Cool Tips About Expenses On A Balance Sheet

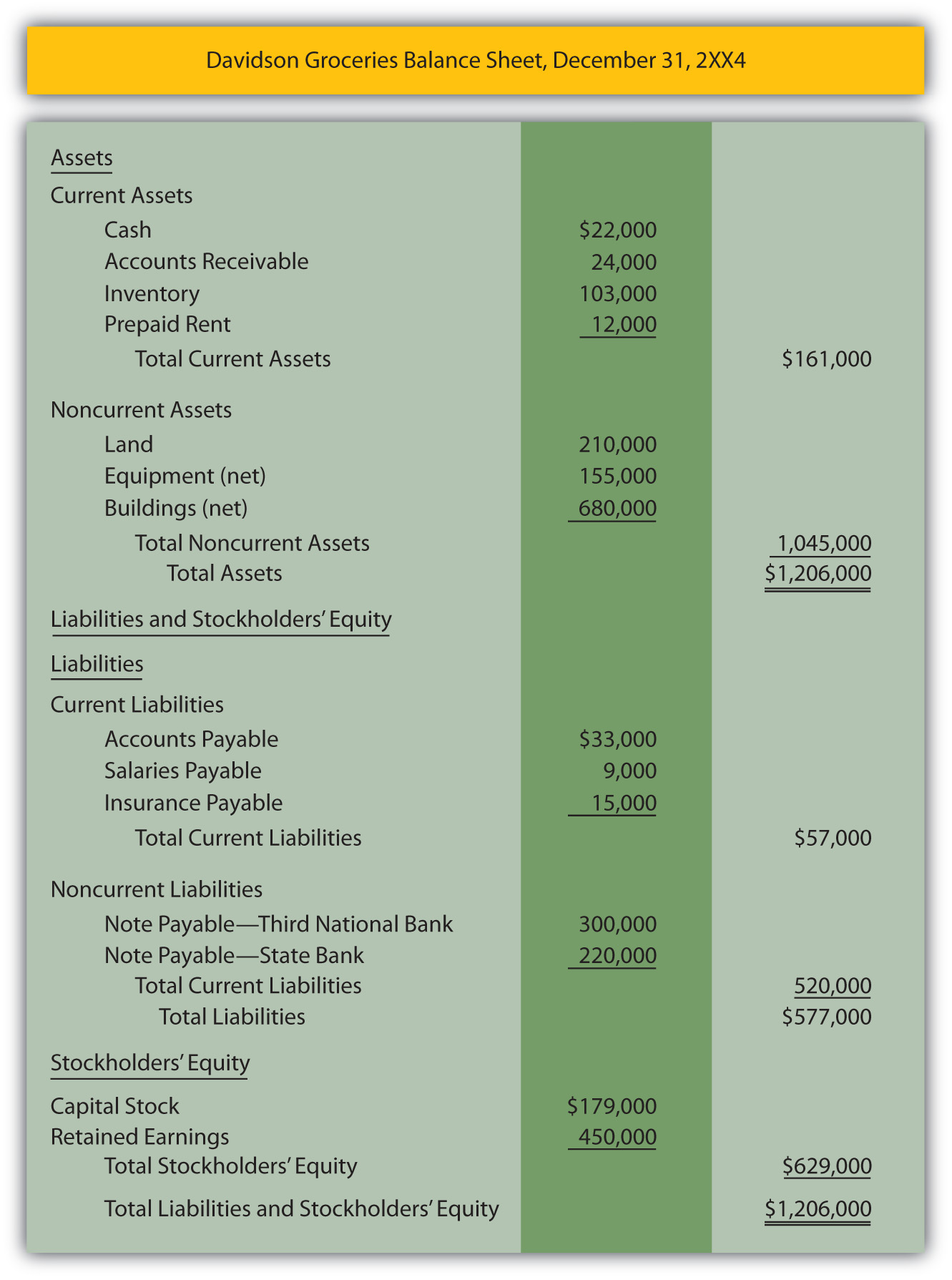

The amount of current assets over current liabilities is a company's working capital.

