Fantastic Tips About Residual Profit Partnership

1,800 in a and 2,200 in b.

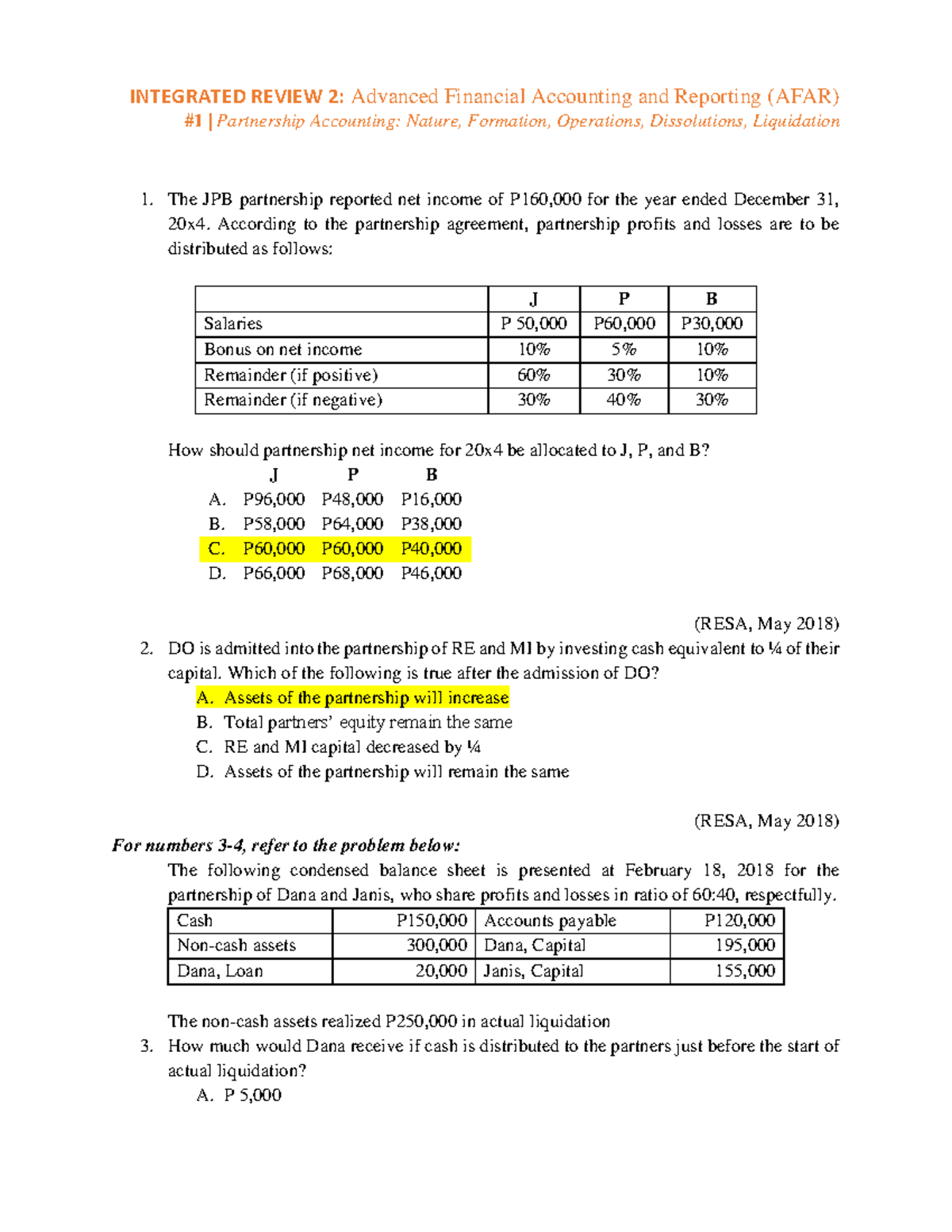

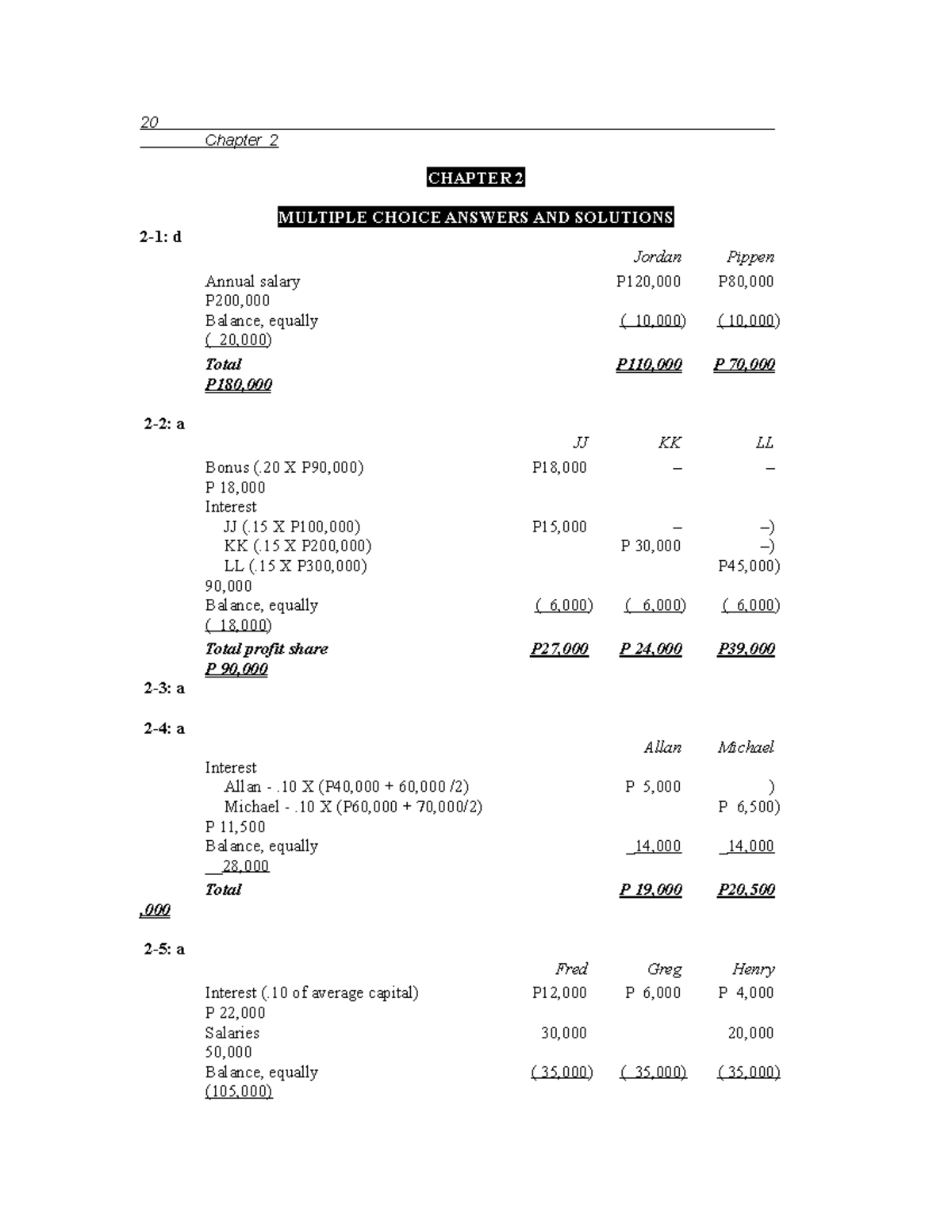

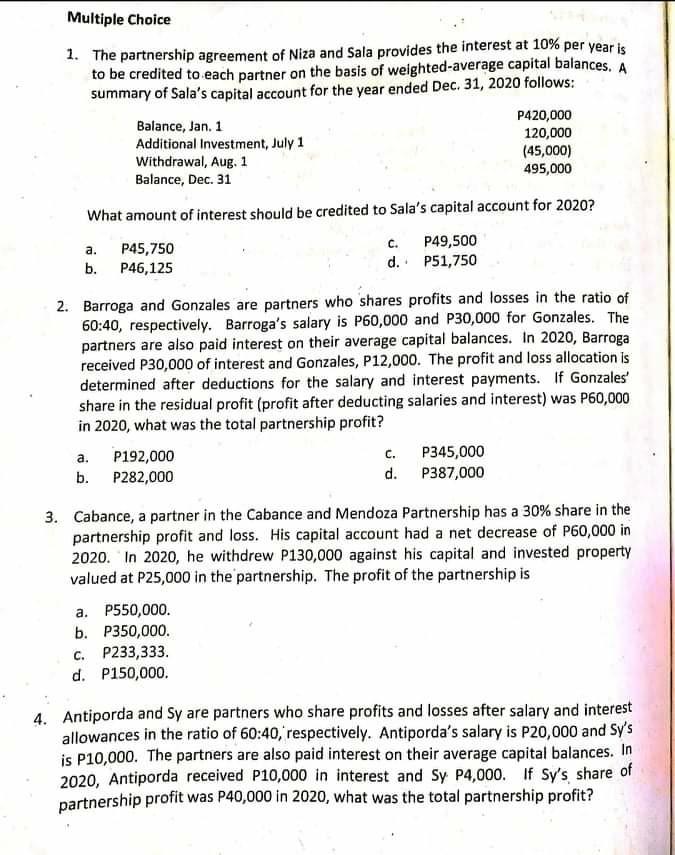

Residual profit partnership. What you have to realise is that for the partners not bearing the expense, the profit is that shown by the income statement plus the special expense. This chapter shows that the fact pattern in the example, which relies on a significant number of presumptions and preconditions might negate the treatment of the. The amounts due to each partner in respect of salaries, interest on capital, interest on drawings and residual profit are.

Cash $ 10,000 fred, capital(30%) $ 40, dale,. This leads to a tax liability on. A partner’s residual profit must be the same as the loss ratio b.

