Amazing Info About Trading Balance Sheet

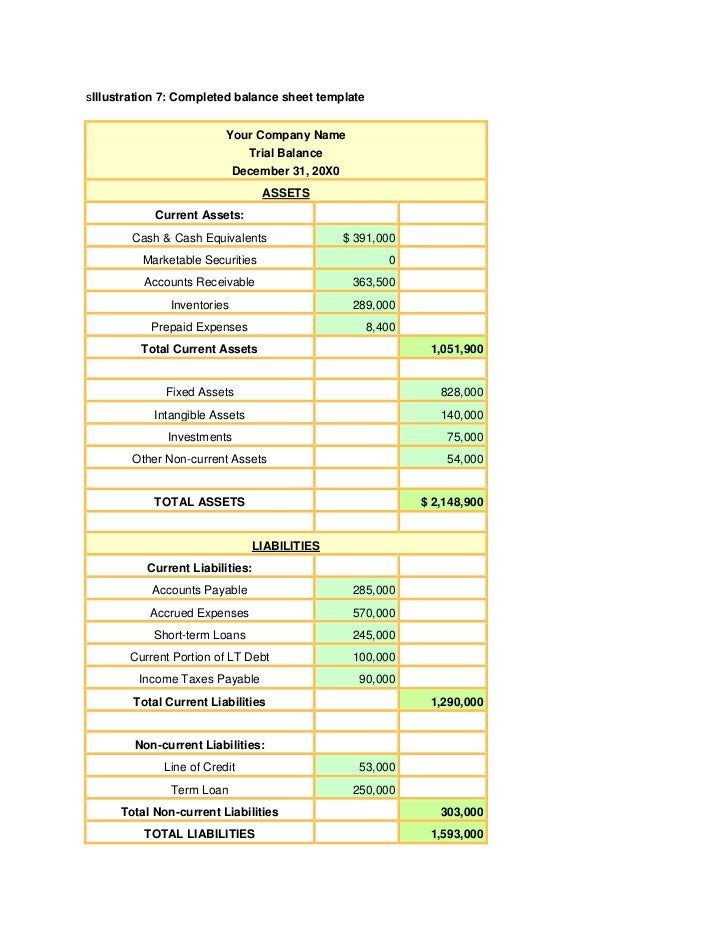

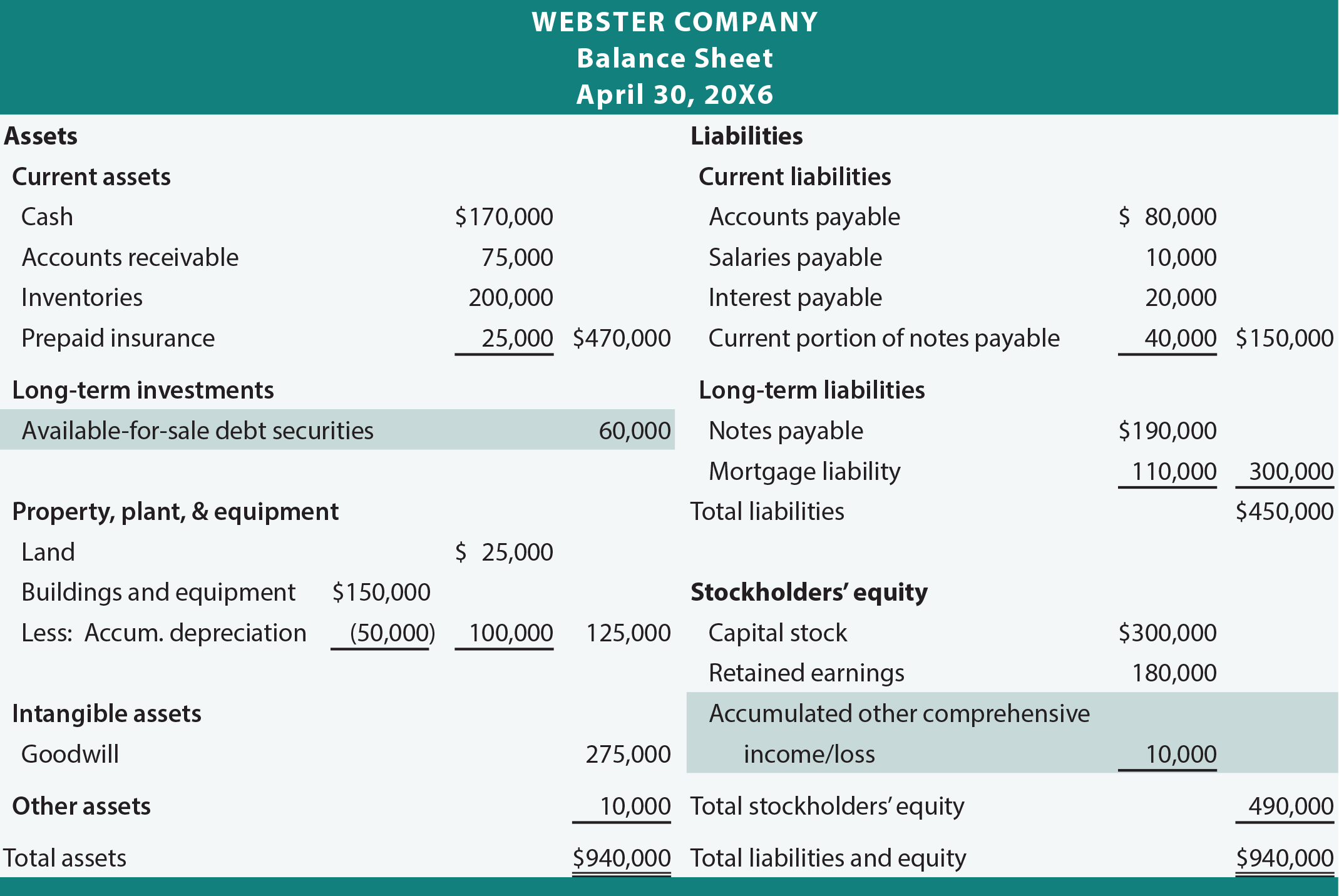

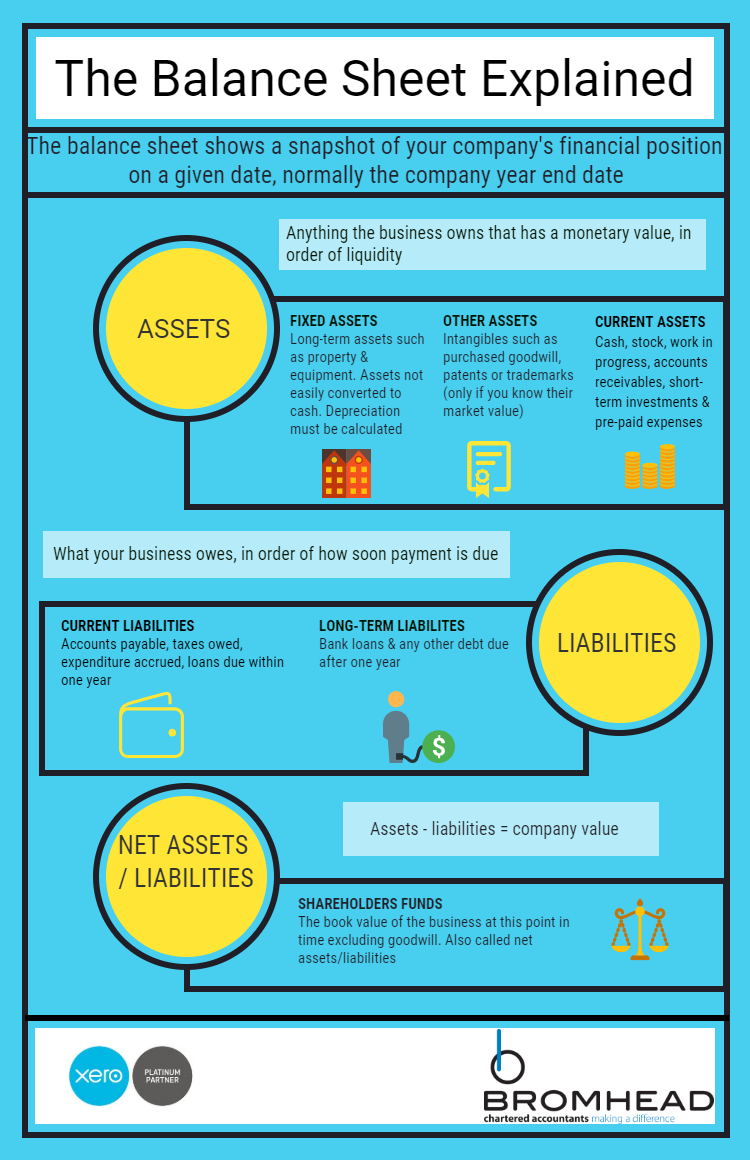

The balance sheet is based on the fundamental equation:

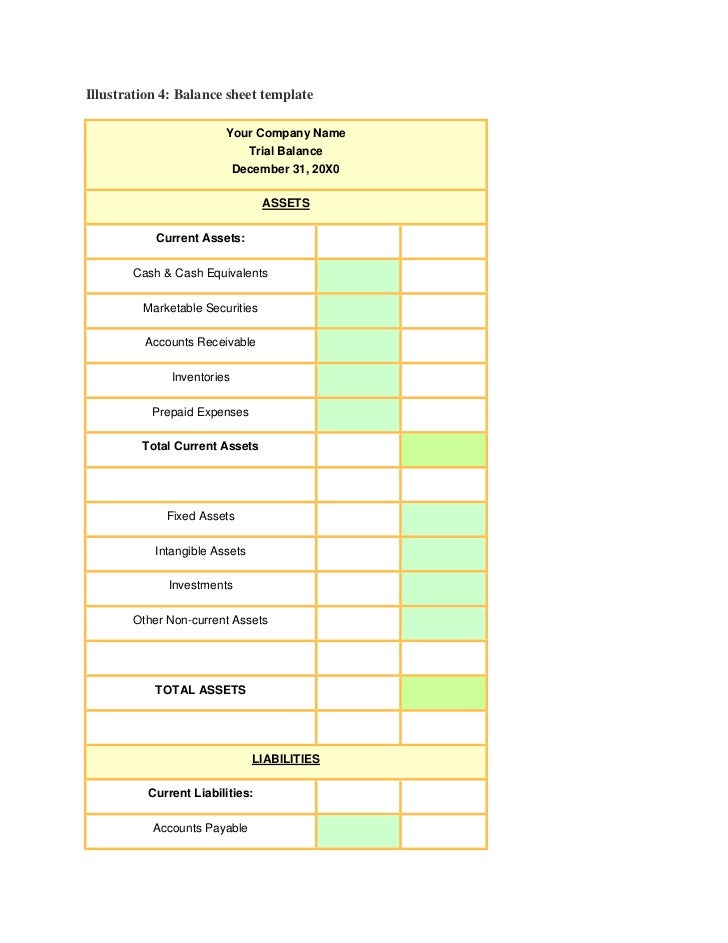

Trading balance sheet. Trading assets are found on the balance sheet and are considered current assets because they are meant to be bought and sold quickly for a profit. Figure 12.3 shares of bayless (a trading security) adjusted to fair value at. Trading securities in the balance sheet are the fastest moving securities among all three.