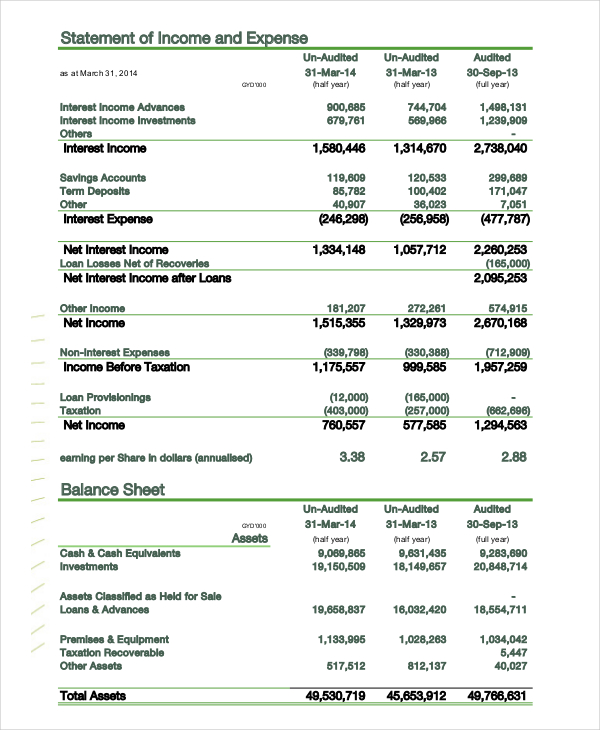

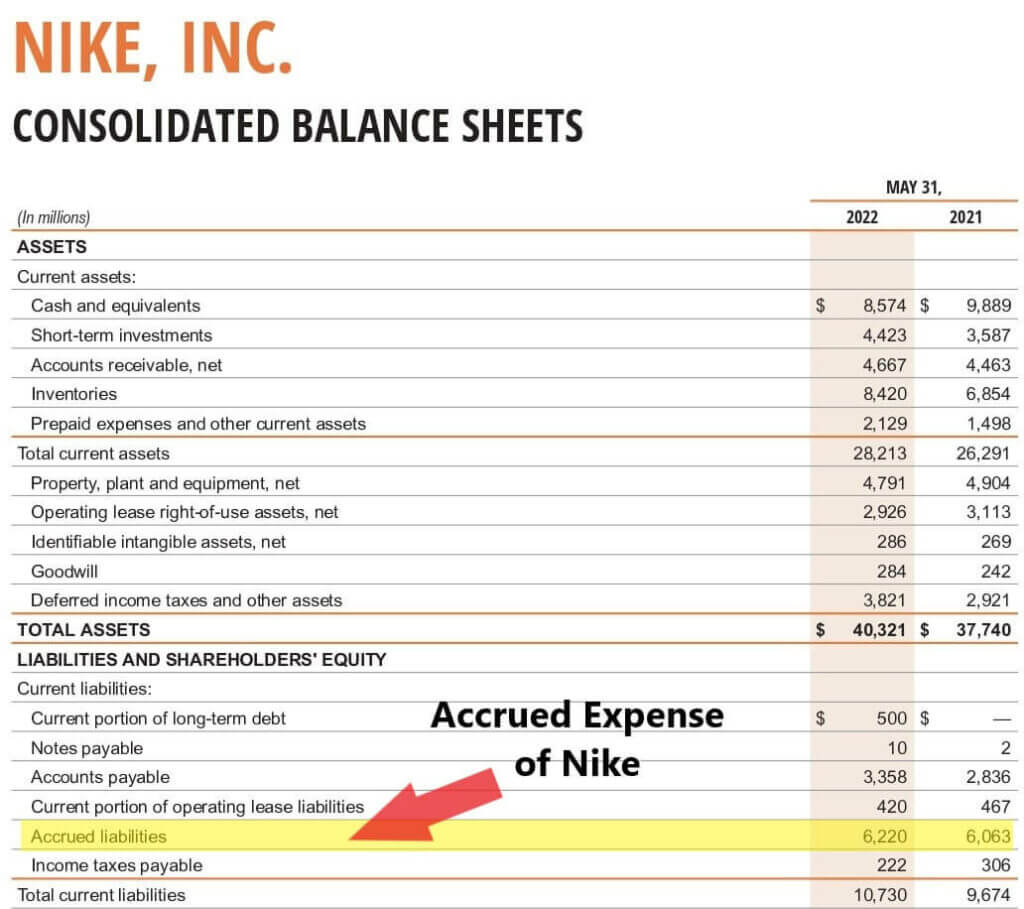

Expenses on a balance sheet. Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. The possible variations are: Depreciation and amortization expenses reflect the allocation of the.

