Awesome Info About Nsdl For Tds Payment

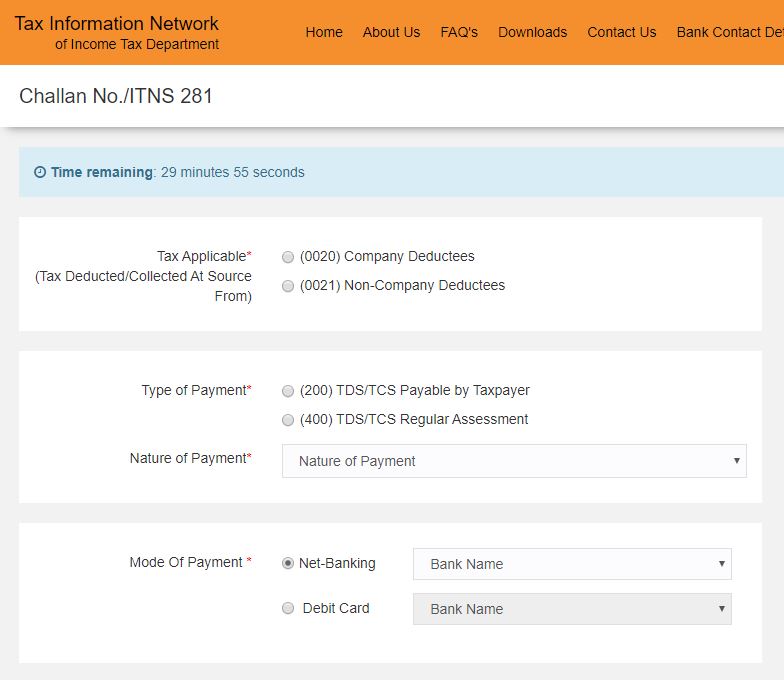

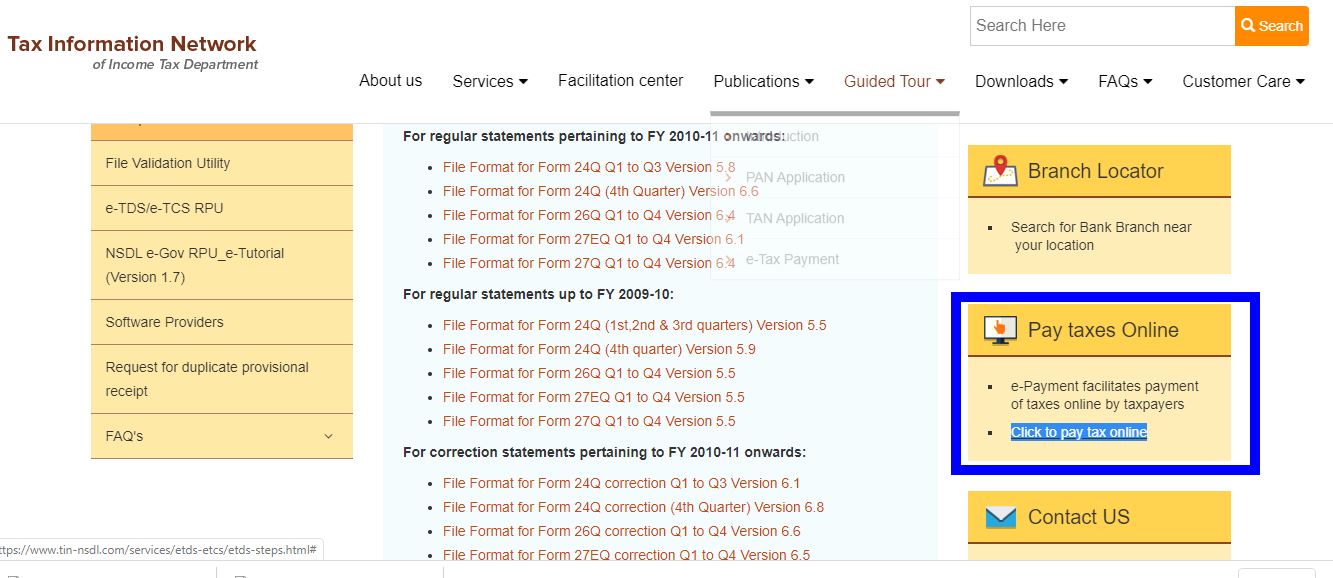

The website will appear as shown.