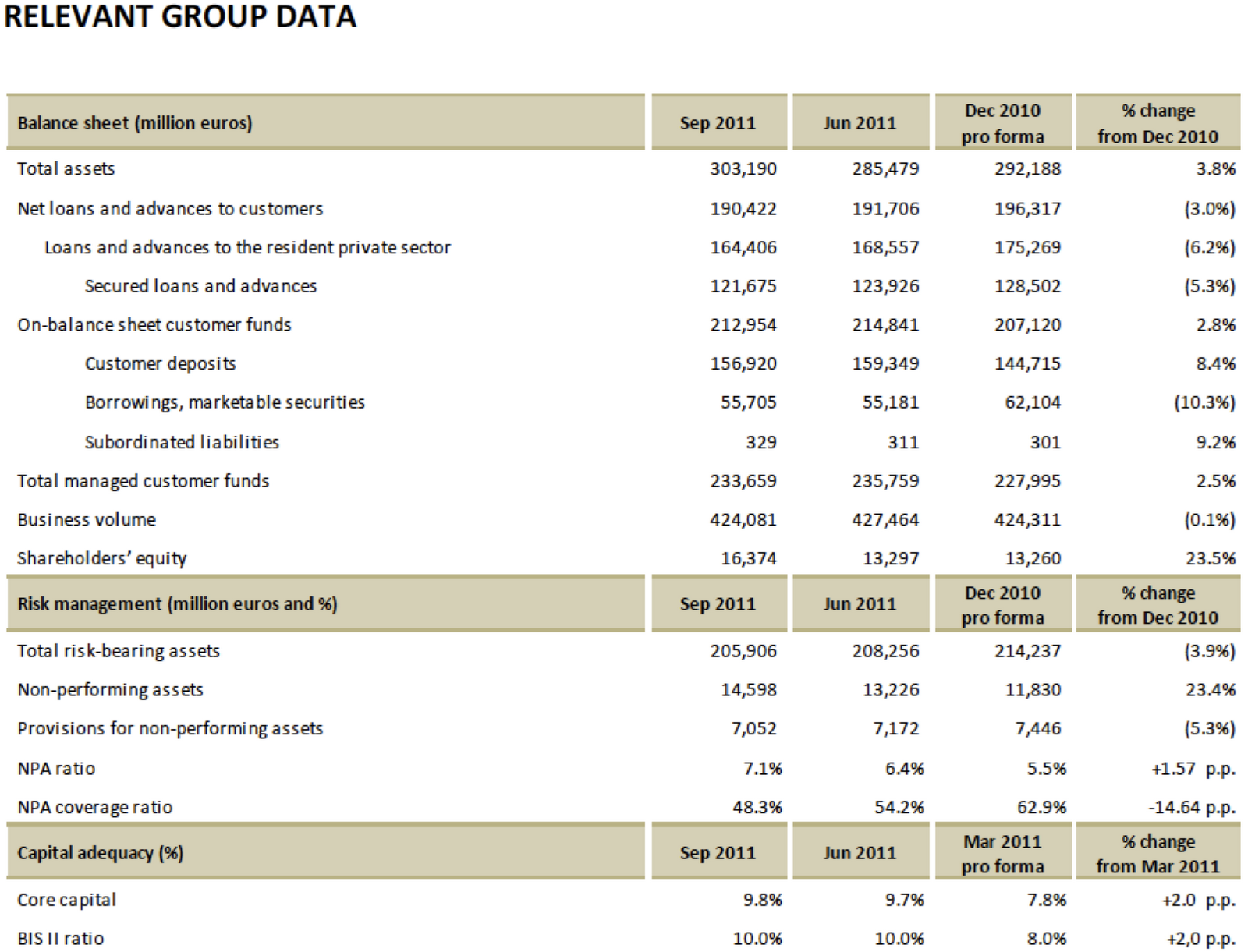

It provides a basis for computing rates of return and evaluating the company's. Fed minutes suggest officials are seeking smallest balance sheet possible. When trading, pay close attention to the liquidity position of the company.

