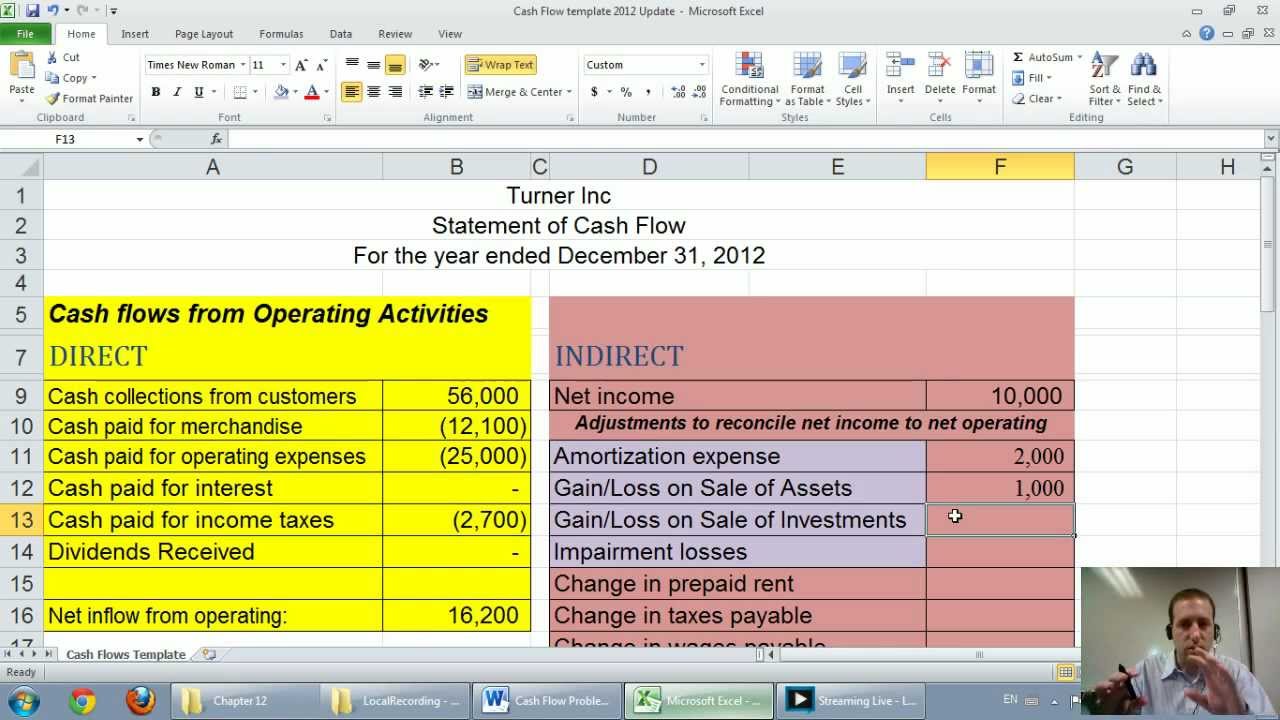

The operating cash flows section of the statement of cash flows under the indirect method would appear something like this: What are the components of the cash flow statement? Cash flow statement indirect method.

