Looking Good Tips About Forex Market Consolidation

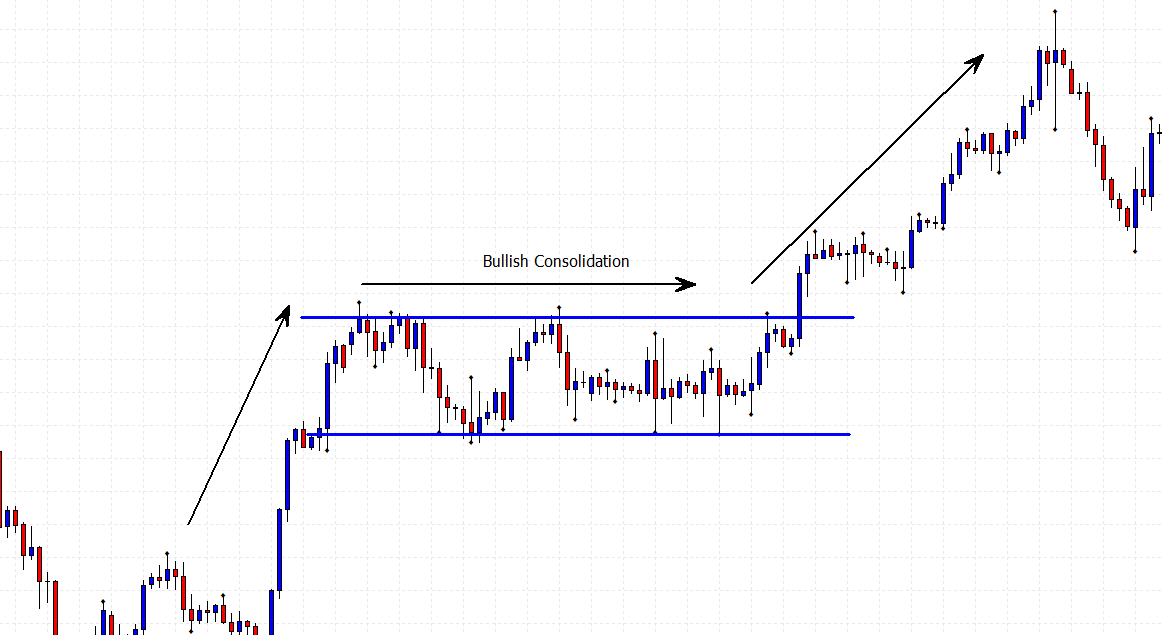

Price has “ consolidated “.

Forex market consolidation. It frequently occurs after downtrends or uptrends and can be seen as a stretch of indecision. Turkey’s central bank held its key interest rate on thursday, keeping it at 45% despite soaring inflation after eight consecutive months of hikes. Yesterday, the s&p 500 index retraced more of its last week’s advances and a rebound from the last tuesday’s local low of 4,920.31, declining by 0.60%.

Political instability, geopolitical tensions, elections, and policy changes can all affect forex markets. It is also referred to as a trading range, a sideways trend or a. Consolidation in the forex market is driven by various factors, with one primary cause being professional traders capitalizing on their profits.

It shows a lack of trend and often signifies indecision among the market participants. Trading the consolidation pattern in the forex market volume. One such pattern that every forex trader should be familiar with is consolidation patterns.

Traders using indicators like moving averages who may well have been in a. The first step is to identify the upper and lower boundaries of the consolidation range. Bullish momentum targets $2,030 amid consolidation.

Instead, its price is only experiencing rangebound price activity. During the wednesday training session, the gold market was optimistic as we continue to witness a notable rally. Consolidation is a common term used in the forex market to describe a phase where the price of a currency pair moves within a specific range.

Forex trading is a fascinating and potentially profitable venture. Forex consolidation analysis is a crucial aspect of trading in the foreign exchange market. How can we anticipate these consolidation periods and protect our trading accounts?

The move was widely expected as the bank. During consolidation, the price of a currency pair will fluctuate within a specific range, creating a trading channel that traders can use to make profitable trades. Monitoring volume is an important aspect of trading consolidation patterns.

This is also seen as market indecisiveness. Uncertainty surrounding political events can cause traders to adopt a wait. As institutional traders who have been in profitable positions during the trend.

During consolidation, traders may observe a lack of clear trend direction and see price action characterized by repeated testing of support and resistance levels. Dealmaking is on the rise as oil and gas producers are looking to improve longevity of inventories at low cost, and focus on cash that can be returned to shareholders. However, to succeed in the forex market, one must have a deep understanding of various trading patterns and strategies.

In forex trading, consolidation refers to a period where prices move within a confined range, showing neither a distinct upward nor downward trend. A market’s price during a period of consolidation will still fluctuate, but it won’t break out of a certain price range. Forex is one of the most consolidation heavy markets out there, if not the most.