Fun Info About Increase In Working Capital Cash Flow

It’s different from net profit in that it also includes the money.

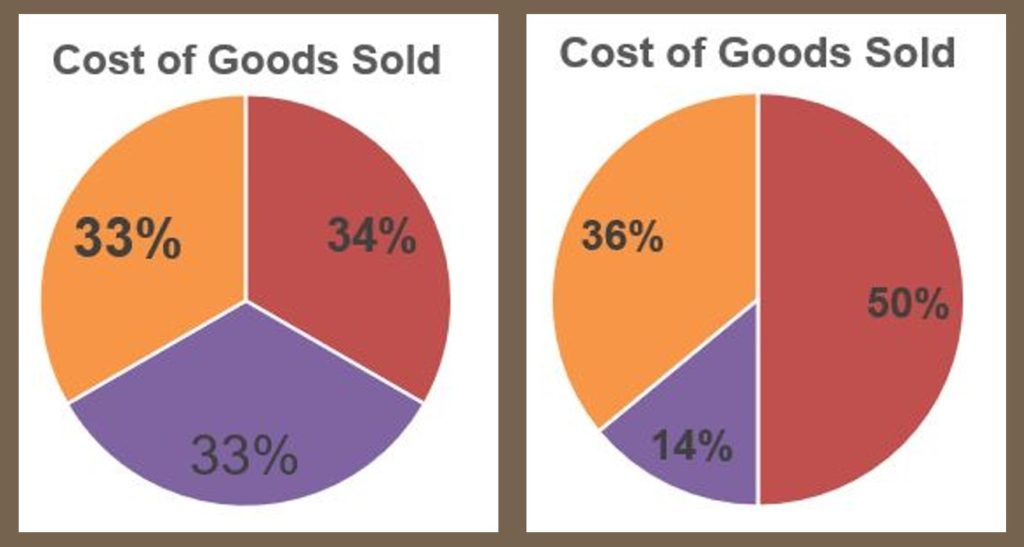

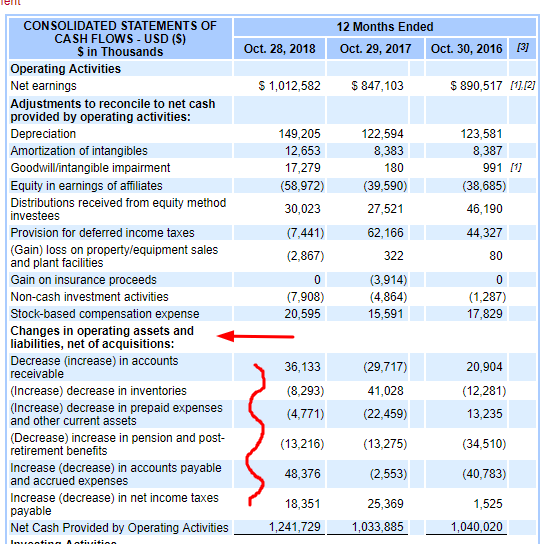

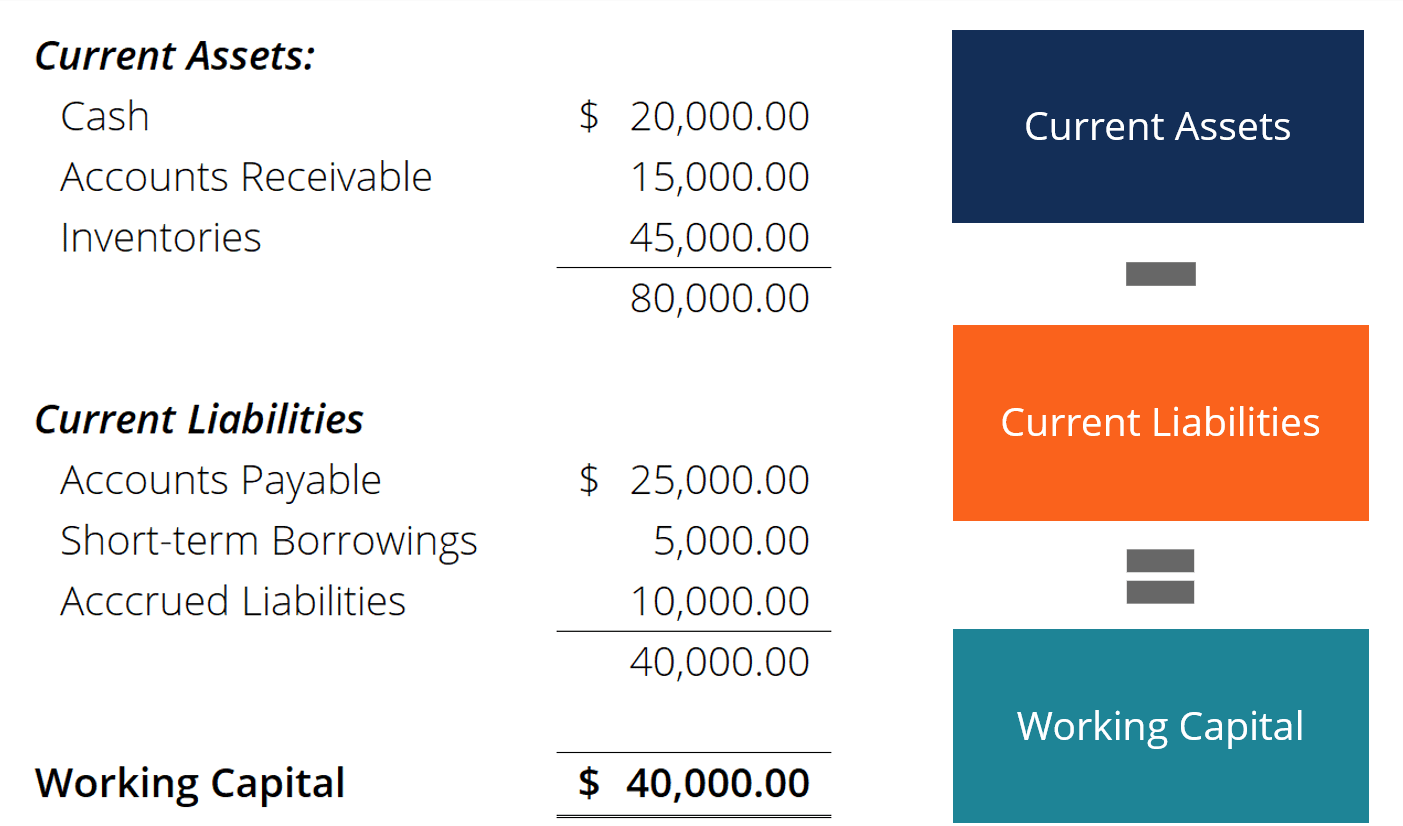

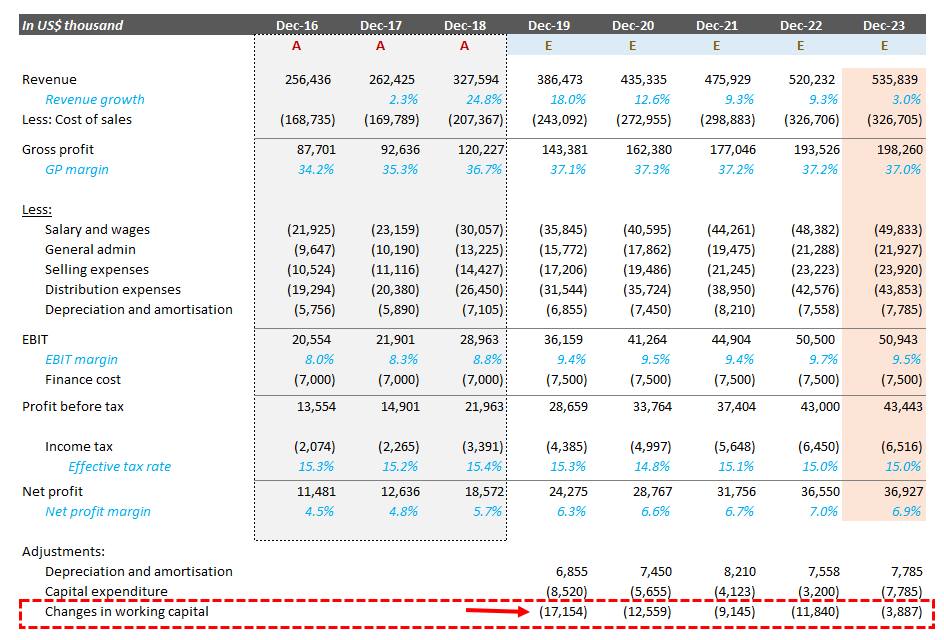

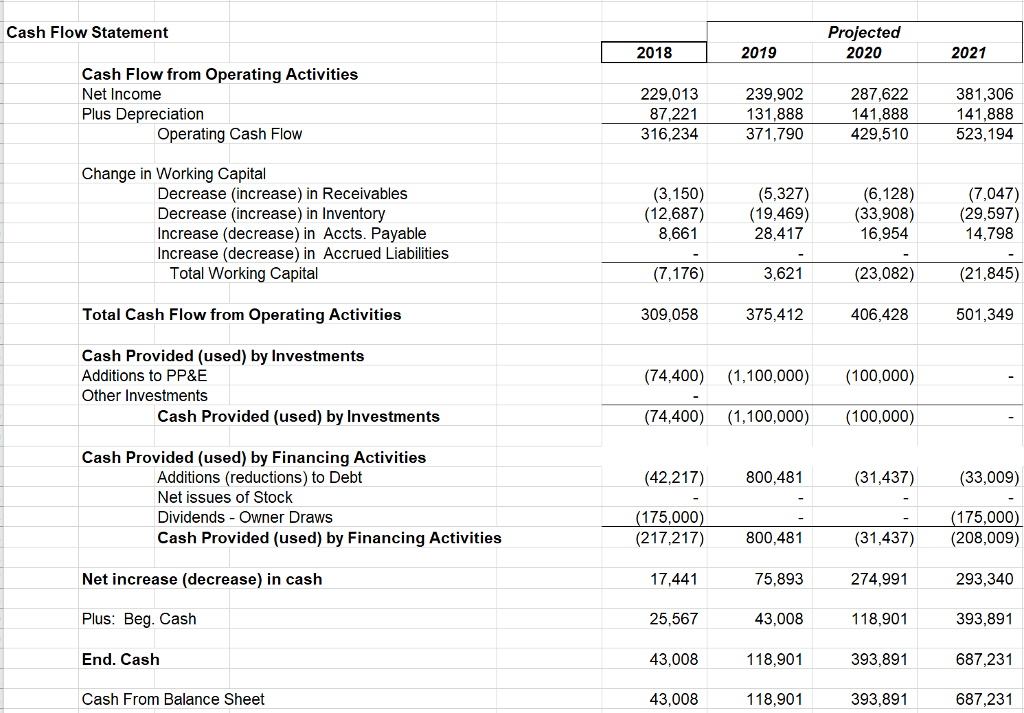

Increase in working capital cash flow. The reason why we subtract out the change in working capital is the fact that we would either come up with a decrease in cash flows if the change is positive or an increase in cash flows if the change is negative. Fcf calculation example using changes in working capital; The difference between a company's current assets and its current liabilities).

Both actions represent cash outflows. Some companies build up inventories, pay down liabilities, or extend their repayments to vendors to. With no changes in working capital accounts, no additional capital expenditures, and in the absence of issuing debt, the company has generated $5 million of cash flow in this period.

A renewed focus on cash flow forecasting Buying additional inventory) or decrease its current liabilities (e.g. Decrease liabilities and improve assets to improve cash flow, decrease your liabilities and improve your assets.