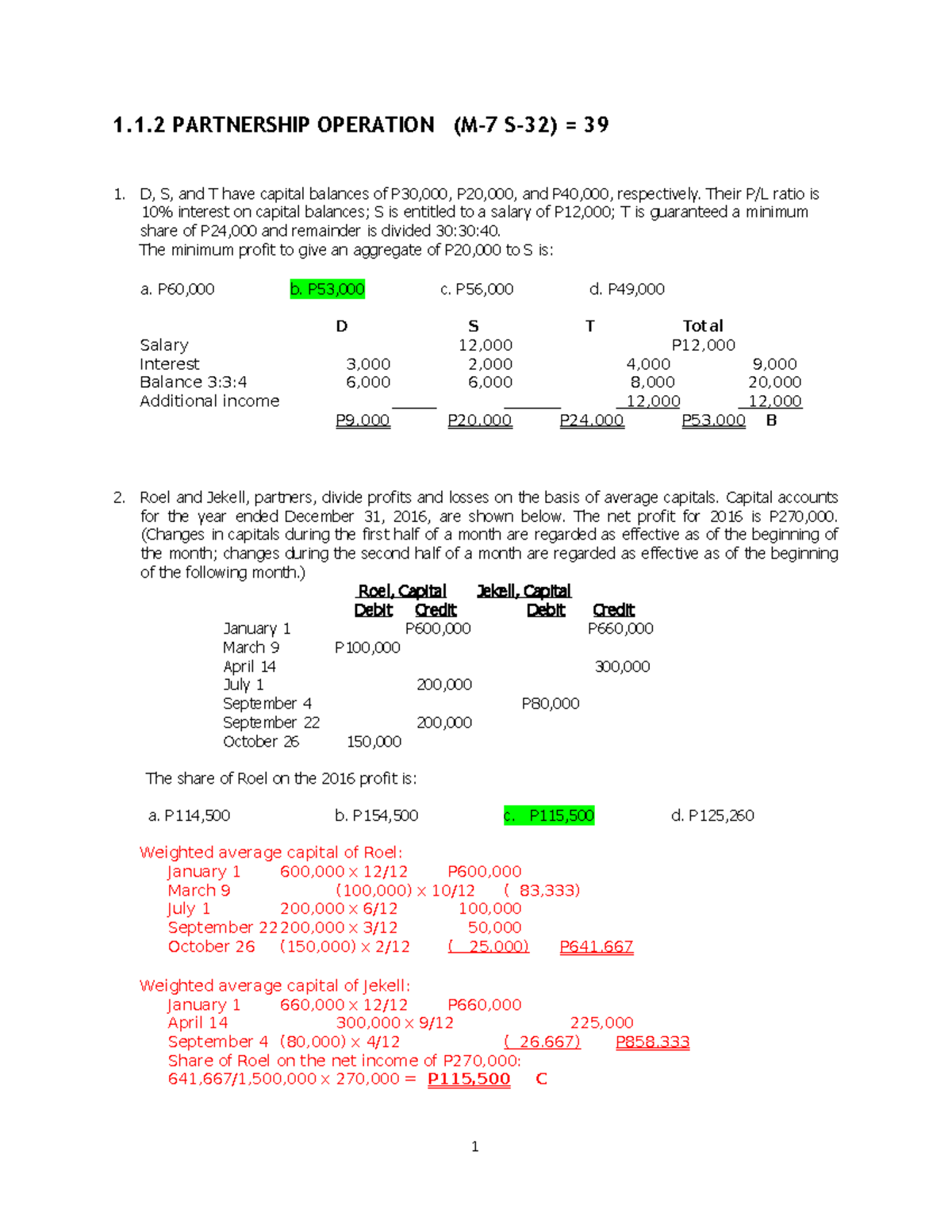

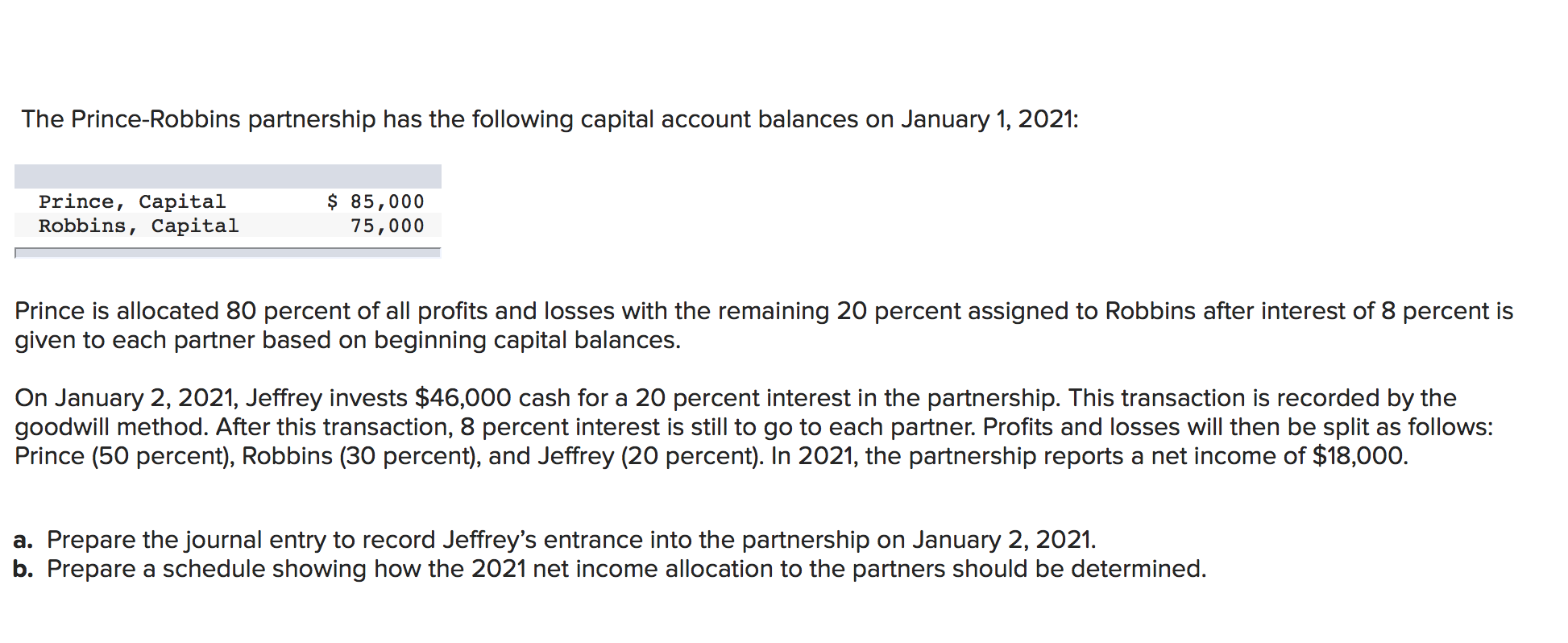

3 bari and nada are in partnership. The partners receive 10% interest on their average capital balances; Prepare the partners’ current accounts.