Those numbers won’t even begin to be meaningful until you’ve. As the price dropped from $50 to $40, there was an unrealized loss of $10 per. That is, the value of a firm’s assets must equal the value of its liabilities plus the equity attributable to shareholders.

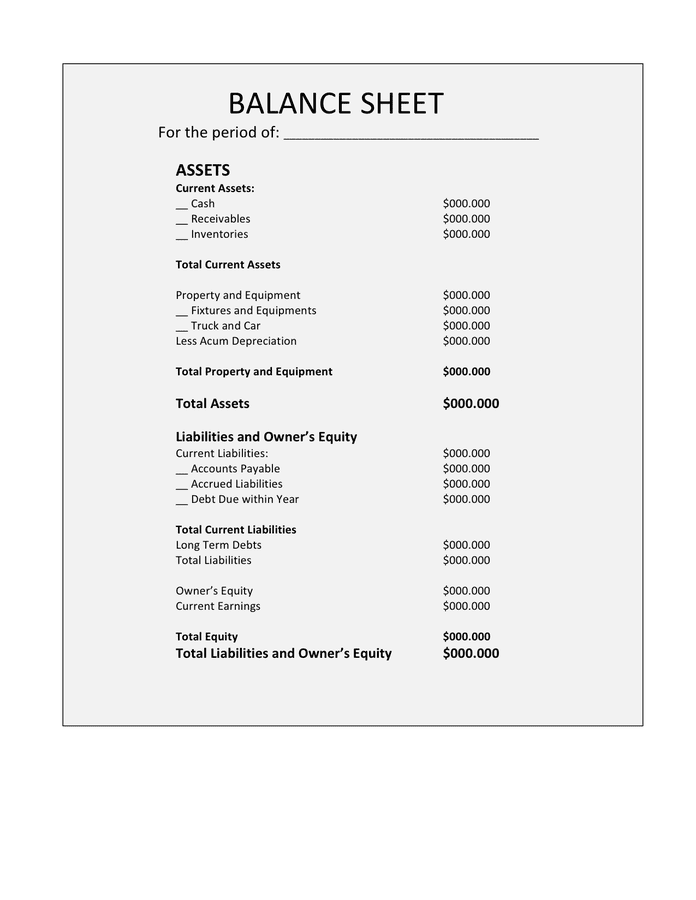

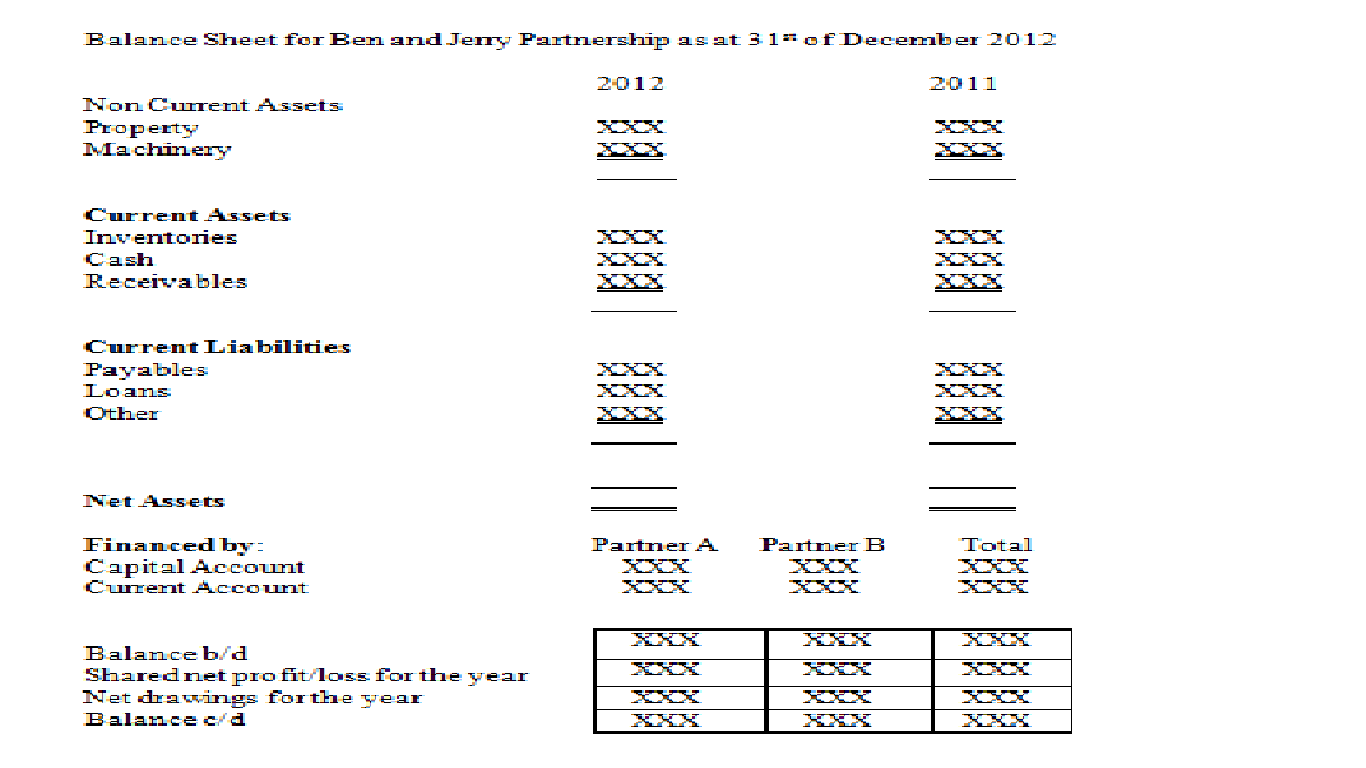

A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday. Assets = liabilities + equity.