Actual working capital decreases; How is working capital presented on the cash flow statement? When a business’s accounts receivable (money owed to it by customers) increases, it represents sales made on credit.

Therefore, companies that are using working capital inefficiently or need extra capital upfront can boost cash flow by. Add the change to cash flow for owner earnings; The level of and changes in working capital are more interesting at the end of the year to assess the operational performance of the company.

For everyday use, the control of cash flow is therefore of greater importance. Any type of operational cash outflow needs to be subtracted from net income in order to arrive at free cash flow. Cash flow plays a particularly important role here, as it has a direct impact on working capital.

Positive changes in working capital (increase in current assets or decrease in current liabilities): The incremental increase in net working capital (nwc) implies more cash is tied up in operations, reducing the free cash flow (fcf) of a particular company. Here’s how changes in working capital affect cash flow:

Last but not least, one of jack’s final tips for how you can improve your cash flow and working capital is simple; Could retailers manage working capital through sustainable cash flow improvements? Conversely, negative working capital increases cash flow.

In the coming years they will need to deal with inflationary pressure, higher costs across areas like freight and utilities, and dampened consumer demands. Last but not least, one of jack’s final tips for how you can improve your cash flow and working capital is simple; Briefly, an increase in net working capital (nwc) is an outflow of cash, while a decrease in net working capital (nwc) is an inflow of cash.

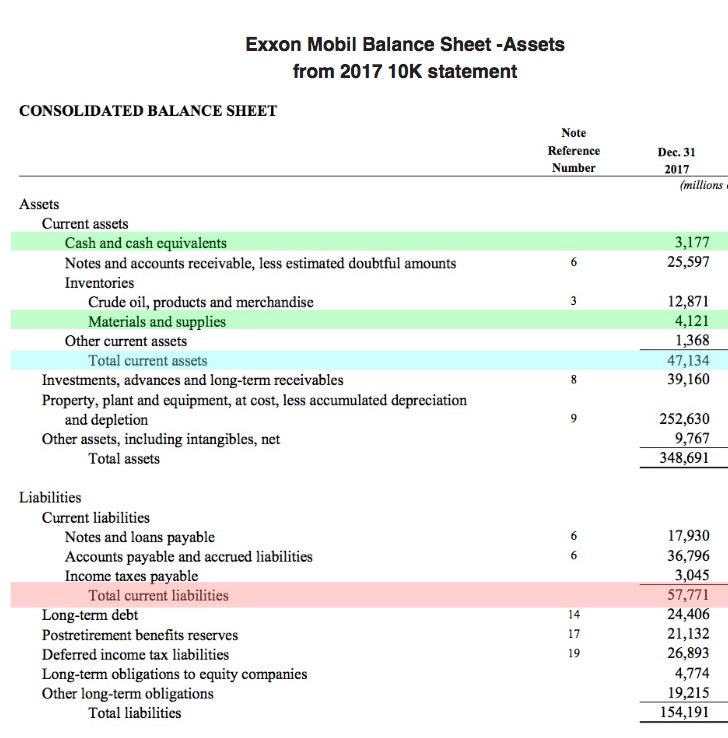

Whereas cash flow describes the money moving in and out of your company within a given timeframe, working capital instead compares your business’s assets and liabilities. Working capital would also increase by $20 billion and would be added to current assets without any debt added to current liabilities; Understand how to sharpen your focus on cash flow management and optimise working capital to relieve the pressure on liquidity during times of economic turbulence.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)