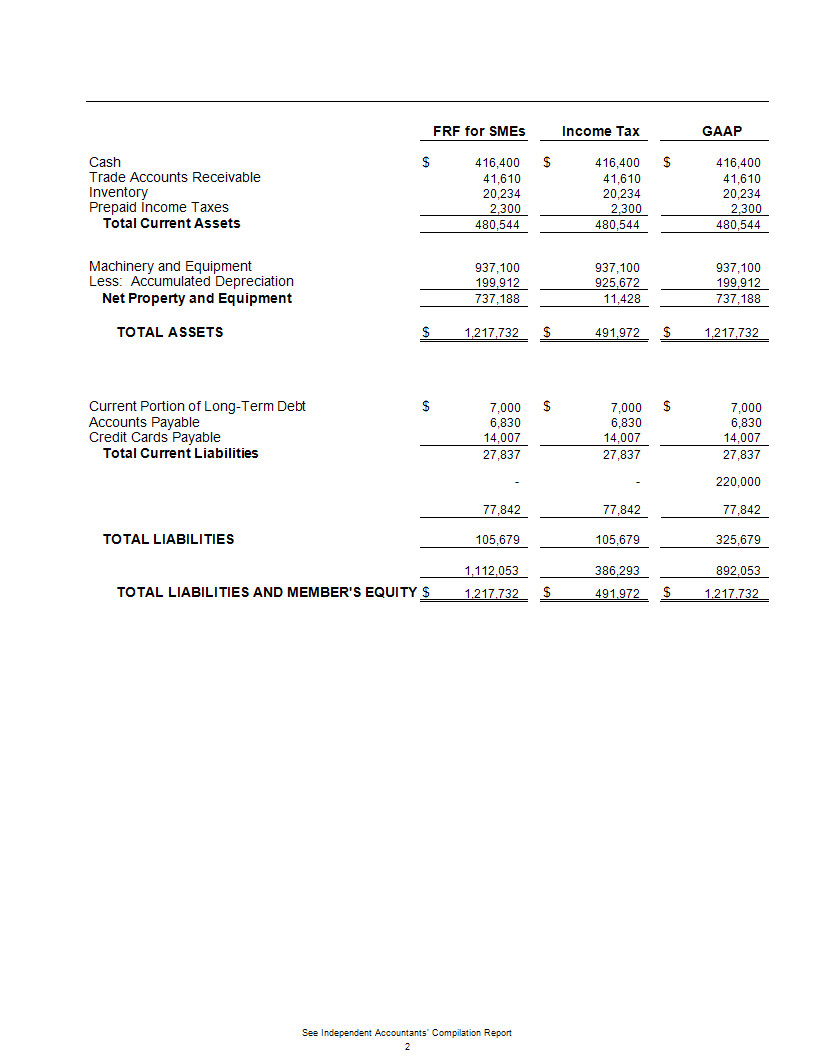

Indirect cash flow statement format. It takes the company's net income and adds or deducts balance sheet items to determine cash flow. With the indirect cash flow method, you begin with your net income and then add back or deduct those items that do not impact cash.

The cash flow statement indirect method is used by most corporations, begins with a net income total and adjusts the total to reflect only cash received from operating activities. What is the direct method? Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

When is the indirect method used? What is the indirect method to create a cash flow statement? Account for changes in current assets and liabilities;

The two methods by which cash flow statements (cfs) can be presented are the indirect method and direct method. The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions.

It is called the indirect method because the cash flows are not used directly for the calculation, but are determined from the turnover. It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: Cash flow from operations, cash flow from investing activities and cash flow from financing activities what do you use an indirect cash flow statement for?

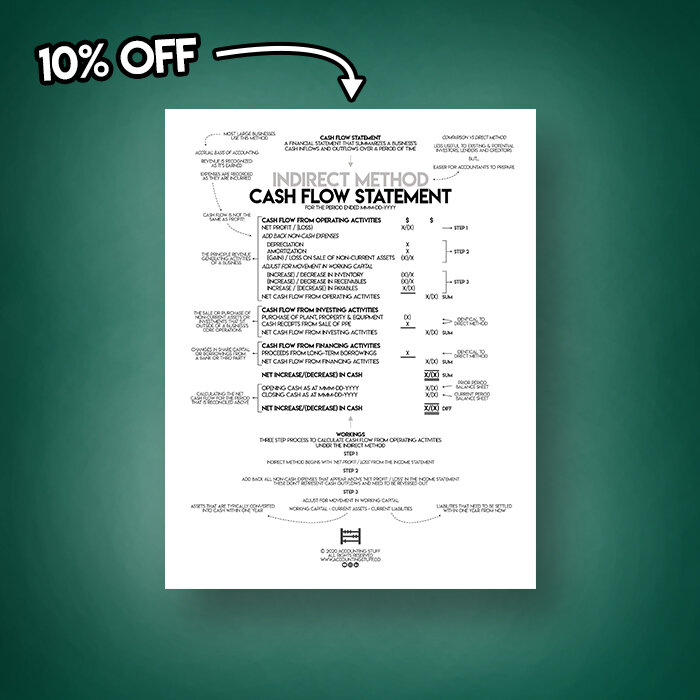

Determine net cash flows from operating activities. Add back noncash expenses, such as depreciation, amortization, and depletion. The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources.

How should cash flow statements be prepared? When should each method be used? Here is the format for the indirect cash flow statement (starting with profit before tax):

To get started, let’s refresh on what a. We know that an indirect cash flow statement outlines an entity's cash movements over a period of time. What are the advantages of an indirect cash flow statement?