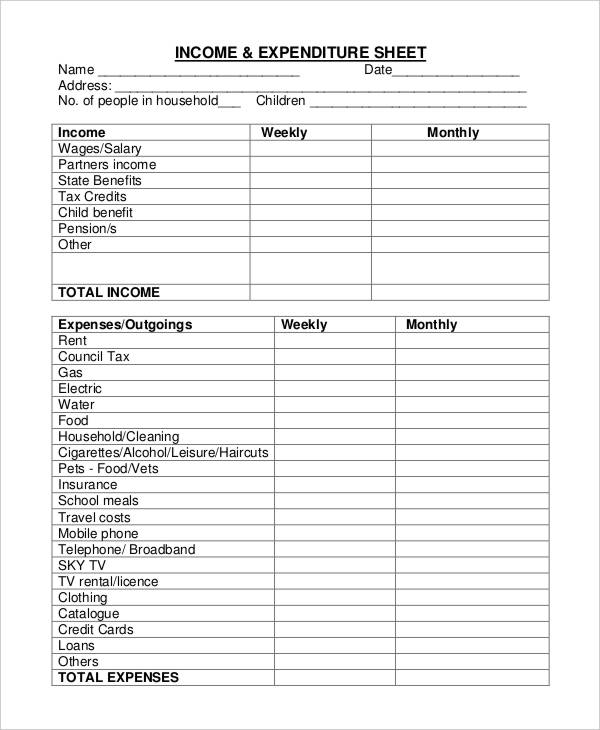

Hence, expenses are those income statement accounts that are debited to an account, while a corresponding credit is booked to a. Accrued expenses, also known as accrued liabilities, are costs that a company has incurred but has not yet paid. Written by cfi team what are prepaid expenses?

An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Cost of goods sold (cogs): How does an expense affect the balance sheet?