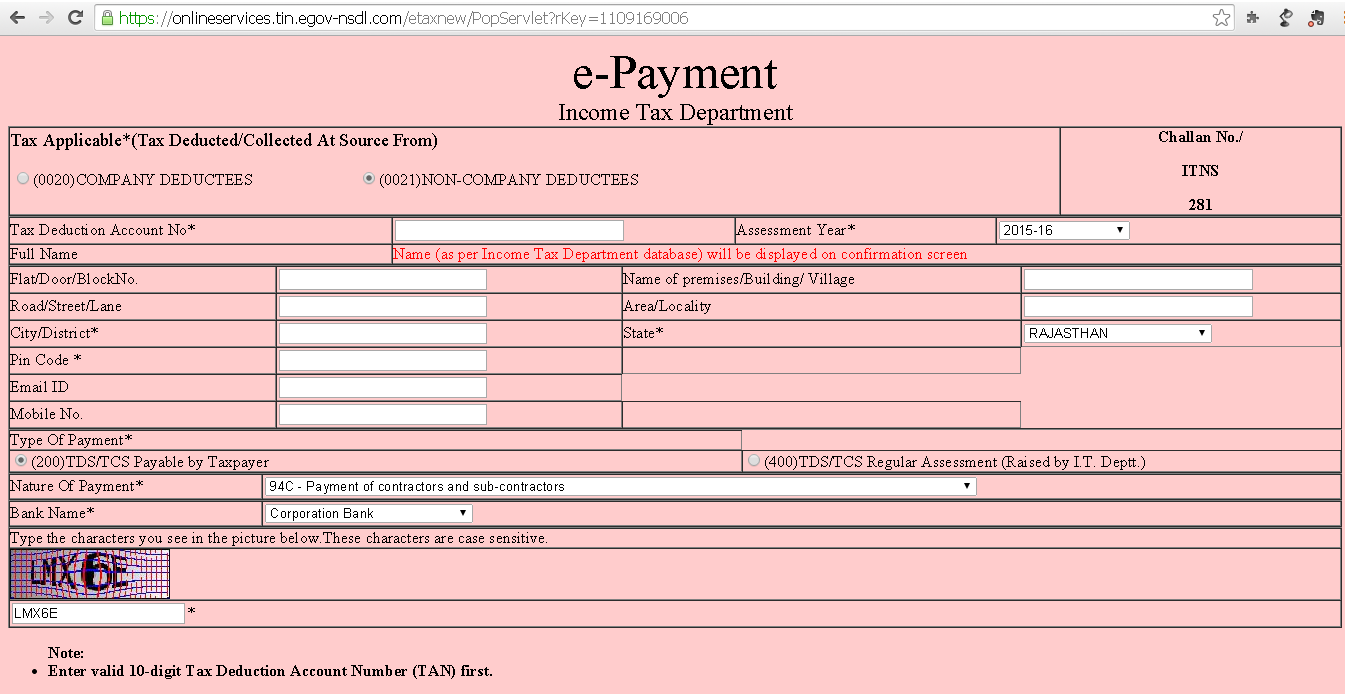

Nsdl for tds payment. Queries related to pan & tan application for issuance / update through nsdl To pay taxes online, the taxpayer will select the relevant challan i.e. Offline payment time remaining :

