Neat Tips About Other Income In Balance Sheet

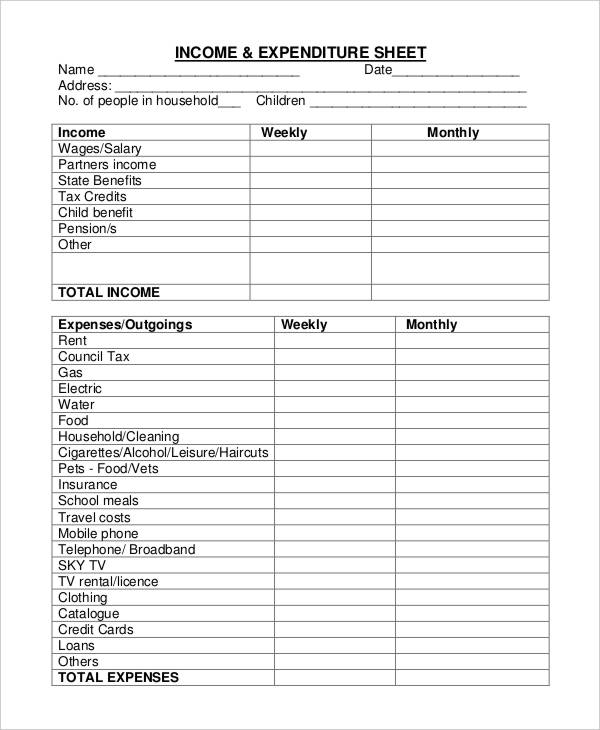

Enhance financial health using our free personal balance sheet template.

Other income in balance sheet. The answer is that each company presents this information differently. It is just like your bank balance. Example other comprehensive income includes many adjustments that haven’t been realized yet.

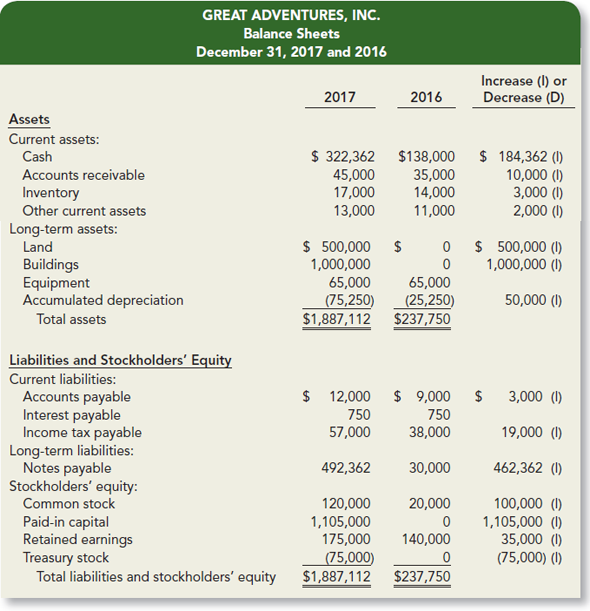

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business. Since other income is not revenue, where do we find it on the profit & loss statement (aka income statement)?