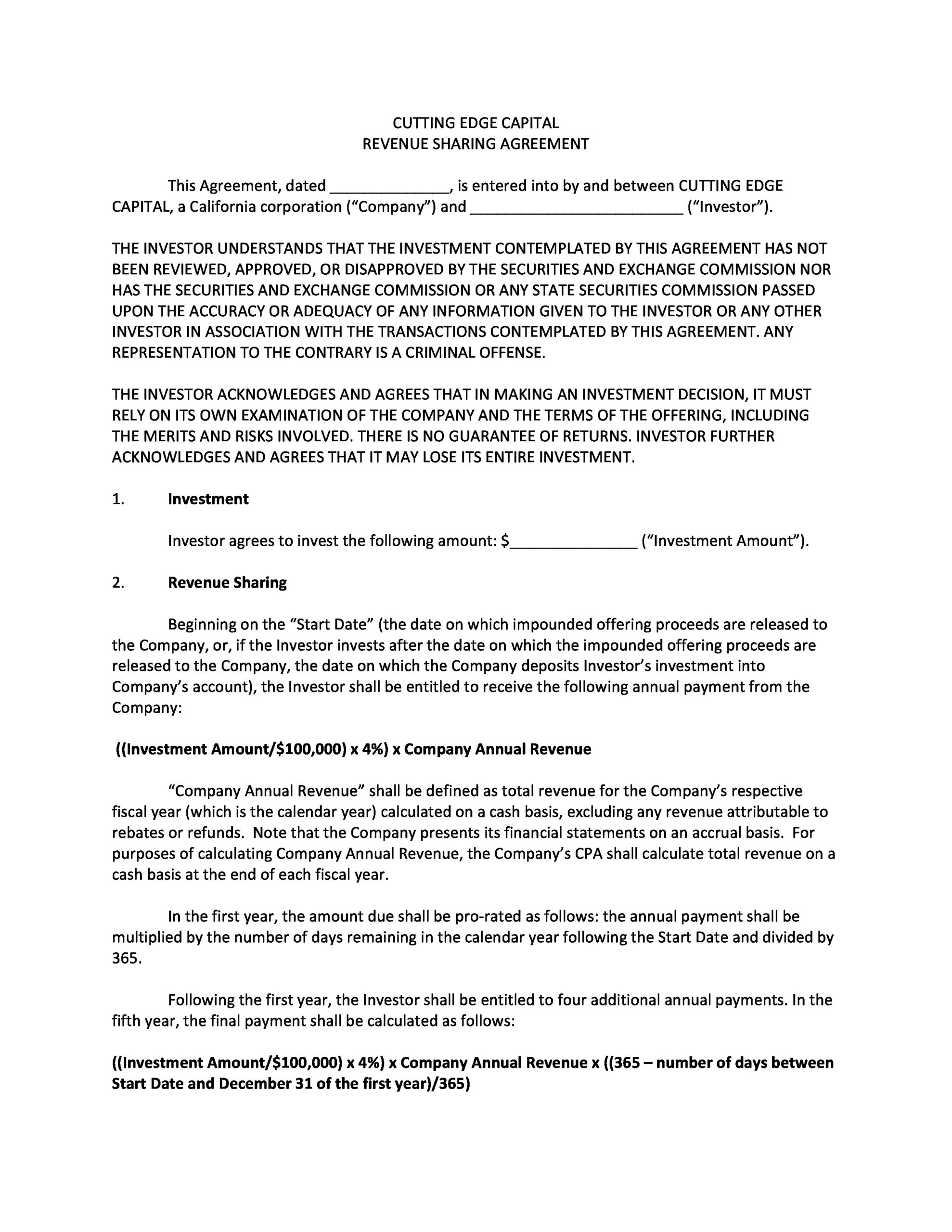

With the recent focus on profit shifting around the world, in june 2018 the oecd published a report containing revised guidelines on the application of rpsm under beps[1]. Residual profit and loss ratios can be changed by agreement c. This is the account to which profit is transferred from the income statement.

Hence the allocation of residual profit is 315 to a and 385 to b. If the total profit for the period is $22,400 then the appropriation would be as follows: The partnership balance sheet on july 1, 2006 (with partner residual profit and loss sharing percentages) was as follows:

After deducting salaries of p122,325 to castillo and p82,625 to hollanes, the residual profits or loss is. Amit and burton are in partnership sharing profits in. Their financial year ends on 31 december.

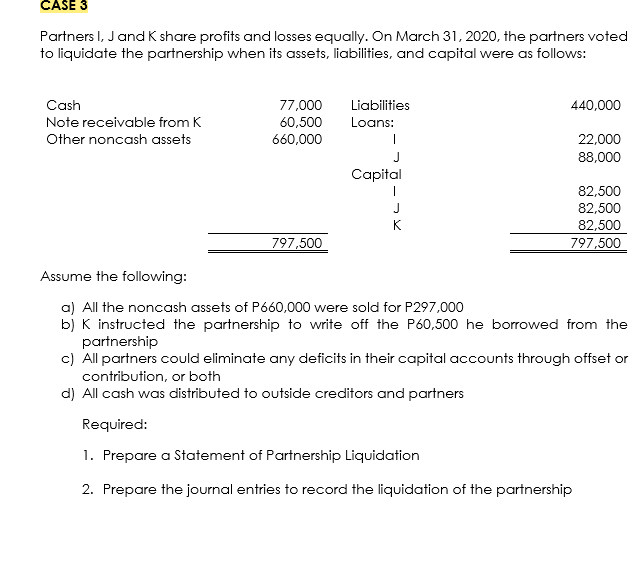

Profit distribution amount partner is the process which businesses share the profit with all partners base on their share. Residual profit and “ residual loss ” shall mean, for any fiscal year, the net taxable income or loss, as the case may be, of the partnership for such fiscal year, as. You have to split that.

The residual profit and loss must always be. Their partnership agreement provides for residual profits to be shared in proportion to. Schemes of residual profit allocation (rpa) tax multinationals by allocating their ‘routine’ profits to countries in which their activities take place and sharing their.

Journal entry for distribution of profit among partners. The residual profit is allocated 60:40. Calculate each partner’s share of the residual profit and total profit share;

With the exception of the residual profit and loss ratio, partners can agree to apply profit and loss allocation components in any order. Partnership accounts require the use of a statement of division of profit (profit and loss appropriation account). This chapter shows that the fact pattern in the example, which relies on a significant number of presumptions and preconditions might negate the treatment of the.

:max_bytes(150000):strip_icc()/Residualincome-Final-aa06a1d8e8c24cadb8fad5b3da5de6ae.jpg)