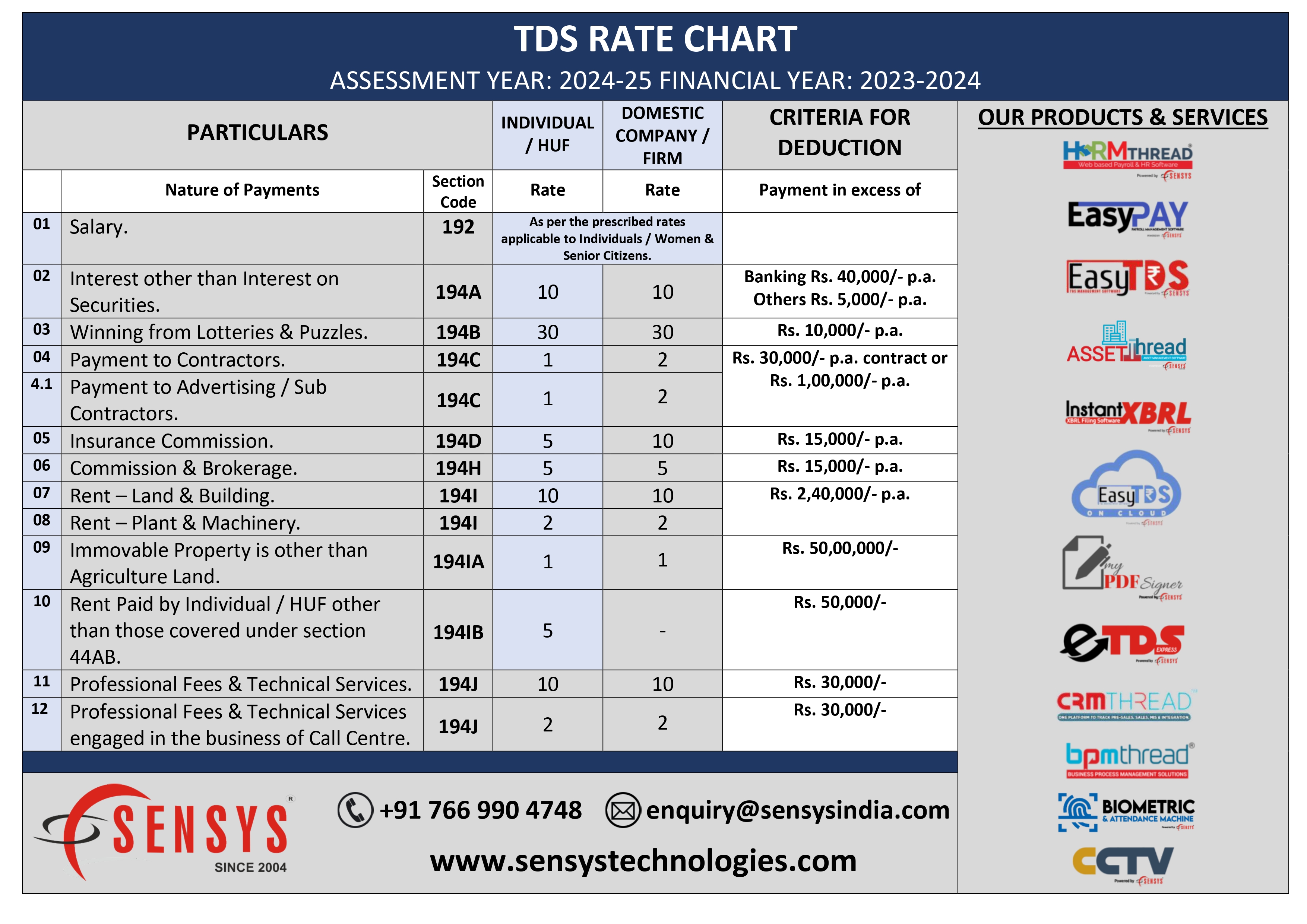

30 minutes 00 seconds view is provided for the purpose of print of form 26qb (i.e. Nsdl or national securities depository limited is the first and largest depository in. There are 2 modes for making tds.

Procedure to pay tds through form 26qb. Tds must be deposited by any individual or business to the central income tax department by using. Tds can be deposited in one of two ways:

Tds on property) generated from. Itns 280/281/ 282/283/285/286/287 or form 26qb/qc as applicable. Navigate to the official tin nsdl website.

To pay taxes online, the taxpayer will select the relevant challan i.e. Also, we have mentioned details of tds forms, tds return filing, etc. Itns 280/281/282/283/284/285/286/287 or form 26qb/qc/qd as applicable.

Enter his or her pan / tan as.