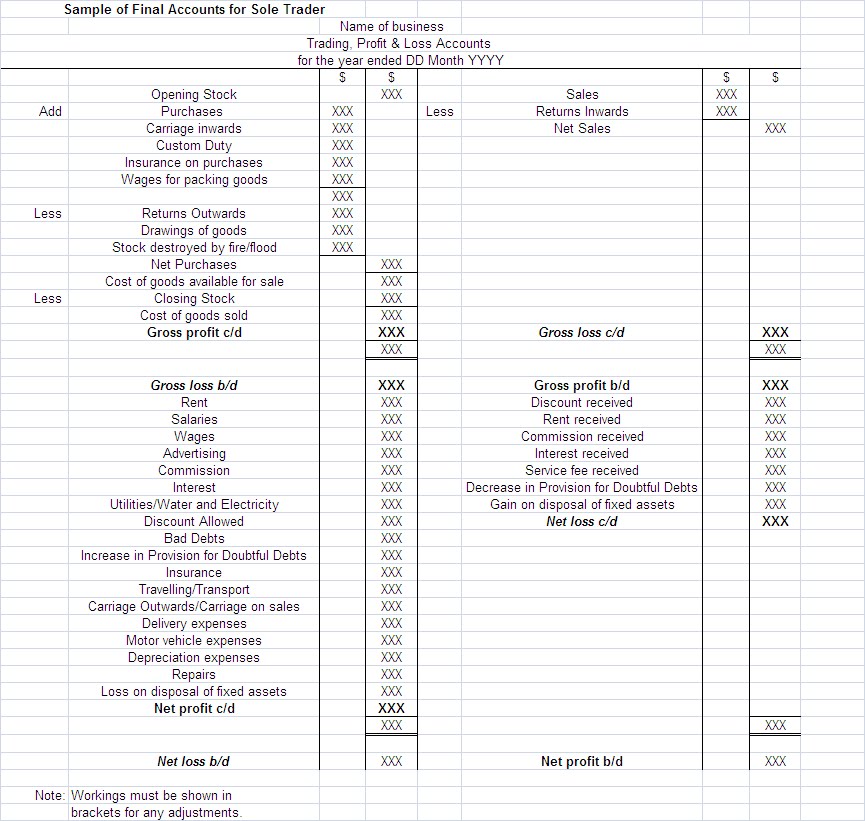

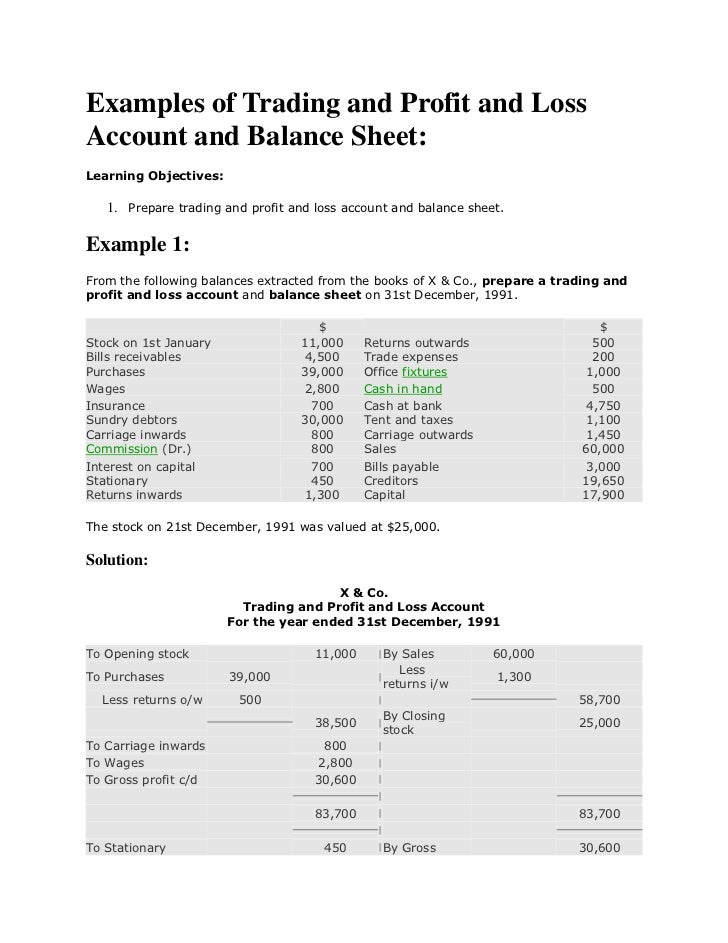

It determines the gross profit or gross loss of the concern for that accounting year. Preparing a trading account is the first stage in of final accounts of a trading concern. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

It is allowing up to $95 billion in treasury and mortgage bonds to. 50m+ traders and investors use our platform. The recorded value of the trading security in the balance sheet is $50, so when the price of john steel’s share drops to $40, then the fair value of the trading securities will change in the balance sheet, and the unrealized loss will have to be recorded in equity.

Hy unaudited npat is projected to be in range of nz$21.0 million to nz$21.5 million. Gaap requires investments in trading securities to be reported on the balance sheet at fair value. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero.

The current size of the fed's balance sheet is $7.7 trillion. A balance sheet is one of the financial statements of a business that shows its financial position. The report can be used by business owners, investors, creditors, and shareholders.

The balance sheet, together with the income. The current size of the fed's balance sheet is $7.7 trillion. For example, a firm that bought company abc’s shares for $3 million.

Zae000005443 (pick n pay or the company) sales and balance sheet update for. Since trading assets are valued at a market value, the value is periodically updated on the balance sheet according to price movements. Tips to trade with the help of a balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)