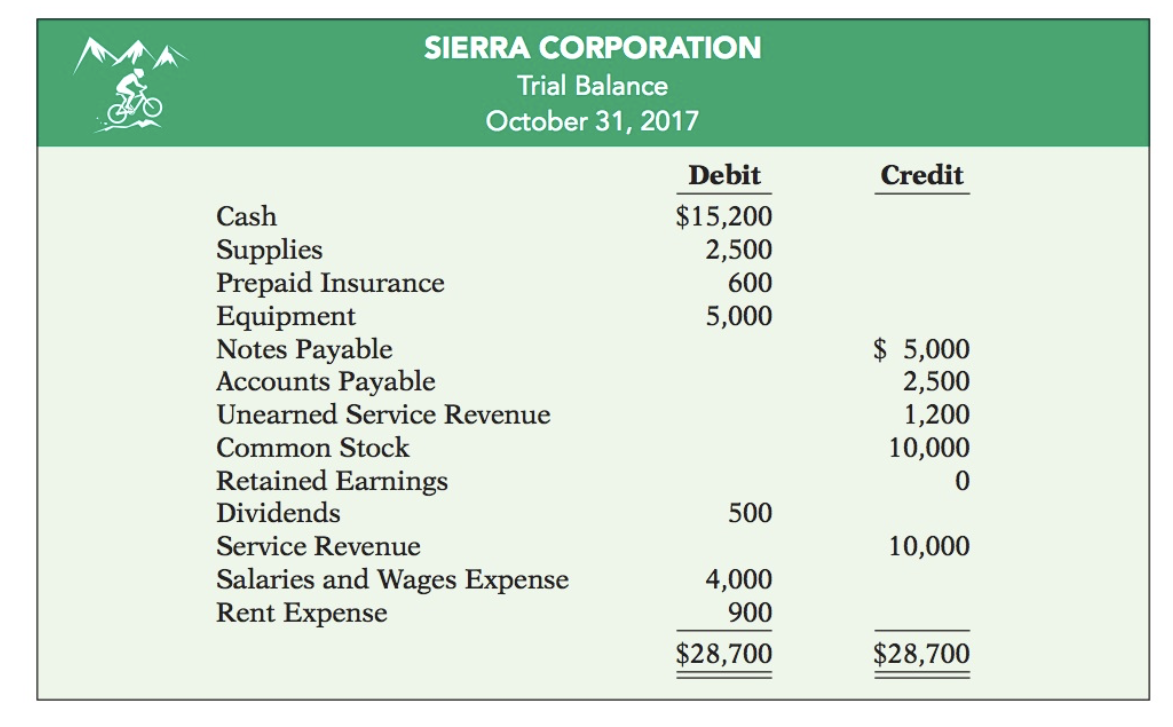

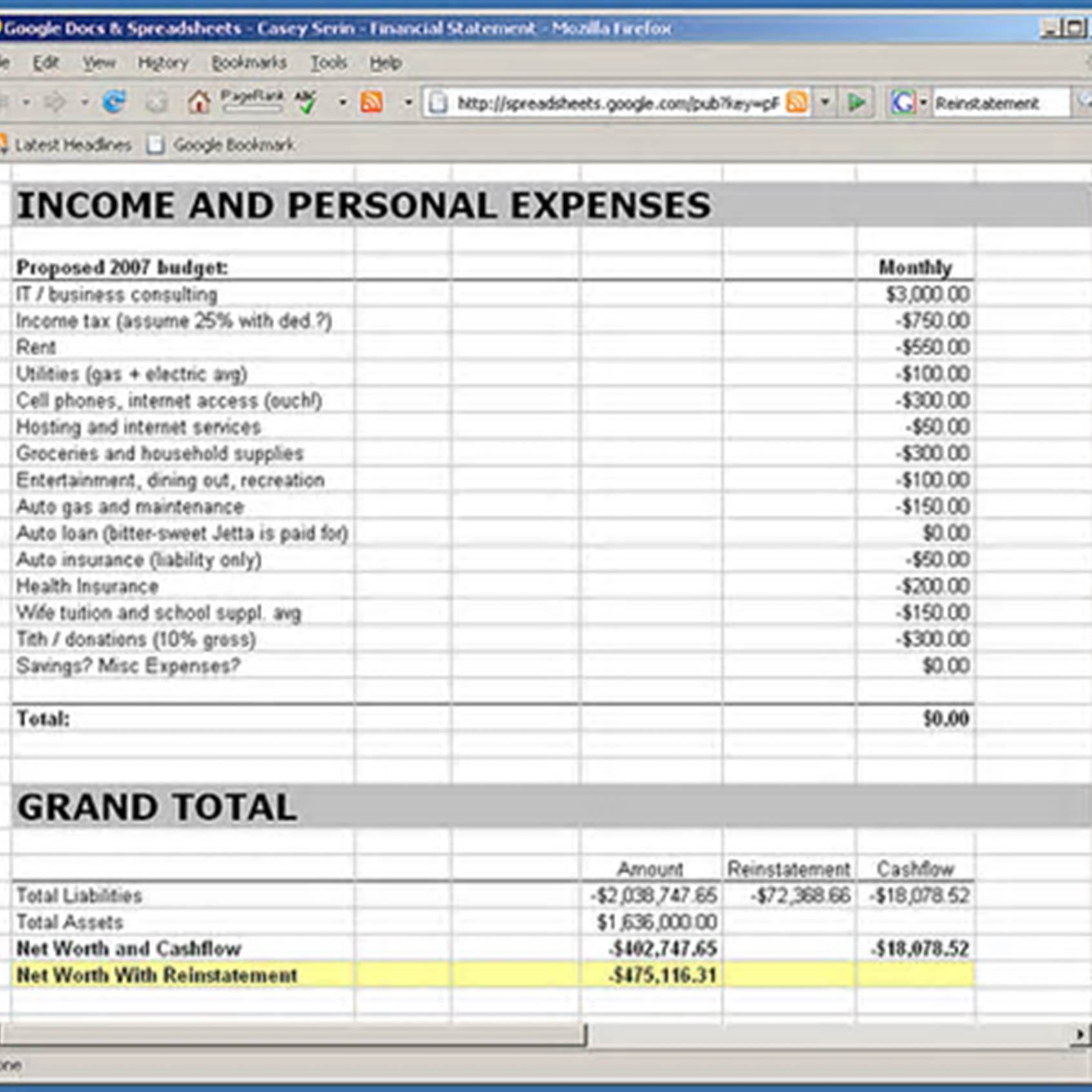

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Cogs represents the direct costs associated with producing or acquiring goods sold by a.