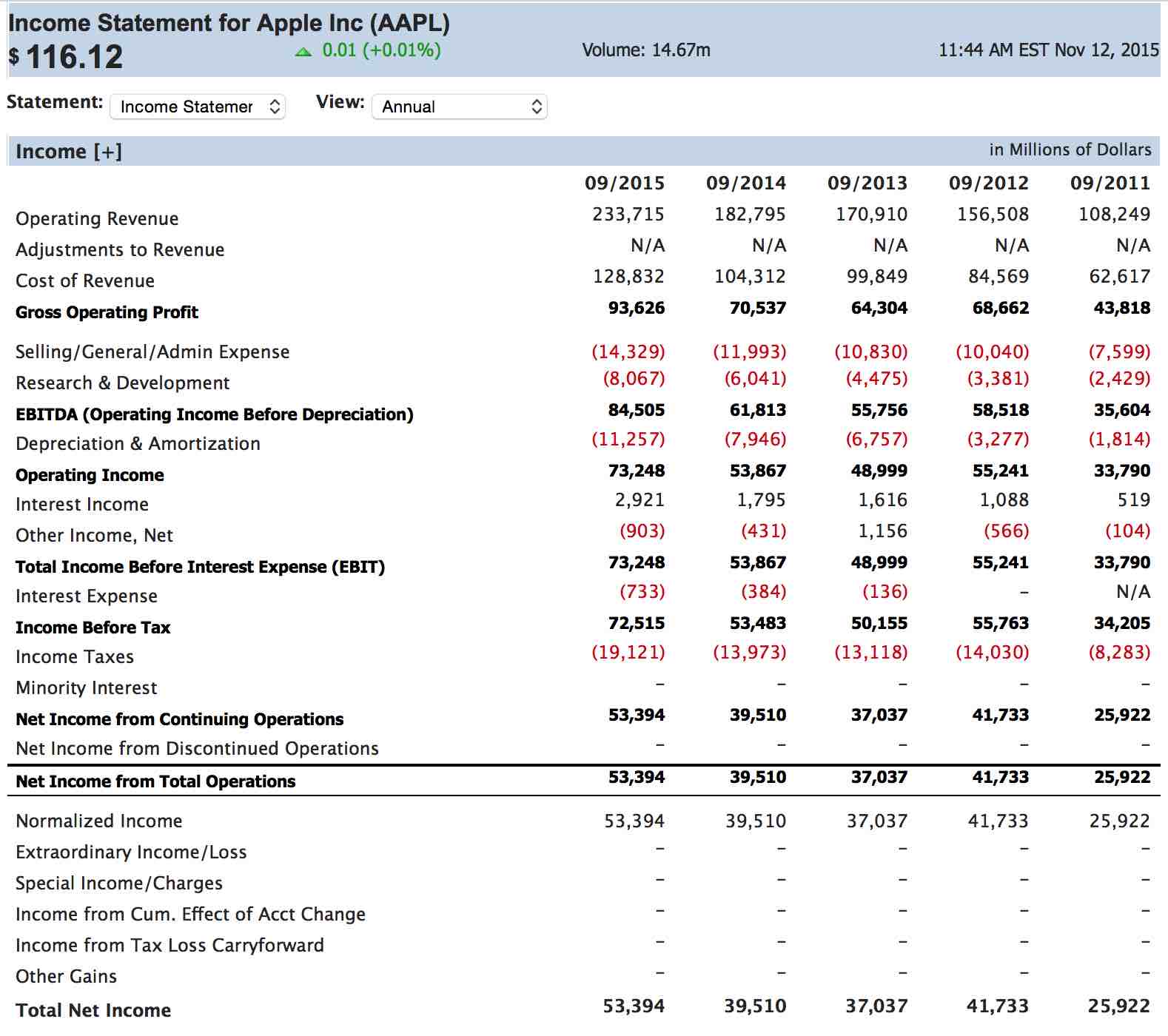

Comprehensive income and a change in terminology in the titles of financial statements. Membership and other income 1,474 1,305 13.0 % 5,488 5,408 1.5 % total revenues 173,388 164,048 5.7 % 648,125 611,289 6.0 % costs and expenses: Thus the result (net income) of the income statement feeds the retained earnings account on the balance sheet.

A balance sheet is a snapshot of your company’s net worth at a. That’s down slightly from the £5.9bn reported at the end of 2022. Retained earnings is also an element of the.

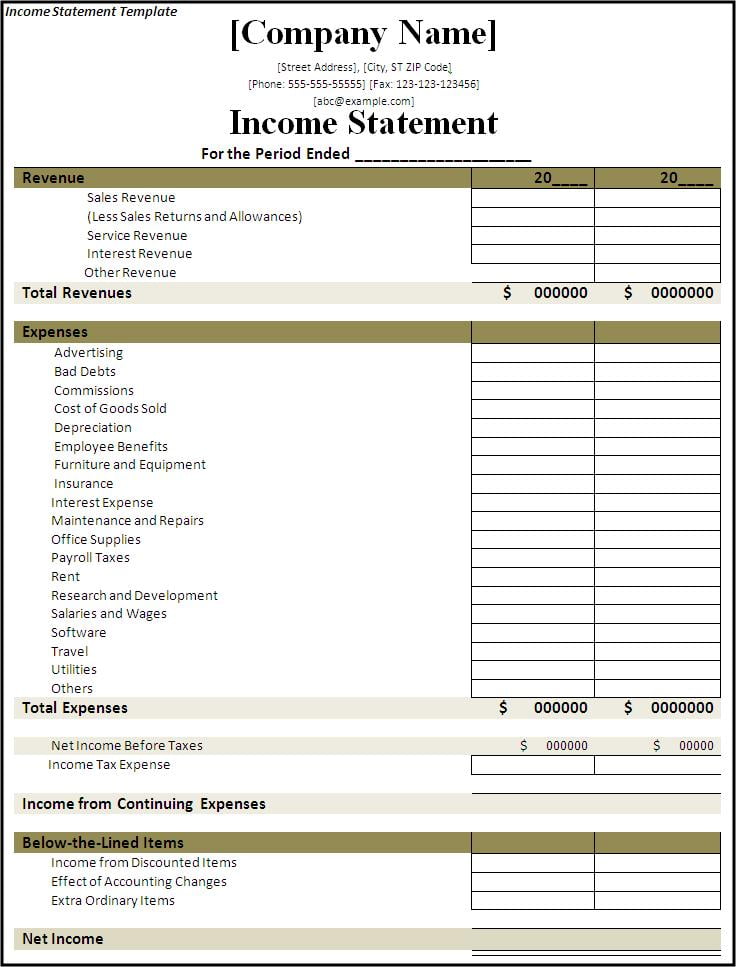

Income statement key elements metrics purpose timeframe uses why should you use financial models for balance sheets and. Other types of income that are commonly classified as other income. In june 2011 the board amended ias 1 to improve how items of other income.

These items, such as a company’s. When clear lake records an expense of $1,500, it must also record the other half of that. Balance sheet vs.

However, with the sharp increase in free cash flow generation, cash & equivalents on the balance sheet have. To a component of equity that is displayed separately from retained. Other comprehensive income (oci) refers to any revenues, expenses, and gains / (losses) that not have yet been realized.

Your bank balance is the sum of all the deposits and. Some show it at the top of the income statement, just below revenue, whereas others show it below operational expenses. Ias 1 sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such.

There is no specific accounting standard said about what kind of income should be recorded in the categories of other income; The income statement and balance sheet follow the same accounting cycle, with the balance sheet created right after the income statement. The balance sheet shows the cumulative effect of the income statement over time.

The interpretation of financial statements. The balance sheet. Accumulated other comprehensive income is displayed on the balance sheet in some instances to alert financial statement users to a potential for a realized.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)