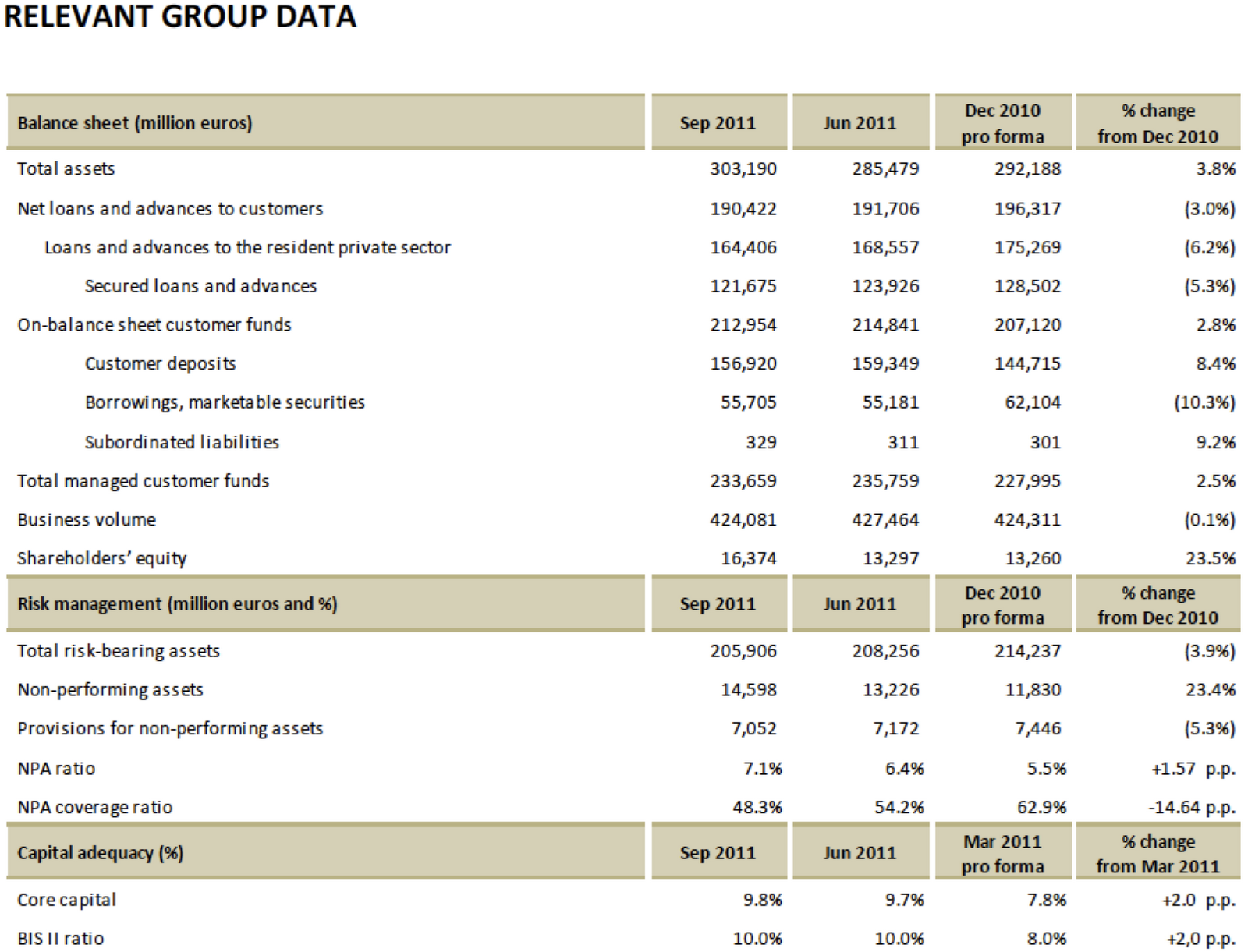

Banks also rely on balance sheets to determine a company's liquidity—the amount of cash and assets easily convertible to cash, such as a company's accounts receivable. The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. In other words, prepaid expenses are expenditures paid in one accounting period, but will not be recognized until a later accounting period.

Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for each. Option one is straight to the profit and loss statement, effectively bypassing the balance sheet. Secondly, it demonstrates that revenues will cause the stockholders' equity to increase and expenses will cause stockholders' equity to decrease.

These expenses can include salaries, interest, rent, utilities, and any other outstanding obligations. What is the balance sheet? One of the fundamental tenets of accounting is that this relationship between assets, liabilities, and owners’ equity must always be in balance (hence the name “balance sheet”):

In short, expenses appear directly in the income statement and indirectly in the balance sheet. Assets = liabilities + owners’ equity The second one is the opposite, where an item or group of items is booked at first to the balance sheet and then as the item is consumed it moves to the profit and loss statement.

The balance sheet is one of the three core financial statements that are used to. This connection between the income statement and balance sheet is important. Here are some examples of common expenses and their effect on the balance sheet:

Hence, the balance sheet is often used interchangeably with the term “statement of financial position”. Balance sheets are typically organized according to the following formula: Most expenses are recorded through the accounts payable function, when invoices are received from suppliers.